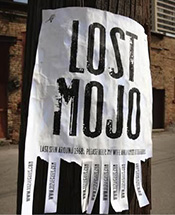

Monadelphous’s Missing Mojo

REPORTING SEASON SPECIAL EDITION: In this bonus white paper, exclusively for rogermontgomery.com subscribers, find out what Montgomery’s view on Monadelphous’s intrinsic value is and why the former market darling Monadelphous is lacking in mojo.

To subscribe and gain full access to all of our white papers containing in-depth analyses and hot tips for value investing, click here.

EXCLUSIVE CONTENT

subscribe for free

or sign in to access the article

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking. Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

He is also author of best-selling investment guide-book for the stock market, Value.able – how to value the best stocks and buy them for less than they are worth.

Roger appears regularly on television and radio, and in the press, including ABC radio and TV, The Australian and Ausbiz. View upcoming media appearances.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Is there anything holding Monadelphous back from establishing a presence in urban infrastructure? (roads, rail, buildings, etc.) I would have thought the engineering and project management skills within the company would be fairly transferable to these types of projects. I would imagine that a sizable part of MND’s workforce is urban based as well (design engineers in the Perth or Brisbane offices or FIFO workers). It made sense to focus operations solely on the mining sector during the boom, but I can’t see any reason why they couldn’t diversify now the boom is over and establish themselves as a major competitor to Leightons.

Thanks Benjamin. Send their investor relations that question and we await the response.

A friend of mine got a bit excited about the MND headline “record profit” today but I had to point out that he was missing the point by not reading management’s comments which indicated that it was not to be repeated, that there had been a shift in attitude in the mining sector away from expansion, that conditions going forward were going to be ‘challenging’ and to expect lower revenue for the next while. There were several of these clues. The one business I find hard to form a strong opinion on is Mineral Resources because on the one hand it has the crushing business which is going to be processing more ore, but on the other we have the iron ore mining exposure which could swing quite a bit with the price of the commodity. For me, I feel the safest to be in is Titan Energy because they are exposed to the gas industry which should proceed unabated and they seem to have established themselves as a quality provider in a short space of time which could win them a lot of work from a small base. I think prices in the others are going to have to slide quite a bit to get value investors interested.

Thanks for sharing those ideas David.

I guess it would be wise to stay clear of all mining services companies for the time being except perhaps WOR

Yes and take a look at Fleetwood’s 77% NPAT decline!

Management has played its cards very close to its chest since February, making it very difficult to form an opinion going forward. I held the stock from early days and progressively sold through the high teens and low twenties as the margin of safety needed to widen. Still watching the stock because of the respect I have for management. Once China’s social evolution catches up with its urban evolution, (currently unoccupied new cities are inhabited) there will be another opportunity for Australia’s resource activity growth. The value of MND’s maintenance contracts may sustain income. Similar case to ALQ.

I think you are right Ian, There will be another day in the sun for MND, albeit the length of the wait is unknown…

Great report Roger on MND, to identify one of the few undervalued stocks in the current market.

How about a report on DCG? –maybe it has slightly better prospects as it turns expertise in mining services to the provision of offshore detention centre construction. Best wishes

WIll take a look Lindsay. Thanks for the thought.