Guest Post: Can you beat the worlds biggest banks?

For new readers to the blog, welcome. Here at Roger’s blog we are conducting an ongoing study comparing the performance of investment portfolios recommended by major broking houses verses a loose selection of A1 and A2 stocks bought as a big a discount to IV as possible.

For new readers to the blog, welcome. Here at Roger’s blog we are conducting an ongoing study comparing the performance of investment portfolios recommended by major broking houses verses a loose selection of A1 and A2 stocks bought as a big a discount to IV as possible.

(Its Roger here: Its important to understand this is a hypothetical investment portfolio based on one of the Twin’s consistent approaches to stock selection. In that regard it is not a collection of small high risk bets whose returns could be easily ramped. I will be very surprised if you see high double digit returns from such an approach for that reason. At Montgomery, managing +$200 million simply precludes us from investing in the small companies that would produce higher returns on relatively insignificant $5000 sums – irrespective of whether or not the returns can be boosted by disingenuous marketing by social media marketing experts or worse, even ramping. Its easy to make 50% per annum on $100,000. Much harder on $1billion. Even personally our individual speculative selections may have a couple of hundred thousand dollars allocated to them and so we are also precluded from employing capital where liquidity may be boosted only by the participation of a small group of invisible Facebook friends. Worse, our experience tells us that such anonymous groups can be a manic depressive bunch and when they’re told that a holding has been sold, the illiquid volumes of the companies they are toying with will produce the very opposite result of that which they aspired to achieved.)

We have been following twin brothers and their investment decisions and performances since December 2010.

The twins each inherited $100,000 and sought differing advice how to invest it, the quarterly reports of their investments can be found here:

http://rogermontgomery.com/will-david-beat-goliath/

http://rogermontgomery.com/how-are-the-a1-twins-performing/

http://rogermontgomery.com/which-a1-twin-is-outperforming/

By the end of 2011 our first twin, the regional Queensland accountant was still head down, trying to help hundreds of clients recover from all the natural disasters of the previous 12 months, government help was available but so was the paperwork. As these tasks drew to a close, Queensland entered a bitter and hard fought state election, so comprehensive was the coverage, it was hard to watch anything else. There had been a lot on, and checking on the performance of his portfolio had really been at the bottom of the list.

Our NSW based public servant had pretty much had the same six months, but for very different reasons. Being in the Foreign Affairs office of the federal public service, he was now getting used to the third minister in 2 years, much changed, often needlessly and nobody had any time for anything other than redeploying resources and priorities.

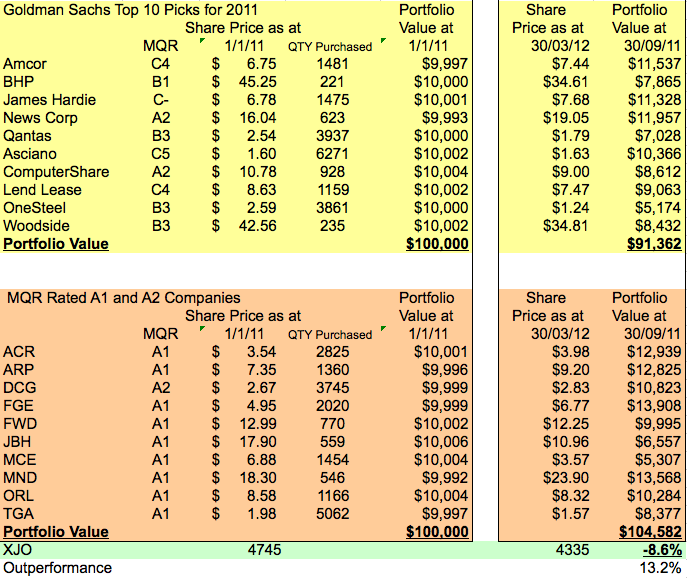

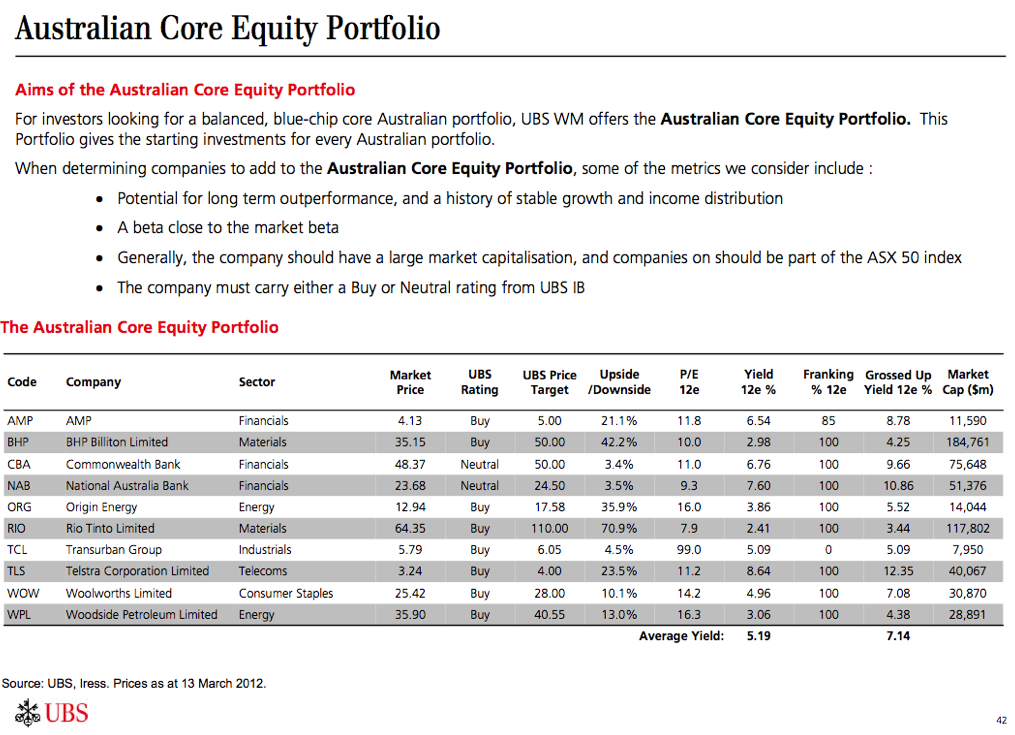

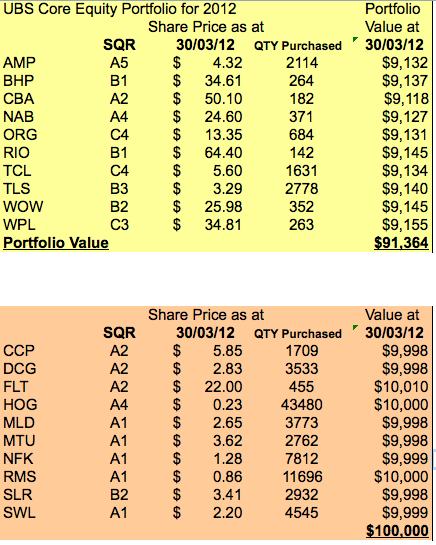

As March ended and the weather cooled, both brothers had a chance for a bit of R&R and to catch up on personal business. Neither were particularly thrilled with the performance of their portfolio; Our public servant , who had always invested through Goldman Sachs had performed exactly in line with the broader market, his portfolio was down 8.6% over the 15 months, and had lost nearly $9 000. He felt he could do better, and had been thinking about getting other advice for quiet a while now, and decided to act. He now only had $91 000 left and decided to switch brokers and became a client of the giant international broking firm UBS, who provided him with their Australian Equity Core Portfolio. Here is an image of the advice from UBS and how his $91 000 was divided amongst the 10 stocks listed.

Source: March 2012 ASX Investor Hour. www.asx.com.au

Our Queensland accountant had faired significantly better, by investing in A1 and A2 stocks he had outperformed the market by 13.2% over the 15 months. However, he acknowledged that a couple of his investment decisions had performed poorly and wanted to rebalance his portfolio, he too decided to act. With over $104 000 available to invest he decided to round down his investable sum back to $100 000 and spend the surplus on a short Gold Coast holiday with his family and the balance on a membership to Skaffold. Skaffold is the research tool that would help him scour the every listed company to find quality stocks that may be selling at a price that offered a discount to estimated intrinsic value. Skaffold would also save him the time of sorting through ten years of annual reports for every listed company. Armed with ability to narrow down the choice of stocks, he would able to focus on the few that met his criteria and do further research on them before investing.

Here are the twin’s portfolios side-by-side:

The varying quality ratings of the 2 portfolios makes for interesting reading. On the basis of quality, the UBS portfolio doesn’t look very disciplined yet the portfolio chosen with the help of Skaffold looks pretty consistent. Except for 1 stock that is an A4. Our Skaffold user feels this cash flow positive producer may be about to be rerated by the market and A4 is as speculative as he could bring himself to be.

We will revisit our investing twins just after June 30 to see which portfolio is performing better, many thanks to Roger for putting the stocks to the test and actively encouraging this ongoing project.

All the Best

Scott T

Keep in mind this is a hypothetical and educational exercise only and not a recommendation of any kind.

Authored by Scott and posted by Roger Montgomery, Value.able author, SkaffoldChairman and Fund Manager, 19 April 2012.

Roger,

Could you let me know how your Eureka portfolio has gone?

I found it an interesting place for ideas.

Cheers,

Paul

I’ll be updating it soon Paul. Thanks.

I keep more permanent records at the end of three months I have a peak at the end of march last year. The XAO, XMD, XSO often perform differently. As I have no major banks, no mining companies, and no insurance stocks. the XMD, XSO are a better guide. I still have some lower ‘quality’ stocks. and my performance is dominated by three or four companies I have held for some considerable time. Since the peak I am down (-)2.6%. XMD down (-) 12.29. I am not unhappy with this as dividends are used for ‘retirement’ income.

Scott,

Keep up the good work, I look forward with interest how these A! and A2 stocks will perform in the longer term, it is interesting to see the significant girations so far! Well Done

Many thanks Kent

All the best

Scott T

Hi Scott, I admire your disciplined approach. Can you suggest a competent financial adviser for a smaller investor?

Thanks Emily, no I cant really think of one, do you have an accountant? Often they know quite a few FA’s and may know one that suits your objectives, age, risk profile etc.

All the best

Scott T

The obvious question is: Will the Queensland accountant be participating in the capital raising by MTU?

I think Ash may have answered that one already?

Hi Hello,

Not in this forum.

They are paying 180M for something that earnned $10m in 2011

Synergies are $5 mill

It’s a terrible deal

Roger has spoken to management and they have said $5M this year in synergies and $5 for the next few years

So best case they have paid 180M for something that possible could earn $25M

Still not a no brainer on my maths………

Cheers

Thanks Ash. Appreciate the clarification. I will check my notes as I can see that my comment “$5mln this year and an additional $5mln next year and the year after” could mean synergies of $5+$5+$5 or $5+$10+$15. The word “synergy” when used to justify the price paid for an acquisition always (yes always) fills me with trepidation too. At this stage the market is giving them a modest thumbs up and we are aware of some bright sparks that own the stock and don’t appear to be selling

Is it time for basics 101 questions for offer dummies. Can somebody please explain the date structure for the offer. It says that the ex-date and trading rights commence on April 18th. Then what is the difference between this ex-date and the record date on April 24th? Is that something to do with the clearing system so that you sell the shares on April 23rd you will still get to participate in the offer?

Thanks.

Hi Matty,

http://www.asx.com.au/research/dividends.htm

Thanks Roger. I was searching the ASX website for definitions without success.

Isn’t it frustrating when companies don’t seem to act in the best interest of shareholders? CST, TSM, NST, RED and MTU. Just a short list of the questionable recent actions.

Could you please hurry up and buy up significant holdings (particularly in the companies I own a piece of) and maybe you could use your significant shareholder status to bring pressure on the boards to act in a value adding manner. But maybe your risk management precludes you from having such significant holdings according to the size of your fund?

You’re all over it Matty.

Hi Phil, thanks for reading my post. I was really disappointed with the price paid for M2’s latest acquisition.

When I finished writing the post and pricing at March 30 closing prices, I submitted it to Roger thinking this is going to be a real challenge this year. However I thought if none of my selections go anything silly I think we’ll be OK. Just 4 days later, MTU do do something silly and their price is now down 12%

All the best

Scott T

“it’s easy making 50% per annum on $100,000, harder on a billion” i’d sure like to know how. It’s never easy

Hi Tony, Stick around this blog and you’ll find chatter about small companies whose recent share price surges – sadly, due to ramping (not necessarily to sell) elsewhere in the digisphere – have produced more than 50%.

Hi Tony, Roger. I sold Cardno (CDD) this week for a 54.8% profit. It does happen. I’m not sure if the price was subject to ramping or not. I bought them in early October 2011, so that’s only a little over 6 months. I sold them because I don’t think their growth-by-aquisition strategy is going to change any time soon. When a company get’s addicted to acquisitions (think QBE), this can be a worry. The more often they aquire new businesses, the harder it gets for us mere mortals to work out whether each one is in the best interests of ordinary shareholders. Plus, the recent steep rise in the Cardno share price alerted me to the possibility of a near-term correction. I can always buy them back if I’m wrong.

I sold Breville this week for a 40% profit also. I suspect their share price spike is partly being fuelled by take-over speculation, so I’ve cashed in those shares too and taken profits. Again, if I’m wrong, I can buy them back. That’s why the sharemarket is the best game on the planet. You can place a bet, then increase it or withdraw it as the race goes on; or take a profit, or change your mind, all while the race continues (to paraphrase Geoff Wilson as quoted in Mathew Kidman’s book “Bulls, Bears & a Croupier…”).

Codan is another company that likes to make aquisitions, although not on the same scale as Cardno (CDD). Codan (CDA) have chosen to write down the carrying value of some of their past aquisitions (in previous years), but their recent profit upgrade suggests that their latest aquisition, Minetec, may be a good one for them. I’m keeping a close eye on them. So far, so good.

The BRG and CDD examples above show that you can make very good profits in this environment, if you do your research and pick stocks wisely. Both of those companies were high dividend paying companies in good financial positions with high returns that were well below my calculation of IV when I bought them. Apart from my concerns with Cardno’s recent increase in aquisition activity, I was comfortable to hold both. The recent share price surge in both caused me to make a call on each stock, and in this case I chose to sell. There are plenty of other stocks. Hopefully, that’s me off those ladders, and straight onto two more (the old snakes and ladders analogy). Two stocks I’m looking at (no recommendations, just looking at them) are RCG and DTL. They are two more companies nearing year-low prices, who have little to no debt and high returns, including good fully franked dividends (which I personally value highly). Obviously more research needs to be done, but that’s a good starting point.

Have Fun!

JC.

Oh, and one more – HOG (Hawkley Oil and Gas). I hold HOG, and watched them drop to 12 cents earlier this year. They are now around 24 cents (100% increase on their year-low price). I trimmed my holdings (by a third) on Monday (16th April 2012) to lock in some profits (33% gain on my $0.18 purchase price). HOG has been mentioned by at least 3 different people on this blog in the past 12 months (which is what alerted me to them in the first place), and Skaffold has a pretty impressive estimated ValueLine for HOG going forward. I’m happy to continue to hold 100,000 HOG. Plenty more where that came from too.

Cheers,

JC.

Hi John,

Thanks for reading my article and for your interesting comments. I don’t own HOG but came across then doing my research for this article. You are right the Skaffold line is very impressive which is why I did more research on them and their forecast future cash flows. Some of their presentations they have released as ASX announcements make for interesting reading.

All the best

Scott T

Thanks Scott – yes, the more I looked into HOG, the more I liked them. I note that earlier this month they announced that they have been granted an unlimited production licence for the 100% owned Sorochynska permit from the Ukrainian state geological department. They have already been producing from this incence (under their prior “pilot production rights” status), athough the processing has been through 3rd party gas processing

facilities located 20km from the licence. The award of this unlimited production license allows the company to commence construction of a gas plant on the licence which will enhance current production rates and accommodate future production from new wells. Recent 3D seismic acquisition and further geological and petro physical analysis will provide the basis of a full field development plan including developmental and appraisal drilling of multiple targets on the block.

What got me really interested orginally was a mention here on the blog about an impressive interview with their CEO which had a podcast available. I haven’t been able to locate that this morning, so I can’t add a link to it, but what basically attracted me to the company was that the CEO said then that they have no doubt that the oil and gas were there. They just needed to prove their expertise in drilling quality production wells. With that in mind, he believed they had assembled one of the best drilling crews around (mostly ex-USA drillers), and was incorporating local Ukranian employees wherever possible to keep everyone happy. He knew they had what it takes, and he viewed it as a blue sky operation (all up-side, very little downside risk), but knew it would be an uphill battle to get the message out there to the wider investment community.

He also pointed out that the local authorities were being more than helpful as they desperately needed the infrastructure and the royalty stream that further production would bring to the local economy.

As far as the location, there is everything they need within close proxmity – power, water, transport. It is not an operation out in the middle of nowhere. I piled in on the basis of the huge upside and the fact that they already had one producing well, with no debt, at that time. Although I have sold one third of my holdings (last Monday) to lock in some profit, nothing has changed my positive vew of this company. Their latest production reports and investor presentations are good.

I’m happy if more people begin to discover this company, or not. Either way, I think the IV will continue to rise, and the SP will follow, at some point. There’s a lot of catch-up to go yet… The best thing is that there are plenty more companies out there just like this one!

Cheers,

JC.

Here is one interview I found with the CEO and is possibly the link you’re referring to:

http://www.brrmedia.com/event/88797/michael-earle-managing-director-ceo

Dave T

Hi Dave. No, that’s not it, but thanks for the link – I just watched the presentation, and it was good. That was Michael Earle, who took over from the founding CEO Richard Reavley. The interview I was referring to was in March 2011 (with then-CEO Richard Reavley) and there is an ASX announcement referring to it on the HOG website- http://www.hawkleyoilandgas.com/ – but that BRR (Boardroom Radio) interview seems to have been deleted (by either BRR or HOG) – probably because it’s old and has been superseded by the more recent Michael Earle presentation (your link).

HOG had a bit of a management shake-up in late Febrary this year and Michael Earle left the business. The founding CEO Richard Reavley has resumed that role again, and another one of the company founders, Glenn Featherby has taken on the role of Executive Chair. It seems the founders have decided to take a more front-seat approach to running their company now.

Even though he has now left HOG, there is still plenty of information in the November 2011 Michael Earle company presentation on BRR that you refer to Dave T. Thanks again for that link.

Regards,

John C.

I remember having a chat with Matthew Kidman about this subject and it often comes up in conversation with other fundies and at broker briefings. Steering a wide berth around growth-by-acquisition has often been a wise move.

Hi RM, I think that neatly summarises Cardno, but I’m not sure about Codan at this stage. I’m still prepared to give them the benefiit of the doubt. Any thoughts!

Not off hand John but we are scouring every day and they both pop up from time to time. We do rate management at Cardno highly and the question regarding Codan is how much bigger do you think they can be in a decade’s time?

I guess that part of the answer to that would be how many more businesses will they buy, and will they pay too much for them? I prefer organic growth, but that depends on the industry dynamics, the business model of the company, and so many other factors. A company like Codan, whose core competency used to be manufacuring Radio & Satellite Communications Equipment, Consumer & Countermine Metal Detectors, and Satellite RF Subsystems (whatever they are), are not a company who can easilly replicate and duplicate their business in a store roll-out, like a retail business. There is far less demand for their products. They need to grow and expand on their core competencies. There is a place for growth through aquisitions in this process. Too much of that, however, sends alarm bells ringing in my head, especially if there seems to be a pattern developing of writedowns in subsequent years for previous aquisitions… As I said before, profit upgrades are GOOD, and it was nice to see Codan release a profit guidance upgrade on April 18th.

I have been very interested in the MTU discussion about their Primus purchase. I note that Ash has given it the thumbs down (“A Terrible Deal”), and he’s not Robinson Crusoe there. I have read another analysis recently by an author I won’t name here (another value investing proponent) who also believes it destroys shareholder value. Pity! I hold MTU, and it’s my only Telco exposure currently. I have to make the call whether this is short-term price movement, or if the price is dropping fast to reflect the drop in underlying value of the company since the Primus acquisition announcement. As is usually the case, I suspect it’s both of those at the same time, but how much of each? My head says sell up, and re-appraise later. My gut says to hold. My head has been winning these battles lately. We’ll see…

John,

Unlike many others I AM a full time fund manager and what I can say is that such price drop aren’t uncommon during rights trading especially when the issue is at such a wide discount. Value destruction depends on the return the raised capital produces. If another raising were to occur to be used to pay off the debt, that would be destructive. This raising is at a discount to the market price but a premium to the equity per share. Thats value enhancing. It is however offset (in this case fully) by the decline in ROE. Our value investing proponent should read their two copies of Value.ble again or send them back and be authentic.

Value.able page 137

“One of the weaknesses of the return on equity ratio is that it can be artificially boosted by debt”

“Two decades out of university, I have formed the conclusion that debt is simply bad and like Buffett, I believe it is unnecessary”

Value.able page 138

“If the owners have put in a little of their own money and borrowed a vastly larger sum, the return on the equity will look very attractive. But watch out”

Cheers

Hi Roger,

I don’t disagree very often but what ever happened to healthy debate and different opinions is what makes a market.

Surely you’re not getting all catholic and saying that value.able is the only one, holy apostolic book on value investing.

Roger, I know it’s good and as you know I have 5 copies but even I would not go that far.

Cheers

Rob

sacrilege Rob!!!! Have a safe Anzac Day.

My quick calculations on the purchase are along the following lines

Primus is $112M in equity that produced a bit over $10M in NPAT last year. Thrown in is some restricted cash meaning that MTU paid around $180M for around 112M in equity that roduced about a 9% return.

Accordingly MTU gets around 5.5% return assuming no growth and no synergies in the Primus business. Bit of a bummer.

However – MTU raised capital above equity per share, borrowed to acquire the business, and appears to have increased the groups cash flow (very handy for paying down debt). These are definite pluses for MTU. It seems from Roger’s above post that overall the good and the bad offset each other leaving us in a fairly neutral position.

Do we trust management to do a good job with what is left? MTU has a pretty good track record. I’m inclined to give them the benefit of the doubt until the figures prove otherwise.

Roger,

Dont you mean that if you raise equity above equity per share it is equity enhancing. It is only value enhancing if it returns more than the existing equity.

I would think if it dilutes ROE then it will reduce the equity multiple and cause the value to be lower.

Cheers,

Paul

Increasing equity per share has a positive impact on the product. The net result depends on the magnitude of the two.

HI Scott,

Before some people come in and possibly talk about the problems with this analysis, i just wanted to say keep up the good work.

This is a fun exercise and i always find them interesting especially seeing what the investment bank has put up. Every time i see these top ten stocks by sachs or UBS and see what they are listing i have to say that they are, well, lets be kind and say they don’t fit my quality filters. Not saying that the share price won’t go up though, just not for me. I like the valueable portfolio instead, however some of these i would have to leave out personally.

All the best

Andrew

Many thanks for your support Andrew. March 30 was also a challanging time to put together the portfolio as a number of stocks had had a run up in March.

I look forward to writing again in July

All the best

Scott T