Why small cap companies are poised for growth in 2024

In this week’s video insight, I delve into the promising realm of small cap companies for 2024, a sector where I’ve maintained a bullish stance since November 2022. The Small Ordinaries Index and the S&P600 Small Cap Index have shown noteworthy gains, underscoring the potential that these companies hold in a recovering economy. As global economic indicators signal a gradual improvement and the potential for a disinflationary boom, the stage is set for innovative small caps to thrive, especially with interest rates poised for a cut.

Transcript:

As you know, I have been bullish about small cap companies for 2024. In fact, I first advocated adding to small cap holdings back in November 2022 and then again in May last year. That call has proven timely for investors with the Small Ordinaries Index up, 5.45 per cent, year to date, and up 21 per cent since the low of October 30, last year. The story is similar overseas, with global small caps also doing well. The S&P600 Small Cap Index is up 23 per cent since its October lows, with most of those gains made early, and the index up just a per cent year to date.

We know historically, small-cap equities outperform their large-cap counterparts in the early stages of an economic recovery, when economic growth accelerates. According to Goldman Sachs economists, (and keep in mind economists get it wrong as often as they get it right), 2024 real U.S. gross domestic product (GDP) growth is expected to come in at 2 per cent. Bloomberg has consensus estimates for growth at 1.6 per cent. Elsewhere, the world manufacturing cycle is staging a broad-based recovery, which often foreshadows the direction of the global economy.

Global GDP activity is indeed gradually improving, which should lead to consensus earnings upgrades. Think ‘soft economic “landing” = gentle “take off” for corporate profits.

It sounds like the world economy entering a disinflationary boom…If so, that would be especially rewarding for investors in quality innovators just as it has been in the past.

For my purposes what is important is not whether growth is 1.6 per cent or 1.8 per cent or 2 per cent. What’s important is that it is positive. As I have been emphasising frequently over the last twelve months or so, positive economic growth, even when anaemic, is supportive for innovative companies provided it is accompanied by disinflation.

Other analysts have a different take; when growth reaches one to two per cent per annum, global small caps have, on average, outperformed large caps… provided interest rates fall.

According to Goldman Sachs, after “an extended pause in global interest rates, they believe we’re now on the cusp of a rate-cutting cycle as inflationary pressures, for the most part, appear to be under control”.

So, after rates rose at an unprecedented rate for the current generation of investors, we now have a consensus that rate cuts are on the horizon. Small caps tend to beat large caps as rates begin falling, and remember, interest rates act like gravity on asset valuations – as rates fall, the gravitational pull on valuations becomes lighter. Finally, falling interest rates also benefit equities by lowering of the cost of capital and boosting profitability.

Who knows…We could have the perfect set-up for small caps this year and next… If disinflation is accompanied by some interest rate cuts and positive economic growth, the equity prices of quality innovators should go up. Of course, nothing is ever certain, but I am backing small caps domestically through the Montgomery Small Companies Fund and globally through The Polen Capital Global Small and Mid Cap Fund…. and don’t forget the recent reporting season proved corporate profits were much more resilient than many had feared.

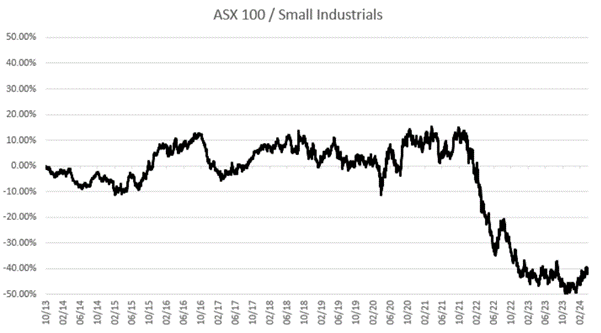

Prior to all of this rosy-ness of course, small caps had a very tough 2022 and most of 2023 relative to their large-cap peers. Have a look at this chart.

As you can see, as has often been experienced, smaller stocks, being less liquid, reflected investors’ concerns more acutely and the challenge for small caps in 22 and 23 was that interest rates were rising, leading to concerns about economic growth.

The good news is that not only is the backdrop now much more supportive for small caps but the previous conditions that drove concerns has meant smalls are the cheapest relative to big caps for many years.

And for those who worry that economic growth might not remain positive, what we have is a valuation environment for small caps that potentially provides good downside protection….

As you can see from this second chart, which is one-year forward price-to-earnings (PE) ratio for the U.S. S&P600 small cap index, the multiple of earnings investors are willing to pay for smaller companies has only been lower after the global financial crisis (GFC), during the GFC, and after the tech wreck at the turn of the century.

The small cap investment universe is one of the most exciting parts of the market in which to invest. You can gain exposure to sectors, industries and themes that simply aren’t available in large caps. Also worth keeping in mind is the small cap universe is always expanding and being refreshed. New companies emerge, there are IPOs, and all the merger and spinoff activity ensures there’s always an opportunity around the corner for those willing to devote their time to the analysis.

You could of course simply run out and buy stocks like Megaport (ASX:MP1), Macquarie Technology (ASX:MAQ), Life360 (ASX:360), Lovisa (ASX:LOV) or Audinate (ASX:AD8) – they’re all stocks owned in the Montgomery Small Companies Fund, so don’t do that as you’ll just be helping us. And the other problem, of course, is you may not know when the manager decides to change their mind and sell. We might not revisit those stocks here at the blog either, and you won’t know we have changed our mind… If you’re convinced, as I am, that small caps are worth having in your portfolio, and that now is the right time, instead of grinding away looking at each small cap stock and assessing its merits yourself, think about handing the reins over to a great small cap team and invest in their fund. That’s what I have done. Speak to your adviser about whether that’s the right course of action for you too.

The Montgomery Small Companies Fund owns shares in Megaport, Macquarie Technology, Life360. Lovisa and Audinate. This blog was prepared 10 April 2024 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Megaport, Macquarie Technology, Life360. Lovisa or Audinate, you should seek financial advice.