Here’s something for bank investors to consider

Most investors in Australian banking stocks don’t give much thought to how our banks capitalise their IT expenditure. But it matters, because the way they capitalise this expenditure affects the quality of their earnings base.

One of the things to watch for when assessing the quality of a company’s earnings base is the degree to which it capitalises spend as an ‘intangible asset’. There has been an increasing use of capitalisation of expenses, particularly on IT, which effectively defers the impact on the income statement through increasing amortisation charges. This provides an even more significant benefit to the market’s perception of value in a world in which EBITDA multiples are heavily relied upon for comparison. By capitalising this spend, the market can easily ignore the impact of this cash investment requirement in assessing the value of the company.

In other instances, companies build large intangible asset balances only to write them down periodically as a significant item, thus ensuring the analyst community never really takes this required investment spend into account when valuing the company.

The big four have capitalised significant amounts of spend for many years, which they classify as software investment. Every 3 or 4 years, they generally take a large write-down of this asset, and the cycle starts all over again. These periodic impairment charges also act to boost reported earnings by reducing the amortisation charge in future periods. While the companies generally claim these are non-cash charges, this is a misleading statement as they reflect a write-off of cash investment/spend in prior periods. So, while they do not necessarily relate to cash payments in the current period, it is still a charge against real capital that was invested by the company.

Because the write-downs are generally treated as a one off by the market, this spend is quite often never really fully factored into analyst valuations.

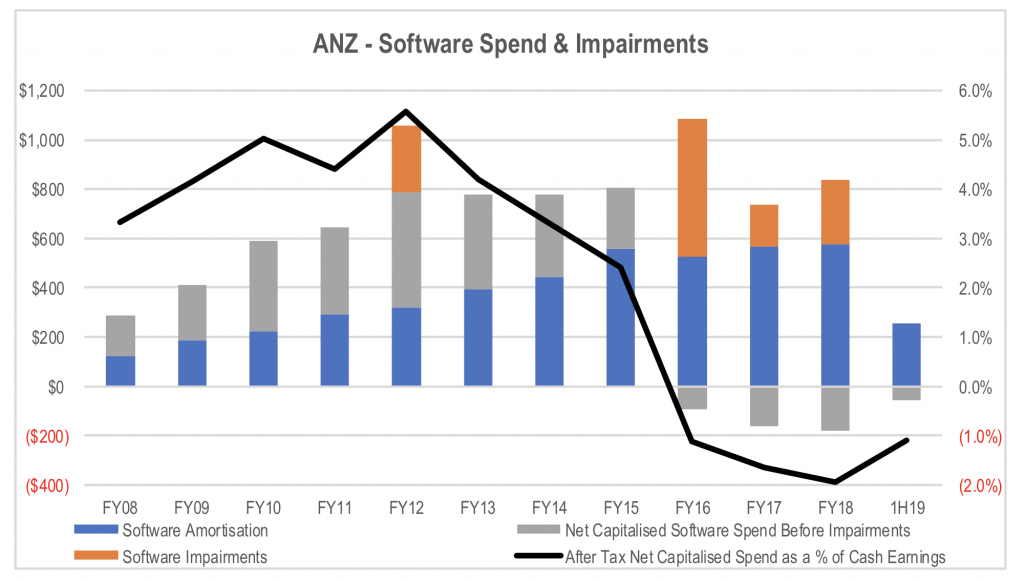

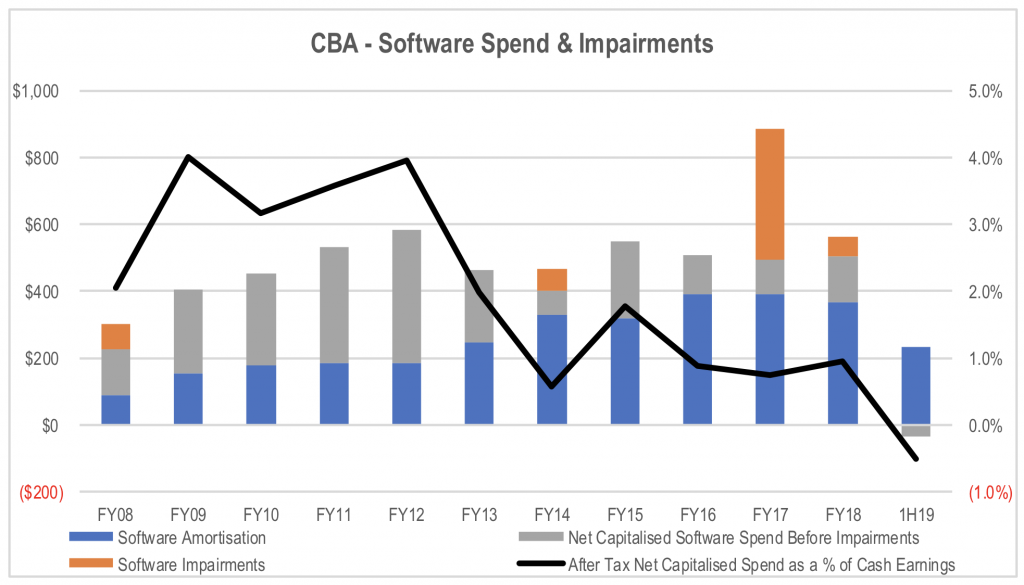

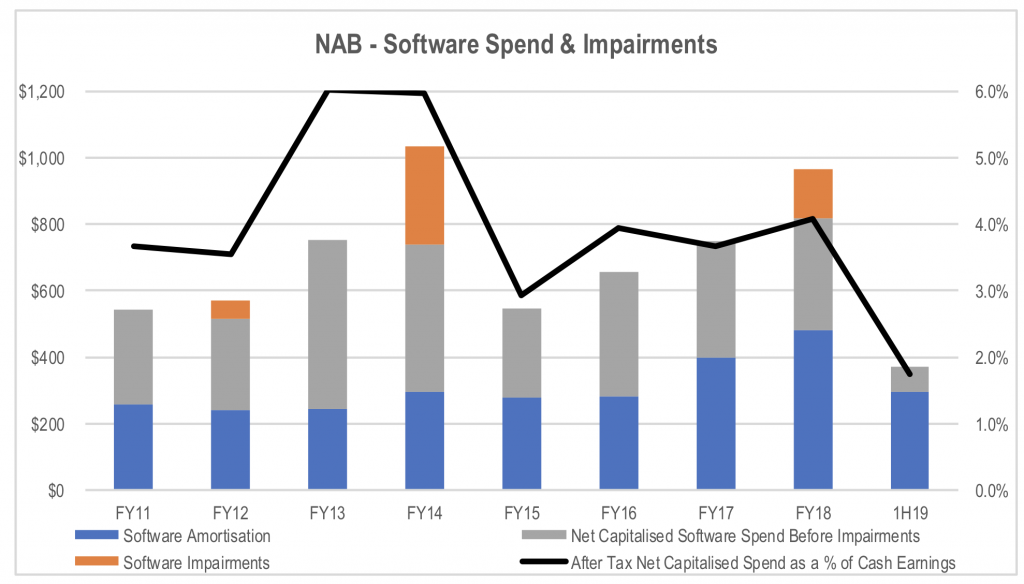

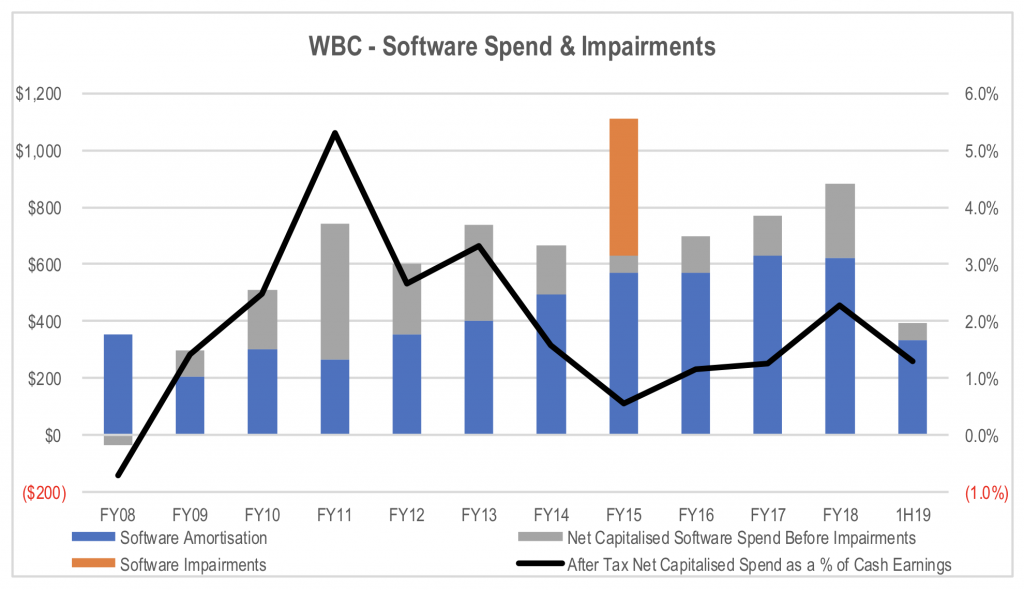

The charts below show the amortisation charge taken to the income statements for each major bank, the net amount of spend that is capitalised in the balance sheet before any impairment charges, the large ‘one off’ impairment charges, and the net amount of capitalised software spend after tax as a percentage of the bank’s stated cash earnings figure. This last figure is the benefit to cash earnings derived from capitalising software spend relative to a policy of expensing all of the spend.

Source: Company reports, MIM estimates

Source: Company reports, MIM estimates

Source: Company reports, MIM estimates

Source: Company reports, MIM estimates

To be clear, we are not suggesting that the banks are doing anything misleading, but this accounting treatment is similar to standard capital expenditure for any industrial company in that it reduces the amount of surplus capital generation that can be distributed to shareholders or invested in growth opportunities.

Given the potential threat presented by Fintechs and Neobanks to the core franchises of the major banks as a result of technology eroding the scale barrier to entry that exists in the current way banking operates, this investment is unlikely to reduce in the foreseeable future. Investors need to be cognisant of the impact this has on CET1 capital generation for regulatory purposes as well as the sustainable dividend pay-out ratio. Notably, APRA excludes capitalised software from its calculation of regulatory capital, effectively treating software expenditure as 100 per cent expensed in a bank’s earnings.

The Montgomery Fund and the Montgomery Private Fund own shares in National Australia Bank and Westpac. This article was prepared 02 July with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade these stocks you should seek financial advice.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hi Stuart,

Thanks for your post. Its about time someone raised this. As a chartered accountant and avid long term investor, I cringe at the whole notion of ‘non-cash charges’ when booking an asset impairment and write off. How was the asset funded in the first place!!

Companies should be required to disclose the initial investments made against the specific ‘non-cash charge’. This would provide improved transparency to the investment community and greater accountability to management deploying capital on behalf of owners (shareholders).

Regards,

Pascal.

good idea Pascal. Thanks for sharing.