Are you overweight in growth stocks?

In an uncertain world, should investors have a strategy that looks beyond current trends and accommodates a range of different possible futures? In recent years growth stocks have had a winning streak, is now a good time to consider shifting the balance of your holdings towards companies that can demonstrate the ability to generate profits today.

Growth versus value

One of the fundamental distinctions that can be drawn in listed equities is the distinction between value stocks and growth stocks. In simple terms, growth stocks are those with a lot of future potential, while value stocks are those that are producing good income right now, relative to their share price.

Value defined this way is not the same thing as valuation, which is a subjective measure that takes account of both current and estimated future earnings. Instead value in this context simply describes a business for which the current earnings are strong, while growth describes a business for which the future earnings are expected to be strong.

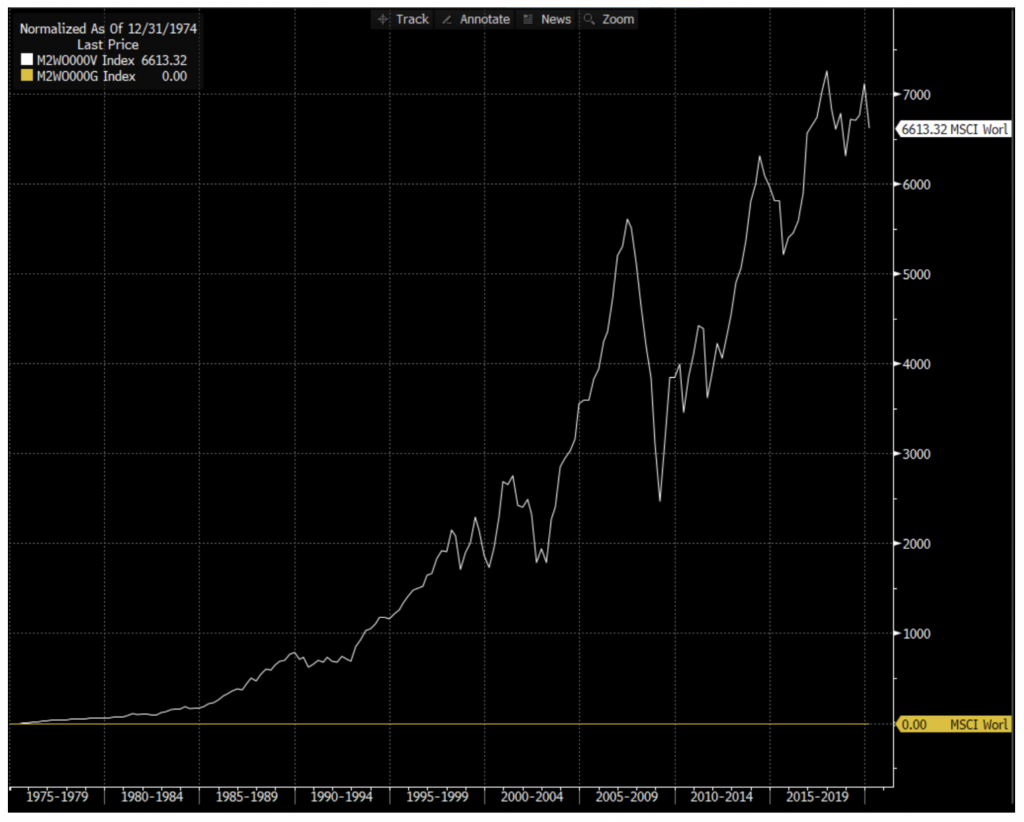

Over long periods of time, value has tended to outperform growth. If we look for example at the MSCI World Value Total Return Index, shown in this chart in white, and compare it with the MSCI World Growth Total Return Index shown in yellow, we see that over many decades, the value index has delivered better total returns than the growth index.

Source: Bloomberg

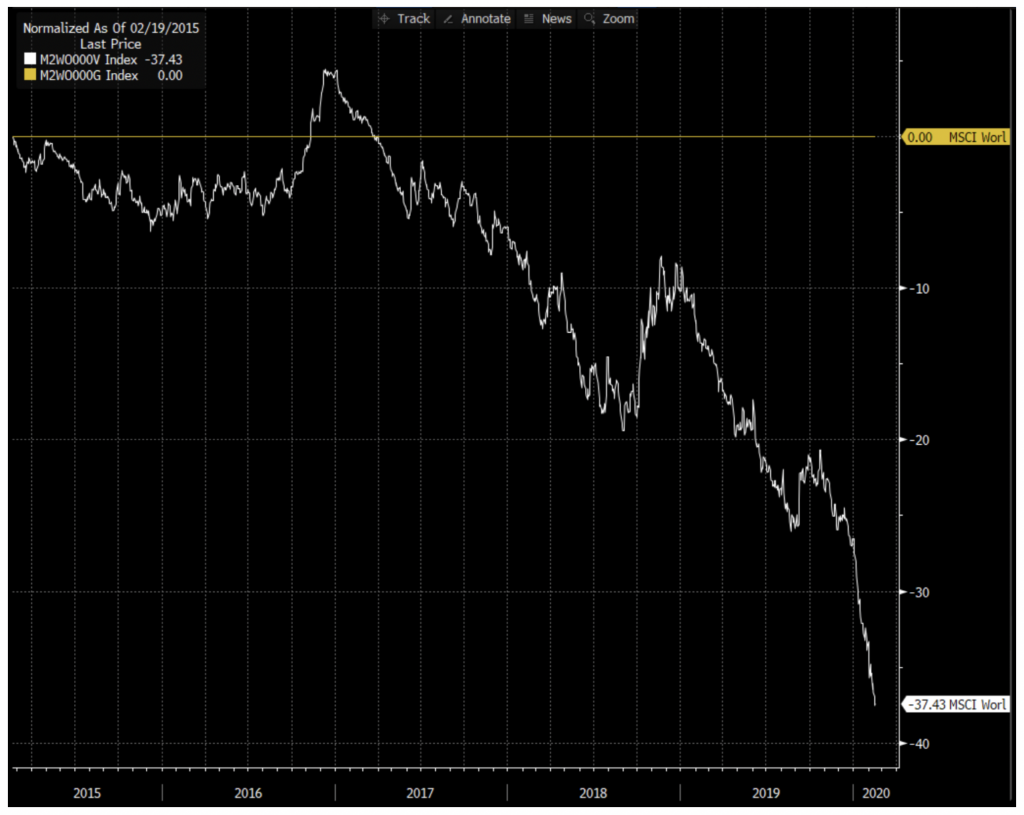

That certainly doesn’t mean that value always outperforms growth, and if we re-draw our chart by scaling the value index relative to the growth index to show the gap between the two, we can more clearly see the relative performance of value vs growth. In this chart we can see periods when value is rising relative to growth, and periods when value is falling relative to growth.

Source: Bloomberg

On the whole, over long periods of time, it looks as though a value investor has enjoyed a significantly better investment experience than a growth investor.

That’s not to say that growth companies can’t be excellent investments or that value companies can’t go broke, but it does suggest that on average, companies with earnings today have been better investments than companies with future promise.

Long-term averages are not the whole story, however. Over short periods of time, value can underperform growth significantly, and if we zoom in on just the most recent five years of our chart, we see a very different story.

Source: Bloomberg

On this shorter timeframe, we can see value getting crushed, relative to growth, particularly during the last three years, and the trend appears to have accelerated most recently. In this analysis we’ve shown a global view, but we see a very similar pattern when we look just at the Australian market.

So, what to make of this underperformance of value versus growth.

There are a couple of observations that we would make here.

Firstly, this is certainly not the first time we’ve seen growth perform strongly. It has happened many times in the past, perhaps most notably during the technology bubble, particularly in the US market, when future potential was all that mattered, and current earnings became almost irrelevant. The long-term history suggests that after these periods of value underperformance, value tends to recover the lost ground, although history doesn’t tell us much at all about when that might happen.

There’s also the contrary view that things could be different this time around. In a world of very low interest rates and with the growing importance of information technology over physical assets, there are some valid reasons to think that future growth potential may be a more important driver of company value that it has been in the past, and its mainly growth companies stand to benefit from that.

Our view is that, in an uncertain world, it makes sense for investors to have a strategy that looks beyond the current market trends and accommodates a range of different possible futures, rather than relying on one particular future.

Accordingly, with growth stocks having been very much on a winning streak in recent years, now might be a good time to consider shifting the balance of your holdings a little more towards companies that can demonstrate the ability to generate profits today, and a little less towards those that offer the promise of large profits down the track.

It may be that the world today is different and that the old rules don’t apply as they once did. On the other hand, it may be that it isn’t, and they do.