A mug’s game

It wasn’t that long ago, with the ASX200 stock market index at about 5700 points, that some magniloquent commentators were suggesting the ASX 200 index would be above 6000 points by the end of the year. Well here we are, on the cusp of 2016, and the index is below 5000.

These commentators will either blame the US Federal Reserve, or China or some other exogenous factor for their inaccurate forecast but what you should take away from their failure is that forecasting is simply a mug’s game.

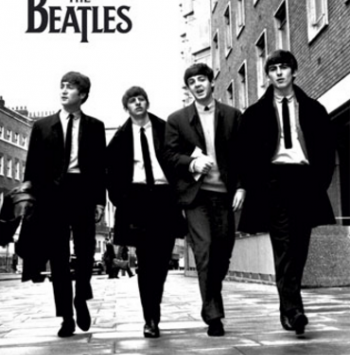

Even when the forecaster is deeply and historically embedded in an industry on which they are commenting, their forecasts can be spectacularly wrong. Consider, for example the Decca Records executive who told the Beatle’s band manager, Brian Epstein, following an audition in 1962. “The Beatles have no future in show business” and “Groups are out. Four-piece groups with guitars, particularly, are finished.”

Then there was the bank manager to Henry Ford’s lawyer who advised him not to invest in the Ford Motor Co. observing; “The horse is here to stay, but the automobile in only a novelty – a fad.”

And what of Microsoft CEO Steve Ballmer who, in 2007 noted; “There’s no chance that the iPhone is going to get any significant market share. No Chance.”

And finally the publishing executive who told an author of children’s books in 1996 that; “Children just aren’t that interested in witches and wizards anymore.” The author to whom this assertion was offered was JK Rowling of the Harry Potter series.

It’s hard enough to get things right when you are an expert and an industry stalwart. What value then is the forecast of those who are neither in control of the elements they are predicting nor aware that there is little value even when they get it right?

Those who presume to understand the machinations of the economy and the markets and then offer their ‘insights’ simply haven’t learned that 1) they will never do better than 50/50 with their forecasts and 2) their forecasts aren’t required for you to be a successful investor.

When we observed that the market was expensive and that banks and mining companies, at the highs, were unsafe investments, we weren’t making a prediction about the direction of the share prices of these stocks or what would happen next. What we simply observed is that investors were behaving dangerously and without regard to risk when they were chasing high yields and ignoring whether those dividends they were chasing were being supported by growth. We were simply saying that it was a mistake to chase yield at the expense of growth.

History and basic arithmetic demonstrates that a growing income can be far more valuable than a high yield. Investors who chase higher yields, especially from companies that pay the bulk of their earnings out as dividends, are missing out on major financial benefits that would otherwise accrue.

Roger Montgomery is the founder and Chief Investment Officer of Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

Hi Roger,its been a couple of months since Tim did his article on the board distruption at IFM,since that time their share price has drifted south.Tim made the point that the company had a solid business plan,however is it time to consider whether management is heading in the wrong direction or are we approaching value territory?

Kind Regards

Hi John, One wonders whether some are letting the tail wag the dog. It could be that the price change is indicating something amiss at the company, or it could be that nothing has changed at the company and a relatively thin trading environment is causing lower prices as sellers force their volume on the market and buyers pull back

With IFM, probably the relatively slow progress being made on replacement of the CEO has not helped with market nervousness? It has dragged out the long disturbance in management of the company. However, it is interesting to note that two substantial new holdings were announced in the last few days, one of which is by Challenger. Indication of reaching value territory? For what it is worth I have been gradually adding to my holding in IFM.

Good article Roger and timely reassurance given the current environment. I find it quite amusing how people get caught up in the noise and hysteria of “the market”. Those that do never seem to say anything constructive about or concentrate on the long term prospects and fundamentals of a business which isn’t what matters most at the end of the day? Ben Clark made a great comment on YMYC on Tuesday this week with words to the effect “the market is made up of over 2.000 participants of which a very small percentage make a profit so why would why would you worry about what it does…” Happy holidays…

out of 1800 listed companies fully 1200 failed to report a profit last year.

Roger, I have often wondered if anyone has done any statistical analysis/reporting on just how average forecasting by financial commentators has been over the years? But maybe any journalist that did such an exercise would be essentially making his own crowd look very ordinary!

David Dreman has done extensive research on exactly that and found that the odds of an analyst forecasting next years earnings within 5% plus or minus are less than half and by the time they are looking multiple years into the future it is almost a complete waste of time. He developed a highly successful contrarian strategy that capitalises on market overreaction and the overly optimistic forecasts for popular stocks and overly negative projections for out of favour stocks

Sounds interesting Guy

Totally agree Roger.

I subscribe to a financial newsletter from a financial tv presenter ( that you regularly appear on) who was predicting 6000 by years end.

Aside from the feelgood factor it makes my ability to get my investment decisions right that much harder because of the expectation that the market will reach that level.

Having said that I have made a few wise plays, a couple being investing in your global and montgomery funds as well as Montaka but that one is early days !

Hi peter,

Best wishes for Christmas and you’re right…it’s only early days.

I am very interested to see how Montaka performs given that a) it is investing globally and b) it can make money in markets going up or down.