Out of work or Pay Rise?

Recently we have been fascinated by the inexorable rise in the share prices of tech companies. You might recall we’ve written about, and looked with suspicion at, the combined market value of US$140 billion for Tesla, Uber and Twitter, despite a combined profit of zero.

We have also noted the increasingly concentrated bet on technology, by investors, with a third of the S&P500’s year-to-date gains attributed to just five tech companies – Apple, Microsoft, Google, Facebook and Amazon. Almost half of all the companies listed in The Nasdaq 100 index (45 companies) are trading on a forward price-earnings ratio of more than 200 times (see Table 1.), including as Tableau, Wix and Amazon, Yelp and Shopify.

Table 1. NASDAQ 100 Companies trading above 200x forward earnings

And lest you think Australia is immune, keep in mind companies listed on the ASX such as Updater and GetSwift are trading on market capitalisations of A$600-A$750 million with little or no revenue.

Earlier this year, lauded value investor, Howard Marks, perhaps best articulated the love affair with everything technology-related when he described investors amore thus; “The pursuit of the new – old timers fare worst in a boom, with the gains going disproportionately to those who are untrammelled by knowledge of the past and thus able to buy into an entirely new future.”

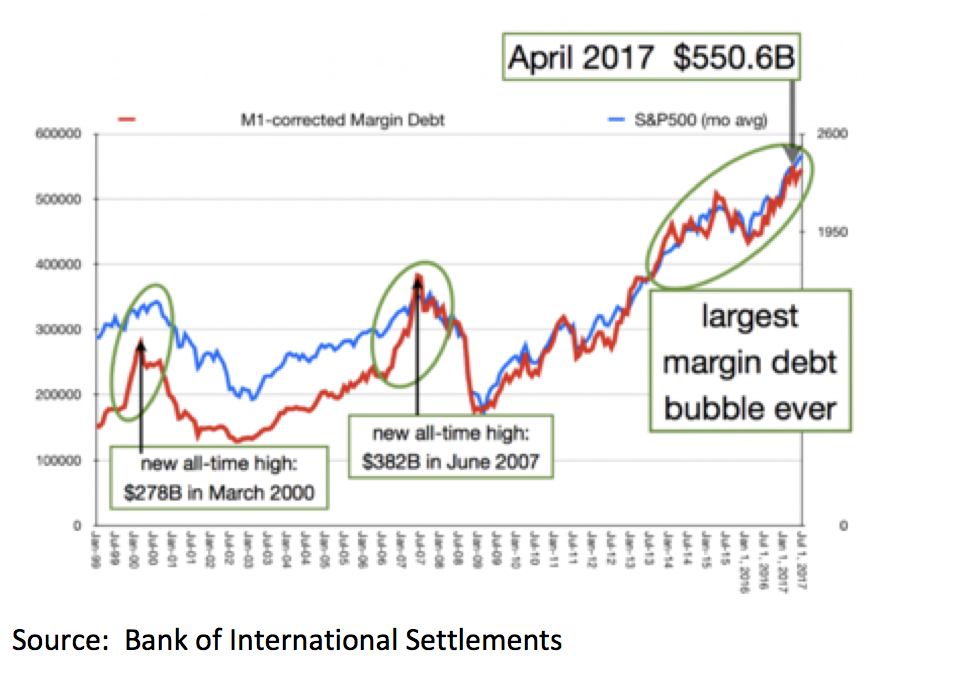

There is little question that the themes of disruption, creative destruction, and particularly automation, have captured the imagination of investors who have also now borrowed record amounts through margin loans to buy stocks (Fig.1)

Figure 1. Margin loans taken out on US stocks now exceeds tech 2000 and and pre GFC booms.

Our concern is that valuations for these disruptive automators factor in a future that will not be disrupted. To suggest that the growth of these company’s earnings will continue unchallenged by competition, by economic setback or legislative response, is to believe in a future that history demonstrates otherwise.

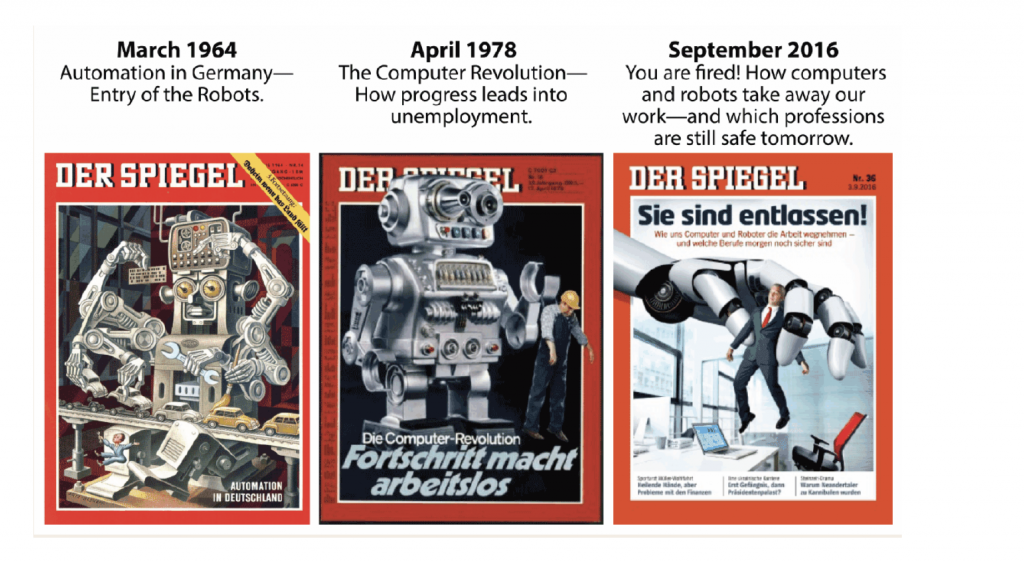

Have a look at Figure 2. Of various issues of German News magazine Der Spiegel. It becomes immediately obvious that the current emotion about automation is not new, reinforcing our observation that ‘disruption’ is just a fancy new word for change, which is constant. More importantly it is clear that fears of automation rendering a generation of people unemployed may be premature and temporary. Indeed the September 2016 cover appears to be an almost exact replica of the April 1978.

Figure 2. Der Spiegel

We have seen this before. In Omaha Nebraska farm land prices soared amid thematic enthusiasm for the westernisation of Asian tastebuds and the replacement of rice with red meat and wheat. That was in the 1960’s and farm prices subsequently plunged.

What experience tells us is that even when the theme is right, there are often many false starts, and more importantly, stock market investors aren’t patient. Therefore, if expectations aren’t met quickly, there will be a reappraisal and a flight to safety.

If automation is really going to kill jobs and if it is happening now amid “the greatest and most rapid period of change in world history”, then employment and salary numbers should be indicating it.

But in Japan, as the FT reported this week; “Corporate Japan hit by severe labour shortages: Companies offer more permanent contracts to retain staff.” You might want to attribute this solely to the deteriorating demographics in Japan, but note also that blue collar wages are surging in the U.S. The Economist reports that the real median income of households rose 5.2 per cent in 2015 and 3.2 per cent in 2016. “In the year to the third quarter, wage and salary growth for the likesof factory workers, builders and drivers easily outstripped that for professionals and managers. In some cases, blue-collar pay growth now exceeds 4 per cent.”

Obviously, investors need to also consider the growth of part-time employment and particularly the negative impact on salaries of the “gig economy”, but the key point is wage pressures are building in many skilled trades, suggesting Der Spiegel may still have a few ‘Automation’ magazine covers to come yet.

With technology stocks trading at price earnings multiples that defy logic, as well as historic norms, it won’t be long before investors grow impatient with automation’s lack of progress.

The Montgomery Global Funds own shares in Apple, Microsoft, Facebook and Amazon

With Automation it only stands to reason that more jobs are created .

Productivity increases ,more stock in less time.

More pallet movements/container movements ,more packaging etc you could go on endlessly .

You need more people to shift this stock and other business that supply that business will likewise have the same multiplyers, then multiply it out over any number of businesses .

Wether it be in the up keep of the Automation(electricians),more fork lift drivers to shift the increasing volumes ,more trucks picking up the stock ,more salespeople to sell it

Again the list goes on and most of these jobs are blue collar ,the cost of goods may fall .

But below the line costs will go up .

The US is putting on workers and while I realise some of these jobs are not what we want ,they do provide the opportunity of work, and then it’s up to the individual to use that to progress himself .

The media have everyone worried about Automation the reality is quite different again.

To call these growth tech stocks expensive based on current earnings is a ridiculous thesis because it’s a poor way to value them.

You could’ve added Facebook to this list 5 years ago, and now you proudly write articles on your long FB position in your global fund. Those who bought Facebook then are now laughing because they saw the future earnings potential beyond the current year or the year after.

To value Amazon purely by their earnings would be ignorant of their revenue, market power or economies of scale is also ridiculous.

Investing in these companies when they have high P/E’s is not irrational. It just doesn’t adhere to traditional, Buffet style, bricks and mortar value investing.

Herman, We have indeed written papers on the subject of high P/E’s being irrelevant to the assessment of value. So we agree with you on that point. More simplistically, if a company’s earnings grow at 100%, then, of course, the P/E halves each year. And on an individual basis, as you have pointed out, there might be such cases. But half the index on 200 times? To believe all of these companies, representing half the index, will all become Facebooks or Amazons is to stretch reality into the realm of the imagination.

“With technology stocks trading at price earnings multiples that defy logic, as well as historic norms, it won’t be long before investors grow impatient with automation’s lack of progress.”

And when that happens, the amount of margin debt outstanding will just exacerbate the correction.

All it needs is a catalyst; a war between the USA and North Korea to break out, a collapse in Bitcoin (and a realisation about all these other things or companies that don’t make money), huge selling due to favourable tax laws etc. – and then in each case, they’ll find out the exits are more crowded than they thought.