Summing up the bubble prognosis

For the last month or two, I have been writing with increasing frequency about the possibility of the stock market boom transitioning into a bubble. There are a variety of reasons for this, and they usually fall under two broad headings. The first is technical and the second is behavioural. Often the latter influences the former, but the reverse can also be true, so let’s agree that the sets in the Venn diagram intersect.

That we have been in a stock market boom can be concluded simply from the nominal returns produced by the S&P500 over the last two and a half years. Following double-digit gains in 2023 and 2024, the first half of 2025 has witnessed another robust equity market performance, with the S&P 500 hitting record after record highs.

Crucially, nominal gains in equities are insufficient to describe a bubble. But the claim the stock market has boomed is safe from dispute.

While these aren’t my own arguments, the technical arguments that the boom might have matured, be in its latter stages or have entered bubble territory, can be listed as follows:

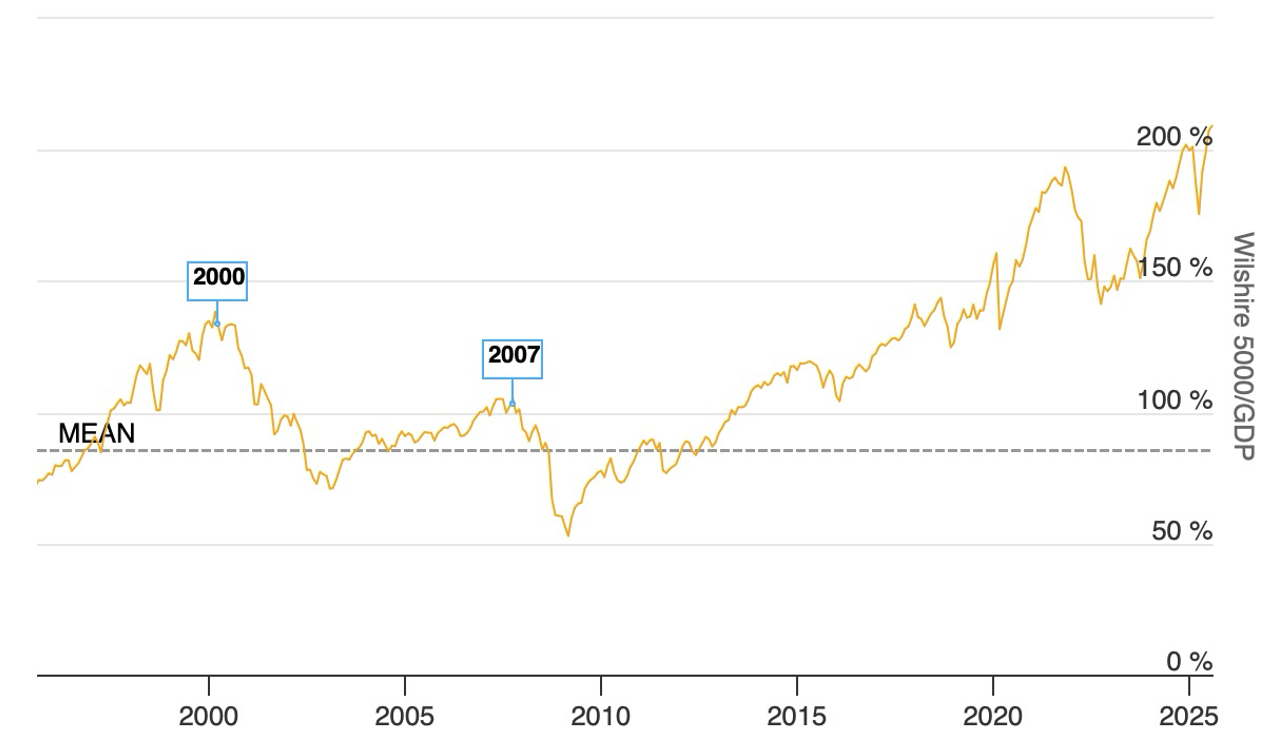

The first, and not particularly strong argument, is that the market capitalisation of equities now exceeds twice the level of Gross Domestic Product (GDP). Historically, and as Figure 1., reveals, the average market cap-to-GDP ratio has hovered under 100 per cent. Previously, the market peaked at 140 per cent of GDP before the Dot-com bubble burst, and 104 per cent before the Global Financial Crisis (GFC).

Figure 1. U.S. Wilshire 5000 to GDP Ratio – August 1995 – August 2025

Source: longtermtrends.net

Importantly, it’s necessary to distinguish between an indicator that suggests the market is expensive and one that suggests the market is at imminent risk of correction. Clearly, if the 104 per cent market cap-to-GDP ratio of 2007 were to predict all subsequent corrections correctly, the market would have slumped in 2013/2014 and many times since. Instead, with the exception of the COVID-19 Pandemic, the market has been rising steadily since the GFC lows of 2009, ignoring the market cap-to-GDP ratio. There is no reason to believe it couldn’t keep growing, especially since the largest companies in the U.S. market now derive vast sums of revenue and profits from outside the GDP-confines of the USA.

Another related argument is the concentration of the U.S. stock market’s capitalisation in a handful of companies. Most analysts agree that about 40 per cent of the market’s capitalisation now rests in just ten of the biggest companies and more than 30 per cent in the Magnificent Seven (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla) alone. A counterargument is that they deserve their heavyweight status as well as historically high market valuations because they are companies changing the course of human history, generating extraordinary profitability, commanding vast market shares, and growing rapidly.

Others suggest their prices have been elevated by nothing more than the Fear of Missing Out (FOMO). Even if this latter argument were correct, this is not a signal of an imminent correction. What high concentration does point to is the market’s vulnerability to a change in sentiment towards artificial intelligence (AI), in this case, or a shift in the AI technology or revenue-generating thematic itself.

The market’s heavy reliance on a narrow cohort of tech firms does introduce structural vulnerability. A stumble in this sector, whether due to earnings misses, regulatory scrutiny, or even just the unpredictable shifts in investor sentiment, could trigger significant market-wide turbulence.

Another argument that we are entering a more vulnerable phase of the boom is that the valuation of the entire market, including those companies outside of the magnificent six or seven, is stretched.

Overall, the S&P500 earnings multiple is elevated. According to Ed Yardeni Research, the S&P500 one year forward price-to-earnings (P/E) ratio is at 22.1 times (as at 15 August, 2025). Its long-run average (not median) sits at about 18 times, and over the last 25 years, the S&P500 has spent a little more than half its time under that average. Importantly, the only time the P/E has exceeded its current level was during the Dotcom bubble of 1999 and early 2000.

Again, however, a high P/E is not a trigger for an imminent correction. As John Maynard Keynes once wryly observed, “The market can remain irrational longer than you can remain solvent”.

What a high P/E does correlate to is lower future returns. A simple investing truism is ‘the higher the price you pay, the lower your returns.’ Historical data suggests that if you buy the S&P500 index at current P/Es, the average return over the next decade will equate to low single digits – about two to four per cent.

Given the risk associated with investing in equities, such a low return doesn’t sufficiently compensate, especially when U.S. ten-year Treasuries are yielding 4.3 per cent to maturity.

The inverse of the S&P500 P/E of 22.1 is the Earnings Yield. That sits at 4.52 per cent, which is only marginally above U.S. ten-year bond yields.

That’s hardly brilliant compensation for risk.

So even if stretched valuations don’t portend an imminent correction, one has to compare the future probable returns to the risk being adopted. It’s a sufficient argument to warrant some ‘rebalancing’ of portfolios – reducing exposure in aggressive assets, at least a little, and rebalancing towards more defensive assets.

Indeed, if your portfolio management involves annual or semi-annual rebalancing, you will be taking profits generated by the strong gains in the stock market and redistributing them to other asset classes.

Behavioural signs that the market has entered bubble territory are perhaps more abundant, even if less compelling.

Speculative exuberance in short-dated options, massive trading volumes being attributed to retail trading of penny stocks, and two-day 80 per cent gains in profitless meme stocks suggest the market is morphing from boom to bubble.

Speculative signs also include unprofitable Russell 3000 stocks tripling in value, leveraged ETF assets hitting US$135 billion, and companies pivoting to accumulating Bitcoin in their treasuries.

According to Bespoke Investment Group, of the 33 stocks in the Russell 3000 that tripled in value since the market’s April 2025 low, only six were profitable in the prior year. Companies such as nLight, Aeva Tech, and Ouster – unprofitable yet up over 200 per cent – exemplify this trend.

And perhaps in an echo of the Special Purpose Acquisition Company (SPAC) boom during the Covid-19 pandemic, today, there are over 60 U.S. publicly traded companies accumulating bitcoin, transforming their shares into leveraged cryptocurrency bets.

Elsewhere, ostentatious displays of wealth and spending, like Jeff Bezos’s €50 million wedding, also reflect exuberance.

There are sufficient examples of irrational exuberance now to give me confidence that we have shifted beyond a boom. We cannot say when or even if the market will correct, but we can say that the longer the bubble expands, the greater the risk of a destabilising setback because the more vulnerable the market becomes to the slightest perturbation.

And we haven’t even discussed the risks associated with Trump, geopolitics or tariffs and their impact on inflation and economic growth, or the precariousness of the growing U.S debt pile under the current president.

The combination of high valuations, examples of unbridled optimism and historical evidence of more modest future returns should be enough to compel you to rebalance.

And the following billionaires think you should too.

Warren Buffett (Net worth: US$140 billion, CEO of Berkshire Hathaway)

While Warren Buffett hasn’t issued any explicit warnings, his actions strongly suggest he views the market as overvalued. In 2024, Berkshire Hathaway sold US$134 billion in equities (including a large chunk of Apple stock) while building a record cash pile exceeding US$300 billion. And at this year’s Berkshire Hathaway Annual General Meeting, Buffett stepped down as CEO but said he would be hanging around to take advantage of any forthcoming ‘opportunities’.

Howard Marks (Net worth: US$2B, Co-founder of Oaktree Capital Management)

Marks, who famously predicted the dot-com bubble 25 years ago, has recently warned investors to move to the investing equivalent of Defcon 5, which, he notes, corresponds to reducing aggressive holdings and increasing defensive holdings. Earlier, in February 2025, Marks warned of a potential U.S. market crash, describing current conditions as “froth” driven by unsustainable valuations and investor euphoria.

Ray Dalio (Net worth: US$15 billion, Founder of Bridgewater Associates)

Dalio repeatedly cautions about a U.S. debt crisis and an artificial intelligence (AI) fueled stock bubble, predicting an “economic heart attack” or full-blown crisis. Dalio has arguably predicted 15 of the last two recessions. Nevertheless, he is reported to have liquidated significant positions and advised diversification to survive crashes, noting “shocking developments” ahead.

Jamie Dimon (Net worth: US$2 billion, CEO of JPMorgan Chase)

Dimon delivered a stark warning in May 2025, urging investors to keep cash ready amid risks of market turmoil from inflation, geopolitics, and overvaluation. He highlighted the need for caution in a potentially bubbly environment.

Jeremy Grantham (Net worth: US$1 billion+, Co-founder of GMO)

Like Dalio, Grantham, another ‘perma-bear’, is also known for spotting past bubbles. He has warned of a 50 per cent market collapse in 2025, describing it as part of a “system failure” beyond a mere recession. He has reportedly liquidated assets and criticised AI hype as inflating the “everything bubble.”

Leon Cooperman (Net worth: US$2 billion, Founder of Omega Advisors)

Cooperman stated in late 2024 that stocks are “fully valued” and likely to decline in 2025, advising traders to sell on strength.

Other notable investors who have warned of impending disruption to the current buoyancy of markets Michael Burry (betting against Nvidia amid crash warnings) and Mark Spitznagel (predicting the “greatest bubble” peak).

This time could be different, and if it is, rebalancing portfolios – for example adding Private Credit – won’t do you much harm. And could just save you some heartache.

Learn more about our private credit funds here.

Contact us

Have a question? Want to know more? We’d love to speak with you about how private credit can potentially enhance return. Simply email investor@montinvest.com or call Rhodri Taylor, Account Manager on (02) 8046 5000.

Disclaimer

You should read the relevant Product Disclosure Statement (PDS) or Information Memorandum (IM) before deciding to acquire any investment products.

Past performance is not an indicator of future performance. Returns are not guaranteed and so the value of an investment may rise or fall.

This information is provided by Montgomery Investment Management Pty Ltd (ACN 139 161 701 | AFSL 354564) (Montgomery) as authorised distributor of the Aura Core Income Fund (ARSN 658 462 652) (Fund). As authorised distributor, Montgomery is entitled to earn distribution fees paid by the investment manager and may be issued equity in the investment manager or entities associated with the investment manager.

The Aura Core Income Fund (ARSN 658 462 652) (Fund) is issued by One Managed Investment Funds Limited (ACN 117 400 987 | AFSL 297042) (OMIFL) as responsible entity for the Fund. Aura Credit Holdings Pty Ltd (ACN 656 261 200) (ACH) is the investment manager of the Fund and operates as a Corporate Authorised Representative (CAR 1297296) of Aura Capital Pty Ltd (ACN 143 700 887 | AFSL 366230).

You should obtain and carefully consider the Product Disclosure Statement (PDS) and Target Market Determination (TMD) for the Aura Core Income Fund before making any decision about whether to acquire or continue to hold an interest in the Fund. Applications for units in the Fund can only be made through the online application form. The PDS, TMD, continuous disclosure notices and relevant application form may be obtained from www.oneinvestment.com.au/auracoreincomefund or from Montgomery.

The Aura Private Credit Income Fund is an unregistered managed investment scheme for wholesale clients only and is issued under an Information Memorandum by Aura Funds Management Pty Ltd (ABN 96 607 158 814, Authorised Representative No. 1233893 of Aura Capital Pty Ltd AFSL No. 366 230, ABN 48 143 700 887).

Any financial product advice given is of a general nature only. The information has been provided without taking into account the investment objectives, financial situation or needs of any particular investor. Therefore, before acting on the information contained in this report you should seek professional advice and consider whether the information is appropriate in light of your objectives, financial situation and needs.

Montgomery, ACH and OMIFL do not guarantee the performance of the Funds, the repayment of any capital or any rate of return. Investing in any financial product is subject to investment risk including possible loss. Past performance is not a reliable indicator of future performance. Information in this report may be based on information provided by third parties that may not have been verified.