The silver lining in higher rates

Financial media is replete with stories observing the fastest increase in interest rates in recent memory, the end of the declining interest rate era, how the fastest rise in short-term rates is inverting the yield curve (2-year bond yields higher than 10-year bonds) and predicting a recession, rising rates are causing the property market to collapse, and how causal inflation is responsible for it all and the financial destruction of many peoples’ lives.

Investors are understandably fearful. Inflation, recession, more rate rises, central banks behind the curve. There’s a mountain to worry about.

The shift to a rising rate environment has not been without negative implications for many equity investors. Spare a thought, for example for those who ignored experience and wisdom and invested in what I call the “profitless prosperity stocks” we consistently warned investors about, some of which have fallen more than 75 per cent from their highs, and even after January’s bounce, remain at prices less than half their 2022 market valuations, such as Wayfair, Shopify, Tesla, Peloton, Carvana, Zillow and Coinbase.

But there’s also good news. Some investors are doing much better amid the higher interest rates.

Before exploring one of these now-more-attractive investments, two Warren Buffett quotes come to mind;

“The most common cause of low prices is pessimism — sometimes pervasive, sometimes specific to a company or industry. We want to do business in such an environment, not because we like pessimism but because we like the prices it produces. It’s optimism that is the enemy of the rational buyer.”

And…

“Smile when you read a headline that says, ‘Investors lose as market falls’. Edit it in your mind to ‘Disinvestors lose as market falls — but investors gain’. Though writers often forget this truism, there is a buyer for every seller and what hurts one necessarily helps the other.”

The reason for the Buffetisms is that interest rates have been high before. What did investors experience then, and how did they respond? And can we learn anything from those experiences?

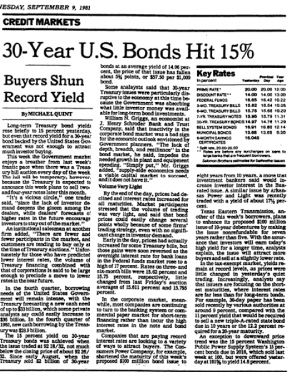

In the northern hemisphere autumn of 1981, the yield on the 30-year U.S. Treasury Bond hit 15 per cent (figure 1.).

Figure 1. New York Times article 1981

Source: New York Times, September 9, 1981, Section D, Page 12

The New York Times article observed, “Long-term Treasury bond yields rose briefly to 15 per cent yesterday, but even that record yield for a 30-year bond backed by the United States Government was not enough to attract much investor buying”, adding, “it’s a vicious circle,” one trader said, ”since the lack of investor demand deepens the gloom among the dealers, while dealers’ forecasts of higher rates in the future encourage investors to stay out of the market.”

Taking Buffett’s advice, ignoring the forecasts of impending doom, and just looking at the merit of the investment opportunity presented, surely you would have purchased these bonds offering 15 per cent for 30 years and backed by the U.S. Treasury all day long. What was wrong with locking in 15 per cent per annum, ensconcing oneself on a beach and living off the interest for 30 years?

According to the New York Times, precious few investors did.

That’s because inflation was roaring and the real returns weren’t nearly as high. Add to that, the prediction of even higher interest rates (which would produce unrealised capital losses for bond buyers), and the then hitherto capital losses from bonds as interest rates rose towards those fateful 15 per cent levels, and it’s easy to see why investors remained agnostic.

As an aside, you could have also bought into the S&P500 index, and with dividends reinvested over the next 30 years, returned 892.29 per cent, or 7.95 per cent per annum[1].

Today, returns from bonds aren’t nearly as high but the sentiment is largely the same. Meanwhile, returns from interest-earning investments have been improving. When risk free rates improve so do those along the entire risk curve. Treasury bonds, corporate bonds, private credit and high-yield bonds all begin offering higher income returns.

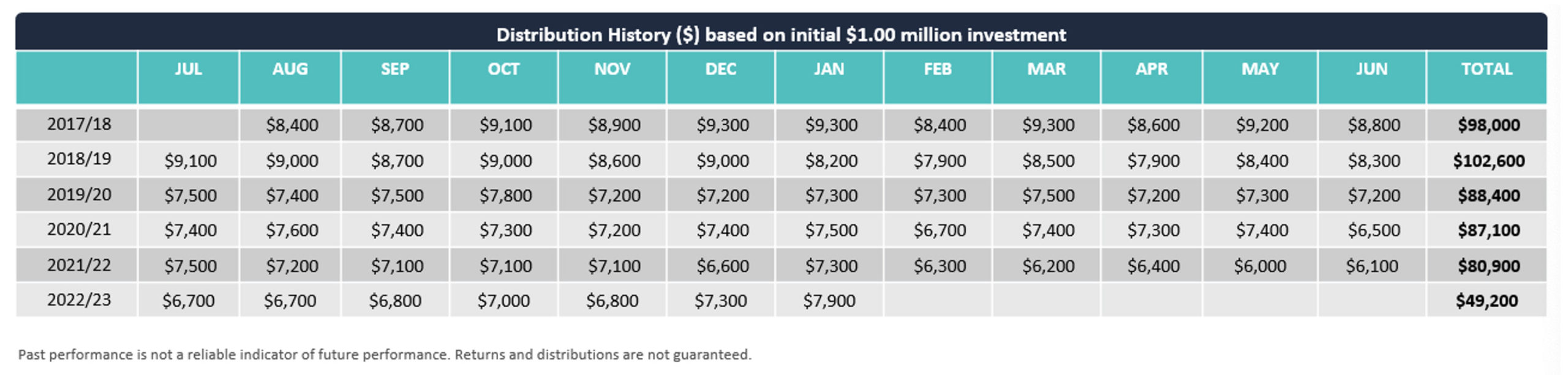

Investors in the Aura High Yield SME Fund have recently experienced rising monthly cash income commensurate with the rising interest rate environment already discussed. While the sell-off in some company shares can only be described as ‘carnage’, investors in the Aura High Yield SME Fund have continued to receive positive monthly income. And they’ve achieved this without diminution in the capital value of their units. Figure 2., illustrates the track record of monthly cash income payments.

Figure 2., Aura High Yield SME Fund monthly income

As interest rates have risen during 2022, and in February 2023, the monthly income paid to a hypothetical investor (with $1 million invested) in the Aura High Yield SME Fund has likewise risen from $6,000 per month ($72,000 annualised, on a $1.0 million investment) back in May 2022 to $7,900 per month ($94,800 annualised) in January this year.

The annualised rate of return for an investor in the Fund, based on January 2022 income, is 9.48 per cent. And keep in mind the five and a half-year track record of monthly cash income above takes into account the period of the COVID-19 pandemic.

The Fund has maintained its five and a half-year track record of monthly cash income as interest rates have risen. Indeed, returns have increased commensurate with the rise in interest rates.

Potential benefits of private credit

Importantly, unlike the stock market, the Aura High Yield SME Fund is not one that an investor might feel the obligation to time their entry into. Private Credit investors are not equity investors. Equity investors have the potential for very high returns because they participate in the volatility of equity markets. By withstanding the volatility, equity investors can receive capital gains and growing income over time.

Private Credit investors are not exposed to equity market risks and therefore avoid the equity market volatility.

While there are risks associated with funds that invest in small and medium enterprise loans – even a fund like the Aura High Yield SME Fund, which is diversified across more than ten thousand small short-term loans – some of those risks are different to the timing risks associated with entry into an equity market investment.

For a balanced portfolio, one role a private credit fund like the Aura High Yield SME Fund can potentially play is the defensive role. Conventionally, this role is satisfied by fixed-income products such as corporate bonds and hybrids.

Meanwhile, at the other end of the spectrum, higher risk, higher yield Private Credit products can be used as an alternative to generate equity market like income, without the associated volatility of equity markets.

Higher rates equal better yields

For many years, the declining interest rate environment pushed investors further and further out along the risk curve in an attempt to generate better returns. Investments in venture capital and private equity, bitcoin and NFTs (non-fungible tokens) were not uncommon even among regular retail investors. Higher rates, however, have put an end to that speculative bubble, crashing the value of many of those assets, but higher rates have also made other investments, such as credit funds, potentially more attractive.

In 1981 investors shunned the attractive returns available from U.S. Treasury Bonds. Speak to your adviser about how to avoid repeating that mistake today.

If you would like to learn more about the Aura Core Income Fund, please visit the fund’s web page to learn more: Aura Core Income Fund

If you would like to learn more about the Aura High Yield SME Fund (wholesale clients only), please visit the fund’s web page to learn more: Aura High Yield SME Fund

You should read the relevant Product Disclosure Statement (PDS) or Information Memorandum (IM) before deciding to acquire any investment products.

Past performance is not an indicator of future performance. Returns are not guaranteed and so the value of an investment may rise or fall.

[1] Source: S&P 500 Return Calculator, with Dividend Reinvestment

This information is provided by Montgomery Investment Management Pty Ltd (ACN 139 161 701 | AFSL 354564) (Montgomery) as authorised distributor of the Aura Core Income Fund (ARSN 658 462 652) (Fund). As authorised distributor, Montgomery is entitled to earn distribution fees paid by the investment manager and, subject to certain conditions being met, may be issued equity in the investment manager or entities associated with the investment manager.

The Aura Core Income Fund (ARSN 658 462 652)(Fund) is issued by One Managed Investment Funds Limited (ACN 117 400 987 | AFSL 297042) (OMIFL) as responsible entity for the Fund. Aura Credit Holdings Pty Ltd (ACN 656 261 200) (ACH) is the investment manager of the Fund and operates as a Corporate Authorised Representative (CAR 1297296) of Aura Capital Pty Ltd (ACN 143 700 887 | AFSL 366230).

You should obtain and carefully consider the Product Disclosure Statement (PDS) and Target Market Determination (TMD) for the Aura Core Income Fund before making any decision about whether to acquire or continue to hold an interest in the Fund. Applications for units in the Fund can only be made through a valid paper or online application form accompanying the PDS. The PDS, TMD, continuous disclosure notices and relevant application form may be obtained from www.oneinvestment.com.au/auracoreincomefund or from Montgomery.

The Aura High Yield SME Fund is an unregistered managed investment scheme for wholesale clients only and is issued under an Information Memorandum by Aura Funds Management Pty Ltd (ABN 96 607 158 814, Authorised Representative No. 1233893 of Aura Capital Pty Ltd AFSL No. 366 230, ABN 48 143 700 887).

Any financial product advice given is of a general nature only. The information has been provided without taking into account the investment objectives, financial situation or needs of any particular investor. Therefore, before acting on the information contained in this report you should seek professional advice and consider whether the information is appropriate in light of your objectives, financial situation and needs.

Montgomery, ACH and OMIFL do not guarantee the performance of the Fund, the repayment of any capital or any rate of return. Investing in any financial product is subject to investment risk including possible loss. Past performance is not a reliable indicator of future performance. Information in this report may be based on information provided by third parties that may not have been verified.

Thanks Roger

Sorry meant to say “Wouldn’t the fund act like a bond where prices fall as the yields rise and vice versa?

Thanks Roger, can you explain to me how the yield of the fund can increase without any diminution in the capital value of its unit’s ?

Wouldn’t the fund act like a bond where prices fall as the yields fall and vice versa?

Does this mean the unit prices wouldn’t increase as yields fall?

I’m confused.

Hi Simon, sorry for the delay in replying. These aren’t fixed rate securities on a secondary market whose prices adjusts to the prevailing interest rates. An investor buys a unit for $1 and receives all the variable income generated from the loaning of that dollar. As long as there are no defaults that become unrecoverable, there is no diminution in the value of the units. Borrowers have to pay back the interest and the principle. Think about a bank lending its cash to borrowers. As interest rates go up they charge more. Borrowers have to pay back the higher interest and the original dollar borrowed.