DAFM’s Digital Income Class is a valuable portfolio diversifier

In today’s volatile and uncertain market environment, many investors are looking beyond the traditional 60/40 portfolio of equities and fixed income to generate reliable returns.

There is growing interest in alternative investment strategies that can offer consistent income, lower volatility, and diversification from traditional asset classes.

That’s why we are delighted to introduce Digital Asset Funds Management (DAFM) as Montgomery Investment Management’s fifth investment partner – and the Digital Income Class, which we believe offers a compelling addition to, and a valuable diversifier within, an investor’s portfolio.

Our “fifth horse in the stable”, Digital Asset Funds Management (DAFM) has been running the Digital Income Class since 1 May 2021. In the 51 months to 31 July 2025, it delivered its initial investors 50 positive months and only one negative month.

About DAFM and the Digital Income Class

First, a bit of background. DAFM was founded by Clint Maddock and Mike Gilbert, who each have over two decades’ experience in trading complex derivative products.

Through sophisticated high frequency trading – 24 hour per day, 7 days per week – the team at Digital Asset Funds Management using specific algorithms, execute thousands of “basis arbitrage” 1 trades per day in Bitcoin futures and, to a lesser extent, Ethereum futures, whereby they aim to hedge every transaction. In short, hedged positions have a nil net directional exposure to either Bitcoin or Ethereum.

For a smaller portion of the trades, DAFM sells far-dated futures contracts until the futures contracts become near dated or expire. These “carry trades” 2 aim to generate a return of between 5 per cent and 25 per cent per annum.

Hence, the Digital Income Class is a “market neutral class” and tends to make more money when Bitcoin is going through a period of greater volatility, or more ups and downs.

Performance over 51 months

The total return of the Digital Income Class over the 51 months to 31 July 2025 was 138.74 per cent (in Australian dollars), or an average annual return of 22.72 per cent, after all expenses. And even allowing for one extraordinary positive month (May 2021) and classifying it as an outlier, DAFM’s Digital Income Fund – Digital Income Class would have delivered investors a return 86.29 per cent (over 50 months to July 2025), or an annual average return of 16.10 per cent.

Resilience in declining equity markets

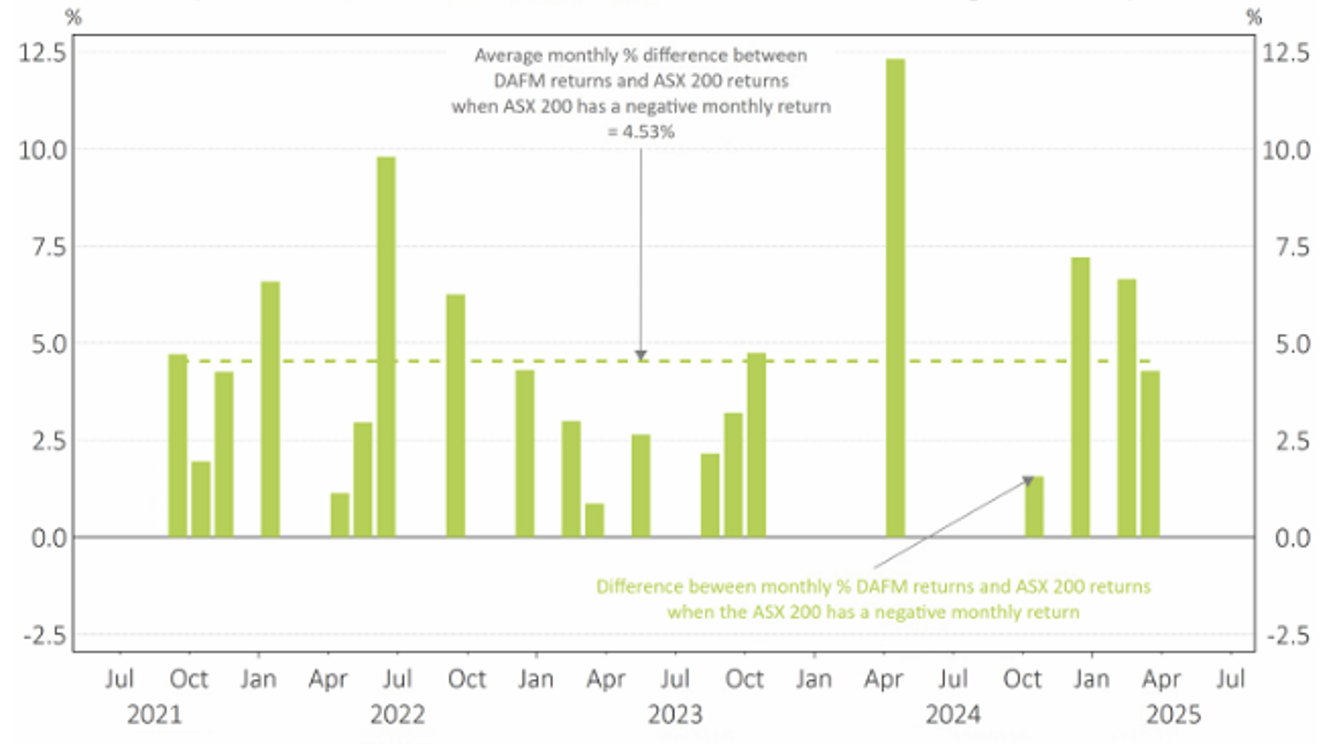

It is the delivery of these returns during difficult market conditions that needs to be highlighted. Over the 50 months under review, the ASX 200 Accumulation Index, which represents the domestic share market, delivered a negative return over 20 of the 50 months under review, or 40 per cent of the time.

As illustrated in Graph 1, below, DAFM’s Digital Income Class delivered investors a positive return in every one of those 20 months. The average monthly outperformance was 4.53 per cent across those 20 months, after expenses.

Graph 1: Digital Income Class vs. ASX 200

(Difference between DAFM and ASX200 has a negative month)

Source: DAFM, PinPoint Macro Analytics, Macrobond, S&P Global

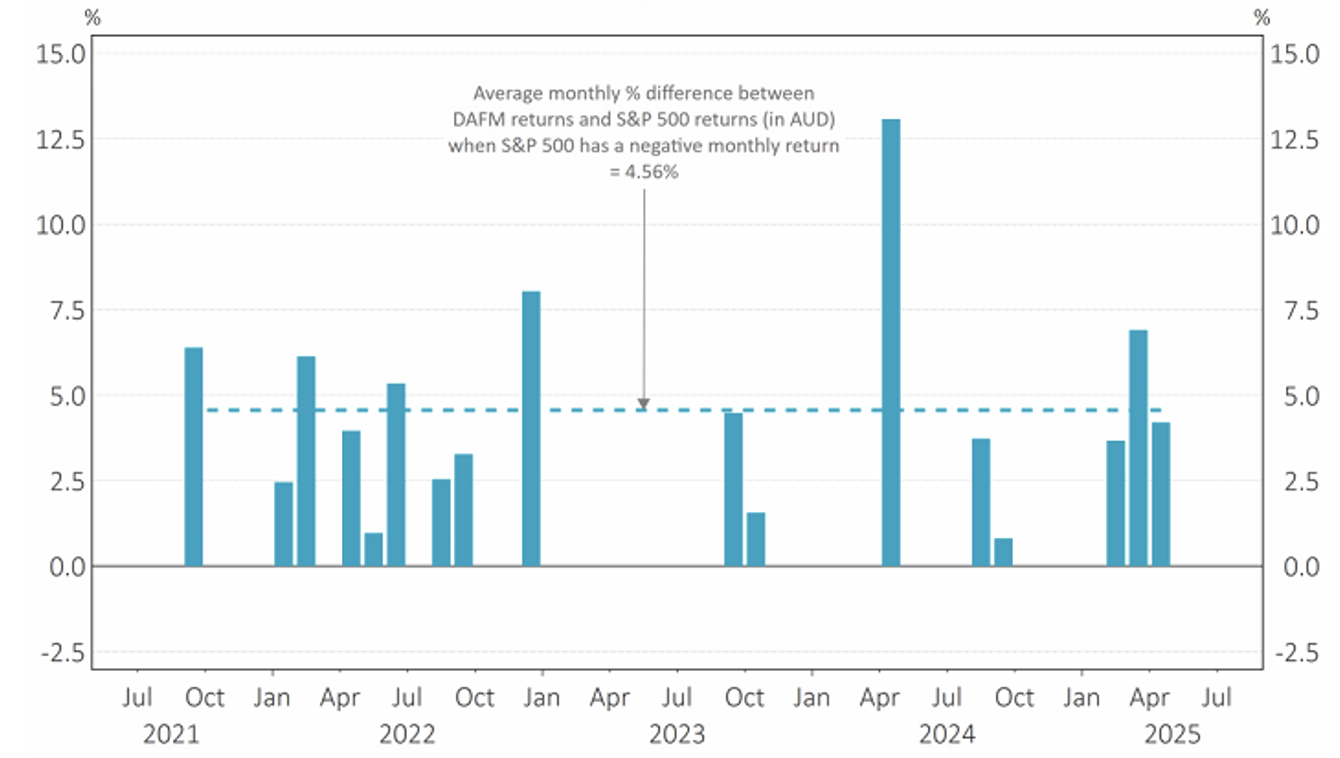

Taking this example further, the S&P 500 Accumulation Index, in Australian Dollars, representing the U.S. share market, delivered a negative return over 17 of those months (or 34 per cent of the time).

As illustrated in Graph 2, below, DAFM’s Digital Income Class delivered investors a positive return in every one of those 17 months. In fact, the average monthly difference saw the Digital Income Class outperform the S&P 500 Accumulation Index by 4.56 per cent, after expenses (in Australian dollars) over those 17 months.

Graph 2: Digital Income Class vs S&P 500

(Difference between DAFM and S&P500 when S&P 500 has a negative month)

Source: DAFM, PinPoint Macro Analytics, Macrobond, S&P Global

Based on its relatively short history, DAFM’s Digital Income Class can be seen as a diversifier from both the S&P 500 and the ASX 200 Indices. The Digital Income Class delivered investors a positive monthly return each time those two indices recorded a negative monthly return.

In the case of the S&P 500 Accumulation Index, the average monthly outperformance was 4.56 per cent (in Australian dollars), and in the case of the ASX 200 Accumulation Index, the average monthly outperformance was 4.53 per cent.

Conclusion

With its strong track record, market-neutral approach, and historical ability to deliver positive returns during equity market downturns, we believe DAFM’s Digital Income Class can be a valuable diversifier for investors seeking stability and uncorrelated returns within the portfolio.

More information

If you are interested in more information on DAFM’s Digital Income Fund, please contact Montgomery:

Investors:

Rhodri Taylor, Account Manager or David Buckland, Chief Executive Officer on (02) 8046 5000 or investor@montinvest.com

Advisers, researchers and platforms:

Scott Phillips, Head of Distribution on 0417 529 890 or sphillips@montinvest.com

Notes

1 Basis arbitrage involves the simultaneous buying and selling of futures instruments to capture price differences between different futures exchanges and expiry tenors.

2 Carry trades aim to profit from the difference between the price of the digital asset today and the price of a future-dated contract, by holding the future-dated contract to expiry or close to expiry.

3 A market-neutral fund seeks to generate positive returns regardless of whether the price of underlying assets, such as Bitcoin or Ethereum, rises or falls. This is achieved by removing directional exposure to the overall market through hedging strategies.

Disclaimer:

The Digital Income Fund is available for wholesale investors only.

Performance of the Digital Income Fund – Digital Asset Class since its inception on 1 May 2021. Net returns after fees and expenses as at 31 July 2025 and assumes reinvestment of distributions.

This is general information and doesn’t take your personal circumstances into account, so seek independent advice before investing. Investing involves risk, including the possible loss of principal. Past performance is not a reliable indicator of future performance.

Diversification does not ensure a profit nor guarantee against a loss. Montgomery Investment Management holds AFSL number 354564.