Carsales continues to profit from a booming car market

If you’ve been shopping for a new or used car over the last two years, you would have noticed that prices have rocketed. That’s been a major benefit to car retailers, like Eagers Automotive. It’s also boosted the revenues and share price of Carsales.com (ASX:CAR), the online automotive marketplace, which has just reported its half-year results.

Second-hand car prices began hitting the headlines when the COVID-19 pandemic had public transport users running for their lives, and into the arms of used car vendors and salesmen.

COVID-19’s impact on the new and used car market, however, has been nuanced, and it occurred at the same time interest rates hit record lows and Bitcoin mining had scooped up the global supply of semiconductor chips.

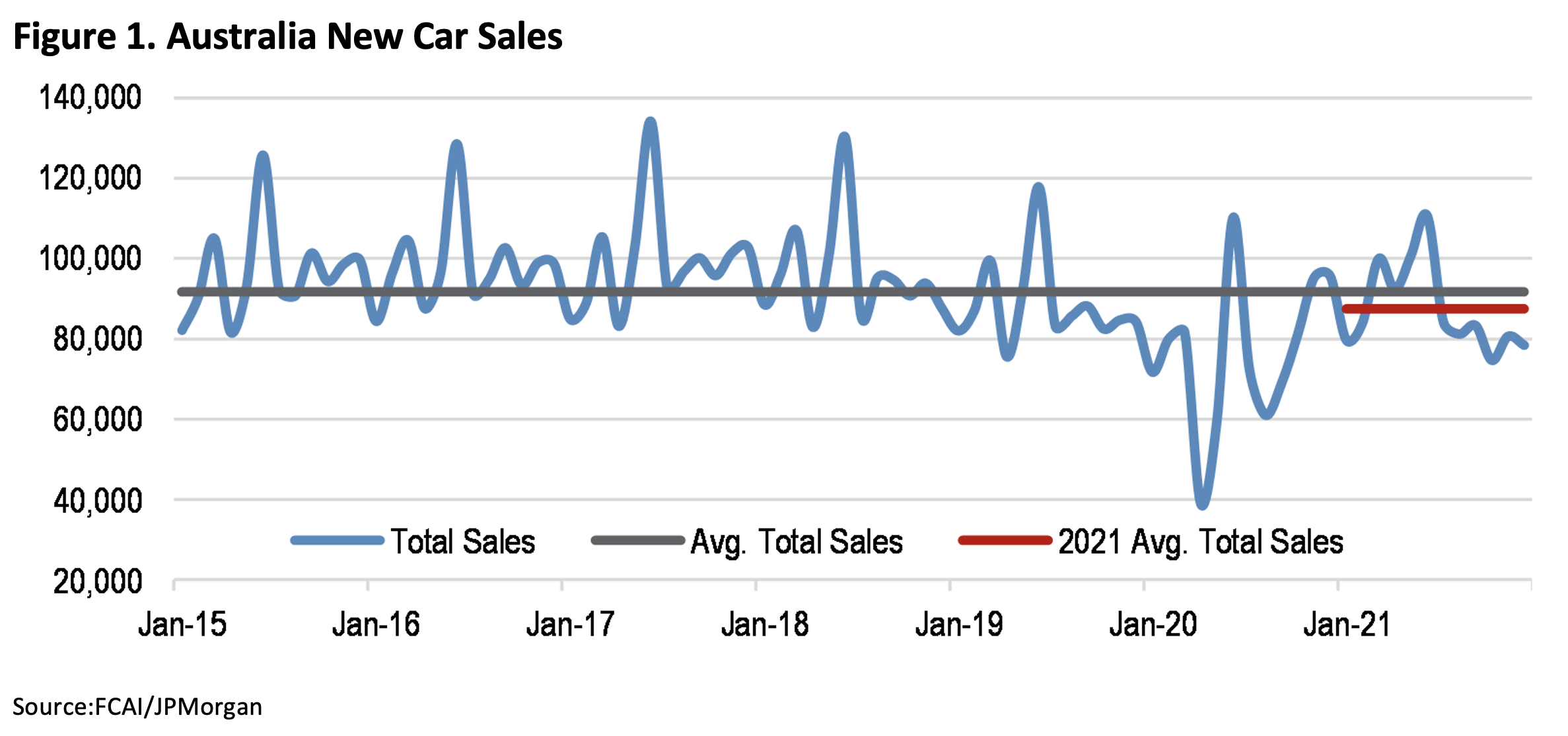

One the biggest impacts has been the fall in the volume of new cars available for sale. This is reflected in Figure 1.

One company navigating the eye of this tumult is Carsales.

Take outs from the first half results announcement

The two key takeaways from the results announcement were the company beating consensus estimates for the first half, and the reiteration of the company’s full year guidance for earnings.

Carsales’s first half revenues of $242m were well ahead of consensus. This is probably because the company included the TyreConnect business revenues of around $12.5 million. Excluding TyreConnect, however, total revenue was slightly ahead of the market’s estimate of $228 million. First half EBITDA (adjusted) was $127 million, which also beat market consensus estimates of $124 million. Finally, net earnings after tax of $89 million was ahead of the market’s $82 million estimate.

Perhaps on the back of the stronger-than-expected result the share price initially jumped from $21.65 to $23.10 but the company merely reiterated its existing full year profit guidance. Perhaps as the market digested this, the share price sank as low as $21.22.

It remains possible the company is being conservative, but some analysts believe strong top line growth will be offset by softer margins.

In the short term, Carsales is expected to benefit from dealers being in ‘clover,’ flush with cash on the back of improving volumes (as the chip shortage begins to resolve) and higher new and used vehicle prices. The additional liquidity available to car dealers may see them spend more on advertising and marketing.

Additionally, Carsales launched geographic location-based pricing in August last year. In September, it increased prices in Sydney, Brisbane and Melbourne and reduced prices in the other capital cities. This suggests the company will be more dynamic with its pricing. Indeed, more recently the websites User Interface was changed. Advertisers previously chose the advertising tier and then the make and model of the vehicle being advertised. This has now been reversed suggesting Carsales is positioning to be more responsive to geography, brand of vehicle, models, features, as well as supply and demand.

Growth options and sustained earnings

In addition to organic growth in its existing domestic business, the company has several exogenous growth options including international markets (for example, the company part owns Trader Interactive – RVTrader, ATVTrader, PWCTrader and AeroTrader in the US), digital retailing (Carsales Select*), trade-in and finance, all of which could see CAR achieve management’s aim of generating sustained double-digit revenue and earnings growth.

These positives need to be assessed considering the execution risks associated with starting new businesses overseas and new adjacency businesses domestically, the possibility of the pandemic ending the heightened demand for leisure vehicles (Trader Interactive), the threat from OEMs (Original Equipment manufacturers) switching to an Agency model in Australia, and the entry of new competitors in the Australian digital retail space such as CARS24. On that latter point, however, it is worth remembering investors feared new entrants competing REA Group’s advantage away (and that was when REA’s share price was $13.00).

There are always risks. Investors are rewarded for correctly assessing those risks. Investors buying Carsales today are paying five times FY23 equity generating 21 per cent return per annum. It’s no bargain at the moment but investors need to ask whether the many options Carsales has could materially improve the return on equity, remembering few bargains exist when interest rates are at historic lows.

*Carsales Select seeks to offer used car buyers peace of mind by providing a detailed car history including registration and accidents, a full ‘pre-inspection’, imperfection photos and a 7-day money-back guarantee.