What the Age of Disorder means for investors

As you’ve no doubt noticed, the news these days is awash with reports of social unrest across the world. It’s prompted Deutsche Bank’s global strategists to argue that we’ve entered the Age of Disorder. They point to six major trends that, together, support their thesis – and which could have a big impact on equity returns in coming years.

Each year, Deutsche Bank’s global strategists publish a long-term asset return study looking back at the performance of different asset classes over time for as long as data is available and also try to look forward and make predictions of what will happen in the future.

In this publication, the strategists argue that we are entering an Age of Disorder which will lead to significant changes to the trends we have seen during the last 30 years.

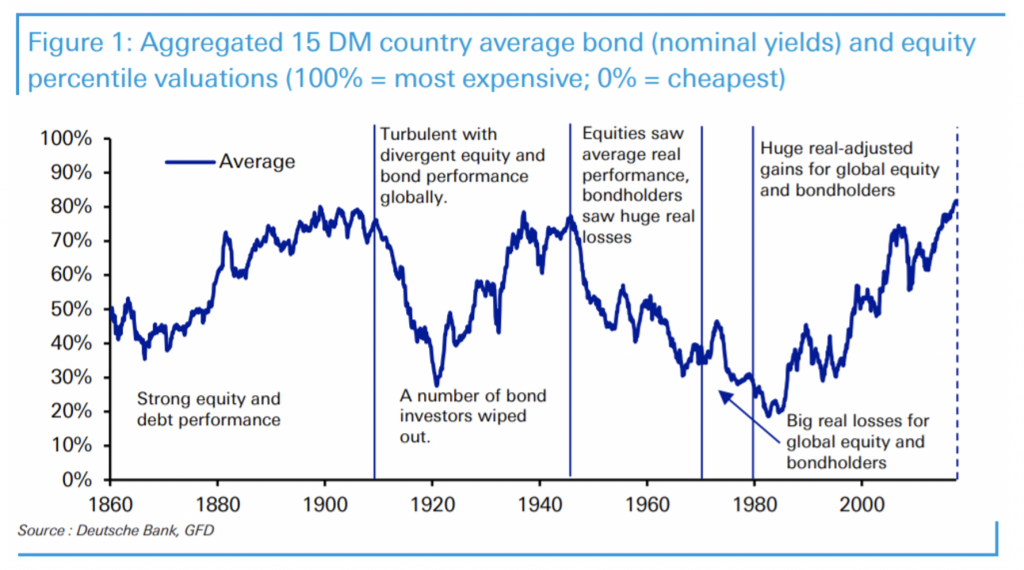

If we look at the following chart, which shows the aggregated valuations of bonds and equities since 1860, we can see that since around 1980 there has been a massive increase in valuations for both bonds and equities. This is of course driven by the steep fall in interest rates in this period.

I will not focus a lot on the historical return but instead describe the arguments that Deutsche Bank (DB) puts forward for why we should not expect the current trends to continue.

Another Cold War

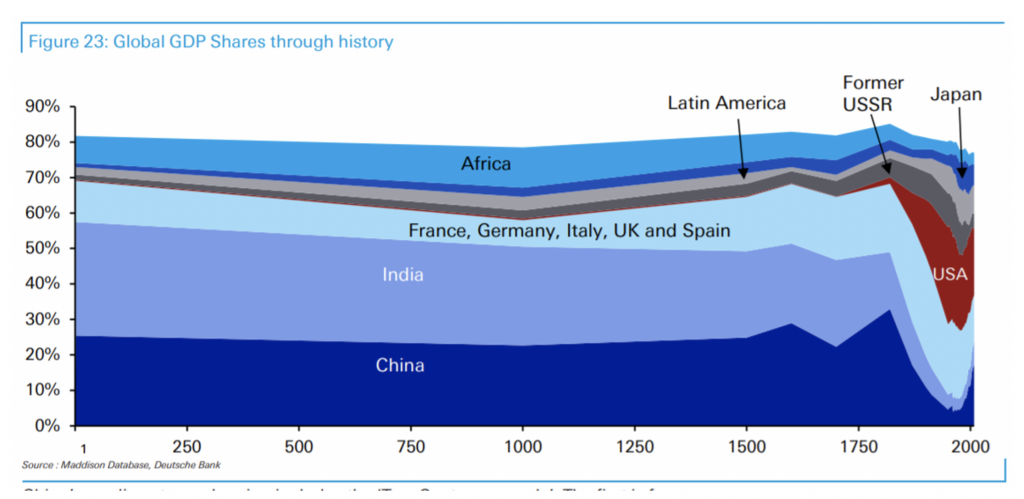

Over the past decades China has risen to become the second biggest economy in the world and is poised to overtake the US within coming decades. We have recently seen a significant deterioration in China’s relationship with the US and some other countries such as Australia. Deutsche Bank argues that this will continue no matter who wins the next election in US as China will be firm that their influence on the world stage should continue to grow while people’s perception of China and, in particular, the Chinese Communist Party in many countries, is deteriorating. This sets the scene for further conflicts which will deteriorate into a new cold war between a US led coalition of Western countries and countries within China’s immediate sphere of influence. What it comes down to is that Western countries want to retain this share of the world’s GDP while China wants to grow its share back to the 25-30 per cent where it was for the majority of historical times, as shown in the figure below.

The process of Western countries increasing their share of world GDP at the expense of China and India was very turbulent and the reversal is likely to also be turbulent.

European Union potential dissolution

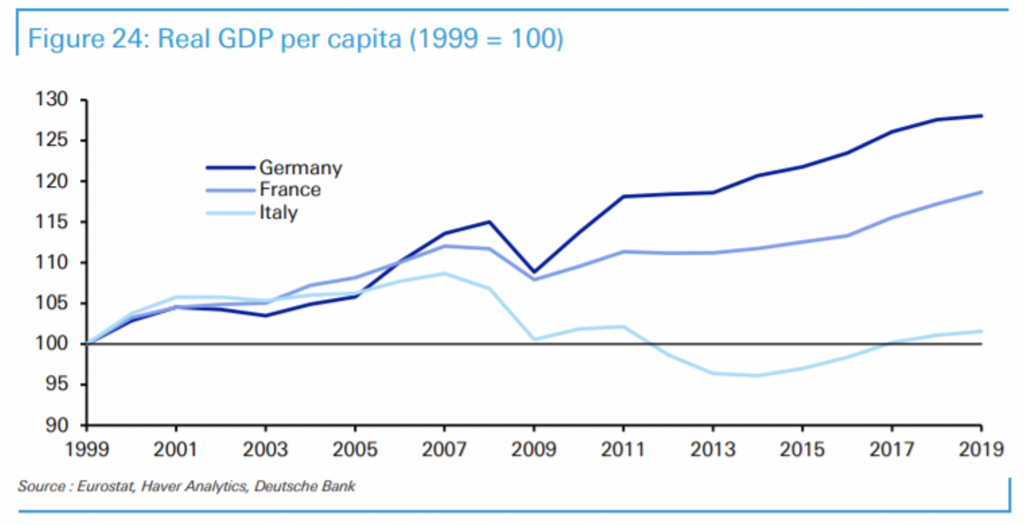

We are just now seeing the first withdrawal from the European Union with the Brexit process and there are more and more signs that the cohesion in the union is further deteriorating with the emergence of EU skeptical political parties in many countries. The underlying cause of the frictions are the effects from running several different economies under the same currency meaning that differences in productivity cannot be adjusted for by changes in exchange rates. As a result, there have been large differences in the growth rates in the EU countries over time resulting in the richer countries having to subsidise the poorer countries, causing resentment and discord. As we can see from the chart below, Germany grew its real GDP per person by 28 per cent in the two decades since 1999 while Italy only grew by 2 per cent.

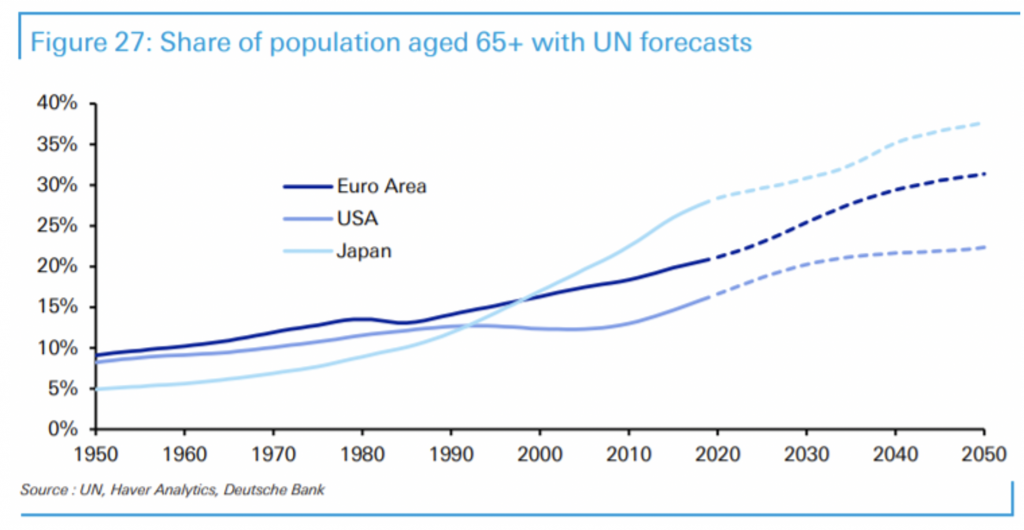

The Euro area is also rapidly ageing with its share of population above 65 years increasing by a faster pace than the major parts of the world.

To offset an eventual shrinking population, the EU countries will probably rely on high levels of immigration from developing countries which, as we currently see, often creates domestic social issues, further seeding isolationists political groups, which is not good for EU cohesion.

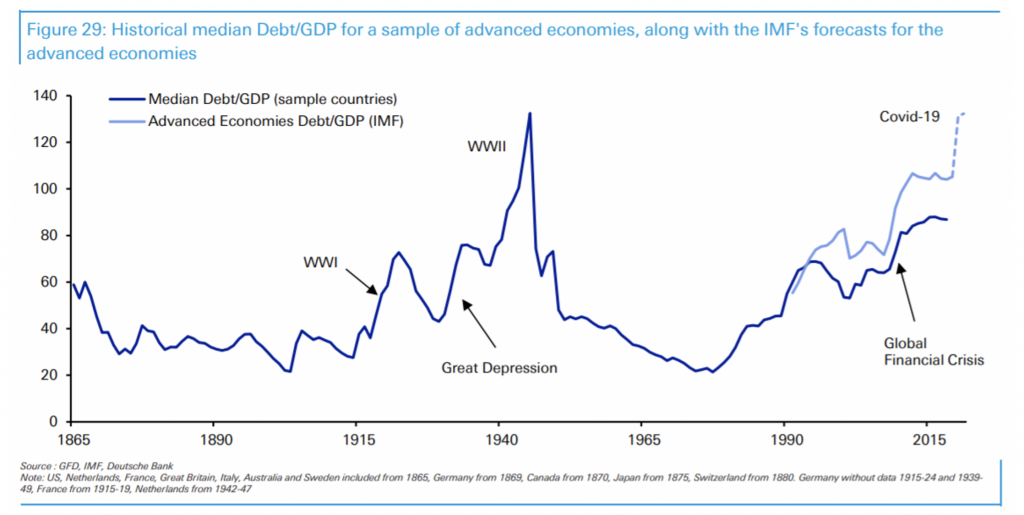

Very high debt levels

Low interest rates and government stimulus during the GFC and the current COVID-19 crisis has resulted in the highest level of debt/GDP since the end of the second world war:

Proponents of Modern Monetary Theory claim that this is not an issue as the serviceability of the debt is made easier due to low interest rates. It is technically correct that countries issuing debt in their own currencies cannot really go bankrupt as they can just print more money to repay existing debt. This would then result in that country’s currency adjusting its value compared to other currencies. To me, the problem arrives when countries all do this at the same time, and all create more money at the same time. This leads to increased availability of money in the total system which creates asset bubbles. Asset bubbles lead to increases in inequality between the people who own assets and the ones that do not and this leads us to the next two issues.

Inflation reappearing (or deflation?)

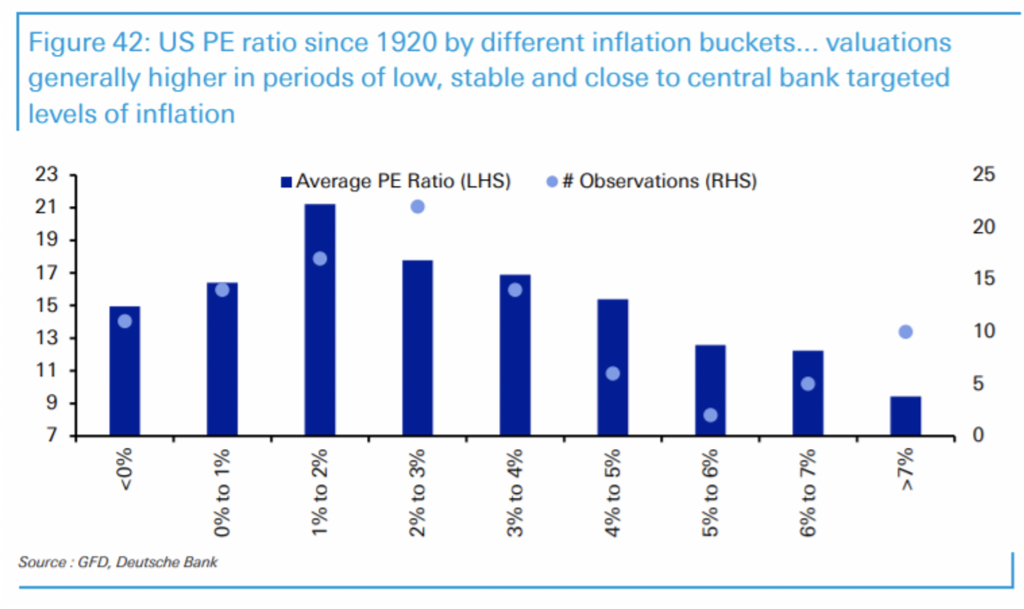

After a period of very low inflation in most of the world, the scale of both the economic disruptions from lockdowns and the stimulus packages launched in response to COVID-19 means that it is hard to see that we will land at a happy equilibrium again. If the scale of stimulus packages are large enough to cause inflation to pick up, or if the economic downturns are greater, causing Japanese style deflation in the future, is anyone’s guess, but at least I do not think that we will end up with the recent situation of very close to zero inflation. Both high levels of inflation and deflation will have a significant impact on valuations of different types of asset classes. Higher inflation will be bad for bonds and companies with high duration (profits long time into the future) as interest rates are likely to increase if inflation picks up. Deflation would lead to even stronger bond prices but would probably be bad for equity valuations as it would indicate low or negative economic growth.

Whichever way it will turn out, it is clear that, at least in the US, equity valuations have been highest when there is a low but positive level of inflation.

The recent disruption to supply chains will likely lead to increased duplication of the world’s manufacturing capacity (“just-in-case” as compared to “just-in-time”) which will inevitably lead to increased costs of production and either lead to inflation or reduced profit margins overall.

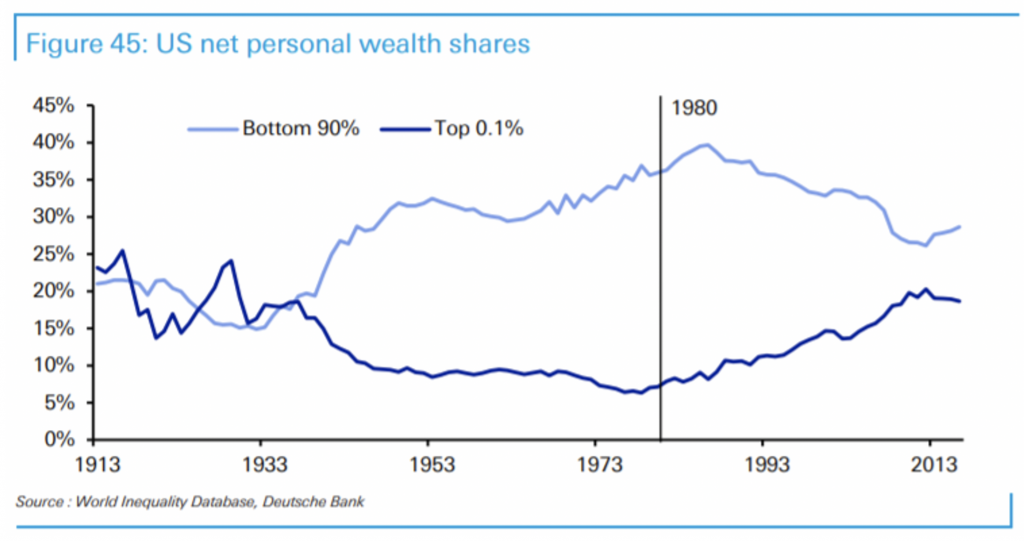

Increased inequality potentially reversing

As mentioned above, the last decade’s falling interest rate and resulting increases in asset prices have resulted in increased wealth inequality with owners of capital disproportionally benefitting compared to workers. This can be seen in the chart below which shows the top 0.1 per cent in the US owning almost as much of the total wealth pie as the bottom 90 per cent:

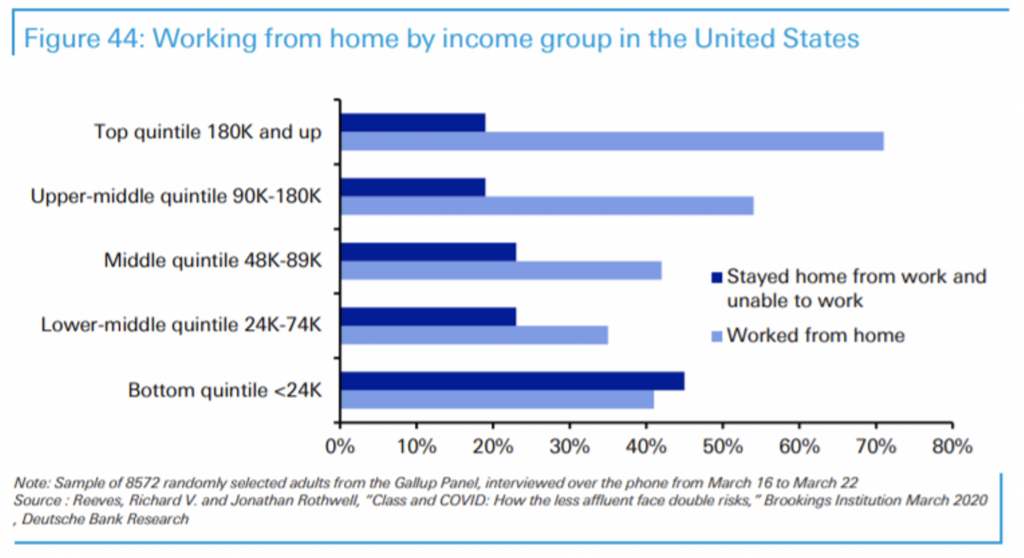

The reactions to the COVID-19 crisis are likely to further increase these inequalities as the stimulus packages launched by various governments have resulted in further asset price inflation while at the same time low income workers are much more likely to be negatively impacted by the various lockdowns and other restrictions launched to stop the spread of the virus:

This is likely to lead to further polarisation of the political spectrum and potentially social unrest as we are currently seeing in the US. If we were to see a reversal of these trends with workers getting a larger share of the total pie, it could have a profound impact on asset prices as it would reduce profitability for companies both through higher wages and through higher taxes. This in turns leads me to the last point.

This is likely to lead to further polarisation of the political spectrum and potentially social unrest as we are currently seeing in the US. If we were to see a reversal of these trends with workers getting a larger share of the total pie, it could have a profound impact on asset prices as it would reduce profitability for companies both through higher wages and through higher taxes. This in turns leads me to the last point.

Intergenerational divide tipping point

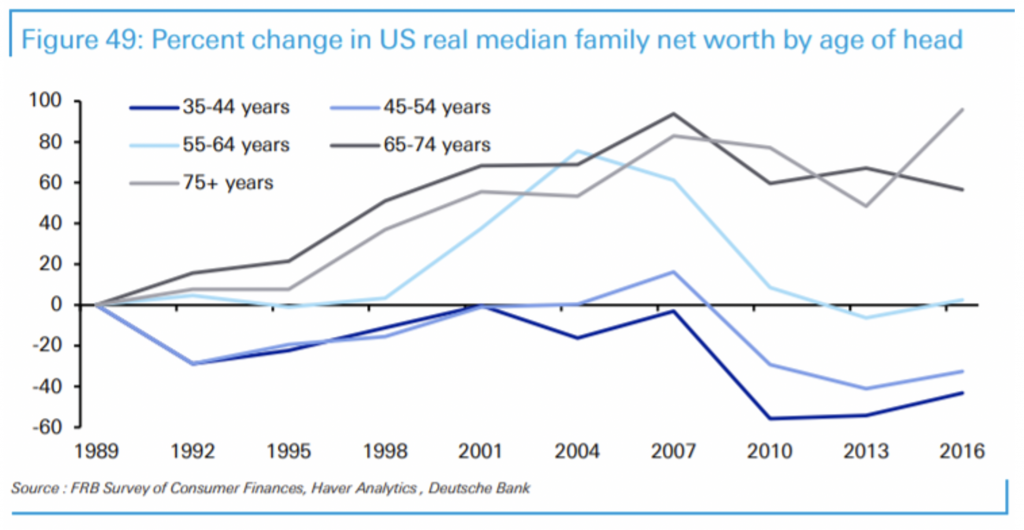

The increased inequality described above has another dimension, it is not just between rich and poor but also between old and young. Older people who had sizeable assets when the falling interest rate trend started have benefitted disproportionally compared to young people who have struggled to get their foot on the wealth building ladder as they have often been locked out of, for example, owning their own home, and instead are having to spend a large portion of their income on rent. As the next chart shows, older people have consistently increased their wealth much faster than younger people since 1990.

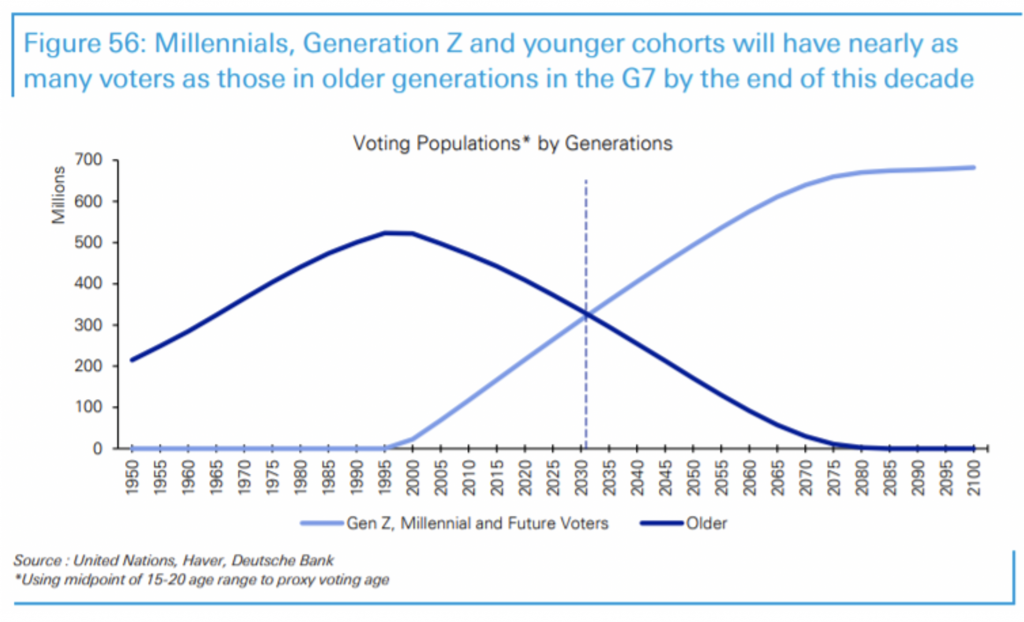

It has also been the case that younger people are more towards the left on the political spectrum and then migrate to the right as they age (as the old King of Sweden, Oscar II, is rumoured to have said “A man who has not been a socialist before 25 has no heart. If he remains one after 25 he has no head”). This has historically resulted in a rather stable balance across the world with governments of each country oscillating around a middle point on the political scale. What will happen over the coming decade though is that the number of voters born after the start of the fall in interest rates and who have hence not been able to build wealth to the same extent as older generations will start to outnumber voters of older generations.

We are therefore likely to see a move in the overall political spectrum towards the left with policies that will be aimed at distributing wealth more evenly amongst the population. These are likely to be in the form of inheritance taxes, higher corporate tax rates and steeper margin income tax rates which could all impact asset prices negatively. Asset prices will likely also come under pressure from the need to shift assets between generations. If the buying generation collectively has less money, the selling generation will likely not get the price that they have historically achieved.

As younger people are also likely to be more indebted than the older generations, they will likely be more tolerant of inflation as this will help them erode away their liabilities faster than in a low inflation environment.

There is also a sharp delineation in the acceptance of the dangers of climate change between the older generation and younger people. For the reasons described above, we should therefore anticipate that the world collective response to climate change will accelerate over time as the voting population changes its mix, which will have an impact on asset prices. It is hard to say if this will be overall positive or negative for asset prices, but it will certainly result in big changes between different assets!

Summing up

Overall, I cannot see anything in Deutsche Bank’s reasoning that I disagree with. The question of what will happen to the prices of various assets is not clear but what is clear to me is that we will see increased volatility and greater dispersion in returns than we have seen the last few decades where prices for most assets have in general been moving in uniform upwards. The good thing is that this will create opportunities for active investors who are able to spot trends early and take advantage of them!

Have we entered an Age of Disorder? Deutsche Bank’s global strategists argue we have, and they point to six major trends that support this. Read on for the impact on equites Share on XThis post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Excellent summary of a complex scenario