Gold Bugs…Nah

Their is something prescient in the name John Deason and Richard Oates gave to their 1869 gold nugget the ‘Welcome Stranger’ and the one Kevin Hillier gave to his 875 troy ounce find ‘The Hand of Faith’. Today’s gold price is indeed very welcome to gold bugs and there is plenty of faith needed that prices will rise even further. But gold bugs have received a terse warning from none other than Warren Buffett who has just released Berkshire’s 2011 letter. For those of you who believe gold (A.K.A. the barbarous relic) is the best investment you won’t find any more support from Warren this year than any other (with the exception of his 1999 dalliance into silver) . You can find his complete letter here: Berkshire 2011 Annual Report.

Here’s the section on gold:

“The second major category of investments involves assets that will never produce anything, but that are purchased in the buyer’s hope that someone else – who also knows that the assets will be forever unproductive – will pay more for them in the future. Tulips, of all things, briefly became a favorite of such buyers in the 17th century.

This type of investment requires an expanding pool of buyers, who, in turn, are enticed because they believe the buying pool will expand still further. Owners are not inspired by what the asset itself can produce – it will remain lifeless forever – but rather by the belief that others will desire it even more avidly in the future.

The major asset in this category is gold, currently a huge favorite of investors who fear almost all other assets, especially paper money (of whose value, as noted, they are right to be fearful). Gold, however, has two significant shortcomings, being neither of much use nor procreative. True, gold has some industrial and decorative utility, but the demand for these purposes is both limited and incapable of soaking up new production. Meanwhile, if you own one ounce of gold for an eternity, you will still own one ounce at its end.

What motivates most gold purchasers is their belief that the ranks of the fearful will grow. During the past decade that belief has proved correct. Beyond that, the rising price has on its own generated additional buying enthusiasm, attracting purchasers who see the rise as validating an investment thesis.

As “bandwagon” investors join any party, they create their own truth – for a while. Over the past 15 years, both Internet stocks and houses have demonstrated the extraordinary excesses that can be created by combining an initially sensible thesis with well-publicized rising prices. In these bubbles, an army of originally skeptical investors succumbed to the “proof” delivered by the market, and the pool of buyers – for a time – expanded sufficiently to keep the bandwagon rolling. But bubbles blown large enough inevitably pop. And then the old proverb is confirmed once again: “What the wise man does in the beginning, the fool does in the end.”

Today the world’s gold stock is about 170,000 metric tons. If all of this gold were melded together, it would form a cube of about 68 feet per side. (Picture it fitting comfortably within a baseball infield.) At $1,750 per ounce – gold’s price as I write this – its value would be $9.6 trillion. Call this cube pile A. Let’s now create a pile B costing an equal amount. For that, we could buy all U.S. cropland (400 million acres with output of about $200 billion annually), plus 16 Exxon Mobils (the world’s most profitable company, one earning more than $40 billion annually). After these purchases, we would have about $1 trillion left over for walking-around money (no sense feeling strapped after this buying binge).

Can you imagine an investor with $9.6 trillion selecting pile A over pile B? Beyond the staggering valuation given the existing stock of gold, current prices make today’s annual production of gold command about $160 billion. Buyers – whether jewelry and industrial users, frightened individuals, or speculators – must continually absorb this additional supply to merely maintain an equilibrium at present prices.

A century from now the 400 million acres of farmland will have produced staggering amounts of corn, wheat, cotton, and other crops – and will continue to produce that valuable bounty, whatever the currency may be. Exxon Mobil will probably have delivered trillions of dollars in dividends to its owners and will also hold assets worth many more trillions (and, remember, you get 16 Exxons). The 170,000 tons of gold will be unchanged in size and still incapable of producing anything. You can fondle the cube, but it will not respond.

Admittedly, when people a century from now are fearful, it’s likely many will still rush to gold. I’m confident, however, that the $9.6 trillion current valuation of pile A will compound over the century at a rate far inferior to that achieved by pile B.”

Before simply believing Warren WILL be right…There’s this in the annual report as well: “Last year, I told you that “a housing recovery will probably begin within a year or so.” I was dead wrong”

A much older quote that summarizes Buffett’s long-held view is this one “It gets dug out in Africa or some place. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”

In my earlier post on this subject HERE, I note; “But I trust you can see the irony in claiming gold is ‘useless’ and yet it can buy [all the agricultural land in the United States, sixteen companies as valuable as Exxon and a trillion dollars in walking-around money].

For those of you who are interested in two alternative perspectives, (assuming the debasing of fiat money across the globe is not enough to encourage you), I thought you might find some of what you need in the following points, and also Warren Buffett’s father’s views. (Note: we only own three or four gold stocks all of which have rising production profiles and do not require ever increasing gold prices to support the returns on equity that justify much higher valuations. So we aren’t quite in the ‘carried-away’ camp even though some have doubled in price. This latter development delights us in this market).

And now a short commercial break…

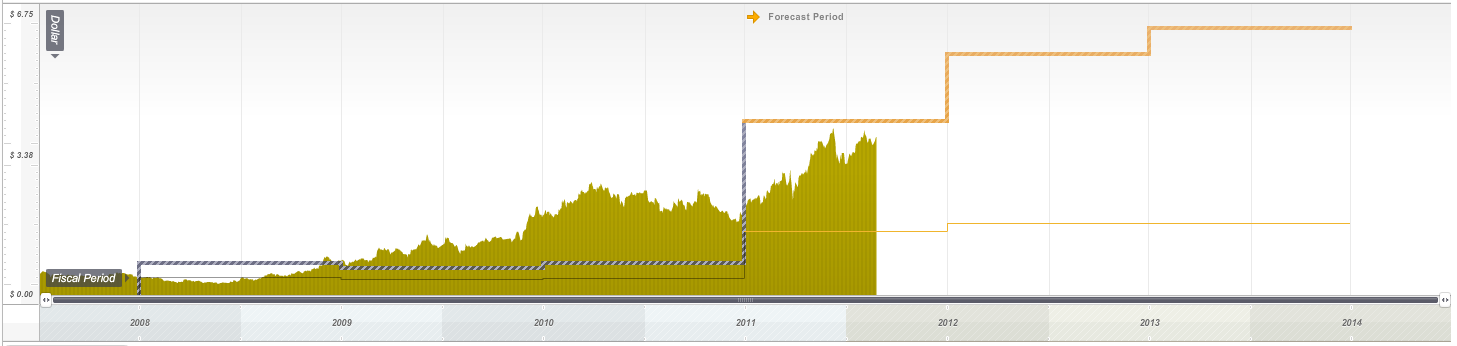

Here are two Skaffold screenshots, each gold stocks we currently own. If you are a member of Skaffold, you should be able to pick them right away. If you aren’t a member, what are you waiting for? Head over to www.skaffold.com and become a member today.

And now back to our regular programming…

From gold’s mouth itself;

Let’s start with the basics of my enduring characteristics. I have some characteristics that no other matter on Earth has…

I cannot be:

Printed (ask a miner how long it takes to find me and dig me up)

Counterfeited (you can try, but a scale will catch it every time)

Inflated (I can’t be reproduced)

I cannot be destroyed by;

Fire (it takes heat at least 1945.4° F. to melt me)

Water (I don’t rust or tarnish)

Time (my coins remain recognizable after a thousand years)

I don’t need:

Feeding (like cattle)

Fertilizer (like corn)

Maintenance (like printing presses)

I have no:

Time limit (most metal is still in existence)

Counterparty risk (remember MF Global?)

Shelf life (I never expire)

As a metal, I am uniquely:

Malleable (I spread without cracking)

Ductile (I stretch without breaking)

Beautiful (just ask an Indian bride)

As money, I am:

Liquid (easily convertible to cash)

Portable (you can conveniently hold $50,000 in one hand)

Divisible (you can use me in tiny fractions)

Consistent (I am the same in any quantity, at any place)

Private (no one has to know you own me)

From an entirely different perspective on gold it may be worth reading the Hon. Howard Buffett. Congressman Buffett argues that without a redeemable currency, an individual’s freedoms both financial and more broadly is dependent on politicians. He goes on to observe that fiat (paper) money systems tend to collapse eventually, producing economic chaos. His argument that the US should return to the gold standard was not adopted.

Human Freedom Rests of Gold Redeemable Money

Posted Thursday, May 6, 1948

By HON. HOWARD BUFFETT

U. S. Congressman from Nebraska

Reprinted from The Commercial and Financial Chronicle 5/6/48

Is there a connection between Human Freedom and A Gold Redeemable Money? At first glance it would seem that money belongs to the world of economics and human freedom to the political sphere.

But when you recall that one of the first moves by Lenin, Mussolini and Hitler was to outlaw individual ownership of gold, you begin to sense that there may be some connection between money, redeemable in gold, and the rare prize known as human liberty.

Also, when you find that Lenin declared and demonstrated that a sure way to overturn the existing social order and bring about communism was by printing press paper money, then again you are impressed with the possibility of a relationship between a gold-backed money and human freedom.

In that case then certainly you and I as Americans should know the connection. We must find it even if money is a difficult and tricky subject. I suppose that if most people were asked for their views on money the almost universal answer would be that they didn’t have enough of it.

In a free country the monetary unit rests upon a fixed foundation of gold or gold and silver independent of the ruling politicians. Our dollar was that kind of money before 1933. Under that system paper currency is redeemable for a certain weight of gold, at the free option and choice of the holder of paper money.

Redemption Right Insures Stability

That redemption right gives money a large degree of stability. The owner of such gold redeemable currency has economic independence. He can move around either within or without his country because his money holdings have accepted value anywhere.

For example, I hold here what is called a $20 gold piece. Before 1933, if you possessed paper money you could exchange it at your option for gold coin. This gold coin had a recognizable and definite value all over the world. It does so today. In most countries of the world this gold piece, if you have enough of them, will give you much independence. But today the ownership of such gold pieces as money in this country, Russia, and all divers other places is outlawed.

The subject of a Hitler or a Stalin is a serf by the mere fact that his money can be called in and depreciated at the whim of his rulers. That actually happened in Russia a few months ago, when the Russian people, holding cash, had to turn it in — 10 old rubles and receive back one new ruble.

I hold here a small packet of this second kind of money – printing press paper money — technically known as fiat money because its value is arbitrarily fixed by rulers or statute. The amount of this money in numerals is very large. This little packet amounts to CNC $680,000. It cost me $5 at regular exchange rates. I understand I got clipped on the deal. I could have gotten $2½ million if I had purchased in the black market. But you can readily see that this Chinese money, which is a fine grade of paper money, gives the individual who owns it no independence, because it has no redemptive value.

Under such conditions the individual citizen is deprived of freedom of movement. He is prevented from laying away purchasing power for the future. He becomes dependent upon the goodwill of the politicians for his daily bread. Unless he lives on land that will sustain him, freedom for him does not exist.

You have heard a lot of oratory on inflation from politicians in both parties. Actually that oratory and the inflation maneuvering around here are mostly sly efforts designed to lay the blame on the other party’s doorstep. All our politicians regularly announce their intention to stop inflation. I believe I can show that until they move to restore your right to own gold that talk is hogwash.

Paper Systems End in Collapse

But first let me clear away a bit of underbrush. I will not take time to review the history of paper money experiments. So far as I can discover, paper money systems have always wound up with collapse and economic chaos.

Here somebody might like to interrupt and ask if we are not now on the gold standard. That is true, internationally, but not domestically. Even though there is a lot of gold buried down at Fort Knox, that gold is not subject to demand by American citizens. It could all be shipped out of this country without the people having any chance to prevent it. That is not probable in the near future, for a small trickle of gold is still coming in. But it can happen in the future. This gold is temporarily and theoretically partial security for our paper currency. But in reality it is not.

Also, currently, we are enjoying a large surplus in tax revenues, but this happy condition is only a phenomenon of postwar inflation and our global WPA. It cannot be relied upon as an accurate gauge of our financial condition. So we should disregard the current flush treasury in considering this problem.

From 1930-1946 your government went into the red every year and the debt steadily mounted. Various plans have been proposed to reverse this spiral of debt. One is that a fixed amount of tax revenue each year would go for debt reduction. Another is that Congress be prohibited by statute from appropriating more than anticipated revenues in peacetime. Still another is that 10% of the taxes be set aside each year for debt reduction.

All of these proposals look good. But they are unrealistic under our paper money system. They will not stand against postwar spending pressures. The accuracy of this conclusion has already been demonstrated.

The Budget and Paper Money

Under the streamlining Act passed by Congress in 1946, the Senate and the House were required to fix a maximum budget each year. In 1947 the Senate and the House could not reach an agreement on this maximum budget so that the law was ignored.

On March 4 this year the House and Senate agreed on a budget of $37½ billion. Appropriations already passed or on the docket will most certainly take expenditures past the $40 billion mark. The statute providing for a maximum budget has fallen by the wayside even in the first two years it has been operating and in a period of prosperity.

There is only one way that these spending pressures can be halted, and that is to restore the final decision on public spending to the producers of the nation. The producers of wealth — taxpayers — must regain their right to obtain gold in exchange for the fruits of their labor. This restoration would give the people the final say-so on governmental spending, and would enable wealth producers to control the issuance of paper money and bonds.

I do not ask you to accept this contention outright. But if you look at the political facts of life, I think you will agree that this action is the only genuine cure. There is a parallel between business and politics which quickly illustrates the weakness in political control of money.

Each of you is in business to make profits. If your firm does not make profits, it goes out of business. If I were to bring a product to you and say, this item is splendid for your customers, but you would have to sell it without profit, or even at a loss that would put you out of business. — well, I would get thrown out of your office, perhaps politely, but certainly quickly. Your business must have profits.

In politics votes have a similar vital importance to an elected official. That situation is not ideal, but it exists, probably because generally no one gives up power willingly.

Perhaps you are right now saying to yourself: “That’s just what I have always thought. The politicians are thinking of votes when they ought to think about the future of the country. What we need is a Congress with some ‘guts.’ If we elected a Congress with intestinal fortitude, it would stop the spending all right!”

I went to Washington with exactly that hope and belief. But I have had to discard it as unrealistic. Why? Because an economy Congressman under our printingpress money system is in the position of a fireman running into a burning building with a hose that is not connected with the water plug. His courage may be commendable, but he is not hooked up right at the other end of the line. So it is now with a Congressman working for economy. There is no sustained hookup with the taxpayers to give him strength.

When the people’s right to restrain public spending by demanding gold coin was taken from them, the automatic flow of strength from the grass-roots to enforce economy in Washington was disconnected. I’ll come back to this later.

In January you heard the President’s message to Congress or at least you heard about it. It made Harry Hopkins, in memory, look like Old Scrooge himself.

Truman’s State of the Union message was “pie-in-the-sky” for everybody except business. These promises were to be expected under our paper currency system. Why? Because his continuance in office depends upon pleasing a majority of the pressure groups.

Before you judge him too harshly for that performance, let us speculate on his thinking. Certainly he can persuade himself that the Republicans would do the same thing if they were In power. Already he has characterized our talk of economy as “just conversation.” To date we have been proving him right. Neither the President nor the Republican Congress is under real compulsion to cut Federal spending. And so neither one does so, and the people are largely helpless.

But it was not always this way.

Before 1933 the people themselves had an effective way to demand economy. Before 1933, whenever the people became disturbed over Federal spending, they could go to the banks, redeem their paper currency in gold, and wait for common sense to return to Washington.

Raids on Treasury

That happened on various occasions and conditions sometimes became strained, but nothing occurred like the ultimate consequences of paper money inflation.

Today Congress is constantly besieged by minority groups seeking benefits from the public treasury. Often these groups. control enough votes in many Congressional districts to change the outcome of elections. And so Congressmen find it difficult to persuade themselves not to give in to pressure groups. With no bad immediate consequence it becomes expedient to accede to a spending demand. The Treasury is seemingly inexhaustible. Besides the unorganized taxpayers back home may not notice this particular expenditure — and so it goes.

Let’s take a quick look at just the payroll pressure elements. On June 30, 1932, there were 2,196,151 people receiving regular monthly checks from the Federal Treasury. On June 30, 1947, this number had risen to the fantastic total of 14,416,393 persons.

This 14½ million figure does not include about 2 million receiving either unemployment benefits of soil conservation checks. However, it includes about 2 million GI’s getting schooling or on-the-job-training. Excluding them, the total is about 12½ million or 500% more than in 1932. If each beneficiary accounted for four votes (and only half exhibited this payroll allegiance response) this group would account for 25 million votes, almost by itself enough votes to win any national election.

Besides these direct payroll voters, there are a large number of State, county and local employees whose compensation in part comes from Federal subsidies and grants-in-aid.

Then there are many other kinds of pressure groups. There are businesses that are being enriched by national defense spending and foreign handouts. These firms, because of the money they can spend on propaganda, may be the most dangerous of all.

If the Marshall Plan meant $100 million worth of profitable business for your firm, wouldn’t you Invest a few thousands or so to successfully propagandize for the Marshall Plan? And if you were a foreign government, getting billions, perhaps you could persuade your prospective suppliers here to lend a hand in putting that deal through Congress.

Taxpayer the Forgotten Man

Far away from Congress is the real forgotten man, the taxpayer who foots the bill. He is in a different spot from the tax-eater or the business that makes millions from spending schemes. He cannot afford to spend his time trying to oppose Federal expenditures. He has to earn his own living and carry the burden of taxes as well.

But for most beneficiaries a Federal paycheck soon becomes vital in his life. He usually will spend his full energies if necessary to hang onto this income.

The taxpayer is completely outmatched in such an unequal contest. Always heretofore he possessed an equalizer. If government finances weren’t run according to his idea of soundness he had an individual right to protect himself by obtaining gold.

With a restoration of the gold standard, Congress would have to again resist handouts. That would work this way. If Congress seemed receptive to reckless spending schemes, depositors’ demands over the country for gold would soon become serious. That alarm in turn would quickly be reflected in the halls of Congress. The legislators would learn from the banks back home and from the Treasury officials that confidence in the Treasury was endangered.

Congress would be forced to confront spending demands with firmness. The gold standard acted as a silent watchdog to prevent unlimited public spending.

I have only briefly outlined the inability of Congress to resist spending pressures during periods of prosperity. What Congress would do when a depression comes is a question I leave to your imagination. I have not time to portray the end of the road of all paper money experiments.

It is worse than just the high prices that you have heard about. Monetary chaos was followed in Germany by a Hitler; in Russia by all-out Bolshevism; and in other nations by more or less tyranny. It can take a nation to communism without external influences. Suppose the frugal savings of the humble people of America continue to deteriorate in the next 10 years as they have in the past 10 years? Some day the people will almost certainly flock to “a man on horseback” who says he will stop inflation by price-fixing, wage-fixing, and rationing. When currency loses its exchange value the processes of production and distribution are demoralized.

For example, we still have rent-fixing and rental housing remains a desperate situation.

For a long time shrewd people have been quietly hoarding tangibles in one way or another. Eventually, this individual movement into tangibles will become a general stampede unless corrective action comes soon.

Is Time Propitious

Most opponents of free coinage of gold admit that that restoration is essential, but claim the time is not propitious. Some argue that there would be a scramble for gold and our enormous gold reserves would soon be exhausted.

Actually this argument simply points up the case. If there is so little confidence in our currency that restoration of gold coin would cause our gold stocks to disappear, then we must act promptly.

The danger was recently highlighted by Mr. Allan Sproul, President of the Federal Reserve Bank of New York, who said:

“Without our support (the Federal Reserve System), under present conditions, almost any sale of government bonds, undertaken for whatever purpose, laudable or otherwise, would be likely to find an almost bottomless market on the first day support was withdrawn.”

Our finances will never be brought into order until Congress is compelled to do so. Making our money redeemable in gold will create this compulsion.

The paper money disease has been a pleasant habit thus far and will not he dropped voluntarily any more than a dope user will without a struggle give up narcotics. But in each case the end of the road is not a desirable prospect.

I can find no evidence to support a hope that our fiat paper money venture will fare better ultimately than such experiments in other lands. Because of our economic strength the paper money disease here may take many years to run its course.

But we can be approaching the critical stage. When that day arrives, our political rulers will probably find that foreign war and ruthless regimentation is the cunning alternative to domestic strife. That was the way out for the paper-money economy of Hitler and others.

In these remarks I have only touched the high points of this problem. I hope that I have given you enough information to challenge you to make a serious study of it.

I warn you that politicians of both parties will oppose the restoration of gold, although they may outwardly seemingly favor it. Also those elements here and abroad who are getting rich from the continued American inflation will oppose a return to sound money. You must be prepared to meet their opposition intelligently and vigorously. They have had 15 years of unbroken victory.

But, unless you are willing to surrender your children and your country to galloping inflation, war and slavery, then this cause demands your support. For if human liberty is to survive in America, we must win the battle to restore honest money.

There is no more important challenge facing us than this issue — the restoration of your freedom to secure gold in exchange for the fruits of your labors.

I am internationally accepted, last for thousands of years, and probably most important, you can’t make any more of me.”

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 26 February 2012.

In Buffett’s recent letter this paragraph really jumped out at me:

“Beyond the staggering valuation given the existing stock of gold, current prices make today’s annual production of gold command about $160 billion. Buyers – whether jewelry and industrial users, frightened individuals, or speculators – must continually absorb this additional supply to merely maintain an equilibrium at present prices.”

I think the gold bulls might argue that $160 billion per year is a mere fraction compared to the amount of ‘zombie’ bonds investors are being asked to buy each week and a fraction of the massive currency supply that was again lifted last week by 3/4’s of a trillion on March1.

Stephen Wyatt’s of AFR.com.au thinks gold is, fundamentally, a complete dog.

Real end-user demand for gold is dismal. The rally has been all about speculative demand.

I cites his most interesting comments in the article (although he did not comment the source of this)

“Gold jewellery demand, which traditionally accounts for 70 per cent of total demand for physical gold, has fallen by a third over the past 15 years, from over 3000 tonnes a year in the mid 1990s to less than 2000 tonnes last year.

Gold, like diamonds and silver and pearls, is so plentiful that on any normal commodity styled demand-supply analysis, it would be worth $US170 an ounce, rather than $US1700 an ounce.”

Link : http://www.afr.com/p/markets/market_wrap/bullion_bulls_are_comedy_gold_LA9EH9O1XJNyCtOVIt7gIJ

China and resources

Bullion bulls are comedy gold

PUBLISHED: 02 Mar 2012 10:42:00 | UPDATED: 02 Mar 2012 14:27:28

Stephen Wyatt

Gold retreated heavily this week, triggering a wave of fear among gold punters. But that’s what bubbles do.

This bubble, though, ain’t over yet. And that’s because the global economy remains in a state of disrepair.

A $US70 an ounce price fall, as occurred on Wednesday, after a market has rallied over the past decade from $US250 an ounce to just over $US1900 an ounce, its record high hit last September, means nothing.

Gold is trading sideways right now around $US1700 an ounce, not far off its peak.

No one can rule out a snap up through $US2000 an ounce; nor can anyone rule out a collapse back through $US1000 an ounce.

But eventually the gold price will collapse. It is just an issue of when, not if. Gold has been driven by the same speculative lunacy as were tulips back in the 1600s in Holland.

After the fact we are all wise, as was the artist Jan Brueghel the Younger when he painted “A Satire of Tulip Mania” around 1640 which depicted speculators as brainless monkeys in contemporary upper-class dress.

One monkey urinates on the previously valuable tulips, others appear in debtor’s court and one is carried to the grave.

After the fact we are all wise, as was the artist Jan Brueghel the Younger when he painted “A Satire of Tulip Mania”, above, around 1640.

Such an analogy of course infuriates raises the gold bulls. They say gold is not a bubble and not a commodity but a currency and a safe-haven investment that protects against the hollow value of paper currencies, inflation and crashes in other assets.

Many advocate, quite incorrectly, that a return to the gold standard would fix the world’s economic problems – look at what a fixed euro has done.

But the gold bugs have clearly been spot-on over the past decade, after being dead wrong over the 1990s. But they are only right, of course, when gold is rising. When it is falling, few see it as a safe-haven asset or a hedge of any sort. Suddenly, it looks a lot more like a commodity.

The undeniable truth is that gold is just yellow and heavy and its value, like that of art, is in the eye of the beholder.

The gold price rally has been driven mainly by speculation with a lot of help from a gold-selling cartel established in 1999 of European central banks along with a concerted effort (let’s not call it collusion or a cartel), around the same time, by gold producers to desist from sell hedging gold production and hence driving gold prices lower.

As a result, the gold price, after falling from its 1980 record high of $US850 an ounce to $US250 an ounce in 1999, a 20-year low, began to recover.

The market was seen as cheap with huge upside. The hot money started to come back into gold and it built into an inflow avalanche. Like any financial asset bubble, as more money poured in and as the price rose still more, so more money was attracted – think tulips.

The belief in gold became further entrenched as other commodities rallied, as the US dollar slumped from 2002 to 2008 and then in 2008 as the world looked like it was about to end as the Great Recession hit.

A lot of that hot money went into gold exchange traded funds.

The amount of gold held by speculators in bullion-backed exchange-traded products now totals twice the amount of gold held by Switzerland.

Today, exchange traded gold funds rank as the fifth-largest holders of gold in the world, after the gold stocks held in the vaults of the central banks of the US, Germany and France and the holdings of the IMF.

Just as that hot money built these gold stocks up to such extraordinary levels, so, too, panic liquidation by speculators can trigger just the opposite outflow of gold from these exchange traded funds, which will in turn cause the gold price to fall probably faster than it rose.

But why?

Because gold is, fundamentally, a complete dog.

Never believe anyone, especially the World Gold Council that represents the interests of the world’s gold producers, who says that gold is highly priced because it is scarce.

The world’s central banks alone hold 10 years’ worth of gold consumption in their vaults. Any commodity with a stocks-to-use ratio like this would be cheap, really cheap.

Then there is the hot gold in punters’ exchange traded funds (as discussed above), the gold on the ankles and wrists and fingers of consumers around the world and the gold bars and coins in the safes, cupboards and drawers of investors.

Gold, unlike base metals, never goes away.

If the price starts to fall significantly, rest assured, a lot of this gold will return to the market.

So the stocks story is truly bearish. But so is the demand story.

Real end-user demand for gold is dismal. The rally has been all about speculative demand.

Gold jewellery demand, which traditionally accounts for 70 per cent of total demand for physical gold, has fallen by a third over the past 15 years, from over 3000 tonnes a year in the mid 1990s to less than 2000 tonnes last year.

Gold, like diamonds and silver and pearls, is so plentiful that on any normal commodity styled demand-supply analysis, it would be worth $US170 an ounce, rather than $US1700 an ounce.

And the counter argument from Simon Black

In Warren Buffett’s latest round of gold-bashing last weekend, he described all the gold in the world as a useless cube that would fit snugly within a baseball infield.If you owned such a cube, you would only be able to ‘fondle’ it… but generate no investment return. The same ‘value’, meanwhile, would allow the owner to purchase all the productive farmland in the United States plus 16 Exxon Mobils, in total yielding over $800 billion annually.Granted, Buffett’s views on gold are perhaps stymied by his poor experience investing in silver some 15-years ago. But still, he fails to see some obvious fallacies in his logic.

Most assets left unmanaged will fail to produce an investment return. The virtuous farmland that Buffett extols in his hypothetical example does not magically spawn corn, nurture it, harvest it, sell it, and deposit the proceeds into its owners’ pockets. Our farmland here in Chile certainly does not.

No, it takes a lot of work, a lot of experienced people, a lot of know-how, and a little bit of luck. All of this has to be managed.

Even the baseball field that Buffett references (when trying to give his investors an idea of the scale of all the gold in the world) is an asset. Simply left sitting there, a baseball field will soon be overtaken by erosion, weeds, and the dilapidation that comes with neglect.

Maintained and well-managed, however, a savvy owner of a baseball field can lease it out to the local little league. Or pull a Kevin Costner and turn it into a tourist attraction. None of this happens without appropriately managing the asset.

Even Exxon Mobil, with all of its royalties and intellectual property, requires tens of thousands of employees to manage the company’s assets, collect the profits, and ensure shareholders get paid.

Likewise, a huge cube of gold left alone in a baseball infield will fail to produce any investment return. When managed, however, gold is like any other asset– it can be leased, traded, loaned out, used as collateral, etc.

More importantly, though, the reason that many gold investors purchase the metal to begin with is because physical gold carries no counterparty risk.

Unlike paper currencies which are issued at will by corrupt central banks, or even Exxon Mobil, whose success depends heavily on the management team’s goodwill and diligence, a one ounce gold coin in your pocket will still be a one ounce gold coin tomorrow. This is the entire premise behind money as a store of value.

As my friend Tim Price told me over drinks in London several months ago, fiat currency is simply an abstraction of the concept of money; paper money conjured out of thin air cannot be real money, it’s merely an idea based on confidence and collusion.

Curiously, only a tiny percentage of worldwide money supply is actually physical paper– most ‘money’ is in digital form, simply entries in a computer… a few bits of code which constitute your net worth. In this way, our currency is actually an abstraction of an abstraction of the concept of money.

To this I would add that the entire financial system is underpinned by a complex network of hypothecated debt and derivative instruments whose notional total exceeds (by many multiples) the entirety of world GDP. In this manner, we are talking about abstractions of abstractions of abstractions.

Gold is real. It exists. And it scarcity dictates that it is a reasonable store of value, particularly in a world of abstract money.

There’s a lot of talk right now, for example, about rising oil prices which have created uncomfortably high gasoline prices. In gold terms, however, gasoline prices are in a deflationary spiral.

Priced in grams of gold, gasoline is near an all-time low. [In fact, there’s a great site run by my friend Charles V. that shows this trend with a variety of commodities and retail goods.] Buffett (and others) argue strongly that investors should be in stocks… that a company like Coca Cola or productive farmland is a better long-term investment than a useless hunk of metal.He’s probably right. Except that the useless hunk of metal isn’t really an investment. It’s an anti-currency… appropriate for those who want to sit out of the market and be in cash without having to be in cash.

Hi,

In these turbulent times, I thought investing in a gold giant like Newcrest would be the safest way to go? Get in a large company which is less likely to go downhill than the smaller companies with less capital?

Newcrest is about 10% up since Jan 1.

Regards,

Peter

Hi Peter,

You have to do your own research, seek and take professional advice before making investment decisions, etc., but IMHO (and the opinion of Skaffold and others), Newcrest (NCM) is overpriced and there are plenty of better gold stocks out there. It’s a B3 with a safety margin of -74% (yep, minus 74%) last time I checked. The IV is around a quarter of the current share price. They also have 765 million shares on issue (a LOT), a negative hedgebook position (-$21m), net financial assets of -6% (minus 6%) according to one source, single digit ROE, declining quality, and stable but average performance.

When there are a number of higher quality stocks trading at a discount to their intrinsic value, I would not invest in Newcrest myself. Disclosure: I currently hold (in alphabetical order) some KCN, KRM, MML, RCO, RED, RMS, RND, TBR, and TRY. That’s just over 20% of my portfolio, so I do like gold stocks, just not all of them, and certainly not the biggest ones (no value there IMO). I’m monitoring a few, like SLR too. I like Silverlake Resources, but haven’t bought any yet. CCU (silver), ILU (mineral sands) and MGX (iron ore) complete my current minerals (mining) exposure. The other 75% of my portfolio is in other sectors. I’m not recommending any of these stocks to you (no recommendations here), but I do know there are plenty of good companies out there that are worth further research. Skaffold is one of the best tools for doing that Peter. It saves you a heck of a lot of time and effort by giving you a huge amount of information at your fingertips that is easy to navigate through, to collate, to sort, to filter, and to compare. It’s well worth the investment.

Regards,

John C.

Hi John

I see our red letter day has not been too bad for us..:-)

It looks good

Hi Ash – yes, I’m up 40% already. Thank you. Looking forward to finding out about their cap raising details on Monday. I see they gave us an updated investor presentation to mull over until then. I sold 5,000 of my 20,000 RED last Monday (12th Mar) at $2.29 (bought for $1.62 on 10th Jan) and bought some more CCU (at $0.77). That may be another happy story, once they get the construction and commissioning behind them. Anything else caught your eye lately Ash?

I’ve been looking into a few more gold stocks, and bought some of them: TRY (yes), IAU (no), GDO (no, too much hedging, too many shares), VGO (no), SLR (not yet), NST (not this time), TBR (yes), RND (yes). Various reasons.

TBR and RND are very interesting, and RND in particular is one of the most illiquid stocks I have ever tried to buy. Bought 20,000 over three days (9th, 12th & 13th Mar) for between $0.38 and $0.42 (av. $0.40), and mine was the only trade on those days and zero trades on the 4 days since, so they’ve closed the week at $0.42. I value them a lot higher than that, but buyer beware – I could never recommend a stock that lacks liquidity to the extent that RND does.

As long as those two store/bank gold instead of selling it, they’ll probably continue to be misunderstood and/or ignored by the market. That’s fine with me. Eventually, they’ll sell the gold. If Barrick don’t buy them out in the meantime. That would ultimately depend on the three directors who control both TBR & RND (and most of the shares). Skaffold likes RND. TBR, not so much… That wasn’t my starting point for those two, but it was certainly factored into my research. If the gold price pulls back a bit more, there might be some even more attractive prices on offer for some of my favourite gold stocks. Either way, life is good! I’ve got 4 days off my day job, time for family, and also perhaps a little more research…

Business over Gold any day!!

Check out asset allocation clip from Yale’s CIO – David Swensen

The comments and research I found very interesting…two parts

http://www.youtube.com/watch?v=AZnuXdfK3D4

http://www.youtube.com/watch?v=g5WZQtpy2yE&feature=related

hi roger, is there some way to find these nano stocks using skaffold filters?? i am still finding my way around it…..regards stuart

Yes, Stuart, its easy. Give Jeremy, Liz or Vanessa a call at Skaffold. Have a look for the filter button at the bottom of your screen under the Aerial Viewer.

Warren’s view on gold is perfectly understandable. He has devoted his entire life to the concept of perpetual growth and the compounding effect of this increase in productivity and supply. This approach has generated lots of wealth for the industrialised world, as well as for WB. It works very well while the productive output of an economy continues to expand. This, essentially is the goal of value investing – find a company that possesses the capacity to increase productive output with a competitive advantage at a reasonable price and buy it.

Comments that you cannot calculate an intrinsic value of gold miss the point. Can you calculate an intrinsic value of the AU$? What about the US$? What if the Reserve Bank (Au) or the Fed (US) decide to inflate your savings or investments out of existence? Say, by keeping interest rates at a level that is far too low for far too long (any of this sounding familiar)? You might be happy with a return on investment of 12 or 14% per annum, but would this still be true if inflation were running at 20%? How would the intrinsic value of your currency look during periods of high inflation?

Gold cannot be inflated away, and that is the whole point. When the entire economy is over-leveraged and elected officials have no choice but to keep up appearances, inflation is ultimately the only option. Hold on to your hats. I recently read that in every civilisation that has ever used fiat currency, when the money supply increases by 20% or more in less than a year, rampant inflation is invariably the result 4 to 5 years down the track. Guess what? It’s happening in the US right now.

The sensible value investor would be holding gold not to make a profit, but to observe the ultimate rule of capitalism – don’t lose money.

A practical example:

Let’s say that a basket of goods costs us $100 today and that the same basket of goods in five years costs us $1000. The value of the currency has been debased by a factor of ten. If you held cash, you would have ‘lost’ $900 (let’s ignore interest, the rate is near zero anyway, remember?). In an ideal world, the value of gold over the same five years would have increased from $100 to $1000. Some would think you have ‘made’ $900. Smarter observers would point out that you are even. And that’s intrinsic value.

Indeed, the rising tide rises less in a world of deleveraging. Having said that we are optimistic about many industrial companies.

Is the stock SLR? just off the top of my head.

It seems to make some sense that gold should hold its purchasing power with respect to paper currencies and serve as an alternative currency because (assuming it remains in demand) it is finite, while more paper currency can be easily printed.

However, since it produces nothing, how can one rationally appraise its fair value now? is US $1700 per ounce a fair price or is it undervalued or overvalued? It doesn’t produce anything so it’s hard to calculate the potential return on investment.

Looking at an inflation adjusted graph of the gold price from 1914 to 2011 (www.InflationData.com), it seems demand has waxed and waned: the price strangely fell during WWI, slowly increased up until the abandonment of the gold standard before falling during WWII until 1970 and then rose steadily to peak in 1980 at US $2337 per ounce before plunging again over the next 20 years to a nadir in 2000 and then undergoing a rapid appreciation in the last decade.

Just eyeballing it the average price buyers have historically been prepared to pay is somewhere between US $500 – $750 (would have to calculate the area under the curve).

It seems golds value is dependent on supply (limited) and demand (possibly growing with growing global wealth in Asia, Brazil & India). However with reference to historical pricing, today’s price is more than double what people have been prepared to pay for it since 1914.

What are your thoughts?

Indeed, what does everyone think?

With the US currency and in fact all fiat currencies inflating away and destroying the purchasing power of each dollar over time the best way to value gold may not be to value it in terms of dollars at all. The best way I have found so far is to value it against other commodities or against the stock market itself.

For instance, how many ounces of gold would purchase a median priced house, a barrel of oil, or even a share of an index fund in the ASX or the Dow over time. There are many charts on the net to see this visually.

Like all commodities and shares you will be able to see gold’s value become over and undervalued over the time.

Gold is not a currency, it is a store of value. In the West we view gold as ‘useless’ because all it does is sit there and shine, but in countries that have experienced economic turmoil or currency destruction (or even just a fall in the currency without ending terribly) they will appreciate the real purpose of gold over history as a store of value.

Gold is not useful as a medium of exchange. History shows that. It is less convenient than paper money and more costly for the government to produce. Inevitably you will have the issue of ‘clipping’ where people take just a slither off each coin, melt it down and have gold. And of course gold money won’t stop the government from debasing the currency. Then Greshams Law applies.

In my view, buying physical gold should not be looked at in terms of return on investment. If you have a view that gold will appreciate and wish to profit from it then buy gold mining stocks or futures. Buy physical gold if you wish to preserve your purchasing power, not against inflation, but against currency debasement – there is a difference.

Stocks are a better protection from inflation than gold in my view. In an inflationary environment, gold can still fall if the supply-demand situation dictates it so. You are better off owning companies with the ability to raise prices, counter inflation, etc. People will turn to gold when they fear that the currency they hold is falling in value or perhaps even headed to zero. It is why gold was reaching new highs in Sep 2011 when there was real fear the euro might collapse; and yet inflation was lower then than what we are seeing currently while gold is yet to hit new highs.

Hi Harley, I agree with your excellent appraisal of gold’s ‘relevance’. I think the 70’s gives us all a salient lesson about the impact of inflation on asset prices.

Hi Roger,

Only see one gold stock screenshot.

Worked out what it is. Where is the other one?

B2 Gold miner with declining performance sounds so speculative to me. How do you work out that it is a worthwhile investment?

Bought MLD and MTU about a month ago using Skaffold.

Happy days.

Michael

Can’t be the right (gold) one then Michael. Increasing production, increasing ROE…Delighted you are pleased with Skaffold.

Hi Roger,

I still think I have the right gold stock. It is a B2 , is it not?

Isn’t the increasing ROE forecast only?

I have had GOLD for the last 5-6 years in my SMSF.

Nice profit and sold it all today.(not gunna go against Uncle Warren)

Never was keen on Gold Miners as the stuff is still in the ground and they have to get it out, which can turn into all sorts of problems. As Mark Twain famously said…well you know what he said.

Big fan of your book and Skaffold but not sure where you are coming from with “Here are two Skaffold screenshots, each gold stocks we currently own”. Just doesn’t seem to fit the criteria of what you normally preach. Any insight into how you came to pick this stock using Skaffold would be appreciated.

Thanks,

Michael

Hi Michael,

We have generated a 100% return from one of those gold company positions. They form a portion of a more diverse selection of companies and while they meet our criteria for investing in the sector, they may not meet everyone’s and thats ok. The vast bulk of our portfolio is exposed to the very things you would expect from us.

ANother poster (who is trying to promote their own website that I haven’t vetted) wrote:

Great newsletter by Warren recently. Learnt a lot from it.

Warren has also now confirmed he picked the direction of oil incorrectly of oil in 2008, nat gas in 2007 (investment on verge of being written off), selling silver early, incorrectly avoiding gold before its huge bull run. There is a gap in his knowledge in terms of predicting where commodity prices will go over multiple durations with consistency. He has reinforced this in his letter to shareholders.

He is arguably riding his silver and gold mistakes into the ground by now evolving the mistake into prematurely calling gold a bubble (probably 5-6 years too early). Again he may be well right for 1-2 years, but I portend vastly off the mark in 10 years. I’m not sure what reasons he thinks gold is a fools investment, and may underperform apart from the non secular adjusted data mined statistical returns he gave us. Does he think because oil failed to travel far above its inflation adjusted high gold is about to something similar being in a relative similar price to inflation adjusting highs position? We had a once in generation crash which created a liquidity squeeze and sent prices artificially down. This is unlikely to happen again with the same magnitude imo.

He has made money on many companies in terms of commodities as he has listed in his newsletter. That was done well and brilliantly, but it doesn’t mean he now has the circle of competence to be calling gold a bubble. He has not made substantial amounts of money buying commodities or precious metals directly for the sole purpose of selling at a higher price – speculation if you have no positive expectancy system for determining the intrinsic value – (unrelated to branding and/or adding value to the commodity bght) relative to his net worth.

Time will prove the Gold “bugs” wrong or right. Results will say all that needs to be said. Gold will one day be in a bubble, but we are not there yet. We are not even close to bubble territory yet imo. If I am wrong (and I have been wrong many times) i’ll gladly admit my mistakes quickly and not repeat them in any related form.

Look forward to next years letter from Warren as the man is a genius and I respect him greatly. He has had a profound positive impact on my investing.

Thanks Roger,

Always appreciate your taking time to answer my questions.

Michael

Hi Roger,

I can only see one screenshot also – found it straight away, and yes, Skaffold has the IV increasing (exactly as in the screenshot), but the 2012 ROE (when you choose “General Info” to replace the “Skaffold Line” screen in “Evaluate”) is 39.31%, dropping slightly in 2013 to 38.04%, and dropping again in 2014 to 33.63%, so although still a very healthy ROE, that is a declining ROE.

I’ve been having a good look at Troy Resources lately (which is not the company mentioned above), and I’m impressed with their Casposo Project (in the foothills of the Andes in San Juan, Argentina). Skaffold has a declining ROE and IV for TRY, but the current MOS is impressive and if they increase their reserves as expected in Argentina… A little exploration success, and… We’ll see…

Hi John,

We own it and think analyst upgrades have yet to flow through to 2014 consensus.

Which one Roger – SLR or TRY?

Buffett has actually made investments in the resource sector.He made an investment in PetroChina and did very well out of it.

The gold price has been increasing however the price of mineral sands – zircon and rutile has been increasing quicker.The reason is Chinese demand.There are opportunities in this sector outside of ILU which has already increased.

Hi

I could only see one one scaffold screenshot not two as Roger had mentioned.

Cheers Peter

Thanks Peter. need to change that.

Its interesting that only gold holds this value in such times and not platinum. While the properties of the two are not exactly the same, they both share a chemical stability that other metals including silver do not (i.e. an enduring value). For instance, I have only ever used platinum crucibles in chemistry because of this stability (they counted them at the end of class of course!). In the past it used to be mined with gold in places like South Africa and they used to treat it as slag (waste), then it later became much more valuable than gold, and now it is worth less again. Its value is now related to economic activity, as it has a few more industrial uses that gold (e.g. catalysts, cochlear implants etc.). What I find most interesting about it is that many describe it as the only precious metal that is not a commodity because it is so rare that it is only mined in South Africa, Russia and Canada in meaningful amounts. There are rarer metals which command much higher prices such as rhenium (shortly to be mined by Ivanhoe in Queensland) at circa $8000/kg, but the things that make gold number 1 in my mind are its beauty, stability, maleability, ductility, and historical sentiment. Another point to consider is that a number of metals are toxic to humans, so you are unlikely to want to be wearing these as earings for very long.

I liked your point about historical sentiment. That is actually one of my main problems with gold, it seems to be sentiment that drives it. It is this sentiment i believe which causes people to use it as an alternative to currency. There does not (to my limited knowledge) appear to be anything that legislates or makes it official that gold is an alternative to currency other than the belief that it is. That belief is enough to make sure that there is a market but it is still not enough for me. I don’t believe the gold standard would ever come back which is why i think of gold in reference to its industrial uses of which as discussed there isn’t many.

Good to see many sides of the gold argument being expressed here. I’m guessing not many people know Buffett senior would have disagreed with his son on such matters, and I admit to being confused as to why Warren would so actively and publicly ‘bash’ gold. Particularly as he lives in a country where the central bank is on a determined mission to devalue its paper currency. Warren’s a shrewd man and I can’t help but think he’s either being disingenuous or simply obtuse. Whatever the case, the market will continue to see gold as useful, as long as Bernanke et al continue to print paper money like it will solve all of their problems.

And there’s always the zombie apocalypse to keep in mind.

Hi Roger,

Very interesting post. I am still in the Buffett camp and would choose the Exxon pile. I think Warren did a good job of summing my thoughts up, not saying either myself or those in favour of gold are right or wrong. Just my preference and belief.

Whilst not necessarily related to the above post (although i think if you dig harder enough you might be able to find a link) i thought i would post the below comment which i saw on another blog i frequent and quite liked. It was specifically related to the US economy and the raising of the debt ceiling but i think it offers a lot for an investor thinking about companies.

“Here is another way to look at the debt ceiling:

Let’s say, You come home from work and find there has been a sewer backup in your neighbourhood….and your home has sewage all the way up to your ceiling.

What do you think you should do….. raise the ceiling or pump out the mess?”

Qantas came to mind as a company that doesn’t have much choice other than to continually raise the ceiling.

Excellent analogy. Mind if I use it on TV or Radio?

I have no problem Roger. I got it from former Walt Disney world executive Lee Cockerill who has a leadership blog on his website.

There are nano stocks out there that are hitting the Graham number:

net current assets alone, deducting all prior claims, and counting as zero the fixed and other assets

I have not seen this for a long long time in the Australian market.

And did you know they are all listed in the ‘Graham Nett Netts’ column in the Evaluate screen of Skaffold! (Even more excitingly, they are all updated daily)

my focus will always be on equities.

Gold is something either for the very rich (a small % allocated away as survival, for the rest of us that small % means didley squat), or for the traders.

Gold is still in a secular bull run, one of just a few asset classes out there. So in the words of Mr Turkey, its a bull market my son, hold on. So for the traders out there, it still makes ‘sense’ to be long gold.

For myself, i wasnt observant enough to get on the band wagon earlier on, i definately dont have plans to jump aboard, not that golds popularity is high. What is its intrinsic value: only what others are prepared to pay. This is not a game for which i wish to play.

Since equities as an asset class in Australia is so unpopular, there is plenty of opportunity to buy into equity positions, get paid for my time (through dividends) and wait for the market to wake up.

In the event that my intrinsic value estimates are incorrect, well the dividends act as a reduction in capital exposed, in a similar way that warren buffett took a position in BAC. at 10% a year, each year that goes by Warrens risk exposure is reduced by 10%.

With the rate of dividends out there in industrial land, i view the Australian market is similar terms.

Yes there is risk, but i am very much being compensated for it. At least when one is looking outside of the ASX200, non-resource sector.

Nice segue and good points Rici Rici

hi roger, is there some way to use skaffold to pinpoint these nano stocks that are being talked about??? i am still finding my way around it… thankyou stuart