Will growing reliance on mortgage brokers hit the banks’ brand power?

In recent years, we’ve seen CBA, ANZ and Westpac increasingly turn to brokers to originate mortgages. But could this trend erode their brand value and, consequently, reduce their ability to generate a higher than normal return on capital?

The quality of a company is something we discuss constantly. One of the indicators of the quality of a company is the power of its brand. Brand power enables a company to generate a higher than normal return on capital employed and equity by allowing it to charge a price that is not purely determined by costs.

While most would say the average person’s brand perception of major banks is poor, they remain entities that rely on the trust of their customers. As such, the perception of the brand, even if it is only the consumer’s perception of that brand relative to the other banks, is important. A stronger brand means that the bank’s customers are stickier and that they are more likely to have multiple products. This leads to better pricing, lower customer acquisition costs and higher margin outcomes for the bank.

UBS released a report on CBA in which its banking team, led by Jonathan Mott, highlighted concerns around CBA’s growing reliance on brokers to originate mortgages.

We also see this as a concern, but not just for CBA. Driving mortgage share through the broker channel is more likely to be a function of price. While service levels can be a differentiator, mortgage brokers are more indifferent to bank brands and more focused on interest rates, commissions and discounts in determining which bank’s product to recommend to a customer. This reduces the product to a commodity. It is harder to extract a sustainable return premium from a commodity product.

Historically, CBA and WBC have originated a greater proportion of their mortgage from within their own branch network. If you think about this from a customer’s point of view, the decision to visit the branch of a particular bank means that they know the brand at the very least. Additionally, it gives the bank the ability to sell products to that customer without direct comparisons being made to competing bank products. While the consumer is likely to have visited more than one bank, they are unlikely to have been exposed to the breadth of competing product alternatives a broker could potentially offer.

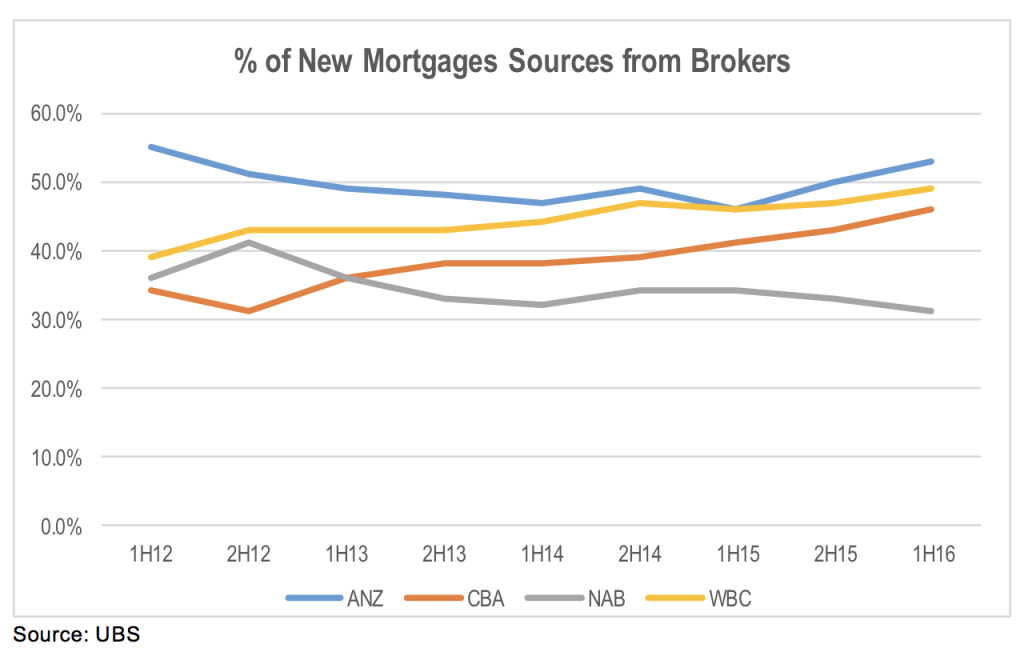

What is of concern is the increase in the proportion of new mortgages being sourced from the broking channel for 3 of the 4 major banks over the last 4 years, as shown in the chart below.

Interestingly, NAB is the only one of the majors that has actually reduced its reliance on the broker channel for mortgage originations.

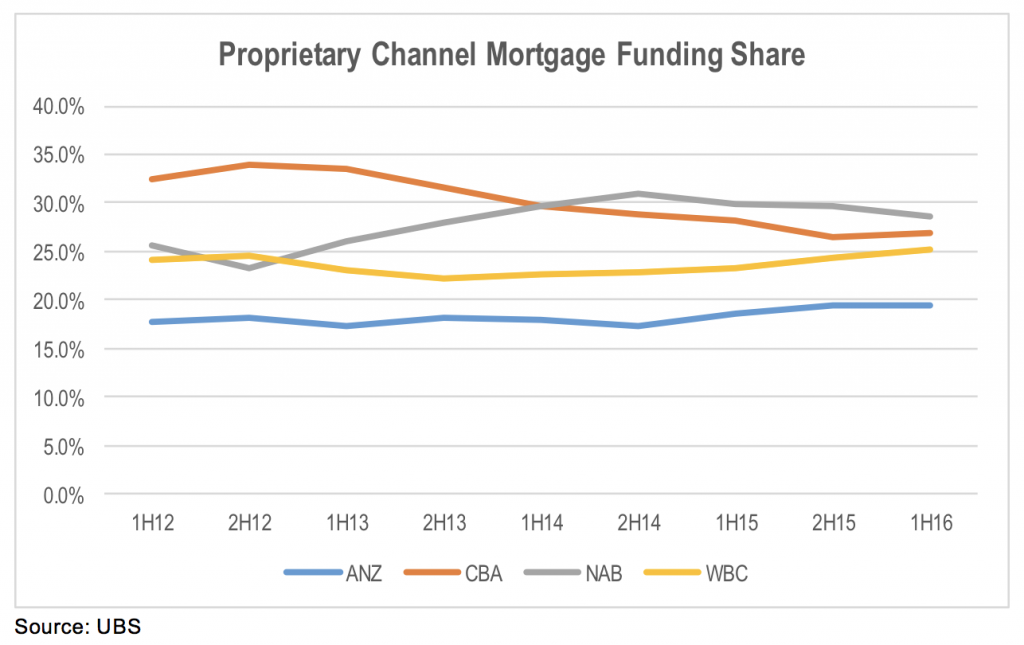

If we look at each of the major bank’s share of mortgage drawdowns that are originated directly from major bank branches, we get a very different perception of which bank is generating the strongest growth from their own distribution assets and brand equity.

Despite losing share in the mortgage market recently, NAB actually has the highest share when looking at mortgages originated within the branch network. WBC has been improving its share, while CBA’s share has been falling. ANZ’s share is well below that of the other majors.

The major banks will still benefit from the oligopolistic structure of the market in Australasia, and their scale benefits are expected to allow them to continue to generate higher ROE’s than the smaller regionals. However, the changing consumer perception of relative brand value might be an early indicator that the quality hierarchy within the major might be changing. As an indicator of changes in brand value, this is something we will continue to monitor.

Stuart Jackson is a Senior Analyst with Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

I feel that the graph is misleading in that whilst nab generates larger % of mortgages from their branch network it’s only a higher amount relevant to % of mortgages they generate and that % is small / less than CBA, WBC and ANZ.

There is very little BANK brand value when a customer goes to a broker. If anything the brand value sits with the broker not with the borrower so what you should be trying to understand is which bank provides the most value to brokers. You will find that different banks are good at different things. My customers are sme’s so a large portion of our Home Loans are placed with ANZ who are more accommodating in this space (I add that they also pay the lowest commissions)

The difference in commissions paid by the banks to mortgage brokers is very little. It’s almost always ease of approval, then price, then commission (in this order) which dictates where a broker places their loans . I know that Australians find this hard to believe because if you are being “paid a commission you are the worst form of human on earth” but it is true . When customers are strong applicants (vanilla) and have the luxury of being approved with any lender, then it is almost always pricing which dictates where the loan is placed. The only caveat I’d add is that most borrowers that fall in this category would prefer to be placed with a brand they recognise so the big4 and 2nd tier banks would most likely be considered in this instance.

Hi Con,

As I pointed out in the note, there are other things that dictate which bank a broker recommends and service/ease of approval is definitely a big component. However, as you point out, if a borrower is is a good credit, then price becomes a primary factor. In terms of the first comment regarding the size of NAB in the mortgage market, that is the point of the second chart. This shows that if we just look at the value of mortgage draw downs that are originated directly from the branch network, NAB has actually had the highest share since 2H14.

Brokers are providing an important services that is giving borrowers better information on product options. This reduces the ability of banks to charge higher prices on the back of their brands. The question the data raises is whether the increasing reliance on brokers for mortgage origination is a sign of the deteriorating brand equity of 3 of the majors. If so, this reduces their ability to generate high returns on equity as it reduces their pricing power.