An Important Announcement

It is with some excitement that I announce that Mr Tim Kelley will soon be sitting alongside David Buckland, Russell Muldoon and myself at the offices of Montgomery Investment Management.

It is with some excitement that I announce that Mr Tim Kelley will soon be sitting alongside David Buckland, Russell Muldoon and myself at the offices of Montgomery Investment Management.

Tim’s background as a director at Gresham Advisory included M&A advice to the likes of BHP in their bid for RIO as well as their merger with Billiton. You can read our Media Release Here: 20120605_Montgomery_Media_Release.

Tim will be joining at a time of great consternation worldwide and I am sympathetic to the nervousness pervading our markets and more importantly, investors’ portfolios.

We expect volatility to continue for some time as Greece moves another step towards deja vu on June 17.

One of the real issues for the United Nations of Despair of course is that their currency does not reflect their individual predicaments.

Germany is arguably less interested in a collapse of the Euro because it is more competitive than it would be if it returned to the DMark. On the other hand Greece’s exchange rate is overvalued.

But for Australia, Greece is a sideshow that ironically has a huge and real impact. This is because Europe is a giant consumer of Chinese and American products and services. In turn, America is a giant consumer of Chinese products. The butterfly effect ensures China – the driver of the one cylinder of our economy that has been working – slows down.

The Chinese slowdown comes just as the supply of Iron Ore ramps up and Australian economic growth, which was being held up by the resource boom, will be hard hit by a slowdown in resource investment and expansion if iron ore prices resume their slide.

At Montgomery Investment management we have been navigating this latest turn of events with both confidence and a little trepidation. Value investors tend to be early to leave the party and the rally between January and April – a rally in many undeserving companies – left us with a little of an egg-on-the-face feeling.

But sticking to our processes (which involves moving to cash in the absence of companies that meet our criteria for value and quality) will inevitably lead to periods of underperformance. Nevertheless we took advantage of the strong, and arguably unjustified, prices on offer in April to take profits on anything with exposure to the materials sector.

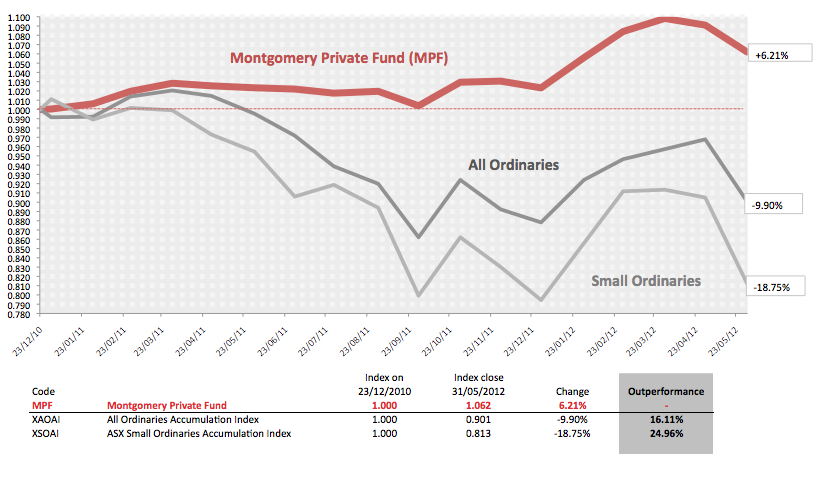

Those of you who have been watching our appearances on TV over the last six months will be familiar with our staunch distaste for mining particularly coal and iron ore. The result of this action to take profits amid what we believe to be declining commodity prices and related-company valuations, has been continued outperformance (see chart, which is net of management fees and charges – an investment in the Montgomery [Private] Fund can only be made by wholesale or sophisticated investor through an application attached to The Information Memorandum).

And so, with market prices declining significantly, we are excited about the value Tim will quickly add for investors in The Montgomery [Private] Fund, right when bargains abound and as markets correct.

If you would like to discuss an investment in The Montgomery [Private] Fund for wholesale investors upon its next opening, please send an email by clicking here and selecting the Apply To Invest tab at the top right hand side.

Finally if you have some time and would like to watch Tom Elliott, Nabila Ahmed (AFR companies Editor) and myself chat with Alan Kohler about Hastie, Iron Ore and Europe click on the screenshot:

Could things get worse? What’s the impact of low interest rates? Who forecastIron Ore prices of $187 tonne?

Should Greece Default?

And a more recent chat on ABC news

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 5 June 2012.

…Oh and let us know if you like us:

Congrats Tim, good luck.

Lets hope FMG get back over $10 soon!!

Hi all,

Not particularly investment related but i am soon starting a finance course at Uni and need to get a financial calculator and thought this might be the best place to get my questioned answered.

For those in the industry, what would you recommend and are there any good places in Sydney to get them?

I had a look and saw that for CFA exams they only accept two kinds so i thought i might go for one of them as that is kind of the route i want to go down in the long term and thought it would be best to use the same version throughout the whole time so you get extremely used to and comfortable with it.

I have only really found the staples online store to have one of them offered.

For as long as I can remember each of us have had an HP on the desk.

http://welcome.hp.com/country/us/en/prodserv/calculator.html

But you’ll have to get your head around the logic.

Thanks for the help Roger, thats is the one i wa actually considering.

Hi Andrew,

I recently sat Level 3 of the CFA – I have used the Texas Instruments BA ii Plus, professional – this is a great calculator, covers everything you will need and is easy to learn/use. I know the HP is the one that a lot of bankers have used for a long time, but its not easy to get your head around the reverse polish notation.

Just my 2c.

Much of the greek debt held by european banks is being repackaged

And onsold by gnomes of zurich to pension funds. When this

Complete greece can default so check your managed funds because the overseas cash holdings could contain a nasty surprise

Roger

The GDP figures are old news except to those who wish to take advantage of them. When I was a Sales Mngr.and later owner of a business which I started with $10000.00 and in 18mths grew sales to 1 million I could always predict what was about to happen because I spoke to dozens of owners and managers every day, the GDP figures are always 3-4 months old. So what is important is how the consumer and public perceive the situation not the chicken fodder the goverments want to announce.The GDP rises and falls as people spend more or less.I happen to like the idea of having 4% inflation a year because most people benefit from that. However we need to spend more on infrastructure in the near future if we are going to avoid a deflationary trend.

Thats my broad view and its about time the Govt. took a big stick to Shell and Caltex – We require a new vision in Oil Refining Aust.

Thanks Gabe. Delighted to hear your thoughts on refinements to refining…

Hey Roger,

That first clip screenshot makes it look like you’re having a severe allergic reaction.

Re your comment about the ‘egg on the face’ feeling when leaving the party early, I always reckon it is better to miss out on some of the the icing than lose the cake.

Besides, you’ve also written about risk increasing as prices rise (in reference to people feeling more secure about their holdings when the market has bounced a bit). So if you feel that the prospects for a company or sector are deteriorating, then even if the market doesn’t agree with you at the time and prices continue to rise, your position should be carefully considered.

I’m sure you’re not upset about selling FGE a couple of months back when you look at where it is now.

Indeed Greg.

Roger and Others

No wonder I could not sleep properly last night – I think i heard the sound of printing presses from USA and Europe from Pottsville Beach – Would you agree it is bad timing on behalf of the big miners to complain about cost blowouts – after all most of the problems seems to be self inflicted and then to say we cant get good staff to come over to the west is also their fault – family men and women wont put up with camp kitchens dongers and no facilities if the want them for the long term.

Is their anyone who believes the latest GDP figures are accurate?

I was gobsmacked to hear that Aust. was allowing the phase two development of the Ord River to go to either Acco or even the Chinese group which I understand is the preferred tenderer and they will have Freehold Title to the land. With the printing of more money and bailouts will we be able to maintain our lifestyle and service our debts and draw on future pensions I think we are flatlining with a bumpy ride ahead – Cheers

Hi Gabe, Tell us more about that! The GDP figures are backward looking so I suspect you will see a change shortly.

A ” leading provider of independent investment research” recently revealed their best shares to invest in.

In a new report, it rates the big four banks, BHP Billiton, Rio Tinto, Santos, Woodside, Woolworths, Wesfarmers and Orica as its top picks.

Is it a case of you can’t be crucified for recommending the big caps?

Great stuff, Roger. When do you think the retail fund might be available because this could be a good time to kick it along a bit?

Hi Michael,

Our draft PDS is ready and we are now making changes to accommodate the new short form regulations. We expect July/August.

You sound like you are getting together quite a good little brains trust at Montgomery HQ Roger. Looking at the performance graph it is just more proof that the method you subscribe too and have taught us works.

Looking forward to hearing more news from the Montinvest and Skaffold camps. I think it is fair to say you have all had a big and successful year.

Thanks Andrew for those encouraging words.

In response to the above graph over the same period TLS has risen from $2.77 to $3.65 a return of 31.7% with a 10.1% div yield fully franked! Just thought that many Mum & Dad investors (who could forget T2!) would like to see their long suffering portfolio stand alongside your results.

The same Mum and Dads that own RIO BHP and FMG? Or Fairfax Qantas and Leighton? Thanks Simon.