Down but not out

Whilst we do not own the shares in the business and haven’t for some time, we previously commented on a number of headwinds we thought Blackmores was facing. Naturally we read their full year result with interest to see how things are progressing.

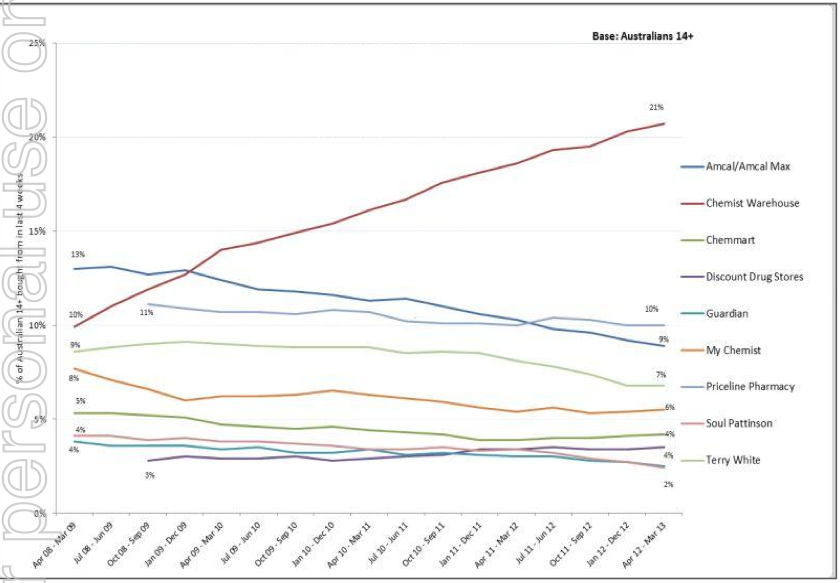

What stood out the most was not what management said, but the below chart which you can find on the very last page of their analyst briefing presentation:

This is the clearest evidence we have seen to date which depicts the structural change within the Australian Vitamin industry. It is force that management has alluded to in the recent past, and we appreciate their candidness and disclosure this time round.

What this chart effectively shows (compiled from Roy Morgan data by Blackmores), is the rise of Chemist Warehouse (the red line) as a major retailer in Australian Pharmacy.

“In the five years to March 2013, the proportion of Australians aged 14+ shopping at Chemist Warehouse in an average four – week period has more than doubled from 10% to 21%”.

At the same time, this rising level of competition has driven a decline in smaller community pharmacies and a spike in product discounting amongst the remaining Pharmacy groups. This includes Amcal, who just four years ago had the largest market share.

Traditionally, Blackmores sold a meaningful portion of their higher-margin products to pharmacies, in particular to the Amcal’s and smaller community stores. A lot of Blackmores’ promotional investment was in training pharmacy assistants, rather than marketing directly to consumers, and there was little to no product discounting as their product was essentially recommended by staff.

In this result it is evident that the rise of the discount pharmacy, combined with the increasing level of complementary medicine sales within supermarkets, is really threatening Blackmores’ positioning.

Both of these retail concepts work in selling high volumes on lower margins. Woolworths, Coles and Chemist Warehouse all play the Walmart game – the big retailers put pressure on their suppliers to fund the discount in the hope of increased volumes driven by larger foot traffic. Chemist Warehouse, for example, often advertises discounts of 50 per cent on certain brands or ranges of products. And if the supplier does not fund the discount, their product range gets reduced or cut.

As one of the most recognized brands in their market, combined with its eighty-year history, Blackmores has historically enjoyed a trusted brand name and a “market darling” status. However, it appears to us they have been unable to hold their premium product pricing power and we expect margin compression to continue over the medium term.

To put this margin compression into perspective, even with sales growth in the region of 4%, Australian EBIT (earnings before interest and tax) declined 26% over the year.

There will be a point when sales will again add positively to the bottom line, and this decline will see the business’ Asian operations become an even larger contributor to underlying earnings. We don’t know when this momentum will swing back into investors’ favour, but we will continue to watch with interest.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

I’ve never been crazy about Blackmores despite impressive profit growth and ROE. Any products that sell on supermarket shelves that are not worldwide brands often have low barriers to entry. Coca-Cola, WD40, Campbells, Heinz are the exceptions. Although Arnotts which is really only sold in Australia is I think a strong great brand.

Strength in a brand can be very hard to measure and I’ve never felt Blackmores is strong enough for me to invest in at these prices.

And Arnotts is owned by the US company, Campbell Soup Company

I’ve always thought Sanitarium might have been a strong brand to be invested in, but I suspect their owners (the Seventh-day Adventist Church) won’t be selling/floating shares any time soon.

If the structure they operate under is anticompetitive it should be restructured.

I used to work in retail and the anecdotal evidence is that that there isn’t much brand loyalty in this space – whatever is placed on a display close to the front of the store with a percentage discount advertised in bold font is bought and bought in bulk. 6-9 months supply at a time of things like glucosamine and fish oil. I’m curious about thoughts regarding how effective branding is in this industry?

Is Blackmores is in a better position to weather the lower margins and take advantage of Swisse’s lowered resources to attract new customers or are both likely to be competing for slices a smaller pie?

And with Swisse’s expansion overseas how much more will they need to spend to gain brand recognition..?

Indeed.

Read that in the AFR, Australians seem to forget that if we pay nothing for product like Walmart that OK if we want to pay staff $8 per hour like in the US.

Swisse based on their ROE would not be considered a good business and entering the US market with the borowing of capital that the article mentioned would make you wonder whether their management has entered the twilight zone.

The chart is not unexpected. I think my life mimics it. I have a pharmacy within walking distance of my unit and a chemist warehouse approximatley 10 minute drive away. In between these two points is another approximatley 4-5 pharmacies. Which one do you think i go to?

My wife and I have found that by going to Chemist Warehouse and buying our products from there we do significantly save money when combining over a year. I worked out that based on a basket of items we routinley buy from chemists we saved about 50% per visit (this is regular not special discoutned prices).

Blackmores need to shift their focus to meet this trend or else i believe they could find themselves losing significant market share to companies like Swisse who market directly to consumers (and do it well) and seem to set their business up to fit this dynamic (and seem to have the largest shelf space).

Interestingly, there has been a significant increase over the last eyar or so of vitamin and other “natural health” and supplements companies advertising on TV. It is quite a competitive area.

Interestingly, Swisse aren’t making any serious money (appear to have admitted in the AFR to “cashflow challenges”) and are relying on an international expansion plan to reduce the impact of operating leverage. They are also massively reducing their advertising spend now that they have achieved 95 per cent brand awareness (which has cost them a pretty penny)…In 2013 Swisse generated revenue of $232 million and EBITDA of just $2 million. This compares to Blackmores revenue of over $320 and EBIT of about $38m. Clearly the 95 brand awareness Swisse has achieved has come at a very steep cost. I wonder how sustainable it is?

That is very interesting Roger. It sounds like a high marketing spend and perhaps a few poor performing product lines (they seem to have everything except an oxygen supplement on sale).

I am always sceptical about the long run sustainability of companies that take a purely market share point of view, such behaviour leads usually to a discounting or price war and the better business usually wins out (and that would be blackmores in the above scenario) due to a more sustainable competitive advantage and better brand. I have built this belief into my investing philosophy.

Thanks Andrew, As my restaurant friend once observed: “revenue is vanity, profit is sanity”.