Driving reform in the automotive market

It’s not often I’m motivated to republish, in its entirety, a speech from the head of the Australian Competition and Consumer Commission.

The subject covered however is one that touches us all, and in ways we didn’t realise. And it represents another example of the change that industries confront from time to time and which investors have to consider and navigate.

Quite simply, it’s incredibly interesting from a number of perspectives…

Below is the full transcript.

Good morning ladies and gentlemen, it is great to be with you today.

The conference topic is “the future of the automotive industry”. With that in mind, let me take you back to my childhood to illustrate how difficult it is to make predictions, especially about the future.

The picture on the slide is Sims Motors in Lorne in the mid-1950s where I spent my first 10 years.

You can see the names Morris, Wolsely, Riley, MG, Chrysler, Plymouth, Desoto, Fargo and Nuffield on the sign. How times have changed the fortunes of those companies.

Morris, which included the ground breaking Mini, started life in 1919. It acquired Wolsely, Nuffield, Rover and MG—the ‘quintessentially British car’. Chrysler, Dodge, Fargo and De Soto were made in Australia between 1951 and 1980.

Nowadays, the ‘quintessentially British car’ is Chinese, manufactured by SAIC, a Chinese state-owned automotive design and manufacturing company, who likewise own the Morris marque.

Chrysler is owned by Fiat, having been previously owned by Mercedes. Chrysler owned Plymouth, which closed its doors in 2001, and the Chrysler plant was sold to Mitsubishi, which in turn ceased manufacturing in Australia in 2008.

Forty years ago you could buy an Australian-made Volkswagen, Mercedes, Renault, Ford, Holden and Leyland. Nowadays, you can’t even buy an Australian-made Holden.

So, are we courageous enough to make predictions about the future?

While the car industry has changed significantly in the past decades, cars and automotive interests remain an important part of the national fabric; the Australian love of cars has not changed at all.

At the ACCC, we want to drive reform to ensure the automotive industry remains competitive and fair to consumers and businesses alike. In the case of the Australian automotive market, there is a strong case for change and particularly as it relates to car servicing.

In bygone days all you needed to fix a car was a mechanic in greasy overalls, because repairs were largely confined to the realm of the mechanical. This is not the case any longer.

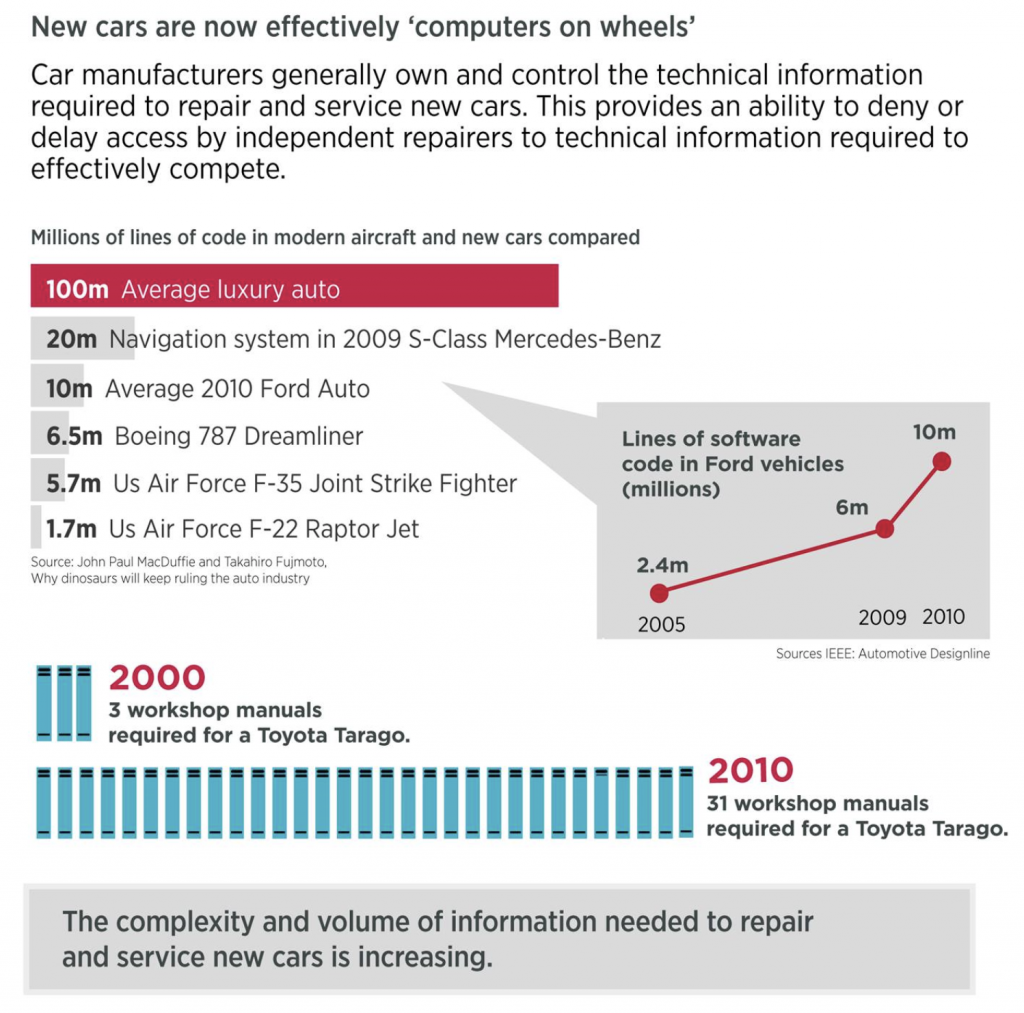

Nowadays, you practically need a degree in computer engineering to repair a vehicle: today’s new cars contain in excess of 10 million lines of computer code, more code than is used to operate the avionics and on-board support systems of modern airliners, to create the sophisticated software that they require to work.

In a sense, you don’t really drive cars anymore: you drive computers.

See figure 1.

To fix today’s cars, repairers need access to volumes of complex technical information held digitally by car manufacturers. This, however, allows car manufacturers to control who has access to the technical information needed to fix cars, often favouring their own dealer and preferred repairer networks over independent repairers.

There are three main issues I would like to speak about today.

First, I will discuss access to technical information. We have recommended that a mandatory scheme be introduced compelling the sharing of technical information with independent repairers, and I will outline the nature of our recommendation.

Second, I will highlight some other observations from the ACCC’s new Car Retailing Market Study that may be of interest to you and your members.

And third, I will give an overview of the Takata airbag recall, how it operates and what obligations suppliers of spare parts have.

Need for mandatory access to technical service and repair information

The ACCC is of the view that consumers benefit from competitive aftermarkets and by having a choice of providers to repair and service cars. Access to technical service and repair information was a major focus of the ACCC’s market study into new car retailing.

Access to technical information has been contentious for some time, with considerable efforts made by industry and Government to address it.

The Commonwealth Consumer Affairs Advisory Council looked at this in 2012 and recommended that industry should develop processes within a reasonable period. It was also recommended that if industry was unable to arrive at an effective outcome, and barriers to competition transpired, then the Government should consider regulatory intervention.

In 2014, the then Minister for Small Business, Bruce Billson, worked with key industry associations to develop a voluntary agreement for the sharing of repair information. In December 2014, the Australian Automotive Aftermarket Association (AAAA), the Australian Automobile Association (AAA), the Australian Automotive Dealer Association (AADA), the Federal Chamber of Automotive Industries (FCAI) and the Motor Trades Association of Australia signed a Heads of Agreement to facilitate the sharing of technical information. In the following year, each industry association developed codes of practice to enact the agreement on their own members.

Under the Heads of Agreement, car manufacturers in Australia committed to providing independent repairers with the same access to technical information provided to dealers and preferred repairers, on commercially fair and reasonable terms.

Despite the Heads of Agreement, and the codes of practice, independent repairers and the AAAA argued that they continued to experience problems accessing technical information from car manufacturers. On the other hand, a number of car manufacturers and the FCAI argued that technical information was available and access had been facilitated by the voluntary Heads of Agreement.

When we looked into this issue as part of our new car retailing market study, we found numerous problems with the detail and timeliness of the information given by car manufacturers to independent repairers, despite their voluntary commitments.

For example:

- We noted that only certain car manufacturers appeared to be providing access to a significant proportion of the types of technical information independent repairers need to repair and service new cars.

- Our technical expert was unable to register as an Australian independent repairer to access information from a particular car manufacturer’s online platform. The only way of obtaining the necessary programming information to complete the repair was to seek assistance from an authorised dealer. Being reliant on a direct competitor for information can never work.

- In other cases, car manufacturers stated technical information was available from their dealers, however their dealers refused to provide the requested information.

- We also observed that some car manufacturers only started providing independent repairers with access to their online technical websites during the course of the ACCC’s market study.

Our technical expert identified that with some brands gaining access to the information could take up to two weeks. We consider that timely access to repair and service information is critical for independent repairers to remain competitive.

Overall, despite the voluntary commitments, many car manufacturers still did not provide online access to technical information, including several large brands.

Further, of those car manufacturers that are sharing technical information, some restrict independent repairers’ access to environmental, safety or security-related technical information due to perceived risks of increased car thefts or unauthorised modifications. This limits the use of the information, and the type of repairs that can be undertaken.

We understand that in the European Union and the United States appropriate safeguards have been developed to share securely these types of information with vetted independent repairers, so it can be done.

What the ACCC recommended and why

Ultimately, we formed the view that few car manufacturers provided equivalent access to the technical information provided to their authorised dealers and preferred repairer networks. This was inconsistent with what the car manufacturers had committed to voluntarily under the Heads of Agreement.

On this basis, we concluded that voluntary commitments to share technical information had not been successful and would not work. Indeed, it is not surprising that manufacturers do not wish to share information with independent repairers when they have incentives to drive consumers to dealerships instead.

Accordingly, we recommended a mandatory scheme to share technical information with independent repairers on ‘commercially fair and reasonable terms’. This should include real-time access and appropriate safeguards to enable the sharing of environmental, safety and security-related technical information.

Options for reform — features and differences of various approaches

The ACCC’s recommendation that a mandatory scheme should be introduced in Australia for car manufacturers to share technical service and repair information is now a matter for Government policy consideration.

We are aware that many stakeholders have been wondering what we meant by a mandatory scheme. In our market study we outlined a few different options. And I note here that Minister Sukkar has just stated that the Government is now considering how a mandatory scheme might work.

Changing the Motor Vehicle Standards Act (MVSA) or Australian Design Rules

First, the Government could use the laws applying to new cars supplied to the Australian market to mandate the sharing of technical information. This could operate either by a legislative amendment to the MVSA, or through a determination under the MVSA amending vehicle standards in Australia to require technical information about new cars to be shared as part of the certification process.

In effect, this would require that the technical information to repair and service cars is available to independent repairers at the same time the car is first sold on the Australian market, or soon thereafter, as an inherent requirement of gaining certification.

A benefit of this option is that any car manufacturer seeking to sell their cars in Australia would be automatically required to comply with a mandatory requirement to share technical service and repair information. We note, however, that including this in the Australian Design Rules may conflict with existing Government policy to harmonise these standards with international regulations.

A mandatory industry code administered by the ACCC

Second, the Government could use the existing regulatory framework under the Competition and Consumer Act to prescribe a mandatory code, binding on the whole industry, with the ACCC as the relevant regulator. We understand that the AAAA supports this option.

The ACCC notes the Government recently released its ‘Industry Codes of Conduct Policy Framework’, which describes when the Minister will consider Government intervention to make an industry code. The matters include whether self-regulation has been attempted, whether there is compelling case for intervention supported by robust evidence, and whether other options would be more appropriate. This last point seems key here.

To facilitate enforcement of such a code, the ACCC would need to develop extensive in-house technical expertise about cars to facilitate the resolution of disputes arising under the mandatory code.

New stand-alone legislation

The Australian Parliament could introduce new stand-alone legislation as well. This could include seeking cooperation with the States and Territories to develop new legislation regulating the sharing of technical information on a consistent basis, nationally.

What happens now and what needs to be considered in a mandatory scheme?

There is now a lot of work to be done. The considerations of how a mandatory scheme should address the issues outlined in our market study will be a complex exercise and detailed consultation will be necessary, as the Minister has just indicated.

Depending on the approach adopted, consideration will need to be given to the governance of the scheme, dispute resolution and how it will be enforced. Importantly, consideration will also need to be given to who will be covered. As stated in our report, we are of the view that not only independent repairers, but also intermediaries, such as diagnostic toolmakers and data aggregators, should have access to technical information.

Industry’s technical expertise will be crucial in defining relevant terms, including the appropriate boundaries of environmental, safety and security-related information, as well as in developing the process to securely release these types of information to vetted independent repairers.

Consideration will also need to be given to how any new scheme can take into account the existing technologies and systems of those car manufacturers who are already sharing some real-time technical information in Australia, as well as the potential for those car manufacturers who are not yet sharing technical information to leverage their existing EU or US-based platforms.

The ACCC, having done the market study, will not now vacate the field. We will continue to engage with stakeholders, including the AAAA, and we will provide advice to Government to assist in the development of a mandatory scheme for you to get access to the technical information you need to fix cars, and to compete.

Other observations from our market study

In our market study we made many other important findings and recommendations.

For example, we raised fundamental issues with the ability of consumers to have access to their consumer guarantee rights under the Australian Consumer Law.

The ACCC has seen numerous examples of practices by a number of car manufacturers that raise concerns. We found that there is a dominant ‘culture of repair’ underpinning systems and policies across the industry based mainly around the manufacturer’s warranties, when enhanced remedies may be available under Australian Consumer Law.

As but one example, with Ford last week we saw that even where a new car has a known mechanical issue, consumers did not receive the ACL remedies they were entitled to. This can involve a consumer bringing their new car in to be repaired repeatedly, instead of being offered a replacement or refund. Many consumers felt their cars were unsafe.

In settling the proceedings against it, Ford has, by consent, admitted it engaged in unconscionable conduct and agreed to pay a $10m penalty for the way its systems dealt with consumers. Ford has also agreed to a significant review of complaints from consumers with vehicles affected by the known mechanical issues, with a view to providing remedies, and will implement compliance measures.

These compliance measures are similar to those already offered by Holden and Hyundai in their court enforceable commitments to update their complaint handling systems to ensure consumer law is front and centre of relevant systems, policies and procedures.

Holden acknowledged that it misrepresented to some consumers that it had a discretion to decide whether the vehicle owner would be offered a refund, repair or replacement for a car with a manufacturing fault, and that any remedy was a goodwill gesture.

We remain committed to industry wide change and investigations into other car manufacturers continue. The motor vehicle industry is now on notice, from manufacturers to dealers, that consumer issues need to be considered individually and consumers must be provided their rights under the ACL, in addition to any warranty rights.

Statements in logbooks and service manuals

The ACCC is also concerned about misleading statements provided in logbooks and service manuals. This includes statements that may mislead consumers that their new car must be serviced only by an authorised dealer in order to maintain the warranty when no such condition exists.

The ACCC is reviewing logbook information and instances of misleading and deceptive conduct, or misrepresentations, will be targeted through action by the ACCC, including enforcement action where appropriate.

Takata airbag recall

The final thing I would like to mention is the Takata airbag recall.

On 28 February 2018, Minister Sukkar announced a compulsory recall for all vehicles supplied in Australia fitted with a faulty Takata airbag inflator and those inflators when salvaged and supplied as spare parts.

This announcement followed an extensive safety investigation and recommendations made by the ACCC.

The Minister decided to issue a compulsory recall because:

- previous voluntary recalls had not been satisfactory in removing the airbags from the market to prevent those vehicles causing possible injury or fatality to drivers and/or passengers; and

- in addition, it was clear that some manufacturers had not taken satisfactory action, or in some instances had not taken any action, to address the serious safety risk associated with these airbags.

The compulsory recall is the largest and most significant recall in Australian history, with a total of four million vehicles affected. This equates to around two in every seven cars on Australian roads.

Worldwide, there have been at least 23 deaths and over 230 serious injuries reported as associated with faulty Takata airbags. Tragically, in Australia there has been one death and one serious injury associated with misdeployed Takata airbags and we don’t want this to happen again.

How the compulsory recall operates

The compulsory recall requires all suppliers of vehicles with faulty Takata airbags to replace them as quickly as possible and by 31 December 2020, unless varied by application to the ACCC.

The recall affects a range of businesses, including around 15 large vehicle manufacturers, the second-hand vehicle market which includes both authorised and independent dealers, auto-recycling businesses, salvage yard operators, auction houses and Registered Automotive Workshop Scheme (RAWS) operators that import, convert and sell vehicles to Australian consumers.

The recall aims to achieve consistency across recall actions by suppliers in specifying timeframes and the manner in which recall action must occur. Broadly ‘Suppliers’ are categorised as either vehicle manufacturers (Original Equipment Manufacturers or OEMs) or importers of vehicles

Obligations on suppliers of spare parts

Suppliers of spare parts must use their best endeavours to identify if they have any faulty Takata airbags in their possession.

If a spare parts supplier has a faulty Takata airbag inflator in your possession they are required to contact the relevant OEM’s head office who must make arrangements to retrieve the spare part from you, at their cost. The OEM must wear the costs, but the spare part supplier needs to assist in identifying any in their possession.

To assist in identifying which vehicles contain faulty Takata airbag inflators, you can view a list of vehicles on the Product Safety Australia website, or alternatively most manufacturers have VIN look up tools available on their website and you can also contact the manufacturer directly.

Authorised representatives on behalf of a Supplier

Suppliers may satisfy their recall obligations, including conducting replacements by using their dealership network or other authorised representatives, which may include independent repairers.

Ultimately the responsibility for compliance with the key recall and replacement obligations falls upon the Suppliers, most notably the OEMs. It is they who are going to be exposed to significant penalties for failing to comply with replacement obligations, and they will need to have regard to these consequences when making decisions as to who and how Takata airbags are to be replaced.

They have been given flexibility to undertake these obligations; they are not required to only use their franchised dealer networks. They can also authorise independent repairers to carry out the work.

We view the use of authorised representatives as particularly important, as this flexibility will allow suppliers to service geographic areas where they may have no dealers present. There are locations particularly in rural and remote areas where it may be more efficient to authorise independent repairers to carry out replacements.

Additionally, suppliers are required to meet certain percentage completion targets in meeting the end goal of 31 December 2020. If there are any identifiable issues in meeting these targets suppliers could authorise additional independent repairers to carry out replacements.

Where to next

The ACCC is meeting with various manufacturers, industry associations and other stakeholders in providing guidance and education about the requirements of the recall and to clarify obligations for each of the following sectors: manufacturers, second-hand vehicle market including auction houses and the auto-recycling/salvage market.

The ACCC is assessing Supplier Communication and Engagement Plans and Recall Initiation Schedules. Suppliers must publish their recall initiation schedule on their website as soon as practicable and by no later than 1 July 2018.

Suppliers must notify the ACCC via the Product Safety Website when active recall is initiated for a new category of vehicle. We encourage you to subscribe to receive updates on our website so you are notified when new recalls are initiated.

Conclusion

The ACCC has been very active in the automotive market recently, sometimes by necessity, such as with the Takata airbags, and other times because we want to see much better outcomes for consumers, and a much fairer marketplace for businesses to compete.

Australia might not manufacture cars anymore, but we can still apply the Australian “fair-go mindset” to how we do business.

This “fair go mindset” has been noticeably missing recently; it must be restored.

Thank you for your time today.

Part of a much bigger picture Rodger,

viz: ask a mechanic “how much” the annual update fees are from the major manufacturers are for software……just a means of transfer pricing (and will eventually put the small operators out of buss..)

ditto spare parts – when you no longer make the spare bits – then import pricing will increase ……likely substantially….

the big picture – is when foregein capital states – that Oz market is not relevant…..and refuses to spend the $$$ to “meet” our ADR’s etc ……

sad……but likely potential outcome

rgds

simon