Keeping an eye on the dividend

Australian investors love their dividends, especially fully-franked dividends that can offer an appealing effective rate of income compared with fixed-interest alternatives, and it’s easy to understand why.

A lot of fund managers – ourselves included – focus more on total return, with the idea being that chasing income at the expense of capital growth is not the right long-term approach, and it’s important to take both components of return into account when making investment decisions.

Having said that, even investors who focus on total returns need to be mindful of the power of the dividend and its ability to influence share prices. In simple terms, if a dividend-paying stock is going to be well-supported by a large section of the investment community then that support may well flow through into an elevated share price, and stronger total returns than might otherwise be expected.

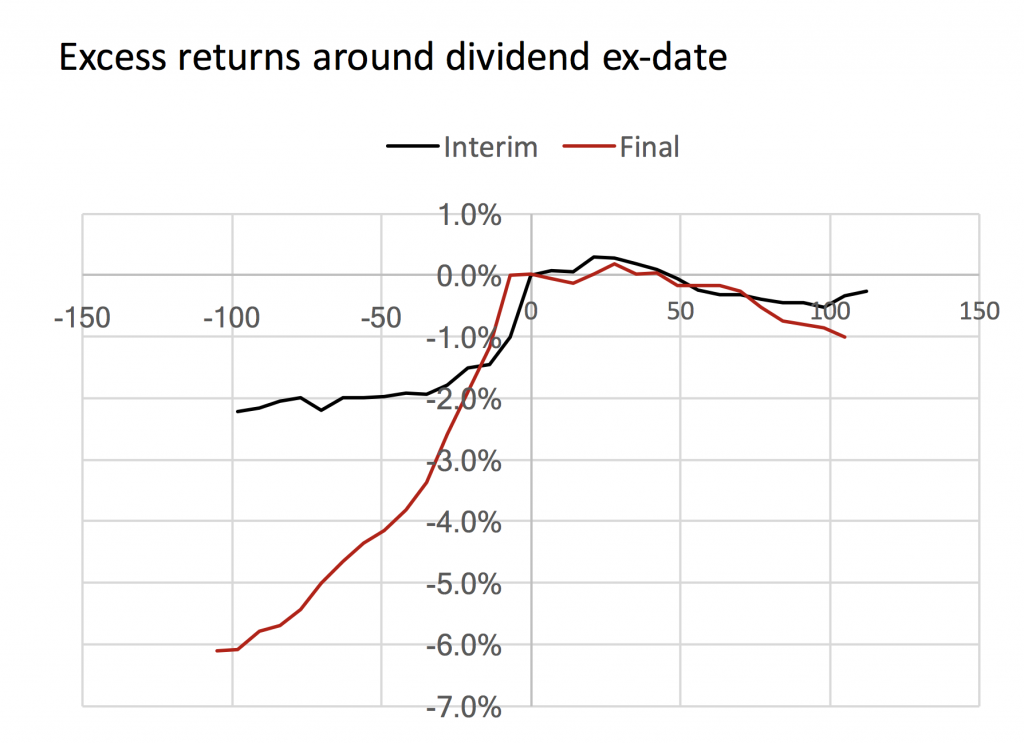

One aspect of this can be seen in the behaviour of dividend paying stocks around the time the stock goes ex-div. The chart below shows the total return for a sample of ASX-listed stocks around the dividend ex-date (day 0), with interim dividends shown in black and final dividends shown in red.

What the chart says is that, particularly for final dividends, stocks tend to outperform in the weeks leading up to the ex-date. Presumably this is because a lot of investors are reluctant miss out on the dividend by selling. Also, this analysis ignores franking credits and so the effect is even more pronounced for an investor who can utilise the credits.

Source: MIM analysis

As total-return focused investors, we try to be unemotional about dividends, and dispassionate about particular stocks. However, if we find in July or August that a dividend-paying portfolio stock has become expensive and needs to be culled from the portfolio, well, maybe we can look on it a little more kindly. At least until September.

Tim identifies why investors who are not chasing income still need to be mindful of the power of the dividend by showing us its ability to influence share prices. Share on X