In gold we trust

With trust in central financial institutions being undermined, and with the U.S. dollar’s status as the world’s unassailable reserve currency being called into question, it comes as no surprise that gold is the asset cementing its place in the spotlight.

As Figure 1., reveals the exponential ascent of gold’s price.

Figure 1. Gold price, September 17, 2025. $USD

Source: goldprice.org

What is surprising, however, is that the question “What backs our currency?” isn’t being answered with abstract policies or even digital ledgers (yet).

And ironically, we owe gold’s resurgence to none other than Donald J. Trump, whose unpredictable political and economic manoeuvres have rendered what was once a steady, methodical and somewhat predictable approach to economic governance of the global financial landscape into a precarious and unforeseeable adventure ride.

In place of predictability, decorum and statesmanship, we’ve got a high-stakes game where tariffs fly like confetti, interest rate demands echo through social media, and the Federal Reserve (the Fed) is treated more like a personal advisor than an autonomous guardian of monetary stability.

The shift hasn’t rattled the equity market yet, but it has propelled gold to new heights, and in so doing turned it from a nostalgic relic into a must-have hedge against the madness and depreciating U.S. dollar.

Gold’s quiet advantage

For many, albeit not all, investors, the counterintuitive appeal of gold lies in a simple economic truth: it doesn’t pay interest. Unlike stocks that pay dividends or bonds that offer a yield, gold does just sit there, inert and unchanging. It’s usually an argument for not owning it in a portfolio – you can’t do anything with it, and it doesn’t produce anything. And historically, this has been its Achilles’ heel – why hold a barren asset when you could earn a return elsewhere?

What is all the world’s gold worth?

The total amount of mined gold is estimated at 216,265 metric tonnes. Converting this to kilograms:

216,265 tonnes = 216,265,000 kg.

Gold’s density is 19,320 kg/m³. To find the volume:

Volume = mass / density = 216,265,000 kg / 19,320 kg/m³ ≈ 11,194.25 m³.

A cube with this volume would equal:

Side length = ∛(11,194.25) ≈ 22.36 meters.

This cube would be about half the length of a 50-meter Olympic-sized swimming pool or roughly the height of a seven-story building, or about the length of a standard basketball court.

Its value is about A$37.2 trillion or US$25 trillion. To put that amount in perspective, the estimated value of all of Manhattan’s real estate in 2021 was US$3.5 trillion.

You could own seven Manhattan islands’ worth of lettable real estate or one virtually useless, albeit large, cube of gold. What would be the better investment over the next 50 years, considering annual rent increases on the real estate and no income from gold?

While the long-term arguments against holding gold are compelling, in today’s environment, shaped profoundly by Trump’s policies, gold’s supposed weakness, which is its lack of income, has become its superpower.

Consider the competition: government bonds, especially U.S. Treasuries. They have long been the preferred choice for “risk-free” returns. Investors allocate their funds to U.S. Treasuries for safety and a modest yield. However, Trump’s persistent campaign to pressure the Federal Reserve (the Fed) into cutting interest rates – often through public tirades or appointing loyalists, combined with his administration’s tendency for fiscal profligacy and protectionist measures like tariffs that fuel inflation – has caused inflation to rise to levels that surpass those yields.

The Real Yield is the nominal interest rate minus inflation. When Trump’s policies push inflation higher – through supply chain disruptions from trade wars or deficit-raising tax cuts – the real yield on a 10-year Treasury can dip into negative territory. Lending money to the U.S. government to receive less purchasing power than you started with is like watching your savings erode in slow motion.

In this scenario, gold shines – literally and figuratively. With no yield to speak of, its opportunity cost plummets when real yields from bonds turn negative.

Meanwhile, Trump’s interference has eroded the Fed’s independence, making monetary policy feel more like a political football than a considered tool of economic management. This has dismantled the traditional case against gold, positioning it, perhaps temporarily, as at least one of the logical alternatives for preserving wealth.

For many, however, gold isn’t an investment; it’s a statement of scepticism toward the ‘system’. Remember, gold is always a bet on fear.

During the 1970s stagflation era, when inflation raged and real yields turned negative, gold prices skyrocketed from around US$35 per ounce to over US$800. Today, echoes of that period abound, amplified by Trump’s playbook. His threats of deeper rate cuts and unconventional interventions (“Not that I don’t have the right to do anything I want to do. I’m the President of the United States.”) have created an environment where investors anticipate prolonged low or negative real returns. Gold, immune to these manipulations, has, at least for now, become the anchor asset.

Erosion of faith and inflation

The broader storyline is one of dwindling confidence in a pillar of the U.S. economy. Central banks should be impartial stewards, guiding economies around crises or through them with data-driven resolutions. But under Trump’s influence, the Fed has been politicised, and consequently, it has become something ‘less’. Importantly, that politicisation isn’t hypothetical; it’s manifested in board appointments, public criticisms, and policy pressures that could potentially be seen to prioritise self-interest over stability.

When systemically important institutions lose their mantle of reliability, at least some investors will gravitate to what they perceive as more dependable alternatives. Today, that’s gold – it’s physical, finite, and unbound by the government’s whims. No one can print more of it, unlike fiat currencies that expand by pressing the <enter> button on a keyboard.

Meanwhile, Trump’s tariff wars, for example, have worsened global trade tensions, causing supply disruptions and increased prices. Each new escalation – whether with China, Europe, or allies – reduces the predictability of international trade, prompting capital to move to safer havens.

Moreover, Trump’s social media eruptions act as volatility amplifiers. A single post railing against the dollar’s strength or hinting at defaults and currency devaluation can send financial markets into a tailspin. Investors, tired of this unpredictability, flock to a buffer, a perceived refuge.

Consider the surge in gold-backed exchange traded funds (ETFs) and physical bullion demand during Trump’s first term. Data shows that periods of heightened trade rhetoric correlated with spikes in gold prices, as uncertainty bred fear. Extending this, under similar influences during Trump’s second term, we could see even more pronounced effects, with gold serving as the de facto currency backstop in portfolios worldwide.

Chaos as catalyst

They say opportunity emerges during disorder, and for gold enthusiasts, Trump’s brand of chaos has been a veritable gold mine – pun intended. Every impulsive decision – from withdrawing from trade pacts to questioning alliances – injects uncertainty.

Gold thrives on fear. It’s the ultimate contrarian ‘asset’: when faith in paper assets wanes, the metal’s allure deepens. Trump’s approach has inadvertently created a perfect storm. By challenging central bank norms, he’s made gold look like the adult in the room. Amid a landscape of manipulated interest rates and ballooning debts, gold’s scarcity and history return as reasons to believe in gold’s status as a store of value.

The increasing interest in gold isn’t the exclusive domain of individuals. Trump’s “America First” stance has strained alliances and fostered a multipolar world where nation-states hoard gold as a hedge against the U.S. dollar’s diminishing dominance. Central banks in countries like Russia and China have ramped up their gold reserves, partly in response to perceived U.S. unpredictability.

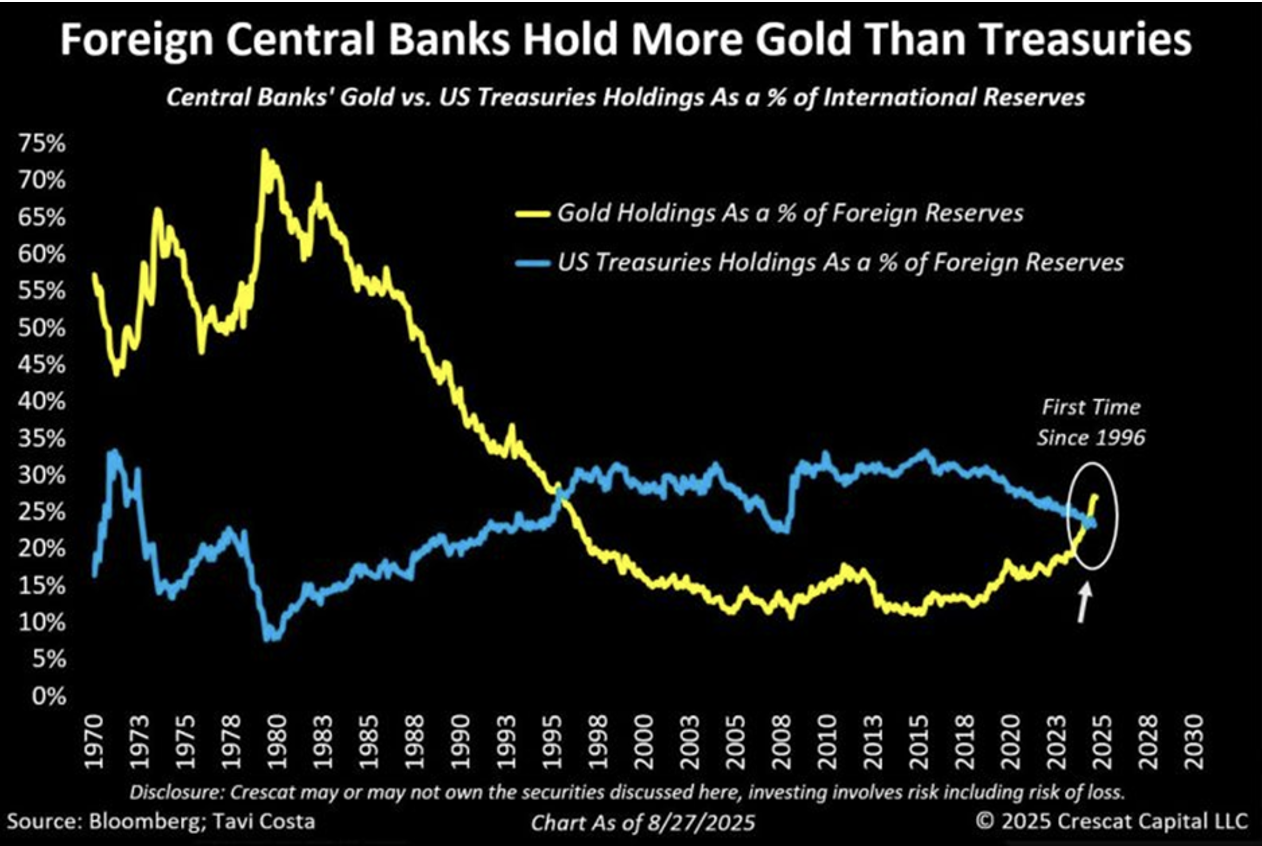

As Figure 2., reveals, foreign central banks now hold more gold than U.S. Treasuries.

Figure 2. Foreign central banks hold more gold than treasuries

Source: Bloomberg

This global shift reinforces gold’s role, creating a self-fulfilling prophecy where demand drives prices higher.

A new era?

I remain wedded to the idea that over the long term other more traditional and income-producing assets will outperform gold. But that does not diminish its potential tactical role in a portfolio.

From the uncertainty that keeps us alert, to the policies that prioritise spectacle over steadiness, and to Donald J. Trump’s rollercoaster, there’s a multitude of reasons to explain gold’s record price.

At least for now, that heirloom jewellery or forgotten coin collection isn’t just sentimental – it’s tactical. Gold might not be about getting rich quick, but it could feasibly help endure the unpredictable. And as institutions falter under political pressure, gold potentially offers security.

Whether you’re an experienced investor or just a curious observer, the message is clear: gold’s lustre grows brighter in a world where trust is being tarnished.

Gold was rising long before Trumpy came to power…

Correct. It isn’t unusual for the influences and narratives that spur a trend to change, as they have on this occasion many times – from a devaluing US dollar, to geopolitical conflict and war, to global central bank buying and to Fed rate cuts.