Bulls versus bears

It’s fascinating to read about the latest prognostications of those who manage billions of dollars of their own or others’ money.

I guess I must be a bit of a collector because I like to make lists of their comments for no other reason than to admire them against one another.

And just in case you haven’t read my view, which I have maintained for the last two years, I believe equities will be supported (read bullish) as long as disinflation continues and economic growth remains positive.

As I noted in August 2022 and have reminded investors frequently since, “… if, in the longer-term economic environment, inheres a combination of modest to low economic growth and ‘disinflation’ – the latter being successively lower rates of inflation – the conditions are excellent for material gains in innovative growth stocks. If your question is whether high P/E stocks, which have led the decline, are likely to lead a recovery, the answer may be, yes.”

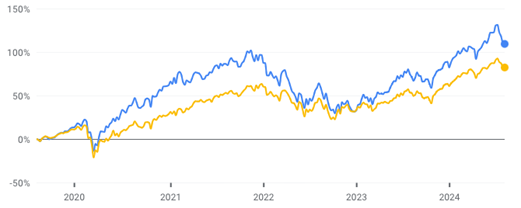

That was in August 2022. Since then, the S&P 500 is up 41.7 per cent, and the Nasdaq has risen 47.8 per cent, even after the recent conniptions.

Since then, we have continued to promote the idea that innovative small-cap growth companies would outperform, having been hitherto left behind the mega-cap tech companies (which themselves were preferred amid lingering fears of recession).

More recently, we have suggested the bull run could run until 2026; “I am optimistic about the prospects for equity markets for the remainder of 2024 and for all of 2025. I believe a process of risk adoption is underway, reversing the conservative stance that dominated sentiment in 2022 and most of 2023 amid fears of rising interest rates and recession. With the subsequent side-stepping of recession along with the acceptance that rates have probably peaked, and with slow deflation continuing, investor appetite for risk can begin to improve.

“The process of investors accepting a more optimistic outlook and then acting on it takes time because there’s inertia, the change isn’t accepted by all investors all at once, and some investors need to see rising share prices before jumping aboard. It could take a couple of years for most investors to be bullish again. From the beginning of the change in outlook, a two-year process of ‘bullish adoption’ would take us to early 2026.”

Figure 1. S&P 500 (yellow) and Nasdaq Composite (blue)

So, what are others suggesting is in store for equity markets? Here are ten predictions, observations and insights:

- As companies were on the cusp of reporting their Q2’24 results, Societe Generale strategist Albert Edwards said, it won’t necessarily take a major blow-up to prick this tech “bubble” – a simple change in the confidence in the magnificent seven’s earnings outlook may do the trick. There’s a hell of a lot now riding on the quarterly profits of Amazon, Microsoft, Apple, Meta and Nvidia over the coming weeks.

- Nick Ferres, chief investment officer at Singapore-based Vantage Asset Management, is one market watcher who has been consistent in his warnings on market complacency. In the first two weeks of July, he put his money where his mouth is, cutting his firm’s equity exposure by 60 per cent, from 100 per cent. “From our perch, the risk-reward on equities have deteriorated for the second half of 2024. For us, the key concern is elevated valuation, narrow equity risk premium and low implied volatility. Stated differently, compensation for risk is poor.”

- On May 20, Fortune reported Wall Street’s top strategist in 2022 and its biggest bear “just gave up on waiting for winter. After predicting a serious stock market correction for over a year, Morgan Stanley’s chief investment officer and chief U.S. equity strategist Mike Wilson changed his tune in a Sunday note, saying he now expects the S&P 500 to rise 1.5 per cent to 5,400 over the next 12 months. A 1.5 per cent rise in stocks over a 12-month period may not sound like a bullish take, given the roughly 10 per cent average annual return of the S&P 500 over the past 100 years, but it’s a big change of heart for Wilson. The veteran strategist previously expected the blue-chip index to sink 15 per cent to 4,500 over the next 12 months—and he’s been bearish for some time.”

- In late May, JP Morgan’s Marko Kolanovic defended his stubborn, negative stance on the U.S. stocks, asserting that the S&P 500 was substantially overvalued, and predicted that the big cap index would end the year at 4200, down 24 per cent from its level at the time.

- On April 15, Ken Fisher wrote, “So far, so good! My 2024 outlook called for strong gains… Global returns of 11.6 per cent through to April 8, alongside a 3.9 per cent ASX rise, speak to just that. More gains await. One key reason? Sentiment. Stocks always move most on the gap between expectation and subsequent results, so gauging the former is crucial.”

- More recently, Fisher added, “This concept that so many people have wrongly had that the market was only about the “Magnificent Seven” or the “Fab Four” or whatever you want, is just wrong when you look at how many countries around the world that have nothing to do with tech have had all-time global highs this year.”

- In February, Billionaire Futures trader and hedge fund manager Paul Tudor Jones told CNBC that the U.S. economy could run into major problems down the road due to its burgeoning fiscal deficits and that the U.S. economy is on an unsustainable path threatening markets.

- Mark Spitznagel, whose Universa Investments specializes in betting on market volatility, told the Wall Street Journal in July that he sees the current financial outlook as like a ‘tinderbox.’ But while Spitznagel described the economy as going through a ‘Goldilocks phase,’ he doesn’t believe it has the foundations to last. He told the Wall Street Journal that rate cuts can often trigger market reversals down the line, and said he is already seeing some other investors follow his lead despite the market’s current state.

- A year ago, Michael Burry, the “Big Short” investor who became famous for correctly predicting the epic collapse of the housing market in 2008, bet more than $1.6 billion on a Wall Street crash. According to CNN, “Burry’s fund, Scion Asset Management, bought US$866 million in put options against a fund that tracks the S&P 500 and $739 million in put options against a fund that tracks the Nasdaq 100. Burry is using more than 90 per cent of his portfolio to bet on a market downturn, according to the filings.”

- In March 2024, Bridgewater founder Ray Dalio says he didn’t think the stock market resembled a bubble. The legendary hedge fund investor said despite the recent euphoria and rallies in the market, the landscape did not entirely meet his criteria for what constitutes a bubble. Among the factors he looks for are high prices relative to value, signs of unsustainable growth, naïve buyers piling in and speculating, and a large share of purchases financed by debt. “When I look at the U.S. stock market using these criteria it — and even some of the parts that have rallied the most and gotten media attention — doesn’t look very bubbly.”

And one extra prediction, just for good measure…

- In May, Wall Street’s biggest bull reportedly wished he’d been even more bullish. BMO Capital Markets chief investment strategist, Brian Belski wrote, “It has become clear to us that we underestimated the strength of the market momentum,” and revised his 2024 year-end forecast to a high of 5,600.