The US Federal Reserve and “Talk of Tapering” (Part 2)

As real interest rates increase, PE multiples should theoretically contract.

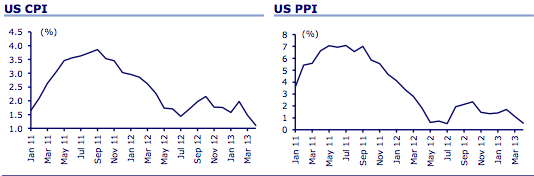

In the past eleven months, US 30 Year Bonds have risen over 1.0% – from 2.45% to above 3.50% – while inflationary expectations have been declining.

In our blog of Friday 7 June 2013 (click here), we focused on rising real US long bond yields or US 30 year bonds minus inflationary expectations.

Because the Federal Reserve has been buying so much Treasury paper ($85b per month) over the past couple of years, artificially low rates of interest have not been allowed to seek their own “clearing” level.

If Federal Reserve Bank demand subsides with tapering, as has recently been indicated by Ben Bernanke, then the “market” will increasingly set interest rates (rather than the Federal Reserve).

And with the improvement to the US economy, that is exactly what is being anticipated.

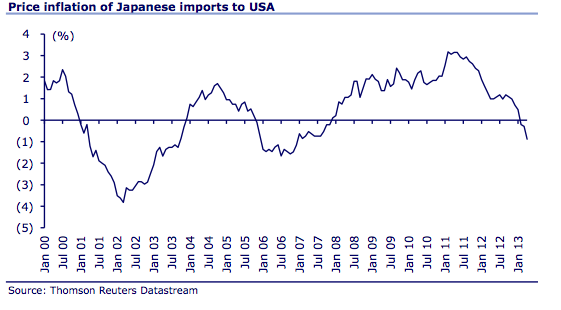

The US is now importing deflation from Japan.

The 20 per cent depreciation in the Yen/US$ exchange rate in the past six months is making Japan’s exports more competitive.

It is logical that Japan’s competitors, Korea and China, are cutting the price of their exports in response.

Assuming US inflationary expectations continue their decline, this may lead to a further increase in US real interest rates.

And the more real bond yields rise, the more nervous equity investors will get.

It should also be added that “the more real bond yields rise, the less free cash flow is available to service new debt – let alone the existing mountains of it.” Indeed maybe the rise in the real rate reflects a concern about the creditworthiness of the world’s biggest borrower…

David,

This is a little counter-intuitive: an expectation of rising interest rates while inflation stays in check. Is there a level of interest rates in the US that would be considered “normal” (or a ceiling) if QE ends, and above which rates should only rise if inflation became a problem?

thanks