Tariff time bomb – could it remove one of the three legs of market support?

Notwithstanding Trump’s concerted efforts to create disharmony, civil unrest and global tensions, there are three things that will determine broader equity market returns for investors. These are inflation, economic growth and liquidity.

We have written extensively about these factors and their influence on markets. While one of the bigger issues is the forthcoming challenge to liquidity from a massive global debt refinancing round that begins in 2026, the interim performance of markets, particularly the performance of higher-quality innovative growth companies, will be determined by whether positive economic growth can be maintained and disinflation assured.

It’s that last factor however that recent developments demand a closer inspection of Trump-inflicted tariffs are challenging the happy combination of disinflation and positive economic growth in the U.S.

On 10 June, a U.S. federal appeals court ruled to maintain President Trump’s extensive tariffs on China and other trading partners while legal challenges to these measures proceed through the courts. The U.S. Court of Appeals for the Federal Circuit granted Trump’s request to stay earlier rulings from a lower court that had suspended some of the tariff-imposing executive orders, meaning American businesses and consumers will continue paying these additional costs on imported goods for now.

The appeals court recognised the exceptional importance of these cases and expedited the legal process, ordering both parties to submit their briefing schedules within two business days and scheduling oral arguments for July 31. This accelerated timeline suggests a final judicial decision could come relatively quickly, but until then, the sweeping tariffs affecting markets and trade relationships with multiple countries remain fully in effect. The ruling preserves the status quo while the courts determine whether Trump had the legal authority to impose these trade measures.

Consequently, and despite the current calm, American consumers may need to navigate a unique economic moment – what many economists predict will be an inflationary storm.

Despite the Trump administration’s aggressive expansion of trade barriers throughout 2025, official price metrics have remained surprisingly muted.

Current U.S. inflation readings paint a picture of economic stability that believes the expected effects of the dramatic shift in U.S. trade policy. Consumer price growth has hovered around historically normal levels. But there’s a disconnect between policy changes and the immediate price effects.

The question is whether this disconnect is creating a false sense of security.

The lag between tariff implementation and consumer price impacts is a well-documented phenomenon. Businesses typically absorb initial cost increases through existing profit margins, inventory buffers, and operational adjustments before passing costs to consumers.

We have previously reported on the anecdotal stores of U.S. importers attempting to push the price rise impact of the tariffs back onto Chinese exporters who have largely refused to accept the resultant lower margins.

The behaviour however creates a delayed reaction that can mislead policymakers and consumers about the true economic consequences of trade policy shifts.

Research institutions have begun quantifying the mounting price pressure beneath the surface. The average tariff rate has climbed to 20.7 per cent, representing the highest level since 1910, fundamentally altering America’s relationship with global commerce.

Economic modelling suggests these measures amount to an average tax increase of nearly US$1,200 per U.S. household in 2025, though much of this burden has yet to materialise in retail prices.

The Federal Reserve Bank of Boston estimates that new tariffs could add a minimum of 0.5 percentage point to core Personal Consumption Expenditures Price Index (PCE) inflation, with potential for much higher impacts depending on how businesses adjust their pricing strategies.

Meanwhile, the overall price level from all 2025 tariffs is projected to rise by 2.2 per cent in the short-run, equivalent to an average per household consumer loss of US$3,600.

Global economic institutions are also sounding urgent warnings about America’s economic trajectory. The Organisation for Economic Co-operation and Development (OECD) forecasts that inflation in the U.S. will “spike in mid-2025” and reach 3.9 per cent by the end of 2025, driven primarily by the cascading effects of trade barriers. This represents a significant upward revision from earlier projections and suggests that U.S. inflation could even be closing in on 4 per cent toward the end of 2025.

As S&P Global noted recently, “Some goods with the highest exposure to Chinese supply chains saw a relatively substantial increase. Prices for toys, for example, increased 1.3 [per cent] from April. But other categories, expected to be hit hard by tariffs, such as motor vehicles and clothing, saw little to no impact. Prices for new vehicles, for example, fell by 0.3 [per cent] from April, while apparel fell 0.4 [per cent].” The calm before the storm.

The contrast with global trends is particularly striking. While other major economies are experiencing declining price pressures, America is moving in the opposite direction. G20 countries are expected to record 3.6 per cent inflation in 2025 – down from previous estimates – while the U.S. projection has risen to 3.2 per cent, up from a previous 2.8 per cent.

One possible factor explaining the current price stability is the “inventory buffer effect.” Anticipating trade policy changes, businesses engaged in unprecedented stockpiling throughout late 2024 and early 2025. We saw this here in Australia, when Breville Group (ASX:BRG) reported a significant spike in its U.S. inventory after it stockpiled Chinese-made appliances ahead of Trump’s tariffs.

This strategic inventory buildup has temporarily insulated consumers from immediate price shocks, but it represents a finite buffer that will eventually be exhausted.

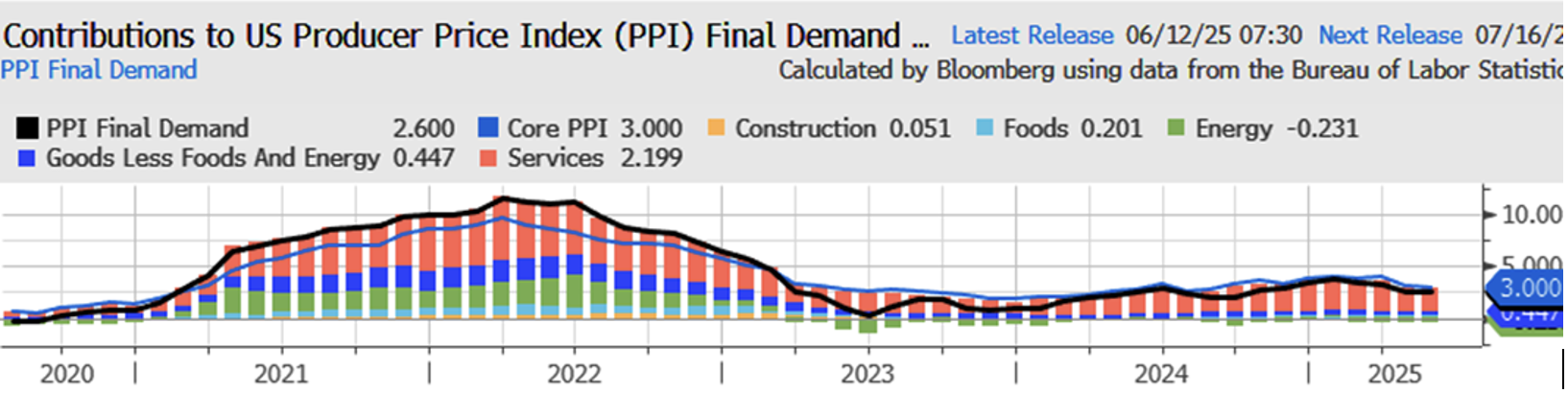

Figure 1. U.S. Producer Price Index (PPI)

Source: Bloomberg

Corporate procurement strategies have fundamentally shifted, with companies front-loading purchases and diversifying supply chains to mitigate tariff exposure. However, these adaptive measures come with their own costs – increased warehousing expenses, supply chain complexity, and working capital requirements that will ultimately flow through to consumer prices.

One possibility, of course, is that any cost increases can’t be passed on, in which case corporate profit margins take a hit. Either way, the outlook for some equities will be challenged.

The uneven impact across different product categories provides insights into how tariff effects propagate through the economy. As I mentioned a moment ago, consumer electronics, toys, and household goods – categories with heavy exposure to Chinese manufacturing – are already showing early signs of price pressure. Conversely, sectors with more diversified supply chains or domestic production capacity have remained relatively stable for now.

This pattern reflects the reality that tariff impacts are not uniform across the economy. Products with limited substitution possibilities or concentrated supply chains face the most severe cost pressures, while goods with flexible sourcing options may see more muted effects as companies adjust their procurement strategies.

Beyond direct price effects, tariffs are creating broader economic headwinds. Economic modelling suggests U.S. real Gross Domestic Product (GDP) growth will be 0.5 percentage points lower in 2025 and 0.1 percentage points lower in 2026, with long-term output remaining depressed even as the economy adjusts to new trade patterns.

This economic drag is a function of multiple factors, including reduced business investment due to uncertainty, decreased consumer spending power as prices rise, and efficiency losses as supply chains reorganise around political rather than economic considerations. The cumulative effect represents a significant erosion of American economic dynamism.

Currently, the inflation picture appears to be benign, but various economic experts suggest the current period of price stability is ending. Business surveys reveal widespread expectations of cost increases, inventory buffers are being depleted, and seasonal spending patterns typically amplify price pressures during summer months.

Ignoring Trump’s insistence that the U.S. Federal Reserve cut rates, the central bank faces an increasingly complex challenge as it attempts to balance its dual mandate of price stability and full employment. Rising inflation pressures from tariffs may force monetary policy tightening at a time when trade policy is already creating economic headwinds.

Maintaining the tariff regime risks triggering sustained inflation that could prove politically damaging and economically destabilising. However, Trump can’t reverse course lest he lose face and suffer political consequences.

If tariff effects begin to manifest more clearly in price data, one of the three key elements of equity market support would be removed. That’s why, as we have said before, investors should watch closely all inflation-related data and note anecdotal evidence too.

The coming months will test whether the American economy can absorb these trade policy shocks without triggering a broader inflationary spiral. Early indications suggest that this test may prove more challenging than investors might hope.

Disclaimer:

The Montgomery Small Companies Fund owns shares in Breville Group (ASX:BRG). This article was prepared 13 June 2025 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Breville Group, you should seek financial advice.