Why the Montgomery Global Fund is outperforming its peers

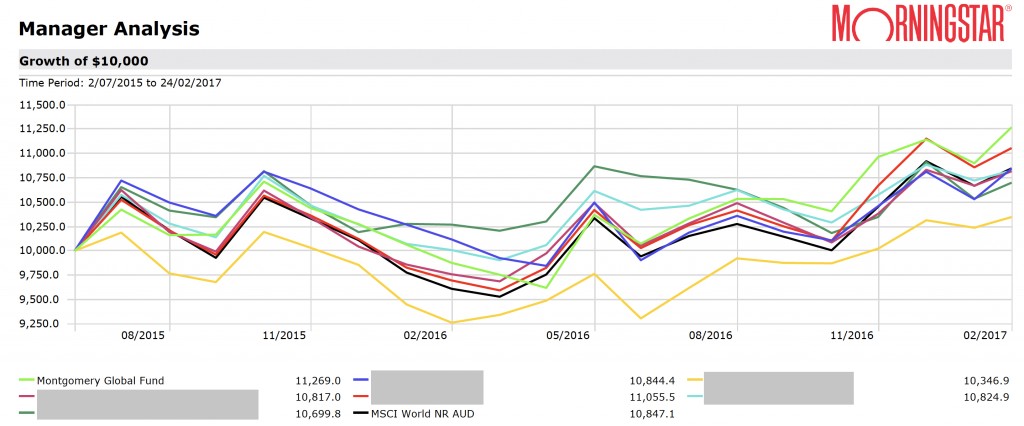

It’s 20 months since we launched the Montgomery Global Fund, and we’re pleased to report it has outperformed both the MSCI World Net Total Return Index – by 4.3 per cent after expenses – and most of our well-known peers. The reason? Careful stock selection. Today, I’d like to discuss two of the key stocks in our portfolio.

The graph below from Morningstar’s database compares the Montgomery Global Fund with six of its peers and the benchmark over the past 20 months. Over this period, the unit price has appreciated from $1.00 to nearly $1.13.

At the time of writing, the Montgomery Global Fund owns 20 stocks, weighted 40 per cent to the US, 28 per cent to Asia Pacific, 14 per cent to the UK/Europe and 18 per cent to US dollar cash.

As many readers know, the Montgomery Global team has a laser-like focus in terms of acquiring high quality businesses where the market-implied expectations about future profitability is assessed to be unreasonably conservative. And, with significant global uncertainty, one theme the team has pursued is the ownership of a handful of stocks well represented on the world’s great technology platforms.

I thought I would take this opportunity to summarise the activities of two of the Fund’s larger holdings – the Chinese-based Tencent and Alibaba. These are remarkable businesses, both enjoying strong bargaining power from their unique technology platform positioning, while maintaining a lot of optionality through significant ownership in early stage technology businesses.

Tencent (market capitalisation of US$257 billion) is the owner of WeChat, the most popular and important app in China. It is a near monopolist on Chinese mobile-internet traffic, commanding 52 per cent of the time spent online by Chinese internet users which number over 800 million monthly active users.

Through its unique app-within-an-app model, Tencent is a platform of platforms, which includes social, gaming, news, video, payments, banking, e-commerce, on-line travel and offline to online. Around 200 million users have their credit cards bound to a WeChat wallet. In addition, Tencent has a number of powerful advertising properties, which are still in their infancy; if the Facebook (market capitalisation of US$394 billion and also owned by the Montgomery Global Fund) experience is anything to go by, there should be a lot of upside here.

Alibaba (market capitalisation of US$259billion) is the Chinese combination of eBay and Amazon. Importantly, it operates the largest social commerce platform in the world (Taobao) with 500 million monthly active users interacting with merchants and other shoppers. This allows Alibaba to capture 30 per cent of China’s digital advertising expenditure and over 50 per cent of the company’s revenue comes from online marketing services.

In addition, Alibaba is the largest cloud provider in China, a top three video streaming platform, and a 38 per cent shareholder in Ant Financial, operator of the largest mobile payment platform in China (Alipay).

Interestingly, the three companies mentioned in this blog, Tencent, Facebook and Alibaba, have a combined market capitalisation of US$910 billion or A$1.2 trillion, and this compares to the ASX 300 which has a combined market capitalisation of A$1.7 trillion.

Interestingly, the three companies mentioned in this blog, Tencent, Facebook and Alibaba, have a combined market capitalisation of US$910 billion or A$1.2 trillion, and this compares to the ASX 300 which has a combined market capitalisation of A$1.7 trillion.

If you are interested in investing in companies exposed to some of the world’s great technology platforms via the Montgomery Global Fund, please click here.

Hi Roger,

Congratulations! I did a search on Equity World large blend / large cap which showed a total of

639 funds. The Montgomery Global Fund came in 43rd which is easily in the top 10% of the best

performing funds.

However, I emailed about this point to Lisa on her article re: performance of index funds.

For example, in your article above you state the MSI World did ~10700 over the time period listed.

I did a quick search on IOO (https://www.blackrock.com/au/individual/products/273428/ishares-global-100-etf) and found a performance of 11585. This is better than the Montgomery performance and places the index fund in the top 4% of performance (over the same period)

I think this continues to make my point that for the average investor an index fund will do as well

or better than most managed funds (without the headaches or fees).

I think one of your readers pointed this out, but I would like to see an active fund manager

provide a fund which minimizes losses to the investor and at the same time guarantees better remuneration for the fund manager.

Regards

Joe

Thank you Joe. Appreciate your observations.