Reece – a tough outlook anticipated for fiscal 2026

The Reece Limited (ASX: REH) share price has recorded a rough year, down around 60 per cent from A$29.20 to sub A$12.00. The company reported its results for the 12 months to 30 June, and it appears pressure on the earnings before interest and tax (EBIT) margin from 7.4 per cent in fiscal 2024 to 6.1 per cent in the six months to June 2025 could continue.

Fiscal 2025 EBIT of A$548 million was down 20 per cent on a marginal decline in revenue to A$9.0 billion. However, the disappointing results from the U.S. operations (267 branches, up net 24) with EBIT declining from A$137 million to A$112 million to A$97 million over the past three half-years is a concern. Accordingly, U.S. EBIT margins have come down from 5.1 per cent to 4.6 per cent to 3.6 per cent, over the same period. For context, Reece acquired MORSCO for US$1.9 billion (renamed Reece USA), which is primarily based in the U.S. sunbelt region, in 2018.

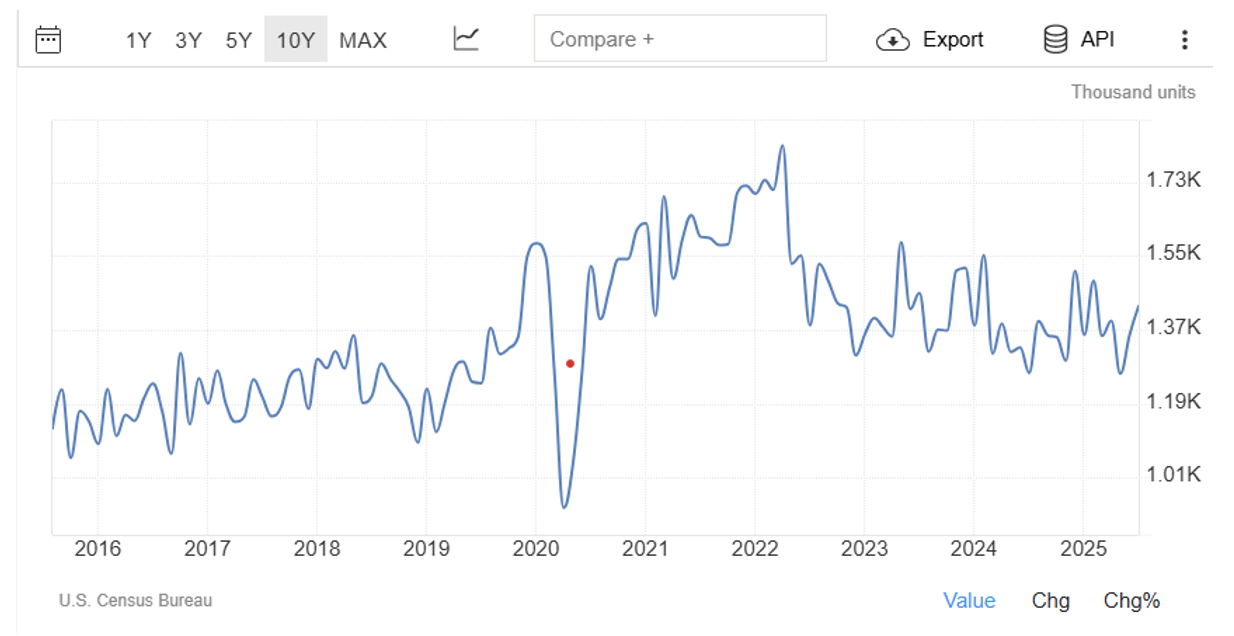

Commenting on the outlook, management touched on the uncertainty domestically (676 branches, up a net 15) with a period of soft activity to play out, and this was combined with the likelihood the U.S. housing market will be constrained for the next 12-18 months with affordability continuing to weigh on housing activity. As illustrated below, U.S. housing starts have declined from A1.82 million in 2020 to average around A1.37 million (-25 per cent) more recently.

Graph 1: U.S housing market

Source: U.S Census Bureau

For the year to June 2025, net debt rose from A$518 million to A$590 million and this was largely attributable to a net A$87 million of business acquisitions. Capital expenditure was A$258 million, as management reinvests in the business with a focus on operational efficiencies. The gross interest for fiscal 2026 is expected to range between $50 million and $60 million. REH’s Earnings Per Share (EPS) declined 24 per cent to $0.49, whilst its Dividend Per Share fell 29 per cent from $0.2575 to $0.1836.

Read my earlier article here: Leaking confidence – Reece’s outlook looking drained.