Putting today’s market in context

For investors, the last four years have seen some remarkable events, which have had a profound impact on equity markets globally. Volatility has been elevated on both the ups and downs. The global pandemic that began in early 2020 induced a sharp correction as the initial curtailment of day-to-day activity became apparent. This reversed quite rapidly with many listed companies posting outsized gains as they benefitted from changing behaviours.

As the pandemic waned, various COVID-era government stimuli, supply chain issues, and the Russian invasion of Ukraine brought a resurgence of inflation after many years of muted price rises and historically low interest rates. Mandated with controlling inflation, most major central banks had little option but to embark on a rapid and sustained program of monetary tightening, which was a novel experience for many market participants.

Throughout 2022, the growth equity universe of companies experienced rapid drawdowns as the present value of future earnings was repriced, with little attention paid to differentiating between companies with established high and steady levels of revenues and profits and those much more speculative in nature.

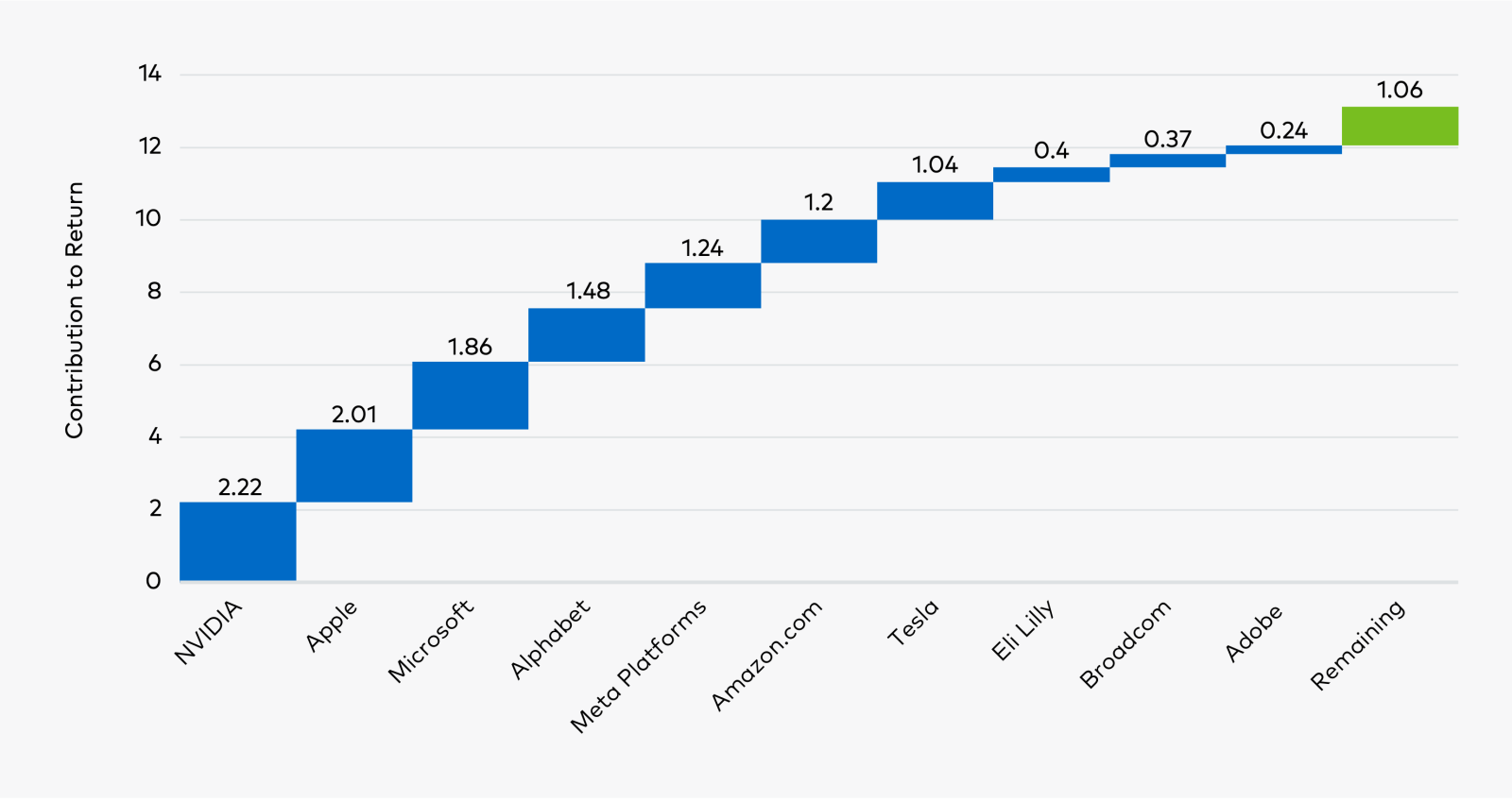

While 2023 saw a return to rewarding robust fundamentals, equity market returns have been distorted by a handful of companies, predominantly in the technology space. Through the third quarter of the year, approximately 92 per cent of the S&P 500 Index’s market return was accounted for by the top ten holdings, as shown in Figure 5. The factors behind this unusual phenomenon are varied, in our opinion. In our view, the generally low interest rate environment over the past decade, breakthrough innovations like generative artificial intelligence (AI), the emergence of platform businesses, and winner-take-all (or most) market dynamics are all contributing factors. Index concentration is also visible globally, with ten stocks accounting for 65 per cent of the MSCI ACWI Index return over the same period.1

Figure 1: 92 per cent of the S&P 500 Index return from ten stocks

Source: Bloomberg. Reflects top ten contributors to the S&P 500 Index return from 12-31-2022 to 09-30-2023. Past performance cannot guarantee future results.

Source: Bloomberg. Reflects top ten contributors to the S&P 500 Index return from 12-31-2022 to 09-30-2023. Past performance cannot guarantee future results.

Recent near-term volatility, driven largely by macroeconomic and political events, has presented challenges for long-term, fundamental investors like us. As always, however, we must look to the future while learning from the past. We must remain diligent and patient when the market is temporarily not rewarding the businesses with the most robust, durable fundamentals.

Looking ahead in large company growth: Key takeaways for investors

In 2024, we will continue to spend the bulk of our time analysing and understanding companies and their competitive environments.

We invest only in what we believe are the most competitively advantaged businesses in the world, a highly focused cohort of companies that, according to our research, are well positioned to drive the mid-teens earnings per share (EPS) growth we seek across our portfolios.

Our experience shows that by focusing on what we believe to be high-quality companies and getting our earnings growth predictions directionally right, the share prices for these businesses should follow earnings growth over the long term. We remain very much on track to achieve this in our large company portfolios over the next three to five years.

Today, the broader index returns are far outpacing the underlying earnings growth of the constituent companies, which suggests that multiple expansion is having an outsized effect on performance. We believe a credible case exists that equity market valuations may revert to their long-term average. If so, this would imply that earnings growth could be a much larger component of future total returns compared to the past decade.

1Source: Bloomberg, as of September 30, 2023.