Avita Medical’s medium-term prospects getting better

Avita Medical’s (ASX:AVH) RECELL System was first approved in the U.S. for the treatment of severe burns in 2018 and prepares, produces, and delivers a regenerative cell suspension, Spray-On Skin Cells, using a small amount of a patient’s own skin.

Earlier this month, Avita Medical received U.S. Food and Drug Administration (FDA) approval, via the Breakthrough Device designation, to use its RECELL System to treat full-thickness skin defects. “The FDA approval now offers surgeons a best-in-class treatment option for a multitude of severe wounds within inpatient and outpatient settings.”

It is understood this represents an expansion of the company’s market opportunity of at least five times, with 145,000 targeted procedures versus the current 25,000 to 35,000 targeted burn procedures. Avita Medical have doubled its field sales force in anticipation of the July 2023 launch, and revenue – which hit US$10.6 million in the March 2023 Quarter, up 40 per cent year-on-year – is expected to ramp-up considerably over the next few years.

The company’s prospects received a boost with the U.S. FDA now supporting Avita Medical’s application for premarket approval (PMA) of its RECELL System for the treatment of vitiligo, a skin condition where patches of skin become pale or white. This is the first therapeutic device offering a one-time treatment at the point-of-care and a pilot program lasting around two years is expected to commence next month, with the commercial launch planned for 2025.

“RECELL represents first-in-class treatment for repigmentation through the delivery of normal, healthy skin cells,” said Jim Corbett, Chief Executive Officer of AVITA Medical. “This is a breakthrough approval for AVITA Medical, significantly expanding the clinical applications for RECELL”.

The premarket approval was evaluated by an expert central review committee (CRC) at six and twelve months after treatment and based upon results from the study comparing repigmentation success rates with the RECELL treatment, which had a superior endpoint. At the six-month point, treating physicians reported a success for 68 per cent of patients for the RECELL treatment, while 80 per cent of patients self-reported it as a success.

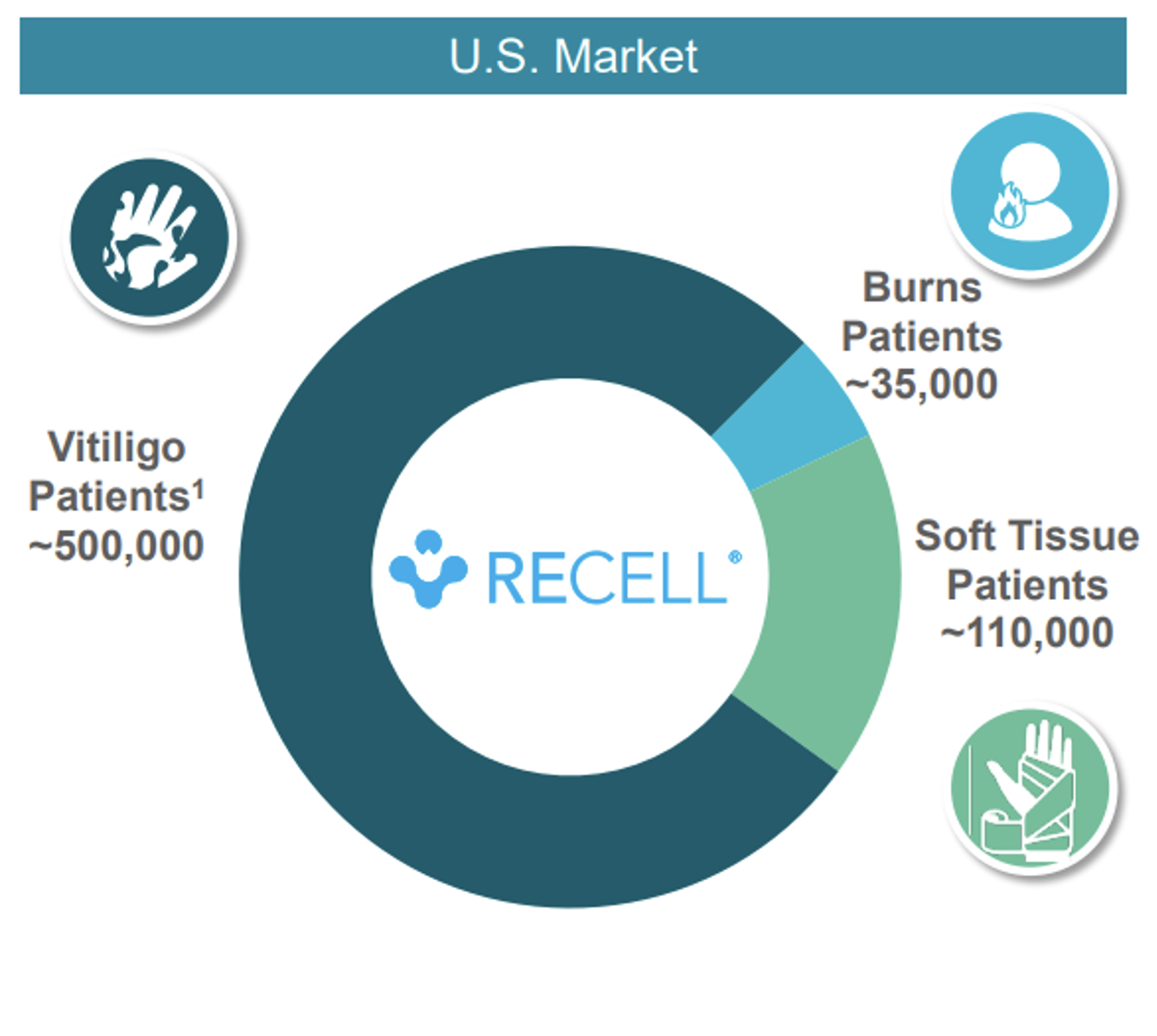

The US market size for Vitiligo is estimated at 500,000 patients and compares with 35,000 Burns Patients and 110,000 Soft Tissue Patients.

With the dramatic increase in the market opportunity from Burns patients to Soft Tissue patients about to commence, and then an anticipated opening-up for the Vitiligo patients from around 2025, it seems Avita Medical has impressive prospects over the medium-term.

You can read my previous blog post on Avita Medical below:

Avita Medical receives FDA approval for full-thickness skin defects

The Montgomery Funds and Australian Eagle Trust Long Short Fund own shares in Avita Medical. This article was prepared 20 June 2023 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Avita Medical you should seek financial advice.