Emerging Economies and their Potential

Emerging markets are growing at least three times faster than the demographically challenged developed economies. Powerful supporting dynamics includes younger, upwardly mobile populations, urbanisation with the shift from agrarian to service jobs, greater female workforce participation and a broadly improved education system.

Developing and emerging markets account for:

- 88 per cent of the world’s population;

- 62 per cent of the global GDP at purchasing price parity; and

- A younger and faster growing population – in Latin America, South Asia, the Middle East and Sub-Saharan Africa, more than 20 per cent of the population is between the ages of 15 and 24.

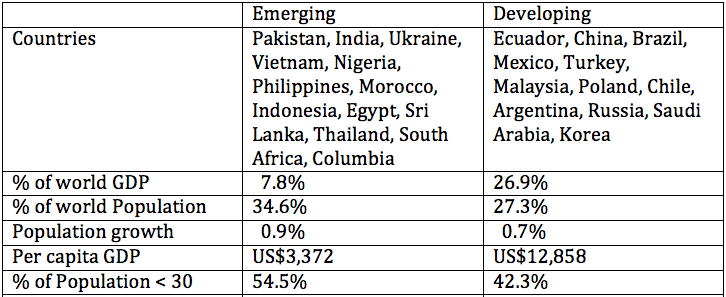

I have listed some interesting facts from a sample of 25 countries below:

Source: World Bank, Euromonitor, BMI Research and Deutsche Bank

Major brand companies like Colgate, Coke, Kimberly-Clark, PepsiCo and P&G are actively trying to position themselves to take advantage of any tailwinds and are constantly making comparisons with the more mature developed countries/ regions including Japan, Western Europe, North America and Australia.

Collectively these account for 56.4 per cent of world GDP, 11.4 per cent of the world population, population growth of 0.4 per cent per annum, average per capital GDP of US$43,332 and have 34.9 per cent of their population under 30 years of age.

To learn more about our funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.

Great factual article David, and as MIM have stated before ‘ Understanding behaviour across and within generations plays an important role with investing. !!