What did JB Hi-Fi, REA Group and James Hardie have in common coming into reporting season?

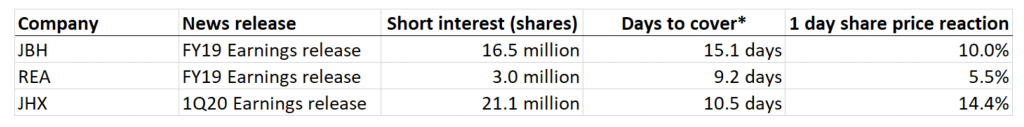

Reporting season is now underway and there have already been a few notable share price moves – JB Hi-Fi (ASX:JBH), REA Group (ASX:REA) and James Hardie (ASX:JHX) leading the way for some larger companies.

Each stock had something in common, which was a relatively large short interest active in the names. As I have written previously, a large active short interest provides a potential opportunity for investors to profit from a potential “squeeze” as it provides a trigger for short covering.

* Days to cover refers to estimated number of trading days it would take to cover a stock’s short interest based on average daily trading volumes

In the case of REA and JHX, both these companies continued their rally in the second day, with REA up a further 6.3 per cent and JHX 2.2 per cent. JBH was also up on the second day, although only 0.8 per cent.

JB Hi-Fi – Net profit of $249.8million FY19 was 2.7 per cent better than consensus estimates of $243 million, while revenue of $7,095 million was slightly ahead of consensus estimates at $7,089 million. The better than expected profitability was largely driven by an improvement in gross margins in The Good Guys, where the previous half was impacted by strong price competition.

REA Group – Net profit of $295.5 million for FY19 was 5.5 per cent below consensus estimates of $313 million, with the miss largely attributable to lower revenues as the weak housing market took a toll on REA’s listing volumes. Despite the miss, the company provided a positive outlook for listings in 2H 2020, as well as company initiatives including monetising agent leads, ability to manage costs, monetising data services including Hometrack and recovery in Smartline post Royal Commission.

James Hardie – reported better than expected volume growth of 5 per cent in softer market conditions (management estimated a flat market) – the growth was around 2 per cent better than analyst expectations. EBIT margins were also better at 25 per cent as the company benefited from initiatives from their Lean cost savings programs.

In each case, the company reported profitability numbers that were commendable in tough market conditions (weak environment for consumer spending for JBH, lower listing volumes for REA, slowing US housing market for JHX).

However, with relatively small percentage differences in the actual vs expected outcomes, it’s unlikely the assessment of a business “value” alters that materially following a half-year or quarterly result (the incremental new information in a full-year result being 6 months of financials). What does change rapidly is the share price. In these situations where the outlook appears to have improved versus prior expectations, shorters will seek to cover positions as the expected catalyst of a soft earnings result triggering a share price fall fails to materialise.

If you would like to read more on short selling and which stocks have a high short interest going in to the results, you can read my article: How to profit from short selling

The Montgomery Global Funds and Montaka own shares in REA Group. This article was prepared 13 August with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade REA Group you should seek financial advice.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY