Rally rally

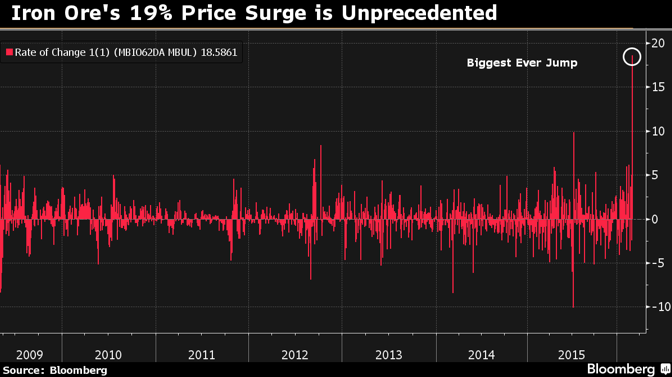

Well, what a difference a few weeks can make in financial markets. It seems that based on the daily moves higher in all things commodities, the bears gave up en-masse on their shorts. Just overnight oil rose another 5.5 per cent and iron ore with 62 per cent content jumped up an incredible 19 percent. The biggest one-day gain since 2009 by some margin.

To put these moves into context however, a few comments from a recent Bloomberg article below are noteworthy;

“The iron ore and steel markets have gone berserk – they’ve departed from fundamentals and are heavily driven by sentiment”.

At the annual National People’s Congress at the weekend, the authorities said they’d allow a record high deficit and higher money-supply target to support growth of 6.5 percent to 7 percent. At the same time, they also vowed to help cut overcapacity in steel, potentially curbing demand for iron ore.

“The crazy surge in futures prices has surprised traders and steel mills, as they haven’t seen a corresponding increase in physical orders.”

Whilst the short-term positive volatility in commodity prices is a boom for producers around the world as represented in their share price moves of late, it’s worth keeping in the back of one’s mind whether or not the above comments are an indicator of the sustainability of this rally.

We have long been of the view that the iron ore market in particular will struggle longer-term given supply is set to continue increasing at the same time demand was/is weakening – which remains our view today.

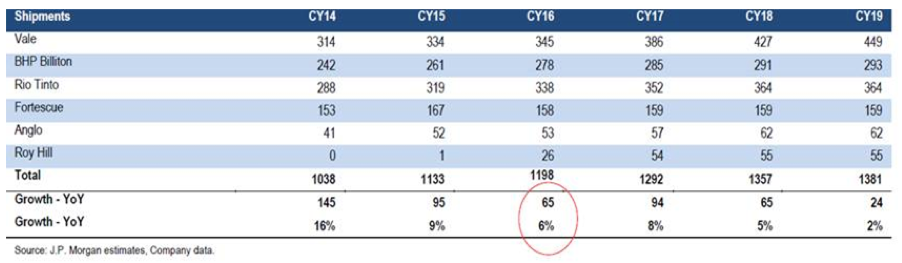

According to JP Morgan estimates for example, shipments of iron ore are forecast to grow by 22 per cent over the 2015-2019 years. We do wonder where all of those additional ships of iron ore are going to go… When supply increases at a faster rate than demand for any price-taking commodity, the impact is lower prices. With that in mind, unless we are about to see demand pickup materially from China, India, Europe or the US, which is not our present expectation, we do find ourselves sitting here wondering how sustainable and for how long will the current financial markets move last if the actual physical market / physical trade (demand) doesn’t not support it?

When supply increases at a faster rate than demand for any price-taking commodity, the impact is lower prices. With that in mind, unless we are about to see demand pickup materially from China, India, Europe or the US, which is not our present expectation, we do find ourselves sitting here wondering how sustainable and for how long will the current financial markets move last if the actual physical market / physical trade (demand) doesn’t not support it?

Something to ponder for those thinking now is the right time to venture back into commodities.

Russell Muldoon is the Portfolio Manager of The Montgomery [Private] Fund. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

It’s an epic short squeeze like never before.

The unbelievable level of spikes were set to trigger the most of the short position’s stop loss points. And after that, there is only one way to continue going forward.

Russell given that the commodity rally is likely to run out of steam eventually as the demand is just not there to match supply, how do you see the Australian Dollar reacting? (given that the international fund holds other currencies).