Two companies benefiting from strong demographic trends

We like to invest in businesses with products and services where the underlying demand is strong and predictable. And when it comes to predictability, there are few things as certain as demographic trends. Today, I’d like to highlight two companies – Resmed (RMD) and Fisher & Paykel Healthcare (FPH) – that are taking advantage of strong demographic trends.

We’re living longer

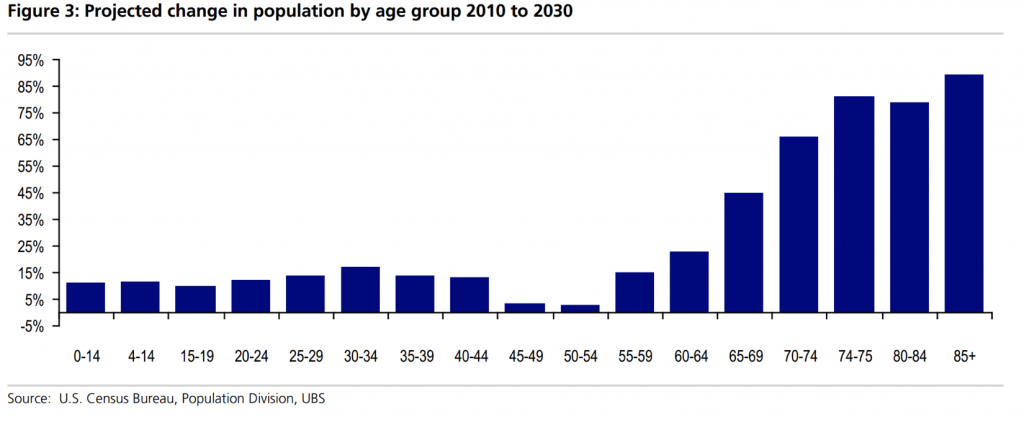

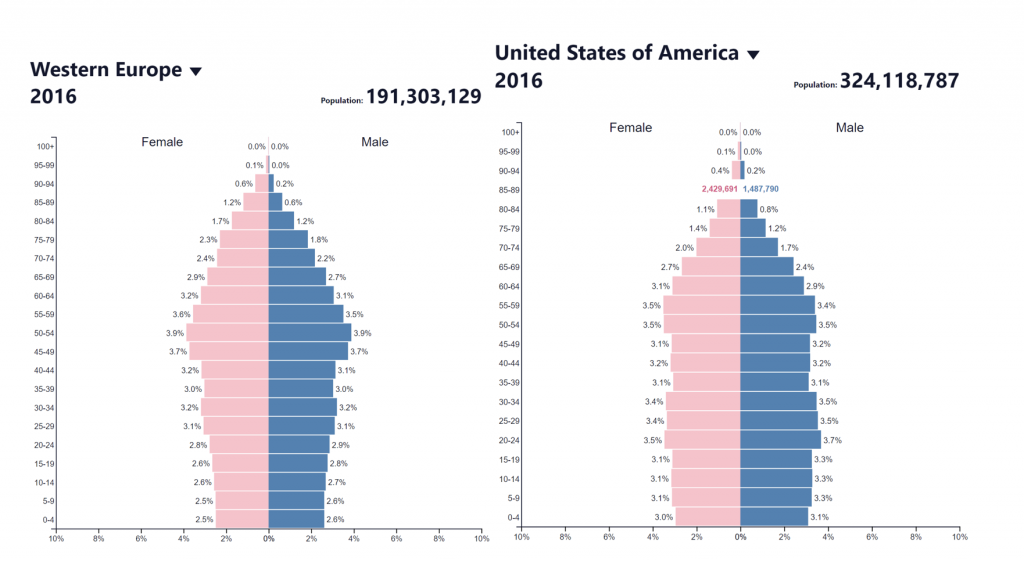

The first demographic trend is that people are living longer and, combined with the “baby boomers” coming of age, the older age groups are the fastest growing segment of the population in all developed countries. If we use USA as a guide, people aged 70+ will increase by about 75% between 2010 and 2030 compared to 15% for the US population as a whole.

Looking at Western Europe, the population pyramid looks even more “top heavy” meaning that we will see even bigger aging of the population than in the US.

We can hence say, with very high confidence, that there will be a steady demand growth for companies that cater to older people.

We’re also getting heavier

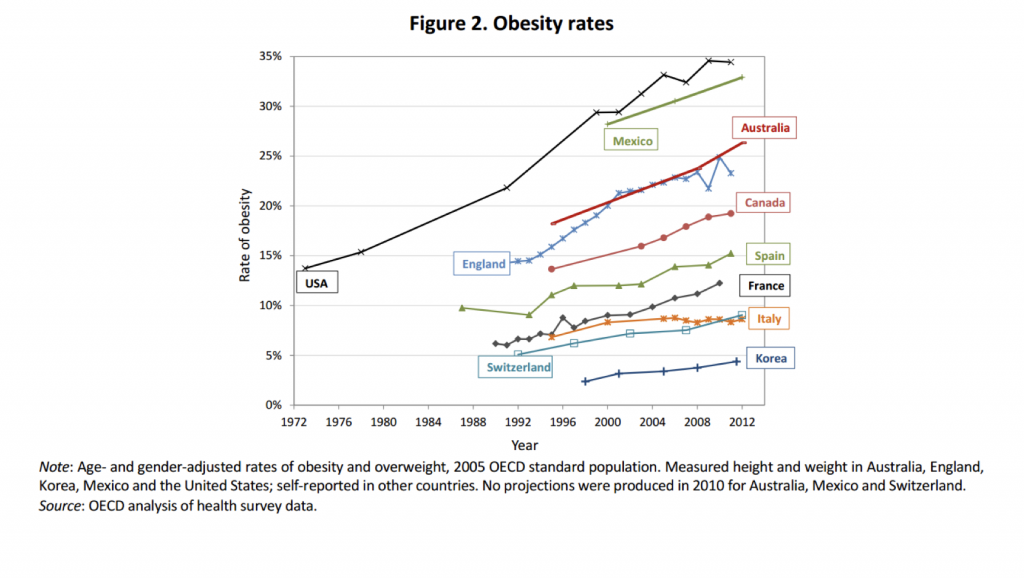

The second demographic trend is that people in the developed world are getting heavier. As can be seen from the chart below, this trend is very steady in all the countries covered in OECD heath data and there are no signs that this will reverse anytime soon. We can say, with almost as high confidence, that people will continue to get fatter over the coming years and any companies that can take advantage of this should also have favourable growth dynamics.

We can say, with almost as high confidence, that people will continue to get fatter over the coming years and any companies that can take advantage of this should also have favourable growth dynamics.

How RMD and FPH are profiting from these two trends

The key is to identify a product that is tailored to the needs of people growing older and heavier, as this should create favourable conditions for good and predictable growth in demand.

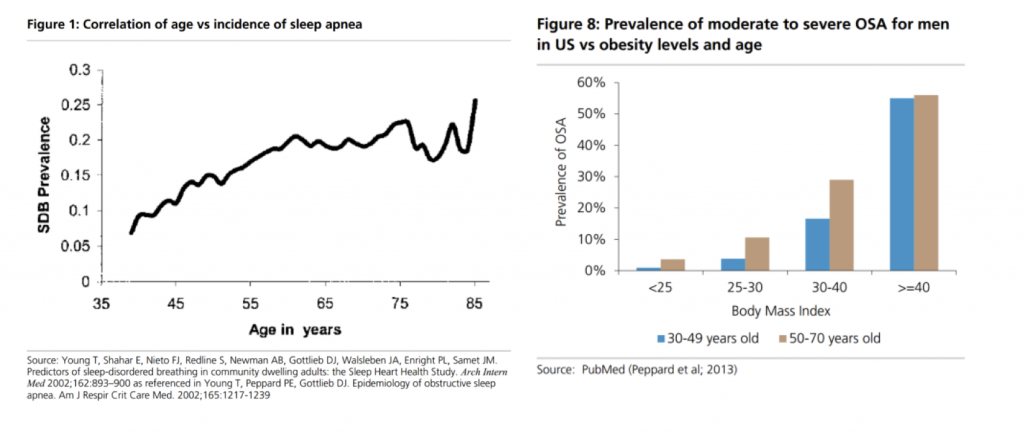

What we do know is that older, heavier people are more prone to the medical condition Obstructive Sleep Apnea (OSA). OSA is a disease in which your airways close during sleep, leading to an inability to breathe. Sufferers often wake frequently during the night and get very broken sleep as well as not getting enough oxygen. This leads to a range of negative effects including higher risk for heart disease, type 2 diabetes and chronic fatigue.

OSA is caused by the muscles surrounding the trachea not being strong enough to hold the airways open and the two main causes of this are obesity (the fat surrounding the trachea results in increased pressure) and age (all muscles get weaker with age).

There are of course a lot of other factors that determine the attractiveness of an industry (level of competition, relative strength of the companies vs. suppliers/customers, regulatory environment, and barriers to entry, to name a few) but a strong and predictable growth in demand is a very good starting point for further analysis.

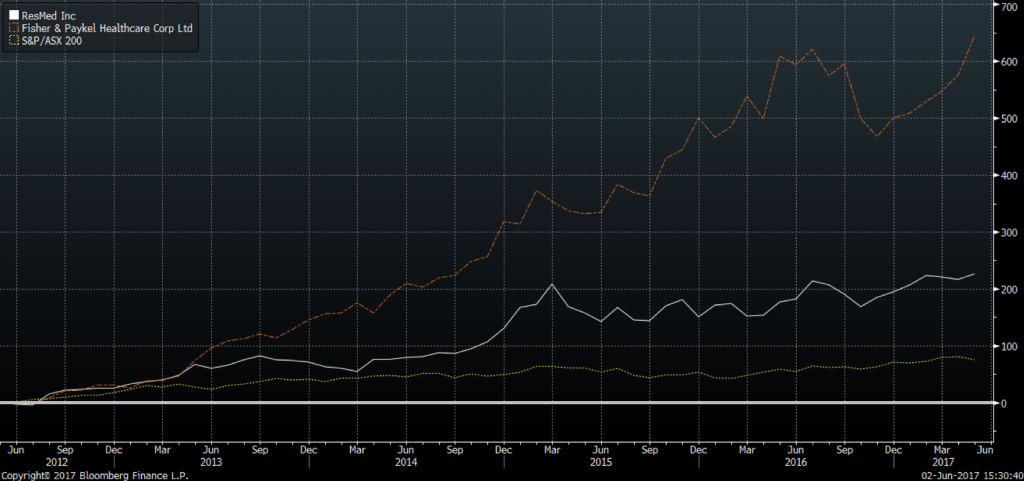

Two out of the three leading companies manufacturing products that treat OSA are listed on the ASX. Both Resmed (RMD) and Fisher & Paykel Healthcare (FPH) have been very strong performers during the last five years and have significantly outperformed the general market.

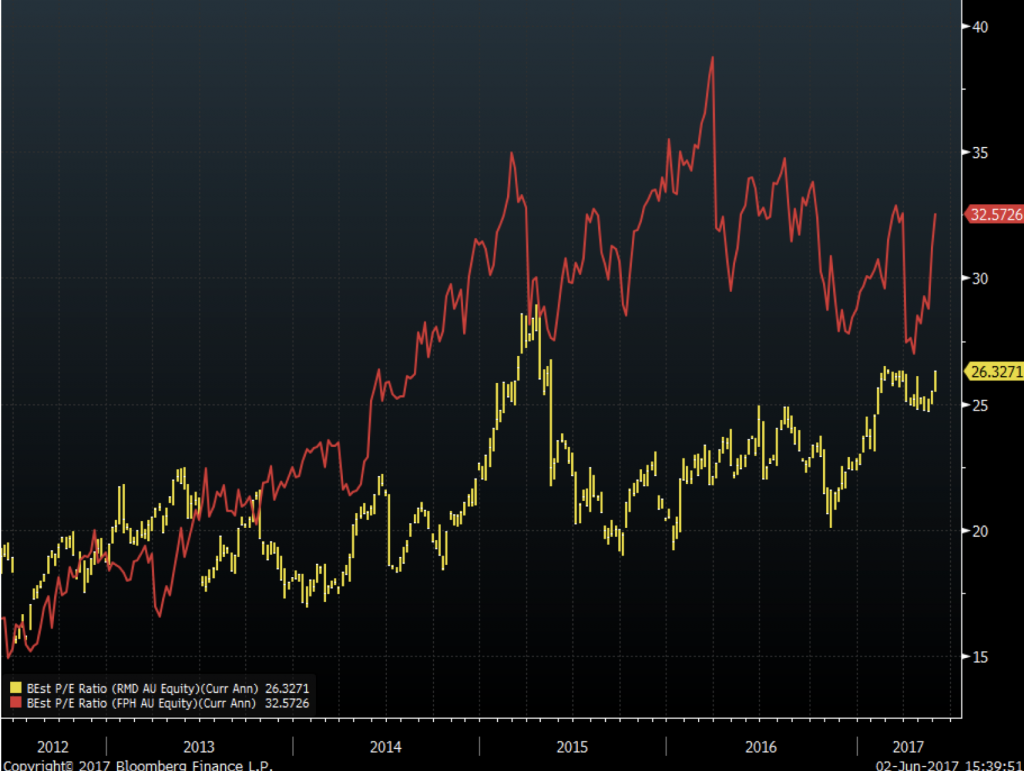

As a result, their valuation has expanded quite significantly and the companies are now trading on 26x and 32x one year forward P/Es, respectively, according to consensus forecasts.

As Lisa pointed out in her blog post recently , a simple P/E is not enough to assess whether a company is attractively priced or not but it has to be put into perspective with the outlook for the business.

What we can say is that in the current environment, where we very much struggle to find good value, companies with very strong and predictable demand drivers are very attractive!

The Montgomery funds own shares in Resmed.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hi,

I would have to totally disgree wth the previous comments regarding CPAP machines. I tried the mouth guard and it did not work. Please note also that OSA is not necessarily an overweight person issue. I am actually quite fit (in fact there are highly tuned athletes that suffer from the condition), it is more to do with the shape of my face/jaw and perhaps having quite large tonsils! Anyway, after going through the sleep tests etc (and after having no success with the mouth guard) I am now using a Resmed AirSense 10 machine with the nasal mask. I am a huge fan and it is already making quite a difference after only a short time of about 1 month. I was totally committed to treating my condition because I was struggling to have the energy to run my financial planning business, raise 4 children and remain committed to my fitness. I am using the nasal mask and don’t find it uncomfortable at all. I am extremely happy. When I sought treatment I requested Resmed as I am also a very happy shareholder (I bought my first pacrel in the mid $4 a few years ago and have averaged up )and believe they have the best products. I find the cost of the Resmed machine to be miniscule compared to the enjoyment of getting my life back and having the energy to do all the things I want to do. My partner also reports that she can’t hear the machine at all (they are so quiet!) and does not disturb her sleep at all. I have no doubt that I will continue to use my Resmed machine for the rest of my life.

I agree 100% Robert, I’ve had a similar experience, and have since been using a simple mouth Gard device which is far more effective in keeping you asleep and about 1/50th the price of cpap.

Hi i have had the unpleasant experience of having sleep apnea and used a resmed cpap machine i think and hope that a new and better technology is available in the near future as these machines are unbelievably uncomfortable very expensive used for a short period and never used again lots of people being ripped off.