GYG exceeds FY24 forecasts, sets positive tone for FY25

In a stellar financial performance, and in contrast to rivals, Guzman y Gomez (GYG) has significantly surpassed both its prospectus forecasts and market expectations for FY24. The fast-casual Mexican restaurant chain reported robust growth across key financial metrics, highlighting its successful strategic initiatives and strong consumer demand.

Results outpace expectations

For FY24, Guzman y Gomez achieved pro forma network sales of $959.7 million, a 26.4 per cent increase from the previous year. This figure not only exceeded the prospectus forecast of $954.4 million but also outperformed analyst estimates. Revenue for the period of $342.2 million was up 32.1 per cent and 0.7 per cent better than prospectus. The company’s underlying earnings before interest, tax, depreciation and amortisation (EBITDA) was $44.8 million, marking a 52.9 per cent year-on-year increase. This was also above both the prospectus and consensus forecasts of circa $43 million.

Net profit after tax (NPAT) also showed notable improvement. The statutory NPAT was a loss of -$13.7 million, better than the prospectus forecast of a loss of -$16.2 million. On an underlying (pro forma) basis, however, NPAT was $5.7 million, a remarkable 94 per cent increase, comfortably beating both the prospectus and analyst expectations.

Segment performance and operational highlights

Guzman y Gomez’s performance in its core Australian market was a key driver of the results and, in particular, the 18 per cent growth in breakfast sales. The Australian segment reported an underlying EBITDA of $45.6 million, reflecting a 49 per cent increase and slightly ahead of both the prospectus and analyst forecasts of circa $44.5 million. Same store sales growth (SSSg) in Australia was 8.1 per cent.

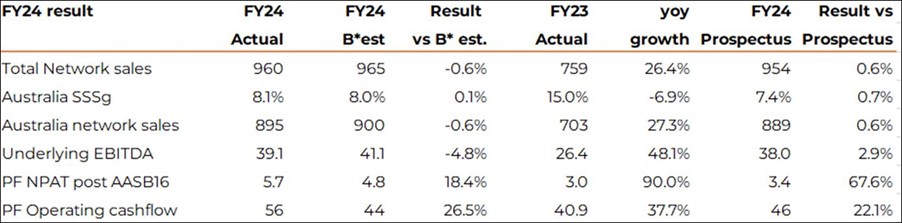

Table 1. Key numbers versus consensus

Source: Barrenjoey

Source: Barrenjoey

In the U.S. market, Guzman y Gomez’s underlying EBITDA stood at -$6.5 million, aligning with the prospectus and analyst forecasts. While the U.S. segment remains small, the company’s commitment to expanding its presence is evidenced by a new partnership with a Chicago-based operator, which suggests management’s confidence in U.S. success remains intact.

Cash flow conversion remained strong at 102 per cent, and Guzman y Gomez’s operational cash flow (PIT) was $36.8 million, surpassing the prospectus forecast of $28.5 million. Notably, Guzman y Gomez’s cash flows have allowed it to achieve a zero-debt position.

Outlook

Guzman y Gomez’s management has expressed confidence in achieving its FY25 prospectus forecasts, supported by a strong start to the new fiscal year. Analysts are already suggesting the FY25 forecasts are conservative. In the first seven weeks of FY25, Guzman y Gomez reported SSSg of 7.4 per cent in Australia, significantly higher than the FY25 prospectus forecast of 4.8 per cent and above the house broker Barrenjoey’s estimate of 5.5 per cent.

The company plans to open 31 new restaurants in FY25, with 30 originally forecast and one from FY24 delayed by three weeks. This expansion is in-line with Guzman y Gomez’s growth strategy to increase its market presence both domestically and internationally.

Market reaction

Since its initial public offering (IPO) in June, Guzman y Gomez’s stock has surged by 62 per cent, reflecting investor optimism in the company’s growth trajectory and financial performance. Analysts believe that the robust FY24 results and a solid start to FY25 will continue to attract investor interest. Since the company was listed, there have been concerns over valuation. However, international investor appetite for high-quality quick-service restaurant (QSR) companies remains strong. Global peers like CAVA (NYSE:CAVA) (share price up +207 per cent YTD) and Wingstop (NASDAQ:WING), (+60.2 per cent) and Chipotle (NYSE:CMG) (+22 per cent) represent just a sample of excellent QSR share price performances this year.

Guzman y Gomez’s FY24 results demonstrate the company’s popularity with consumers, strong financial health, and a zero-debt position. With an optimistic outlook for FY25, Guzman y Gomez is well-positioned to continue its growth trajectory, delivering value to shareholders and strengthening its brand in the competitive QSR landscape.

Interests associated with the author own shares in Guzman y Gomez as at the date of the article. The author’s views on the security/ies may change over time.