Who makes your A1/A2 small cap list?

Time was a rare commodity on Peter’s show last night. Whilst I managed to list a few A1 and A2 small cap stocks that I consider make the Value.able grade, there just wasn’t time for details. So, as promised, I have put together a quick precise of two stocks (in boring businesses) I listed last night.

Time was a rare commodity on Peter’s show last night. Whilst I managed to list a few A1 and A2 small cap stocks that I consider make the Value.able grade, there just wasn’t time for details. So, as promised, I have put together a quick precise of two stocks (in boring businesses) I listed last night.

Remember: DO NOT rush out and buy shares in any company I discuss with Peter or any other media outlet (or here at the blog) without conducting appropriate research and seeking personal and professional advice FIRST!

These insights are not a solicitation to trade any security. I may own shares in the companies mentioned. I cannot predict share price directions – they could all fall by 80% or more after you buy. Finally, I am under no obligation to keep you updated with any change of my view, my estimate of the Value.able value of the company or my Montgomery Quality Ratings (MQRs).

Before I begin, here are the highlights from last night.

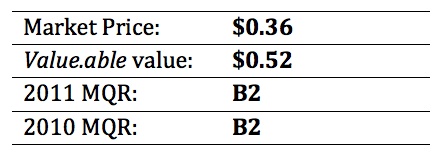

Zicom Group (ZGL)

In 2007, the first reported results after purchasing the Zicom Group, the company earned $6 million on equity of $21.6 million (ROE 27.7%). Since then another A$8 million has been raised from owners and profits have risen to A$8 million. Return on additional capital is 25%.

In the HY11 results, the company announced a profit A$7 million. Revenue grew from $47.75 million in the previous corresponding period to $71 million. A buyback of $4 million shares occurred in the half.

Company forecasts are for a full year profit of $12.9 million, which would representing a return on equity of 18%. Growth in equity is exceeding growth in profits, however the ‘growth’ has been through retained earnings.

Zicom has four divisions; Offshore Marine Oil & Gas (43% of revenue, makes winches and ROV’s/oil rig boom to help – think winches on ships that lift ROV’s off deck and into water), Construction Equipment (39%, concrete mixers/marginally profitable & foundation equipment), Precision Engineering & Automation (14% constructs automated production lines, ink cartridges for HP, semi conductor and medical devices and associated components) and Industrial and Mobile Hydraulics (4%).

ZGL’s order book stands at $83.2 million, up from $68.9 million. Cash flow was negative $10 million, however $5 million was spent seeding two start-ups and another $5 million was spent on acquisitions ($700k of PP&E and $4 million on buying back shares).

Click here to read Roger’s latest insights on Zicom, published 6 April 2011 in Alan Kohler’s Eureka Report.

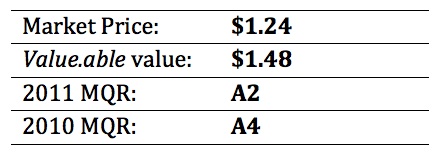

Codan Limited (CDA)

Codan Limited designs and manufactures a diversified products range for the international high-frequency radio, satellite and metal detection markets (think Minelab metal detectors).

Shares on issue are virtually unchanged from a decade ago and borrowings, which surged from $2 million in 2007 to $73 million in 2009, fell to $52 million last year and another million in the latest half year.

CDA’s 2007 profit of $11 million fell to $8 million in 2008, then rose to $24.4 million last year. The company forecasts profit of $20-$22 million in 2011 (optimistic analysts believe this figure will be higher, circa $24 million).

Since 2001, CDA’s profits have increased by 10.13 per cent per annum, from $10.268 million to $24.472 million

To generate this $14.2 million increase in profit, shareholders have put in equity of $21.859 million and left in earnings of $23.150 million (32%). The company has also borrowed $8.615 million net, in addition to the $43.483 million of debt held in 2001, resulting in current debt outstanding of $52.098 million and a net debt to equity ratio of 46.66 per cent.

Return on Equity is the best measure of economic performance, and CDA has averaged 31.02 per cent since 2001. Recently, CDA generated a return on equity of 37.94 per cent.

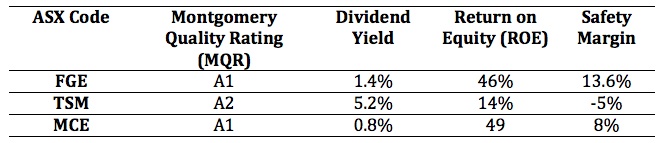

Finally, I also mentioned a small number of small cap stocks that are high quality and appear to be trading at a discount or close to my estimate of intrinsic value at the moment – Forger Group, ThinkSmart and Matrix Composites and Engineering. Here is my list:

Over at facebook.com/montgomeryroger Unc Dev’s list includes Thorn Group, Reckon, Iress, Nick Scali and Fleetwood. Shuo nominated PFL and Kristian proposed FSA, SWL & RQL. Which stocks make your A1/A2 small cap list?

Posted by Roger Montgomery, author and fund manager, 25 March 2011.

Hi Roger,

I have just finished reading Value.Able and have valued a company which i have shares in. However very unsure as to my accuracy. Would anyone be able to give me their valuation of LGD from the half year results . I calculated $. 41c but would appreciate a second opinion.

Thanks

You will definitely get a second opinion here ‘froggy’.

Hi Roger,

Please allow me to posthumously nominate Cellestis – they are in the proceeds of being taken over. It is such a shame that a promising little Aussie company disappears off the investable list after being taken over by another big company.

What are the real drivers here? From a cynical point of view the directors may have certainly earned a little extra when their options will be taken out. Certainly a few industry players had a whiff of this as the share price was driven upwards in the weeks leading to the announcement. From a pure business point of view maybe there is alot a bigger company can do to develop and market the technology into other applications. But they certainly seemed to be travelling nicely with good cash flows to grow the business. A shame this “value” is being gobbled up in goodwill to disappear into a big medical conglomerate. From the media release “Attractive premium of 24.3% to the 1 month VWAP and 31.5% to the 3 month VWAP…” It seems to be value destroying for alot of smaller shareholders who if you were in for the long haul could see the price at a disappointing discount to the business IV if they just wait a couple of years!

Regards,

Matt

Hi Matty,

It happens.

I felt the same outrage when ITX was taken out.

Not much you can do about it though.

IDL is a provider of capital equipment and services to the mining industry and has significant exposure to growth in China particularly in relation to coal mining.

It had a capital raising in the first six months of this FY…I’ve averaged the 30/6 and 31/12 equity to come up with $269m and an asset backing of 82 cents at 31/12…….dividend payout ratio is 28% …..debt to equity a little over 30% and directors are forecasting NPAT of $50-$55m for the full year (say $52.5m)…..this will result in an ROE of 19.5% (say 20%). Applying an investment return of 10% and using the formulae in Value.Able I arrive at $2.52 and the stock is trading at $1.445. BTW in a case like this I look back at previous forecasts by directors to see if they’re prone to exaggeration or inaccuracy (think DOW) but I think this board is staid and is more likely to under-promise and over-deliver…..always a good trait.

This is a business I’d want to own (I’ve owned shares for sometime and topped up with more late last week) and seems to have a good margin of safety. I’m not talking up my own book (I’m in for the long term) and made a similar post about ZGL when it was $0.30.

Hi All,

FWD Doing self imposed homework, could someone please check.

Curr equity 157, curr shares 54, EQPS $2.91, NPAT 39, Div 35,

POR 89.74% (used 90) Av equity 149.5, ROE selected 25% RR 11%

IV $7.22 (I used June 10 finalcials). Thank you

Stop blindly following roger.. please.

Ben,

A lot of people follow Roger but for good reason, he is the best there is in Aust. I personally feel the comments on this site are exceptional and a lot of members are coming up with good companies/subjects of their own worthy of discussion. Keep up the great work fellow graduates.

BTW I think I am falling in love with VOC. Yes Roger mentioned it (as did others here at the blog) first but I can’t help it, LOL. Future prospects are so bright I need to wear shades. Do your own research as I own VOC. As Warren Buffett said the best purchases he ever made were the ones where the figures almost told him not to but he couldn’t resist.

Ron,Ash and Jonesy

Contacted NOE today about some questions,and secretary said no prob but e-mail me.I for one do like the field they are in but appear to be well out in my IV calcs.Please point me in the right direction i used POR 26% ROE 40% and EQPS 13cents.

I undestand this is only a minute area before deciding if investment grade however i came up with an IV of 74cents using a RR14%. If all goes to plan the annual report should be released about 15th march according to the info i recieved.

Many thanks to all Grant.

Hi Grant

Just going through some of my inputs. You’re right, current EPS is around 13 cents. However, this has more than doubled from 2010 so I used ending equity rather than an average of beginning / ending equity. So this would have the effect of halving the current ROE to about 21%. This would give you an intrinsic value around the current price. Once the new facility is up and running, the output should be doubled, an assuming a constant EBIT margin, this should give you EBIT of around $30m. Taking off around 3m in interest payments, should give NPAT of $18m+ which would give you a ROE of closer to 30% and IV over 50 cents.

Note however, some of the words being used: “once”, “assuming”, “should” – no guarantees that anything works out as you hope it would, it could all end up costing a lot more and there could be another capital raising on the horizon, hence the delay in me pulling the trigger as yet!

Current IV 32c from memory… Wait for half year results and see how they are dealing with pricing pressure

CDA H1 cash flow statement raises a few questions. Can someone explain for me the blow-out in cash costs (paid to suppliers and employers) and the resultant collapse in cash from operating activities with the implications of this for the next half and full year?

Hi Roger,

MCE Trading Halt, share placement ! Any insights ?

PK

VOC.

$20ML intangibles,

Deferred tax $.7ML asset,$1ML deferred tax liability

Borrowings $13.8ML

Share buyback $6.5ML

Issued shares $1.3ML

To me there seems to be some inconsistant if i’m reading the half yr report correctly.Anyone care to comment.

Also from Trevor Sykes generally re capitalization of expenses:

He asks how much could it be sold for and who would buy it?

Hi Pat,

An accounting profit is Revenue – expenses. Taxable income is assessable income – allowable deductions. Assessable income is different to accounting revenue. For example revenue not yet received is not assessable. Deductions are not always equal to expenses either. The rates of depreciation allowed under accounting and under taxation differ. Some expenses such as entertainment are not deductible. Doubtful debts and long service leave are also treated differently. There are many. There is also differences between the balance sheet prepared for accounting purposes and that prepared for taxation purposes. The differences between accounting and taxation profit and balance sheets leads to recognition of deferred tax assets and liabilities. Here’s a neat list I found:

ITEM Accounting Treatment Tax Treatment

Depreciation As per AASB 1021 Often accelerated

Doubt. debts Expense when doubtful Tax ded when written off

Long Service Leave Expense when accrued Tax ded when paid

Rental Costs Prepaid until used Tax ded when paid

Rental Revenue Liability if in advance Taxed when received

Entertainment Treated as expense No deduction for tax

Research & Dev Capitalised and expensed Tax ded. when paid

Goodwill Amoristed No deduction for tax

Tax Loss No treatment Offset against future income

Moving on, I find the balance sheet cash flow method I describe in Value.able helps cuts through some of your concerns.

Hi Pat,

have a look at how the intangible is generated and what the liability is related to.

Attention all bloggers.

What are you all waiting for? NCK has an IV of $2.59 @ 10% RR and $1.97 @ 12% RR so at $1.54 why aren’t you all buying it? I bought at $1.80 so get buying and HELP!

The reason we r not buying it is because furniture businesses are tough businesses with very low barriers to entry. Maybe if it was trading around 80cents it would be cheap enough to take the risk of selling leather lounges….

As an aside note, go to Moore park supa center and notice how many new and different furniture stores pop up and close down regularly. This one is not 4me at these prices.

I went into the huge Nick Scali showroom in South Melbourne recently, and the only other people in there were two salesmen down the back. Looking at the prices I’ve seen similar furniture for much cheaper.

Not for me at any price

Your IV looks a bit high, but if you have done your research and confident in your numbers, you shouldn’t be worried about a fall in the price – you may even buy more.

This is an era of mining sector, why ‘d someone ever think of buying into retails sector ? It seems that you are swimming against the tide mate. You may reach your target in 10 year time, but is it worth your 10 year of life ?

Hi Bloggers

Mining services over furniture , no matter who is running it. It’s not the boat to be in now I feel

Cheers

Jim

lol .next time roger is on tv I will call in and ask him if he owns any gold stocks if so which ones .

i own slr rms fml mml but very small % of total holdings used to own ncm newmont barrick lgl kcn eld rsg sar and lots more i had a whole zoo of gold miners still think silver gold will go higher but i started investing in gold when it was 420 oz not as popular then as now every one seems to be gold crazy gold buyers every were in shopping centers they have gold buyers on the radio ,

Soros said gold is going to be the ultimate bubble he has increased his holdings , so i guess he wants to ride the bubble

mark faber and jim rogers said that gold could very well be cheaper now than 10 years ago because of the high debt and

money printing in us and other central banks jim rogers and mark faber peter schiff al think we could have global currency crisis in near future then a medium of exchange will be needed

sorry for any spelling misstakes spell check does not work here

Regarding Zicom, I am interested to hear other people’s opinion about the structure of the board, quality of corporate governance and remuneration.

This is one area that stood out to me in reading the annual reports, so I thought it is worth a mention.

Hi Dane,

I am as interested in your thoughts as you are in mine :)

Cheers

Craig

This is an important part of assessing an investee given agency risk and I, for one, am also very interested to hear everyone’s findings…

It is all in the family.

Nepotism risk is high. Good if you are a family shareholder. Perhaps less so if you are a passive shareholder.

And watch out for those disruptive technology investments. They can “eat your lunch” and do so more often than not.

Hi Lloyd/Dane/Roger

My thoughts are this

With GL Sim is the majority holder with 35% of the company, my guess is that the incentives are in the right place for small shareholders and the Sim family interests to be aligned.

I also think actions are louder than words. The companies capital management during the GFC was value enhancing for shareholders, a laudable show?

And more speculatively: It’s easy to be a bit suspicous of family interests, but providing the financial interests are aligned with shareholders (tick) I think it might even be a benefit. It appears that the eldest son has been well educated (honours from Columbia Business school?) and I would guess he has been well groomed under tutalage of GL Sim who by all accounts appears to be a very well respected businessperson.

Lloyd: I agree about the startups. Value destroying until proven otherwise?

Thanks for your thoughts Lloyd. What do you guys thing Roger/Dane? Any insights?

Cheers

Craig

Hi Craig,

I have written a short piece for Alan Kohler tomorrow.

My thoughts on a general level are that family is not a big problem in management, but a little worrying in M&A deals. I like big shareholdings in top management and board, but only if they are paying themselves largely as shareholders. In this case I hesitant due to what at a glacé l

My thoughts on a general level are that family is not a big problem in management, but a little worrying in M&A deals. I like big shareholdings in top management and board, but only if they are paying themselves largely as shareholders.

In this case I am hesitant due to what at a glance looks like undervalued equity remuneration. The lump of shares issued at 10c is a concern. I understand the argument that the minor shareholder can benefit from the alignment of management through their equity holdings, but only if the risk of M&A and remuneration to the detriment of shareholders is minimal.

Probably a good punt, but I feel like I am not part of the family and consequently won’t be looked after in tue same way.

Hi Dane,

I think you are right about undervalued equity remuneration of course. However I am not sure the family connection is any different to the general institutional imperitive of the entire ASX. It’s hard to find a single company on the ASX that does not engage in corporate backslapping of the dilutionary kind.

In fact one of the only companies I can think of that actually remunerates and incentivises in a rational and shareholder focused manner, is RYM on the NZX. Their shares on issue have not altered since listing a decade ago, they offer no options to executives. Instead they provide an interest free loan for exectutives to purchase shares in the company. A laudable approach indeed.

If only others would follow this example on both bourses. :(

Roger,

Thanks for your Zicom insights on EurekaReport. You didn’t just give away the valuation formula behind your growth table by any chance did you? ;-)

“More importantly, return on equity could exceed 25% in 2011 and 28% over the next three years. Zicom gets a Montgomery Quality Rating of B2 and paying 1.74 times equity for Zicom is akin to buying a bank account that earns 25–28% per annum.”

Craig

Hi everyone,

I started noticing everyone is discussing all these mining stocks here.

Sure we r in a commodity boom and every miners’ shares are skyrocketing. But let’s not forget these guys r price takers with no competitive advantage what so ever!

Let’s go back to basics and start thinking about the businesses that have real moats around them.

What I think is happening is that we r running out of A1 stocks to value and resorting to speculative mining stocks even if they r profitable.

BE PATIENT! We can’t always find bargains. Opportunities will come, so make sure u have the cash to capitalize on them.

I thought I would just mention this. Thanks

Ron,

I’ll have to disagree with you here. If you look at economic cycles (and global imbalances) it makes sense to have commodity exposure right now. Conversely, retail companies can still have margin pressure due to rising input costs no matter their competitive advantage. This scenario can last for years.

That’s fine if you want to ignore commodities, however the reality is that they are a viable asset to invest in when the time suits. The same thing applies to retailers. It depends on if wish to buy and hold for 20 years or if you have shorter timeframes.

To say that all miners, even if profitable, are speculative is denying the fact that all forms of investment is inheritly speculative as you are making a call on the future. The irresponsible thing to do is to invest in a company without understanding of value and this is often done by most people when investing in mining stocks. There is no reason in my view to ignore a large sector of the investment universe and no reason it can’t be done with a value investment philosophy.

Those who feel uncomfortable in this area should stay clear but for me this is the safest place to be given the cycle and environment in which we find ourselves. I’d like to preserve my purchasing power.

Have to say I totally agree with Ron (and Buffet!) on this and disagree with Steve.

As Ron said, the problem with miners is they are PRICE TAKERS. They largely rely on commodity prices to determine their profits, where as great industrial companies rely on their great products, marketing and human ingenuity to deliver consistant ROE over long periods. Future commodity price movements is indeed speculation.

If you don’t believe me look at the huge outperformance of the industrial index compared to miners over the long term. (With a few exceptions like BHP who is large enough to be a price maker.)

You definetely shouldn’t be in resources solely because we are in a resource boom.. because like all booms, it won’t continue for ever.

Adam,

I’m not talking about investing in resources due to a resource boom. I’m talking about the fact that we are in the right cycle and that I see significant benefit in having exposure to precious metals and also oil/gas. We have a major global imbalance and huge levels of liquidity meaning coming rampant inflation. This is why you invest in resources.

You are talking about BHP for example and I’d assume you are referring to the last few decades. Industrial stocks (index) can end up at the same nominal value for up to two decades. This excludes the erosion due to inflation. If you are comparing from 1980 then you are not looking at the right period and this is a different cycle than from 1980 to 2005ish.

You refer to Warren Buffett. Did you know he took on a large silver holdings early this decade?

No, resource booms don’t continue forever and industrial stocks don’t go up in a straight line forever. It comes in cycles. This cycle should last till between mid decade and 2020. We have a massive inflation problem on our doorstep right now and we are definateky living in interesting times.

Refer to Jim Rogers’ work if you are interested to learn more about the cyclicality.

Hey Steve,,

Jim Roger quote……..If you want to be rich learn to to ndrive a Tractor

Nice post

Thanks Ash,

He also said that they (farmers) will be all driving lamborguinis lol.

Heard that recently US farmers have stopped growing their usual crops and are growing cotton this season! Wonder what will be the crop of next season!

Hi Steve,

There will be lots of rich cotton farmers in Australia this year.

Next years crop will be the ones they did not plant this year hence creating future shortages

The one thing I can say to watch out for is that 70-80% of chinas GDP growth is in fixed infrastructure! This is unprecedented and not sustainable. This is why commodities are in high demand. I also get quite worried when people justify their opinions by ‘this time it’s different’ comments.

Have a listen to Jim chanos and if I’m not mistaken, according to Jim Rogers this commodity bull run began in 1999 and usually lasts around 14 years or there about.

Again this could go for a while more but I have never been good at selling at the peak and buying at the bottom. I’m happy to be close enough! ;-)

Hi Ron,

I love your posts and your contributions here on the Blog.

I disagree about the sustainability of Chinese growth.

Income and urbanisation drive infrastructure growth.

As China’s (and India’s) economy grows we will see a rise of the fortunes of the middle class.

Middle class for BRICs (Brazil, Russia, India and China) will increase from 300 million in 2008 to about 1.4Bn by 2020. China’s per capita income will rise by 175%. Chinese and Indian cities will grow by 30%.

During the eighties I witnessed massive infrastructure change in Singapore. They were continually knocking down and rebuilding Orchard Rd. The changing face of that small island was amazing. I couldn’t believe their MRT had full platform length glass and stainless steel partitions for boarding their trains.

On top of this, consumer spending will soar. This middle class will want air conditioners, phones, cars, ipods etc. Air travel in China alone will increase to a billion passengers a year by 2018.

The middle class will want the latest of everything so you can expect that infrastructure will constantly need maintaining and updating.

China plans to increase their rail network from 78,000Km of track in 2008 to 120,000km by 2020. Coal accounts for approx 50% of goods carried by rail and 7,000Km of the increase will be dedicated to transporting coal.

I’m not saying it will last forever but I don’t see an end real soon. When we talk about China, I think we often forget the sheer size of the place (population and area).

Cheers

Rob

Ron,

Your view is the popular one assumed by many mainstream economists and I don’t buy it.

The reason why commodities are the place to be is not related to china specifically. There are many many more people in this world today and they need food and energy. World resources are not infinite and you can print food they same way the US Fed can print money.

This is not about China building more houses than it needs. Do you think they will stop eating? Stop wanting to drive? Energy demand is insatiable regardless and the only way to find new solutions is by market prices increasing significantly.

This is not about base metals or even demand of them either. World money supply has gone through the roof and it takes more paper currency to by the same commodities. Don’t even think about Chinese economic grown rates when considering these problems – they are a side story here.

Jim Rogers and others say 2001 and around 15-17yrs is typical. We could face this for quite a few years yet and it’s not about timing the market (in my view) – it’s just a matter of watching the world and seeing when the problems start to be fixed and I’m sure it won’t happen overnight and they are terribly big issues!

Not a fan of Jim Chanos as he is too focused on Chinese property from what I’ve seen (obsessed?). There are many other aspects to consider.

Anyway, hope this is helpful to some. It is a topic close to my heart as I believe that the issues we face will impact on investment outcomes.

1999 and lasts 15-20 years… He has said this one might be longer than average as GFC caused delays.

I disagree that it’s the opinion of many mainstream economists, they r all bullish as their employers r recommending their clients to buy the miners…

Anyway I guess time will tell who’s right and who’s wrong….I hope u will be right!! ;-)

Ron,

Perhaps I should be more specific – some of the international economists have this viewpoint.

With regards to Australian economists… it hurts my ears to listen to them.

I’m pretty sure I’m right, but you never know and I’m always happy to hear other views and correct myself if I’m wrong.

Hi Ron,

Good call, This is something that is on my mind as well. Consumption as a percentage of GDP must rise and Fixed Investment must decline in China

For commodity booms and busts people lump them into one category but sections have different metrics. If we look back at the last boom during the 1960’s and 1970’s then we find that base metals were the first to boom (anyone remember a company called MIM which had( and I have not looked this up but it will be close) a market cap of close to BHP in the early 1970’s.) However base metals were the first to decline in the mid 1970’s. Precious metals like gold and silver continued on untill 1982 and agriculutural commodities boom lasted a few years after that.

If you listen to Jim Roger he is now on to agriculture and I would just guess that the reason is it is the last to boom and the last to bust in a commodity cycle.

Just my thoughts

Hey Steve,

Correct me if I’m wrong —

The key will be how accurate you can predict the commodity circle timeframes. The winners, no matter in which sector, always have competitive advantage. Say BHP & RIO’s competitive advantage are their economy of scale, their long history and experienced operations, their system and structure etc. I don’t have deep insight into small miners… some questions may be.. Are their earnings mainly driven by the raising commodity prices only? How certain they can find quality ores under the ground? Will they able to sustain rising cost pressure? If you are convinced some small miners can maintain the high ROE in the next 10 or more years, then becoming a business partner maybe a good idea.

I think buying commodities directly in order to hedge inflation is different from investing in small miners.

I’d personally prefer quality mining services companies, the competitive advantages are quality of work produced, experience in the field, client relationships and specialised skills. More importantly, although they are more or less exposed to commodity prices, they have to charge service fees regardless how profitable of these projects to the miners. (Think of your stock brokers, they don’t care what stocks you buy, they are happy enough as long as there are transactions)

Regards,

Wing, I follow Jim Rogers and David Skarica. There are pretty well defined timeframes.

Mining services aren’t without risk (not against them I did hold forge and still hold matrix) as they can be impacted from fixed contracts when their input costs rise and especially energy costs rise. Also an economic slowdown due to inflation would be a risk.

At the moment i look to invest in miners as a proxy to holding the commodity with the duel benefit of gaining leverage and also investing in undervalued companies. Obviously there is volatility and they can fall along with the overall stock market.

Hi Wing

I have a different take on Mining Service Companies. The competitive advantages you mention might be of use in winning work in the good times though I have my doubts that they will count for much in a down turn. I have worked for one of the majors and the overriding strategy in out-sourcing was to ensure the fixed costs and in house capabilities of the business were appropriate for the bottom of the relevant commodity cycle – above that contract as much as you can. Whether a contractor could do it better or cheaper was in reality a secondary consideration to making it a variable cost in a downturn.

To an extent I think the outsourcing boom has desensitized the producers to the commodity cycle and the risks have been passed to the contract service companies. Time will tell if they are any good at managing the risks though I suspect some service companies are coming to market now because current owners already know the answer and want to take cash of the table in the good times.

My opinion is that the Service Companies are highly exposed. They carry the capital assets; the sticky workforce and some heaven forbid even have debt whilst revenue is dependent on the amplitude of the commodity cycle

The good ones will have contract terms in place to help mitigate their risk but without being an insider it’s hard to know much about contract terms. Diversification in revenue sources between mining, infrastructures, commercial etc should also be helpful in managing when the commodity cycle turns down.

Ironically the poorer quality mining service companies experience the strongest share price increases during the goodtime because they are more concentrated towards mining, have higher operational leverage (some even have financial leverage) and margins starting from a lower base. But everything that works on the way up reverse on the way down. Generally I think the whole industry dynamics are poor but good money can and is being made now. Continuation of the commodity boom though will be critical to the well being of all but a few who will survive and eventually dominate. (those are the ones I want to buy and at that time)

That’s how I see it anyway.

Many Thanks Gavin, for your information provided! So that’s why I said “quality” mining service companies will be my choice. Those ones with high ROE, high operating CF, little or no debt and managed by owner-like managers will be more attractive than the others. I do agree that it is exposed to the commodity cycle as well.

And yes Steve, I’ve also watched Jim Roger’s video posted on Youtube and some bits and pieces from economists, who mostly pointed to a bull commodity cycle the next 10 years or so. I was just trying to point out that when buying commodities you are exposed to the commodity prices risk; but when buying small mining companies you are exposed to the risk at the company level and commodity prices will only become a factor of those risks. But if you have identified the competitive advantages of some small miners, I’m sure many of us would like to know your insights :)

Hi Wing,

The whole point when investing in miners is to be exposed to the commodity price risk. One can invest in miners and gain a dual benefit of being a value investor plus having upside to the commodity price.

It is a completely different equation to investing in mining services companies. You need have have a view on the underlying commodity itself.

So yes, there are risks, however there is equal reward. Therefore if you have a good idea of what is happening, you can have significantly more upside compared to a mining service business. It all depends on what you are trying to achieve and your understanding (and therefore confidence) of the underlying commodity.

With all this talk of overseas investment; I thought of an idea to maximise returns and minimise risk (though not sure if individual investors have access to this type of strategy).

Assuming that one believes the Australian dollar is high at the moment and that one can find overseas companies at under intrinsic value, obtaining credit from overseas (i.e. in the US/Europe/Japan) where interest rates are low and then investing the money in stocks in those countries which will appreciate over time would seem a good way to achieving wealth. You would have bank accounts opened in the other currencies/countries and could then transfer funds in and out over time based on the currency levels/investment opportunities.

Does anyone know whether Australians can obtain credit overseas to invest with in those markets (i.e. a margin loan, but preferably a personal loan so that no margin calls are involved?)

Alternatively, are there ways to obtain credit from overseas and bringing it over to Australia; then either investing in term deposits (and profiting from the spread – bearing in mind currency fluctuations) or investing on the ASX? The aim would be to obtain long term fixed loans from overseas, which, if obtained cheaply enough (which looks to be the case currently), would almost guarantee significant profits over time considering the edge we hold as value investors.

Would love everyone’s thoughts and Roger’s if you have a view as to whether this was possible for individual retail investors (or in any other formats – such as starting a company to try and obtain the credit) to invest in overseas markets from borrowed credit – as now seems as opportune as ever to give it a go!

Thanks, James

Check out ASX: USD for investing in the rising U.S dollar. You may also get the benefits of receiving capital gains/losses tax advantages as apposed to having to report earnings as an income. Personally I believe that the Aussie $ will rise to $1.07/1.08 U.S before the end of the FY. So you still have time (IMHO) on your hands to look into this ETF.

Two problems with ETFs are:

1 they are not always liquid enough

2 in volatile times they don’t necessarily reflect the exact value of their holdings. Refer to Japanese equities ETF recently.

Hope that helps.

Hi Ron,

I admit to not being very well informed about ETF’s but I was under the impression that the people operatating the EFT are duty bound to be markets makers and provide the liquidity.

If we have any ETF experts out there It would be great if you could clarify how the operate.

Hi Roger,

Seems like people are interested in overseas businesses especially with the Aussie dollar being strong. I own shares in PET. Wayne Peters scoures the world and buys undervalued high quality businesses – a lot are in the US. Importantly he hedges currency risk. Perhaps worth a look for some people who want a lower risk exposure without some of the complexities of currency/tax etc.

Regards,

Michael S

ONT’s numbers are great but the major risk of a business like this is that its’ goodwill goes up and down the lift every day

What do people here think of DRA? Small Gold producer, debt free, in production. Hard to see a competitive advantage, but seems pretty cheap compared with IV even at a 15% RR.

Chris,

Looks pretty good with large upside based on IV.

However, the is something unidentifiable that is concerning me and I have no idea why – I think it may be a feeling that their future growth potential via exploration isn’t absolutely certain (although some of there grades are fantastic). Have only have a brief look at this stage.

Hi Steve I

Is it the high cost of production that is of concern? Also I cant seem get a picture of the future production over the next 3-5 years.

Vishal

Hello Roger,

Do you think the buy back by JB HiFi today was enough?? At least they did not pay out the money in dividends. What is the IV now?

Regards

John F

Roger, I had replied to an email you sent me in 2010 recently. Probably it got sorted to your junkmail but look for that.

Interesting that CDA has shot up to Roger’s estimate of intrinsic value but ZGL hasn’t and is still at quite a discount. ZGL’s last big price move actually occurred before Roger mentioned it. ZGL also had the higher discount to IV and Roger projected higher growth rates of around 10% per year compared to CDA’s relatively flat growth

Hi folks,

If you get time, have a look at the Prospectus for GR Engineering Services Ltd which work out of WA.

Raising $30M by issuing 30M shares. Very impressive reading. Reminds me of MACA (MLD).

I believe that all shares are already reserved for clients of Argonaut Securities. Rang them today to ask some questions, but they were just flat out rude.

I’ve lodged an application for an allocation but believe I won’t score any (similar to MACA).

Still I’d encourage you to have a look. I expect it will open somewhat above the $1.00 mark.

Hi Stephen,

Thanks for nominating GR. Just had a quick look using beginning equity, Im getting a current IV of $0.57 using 14% RR, NPAT of $17.8m, 120m shares on issue and equity of 1.8m, $0 dividends, POR 0%.

Based on the prospectus forecast numbers, I’m getting a forecast IV of $0.78 using an RR of 14%, NPAT of $18.77m, 150m shares on issue, equity of 30.37m, $0.04 Dividends P/S, POR of 85%.

If I use average equity, I get an IV of $1.45, which represents a significant premium to the listing price…

Cash flow looks like it will be positive.

NPAT growth as stated looks to be only 8% – could be understated – but not spectacular as is.

Anyone else had a chance to look at this – are my numbers correct? opinions?

Rob

Hi all,

Update. My numbers were incorrect (wrong multiplier, amongst other things). Im now getting an IV of between $1.74 & $2.03 based on the adjusted half year numbers and forecast NPAT for 2011. More investigation needs to be done.

Rob

Hi Robert,

Much more needs to be done because the company’s strong cash flow and dividends over the last two years may be a function of a low spend on PP&E. Have a look at the cash flow statement for FY2010 and HY2011. You will notice $15mln was taken out in FY2010 and another $15m in the last six month financial period. Would this have been possible if an appropriate amount was spent on maintenance etc? Is the low spend on capex because the company is not capital intensive (good) or is it because the owners chose to take the cash out and let mum and dad investors fund the capex needed (not as good)? The concept that ‘all the money being raised is going back into the business’ is less attractive when measured against the low spend on capex in the last 18 months of less than $600,000. Not much for a business that earned cash revenue of $210 million in the last 18 months.

Roger, You understand and see things I don`t. Thanks a lot. I would have bulldozed in when they list as I had IV $1.61.

Hi Ken

A1

Depending on the price I may still bulldoze in

Hi Roger,

Thanks for that.. Very good point!. It seems rather cheeky to have taken $30m out, only to ask for it back from prospective owners.

Indeed, a very low capex figure.

Rob

I’d be thinking something close to 20% of net operating cash inflow would be reasonable for an engineering firm and the recent figures are not in that ball park. Add in the strange $30m dividend immediately followed by a $30m capital raising makes me have second thoughts. I would like to see some annual reports going back about 5 years to get a better idea on management and how well the company has been run to date.

For my money if they list @ $1.05 they are still a good buy. Make sure that you don’t expect GR to repeat MACA performance though. Treat each stock on its merits. Remember to turn the stock market off once your invested.

Simon, That`s easy for you to say.

Hi,

I was surprised to see GRES nominated. A bit of history on GRES. I happen to know most of the key people at the top management as well as all the second line managers. Because I worked with them very closely in the past. They did built a 4.5 Mtpa gold processing plant in Kambalda (where I used to work) about 4 years ago. I was the client representative they were the engineers. Most of the present GRES people used to work for JR Engineering Services (JRES). JRES had a workshop in Kalgoorlie to provide plant maintenance sevices to mining companies around Kalgoorlie (mostly small gold mining companies). At the same they started designing and building small processing plants ( 0.5-2 Mtpa capacity). Just before the previous mining boom, the owners (key owner Joe Ricciardo) sold the company to Downer EDI, and it was called Roche Mining (JR). Once the time was up (about two years ago I think) all of them (including managers, principal and senior engineers) left Downer EDI to form GRES.This is also the same group who built a big mineral sands processing plant for Iluka. This is the plant for which Downer suffered quite a bit of well documented financial problems. I doubt the plant they built for us (gold plant) was a financial success for them either. One of their key design managers now works for Abesque engineering, which is a subsidiary of FGE. These people are capable, no none sense people who can build cost effective plants. As long as the boom lasts. As for their competitive advantage, being an extraordinary business and have a high ROE, I would have hesitations. It might turn out to be a success story. But I prefer to would sit on the sideline for this one and invest in companies like, for example, Vocus.

Yavuz

some more small caps for further research and trading below IV (some of them have high debt to equity and highly iiliquid):

NOE, CSV, STS, AMB, CDD, DDR, VMG, LIC

Just my humble opinion but the first on the list is by far the best.

I have looked at it a few times but have never pulled the trigger.

Keep up the good work Ron I for one love your posts.

Not saying I always agree with them but that is what makes a market :)

Novarise Renewable Resources International Ltd (ASX:NOE)

Had a look at this stock after Ron made the suggestion to have a look at it. The fact that it is involved in recycling waste plastic also aroused my curiousity.

Novarise is an ASX listed company based in China which produces fibre grade polypropylene (PP) pellets from recycled polypropylene waste. From this, they then produce materials for domestic and export markets. As a synthetic chemical fibre it has advantages over eg nylon and polyester in that it’s corrosion resistant, non toxic and wear resistant. The range of products that this can be used for include bags, footwear, clothing, rope, tents, backpacks and laptop carry cases. The company has long term relationships with international brand notebook bag producers including HP, IBM, Dell, Toshiba, Samsung, Acer and Asus as well as the worlds largest beach chairs and tents producer.

Novarise is the only major producer of recycled PP in China and the technology it uses to produce the pellets from waste products is significantly more economical compared with producing virgin PP. The cost of processing PP waste materials into recycled fibre grade PP pellets is approximately 20% lower than the cost of using virgin (non recycled) PP pellets. In 2010 the company was granted patents related to the production of these PP pellets including a pellet bulking device, cooling device and a plastic peletting model.

In 2009, Novarise was producing 25,000 tonnes annually, increasing to 35,000 in 2010. The company had an IPO in 2010 to raise money for a new production facility, phase 1 of which is due to be completed in the 3rd quarter of 2011 resulting in an increased capacity of 75,000 tonnes annually.

The competitive advantages with the company are in the technologies that they use to produce the pellets – no other company can currently produce PP pellets from waste PP product. Also, the long term relationships that the company has with multinational corporations regarding producion of notebook cases.

Risks of investing in the company include the risk of being exposed to currency fluctuations (earnings being in RMB). Other longer term risks include competitors producing a competing cheaper product, somewhat protected currently due to the patents on their technology.

Looking at annual reports and financial data, I have Novarise currently trading around intrinsic value (using RR of 12-13%), but with significant growth likely over the next few years. However, any gains to intrinsic value may be offset by the need to raise further capital in the future to fund further expansions to the current production facility. There is a reasonable amount of debt on the balance sheet however, currently 59% of equity, which needs to be taken into account.

Whilst there are some analysts who are quite bullish on this stock at present, I don’t think this would classify as an A1 or A2 business, and like Ash, I would prefer to wait for a slightly bigger margin of safety before pulling the trigger on this one.

Hi Ash and Ron,

NOE has to much debt for my liking if that were to reduce i would become a big fan, CDD looks ok i beleive it is undervalued.

Cheers

Hi Kevin

NOE has lots of cash ATM too

Hi Ash & Ron

Very new to Value.able. I need help with IV of CDD. Looks like $6.80 to me but I’m a bit confused.

Thanks

Hi Allan,

Sorry I can’t help you. I don’t consider CDD a good enough business to value

Ron,

Any idea on how the new plant development is going? I was going to give the local non-executive director a call to discuss. The last photos on their website are from January 2011.

On their recent results they were discussing pricing pressure from competition… I think thats what turned me off about it, and the fact that I don’t trust Chinese companies with dodgy Chinese regulatory agencies.

But on paper it looks interesting.

Maybe one to watch…

Thanks Ron,

My field of expertise is Governance and the recent resignation of 2 Non-Executive Directors sends a shudder through me, especially in reading the commentary around why they resigned (basically saying they were too busy to continue). I’ve put in my call and see what I get back. It will be interesting to see what sort of contract is in place with key buyers of the products as well e.g. IBM, Dell ….

On a side note, I did quite a bit of work with Chinese Regulatory agencies in the past and they are improving. Improvement has to be measured though against the baseline and the framework in which it is governed within.

I haven’t had a response from the company yet. This coupled with today’s announcement are enough to take this one out of the loop for me; particulalry the responses (rather than the issues). Lots of potential but many considerations/risks as well.

Hi Fellow Value-ablers,

I have a picks and shovels stock which has been on my watchlist since it’s recent listing, Allmine Group (AZG).

From what I’ve read of there prospectus and prior financial reports they sound promising. I must add I have not yet managed to get round to recalculating my IV for their recently announced acquisition.

Any feedback?

Have a look at the position of financial statement.

$9.9 m in goodwill.

With the company looking to make further acquisitions as stated in the half year report the fact that goodwill has reared its ugly head is not great.

Also the ROE I calculated is not great at around %10.

Hi Roger. What happens now that you are a price mover? I trust you will us your power for good :)

I am only getting a value of about $1.70 for Vocus. I think you can only count on earnings for 14 years (i.e up to when the IRU runs out), and therefore the Value.able formula can’t be used.

It is also making acquisitions that are hard to value. From the information available to the public, I am struggling with this one. There is too much speculation involved for me.

I have a large portion of my SMSF in cash, so was hoping to find something to put some cash into. No doubt I will be the pessimist who was wrong on this one!

Hi Roger,

Did you just happen to get your first publicly noted speeding ticket today for CDA. LOL :)

Cheers

Rob. W.

Its good to see that Roger’s ideas might be moving the market!

Codan received a speeding ticket to which the company replied:

On 24 March 2011 Peter Switzer discussed the Company on Sky News Business when he had Roger Montgomery. Following Mr Switzer’s segment, on 25 March 2011 Mr Montgomery published an article about the Company detailing the Company’s profits and return on equity. The Company considers that this may have had an impact on the price change and increase in volume of trading in the securities of the Company.

I am about to issue a WARNING.

Hi ALL readers of this blog,

If you buy shares in companies merely because I mention them on Peter Switzer’s show, or anywhere else for that matter, and you do no research of your own and/or do not seek and take personal professional advice, you are worse than irresponsible.

As you know I recently mentioned Codan on Peter’s show and perhaps coincidently, the company’s shares rallied the next day. I was appalled to hear of the possibility that the price of Codan was pushed up so fast that the company had to respond to a speeding ticket from the ASX. Codan is a serious business with real people working there who may even have their financial futures tied to the share price. Volatility in the price of the shares does nothing but distract them from the much more value.able task of running the business to the best of their abilities.

Where I own a company’s shares I always articulate it. I did not say that I own Codan (ASX: CDA). I do not own shares in Codan.

If you buy shares in businesses merely because I have declared my own interest in them (as I am required to do), you are equally irresponsible because;

1) I may get it wrong,

2) I am a very long term investor and I look forward to shares prices falling, while you may not look forward to it.

3) I look for very large discounts to intrinsic value (many of you do not appear to require such discounts)

4) I look for many factors that may or may not exist in the company’s mentioned on tv because there isn’t enough time to discuss every aspect.

5) I am not able to predict short term share price direction,

6) I may change my mind at any time and sell (see some of the rules I follow for selling in my book) and

7) I am not under any obligation to tell you of, or keep you up to date with, any of my buying and selling.

Finally just because I own a business does not mean you should. Only if you truly understand a business, its industry, its competitive landscape and the future of that landscape, only then you are able to come to make an informed investment decision. There are some people who can make informed decisions and understand what a business will look like in 5-10 years time. These are the people who should be buying shares in those specific industries and companies.

The business of managing your finances is a serious one and not one whose foundations should be built on tv commentary. You cannot hope to sustain good performance by simply entering a race to buy something I have mentioned. You will lose money following such an approach.

Just to be clear, the companies I mention are those that I believe are worth researching carefully. Nothing more. They are not necessarily businesses that are worth buying now.

If you have not done your research and the shares I mention fall 10%, 20%, 50% or more, what will you do next? This may be a mouth-watering opportunity or it may be a reflection of a development that causes me to sell out, but I may never mention the stock again because I might not be asked by anyone what I think about it again.

Please be warned.

Just to prove a point, I personally watched the program, calculated the IV of CDA and read their reports that night, but I decided not to buy it because I don’t think I have enough information to make an informed decision. And I am not regretting it.

I still have a view that we need to differentiate Roger’s “followers on this blog (or value.able graduates)” vs “followers on tv and eureka report”

Again, I came across CDA on 17 Aug 2010 when Roger posted “Who is in front of the reporting season avalanche?”

I have made similar decisions Joab. I didn’t buy FGE and MCE the first time I heard Roger speak of them. I now own them, but only after I came to my own decision about them. There are many others that Roger has mentioned that I have approached e.g. Decmil.

And Roger – Great post. I believe there are many who are blindly following others. Like Joab I decided against CDA. I may not make quick profits, but I hope I have learnt some of your lessons so that I can develop a long term wealth strategy. Keep up the great work and again many thanks for bringing this community together.

If you buy shares in businesses that are mentioned by Roger without thinking about how they fit in with your investment strategy or having insight about the business via research, you haven’t taken away the true gift from Roger as provided by value.able.

Well said and very timely.

Roger,

What do u care. If people are dumb enough to rush in and pump the price up of stocks u own, than let them do it! At the end of the day u will benefit from it.

I know it’s not what u r trying to teach, but that is the nature of human beings… GREED!

The real valuable graduates on this blog, listen to ur insights, go do their OWN research, and then decide whether they wish to own a business based on the IV they come up with etc.

keep up the great work.

Thanks for the encouraging words Ron. Good night all.

Ron,

I do not think dumb people following Roger advice. When I bought his book back in August last year, I did not beleive his IV calculation method, I thought his recommedation of all the A1, A2, etc… are all bluff like other share recommendation that I had with other share guru that I subscribed in the past. However, I still give it a try by making an exel spreadsheet that calculated the IV of all the 25 companies ( A1 to C5) that he recommended, and in one of the column contains the current share price at that time. And you know what ,most of them gone over 100%, even a very very low volumn traded share like LYL ( a few thousand share per day), or the one STU (hanging around 50c for a while prior a take over offer pushed it all the way to 90c). I missed out FGE at below $3 and MCE at below $4, because I did not trust him at that time. Luckily, I gave it a try and observed, finally I get it FGE at $3.90 and MCE at $4.87 with a very very large holding; trades many time but the amount of holding remains the same till now. I missed ACR, LYL and STU due to its low volumn trading. I have made heap since, whatever Roger recommeded I ‘ll buy it because I know I ‘ll never lose. This Roger is amazing, LYL share price is my eye opener, I don’t know how its SP keep going up north with a few thousand shares trading every days like this. So they are not dumb Ron, dumb people cannot make money.

Hi Henry,

I am delighted you have done so well. No investor _ I am referring now to me – will ever get them all right. If you put someone on a pedestal, they will eventually let you down. Best to treat me with the same skepticism as that which I am sure you apply to other experts. I have no special genius that can completely mitigate the risk of loss. I live in constant expectation of something going wrong. Please be careful and do your own research.

Hi Roger,

The only thing I know is that I do not lose sleep by buying the shares that are on your list over the middle east turmoil or Japan earth quake. I even use those events as an opportunity to accumulate more. While others are panic selling, I am buying with a smile on my face. This was never happen to me since I get to know stock market in 2001, and was beaten black and blue by it since then. If I knew you a bit earlier, I would be retired by now. Thank very much Roger, I ‘ll let you know when I make my 1st mil.

Henry,

What I meant is that if u blindly follow Roger and buy anything he mentions without doing ur own research, than u missed out on what he is trying to teach u!

But I do agree that it’s been a very profitable strategy doing just that in the last 6momths!! ;-)

Maybe Roger won’t b so generous going forward…. Than what will u do??????

Good luck!

hi Roger,

i just wanted to take the chance and thank you for the enormous contribution you have made to my investment skills over the last 9 months.

your book has helped me refine my investment techniques and think in a more clear and consistent approach when valuing companies.

in addition, your insights and blog has helped me discover new companies to research and i have made a lot of money in doing so.

i thank you again and looking forward to your future valuable thoughts and insights.

cheers Ron.

Always a pleasure Ron. Its pleasing to read your comment ‘to research’. All the best.

Am wondering if anyone has looked at Delta sbd-DSB as a recently listed small cap.

DSB is a coal mining service co which to me looks value and wondering what IV others get.

with 10% ROE i wouldn’t touch it unless it was trading with 50% discount to book value.

Hi Dave,

I’ve just taken a very quick look.

ROE is only just over 10%, which isn’t spectacular. With a 10% RR (and many would want higher RR for such a company) the multiplier is only 1 * Equity. On that 10% RR basis, I got IV of about $0.99 (2010) rising to about $1.07 (2011).

This is assuming 99c equity/share at listing, growing to $1.07 (assuming a 2011 profit of about $5M and payout ratio of 30%).

With IV not rising particularly quickly, ROE not fantastic and discount not great, I will pass on this one and keep looking.

Roger,

You are right about time being at a premium on Switzer. I don’t understand why he gets experts such as yourself on, then proceeds to interrupt them when they are giving information. If only he would realise that his show would be watched by even more people if he asked the initial question, then remained silent until the guest has answered!

I only watch the show when you are on for this reason and even then I grind my teeth at his constant chatter.

Thanks for sharing your expertise on TV and on the blog.

jeff

Hi Jeff,

Firstly, I am not the leader of the Peter Switzer Fan Club but to be fair to Peter he is just trying to ensure that his audience understands what is being said by the expert he is interviewing.

My mind is drawn back to the words that Denziel Washington used In the movie Philladelphia

“Explain that to me like I am a 12 Y.O.”

Peter is just doing this and I think he is actually good at it despite yours mine and others irritations

Roger please assist:-

required Return is established by :-

Risk Free Rate Plus Inflation divided by (1 minus your tax rate)

eg (6% + 3.5%) / .(1 – 0.3) = 14%

You quote ” Investing through a family company, my after tax performance is 10%”

My Question is:-

As I am over 60, and everything is tax free should I ignore the tax part of the calculatio to get back to the 10%?

Re MLD. Patersons stockbrokers have 2012 NP forcast of 38.2m. eps of 25.4c and POR of 35.4%. For 2013 they forcast NP 46.1m. eps of 30.8 and POR of 39%. I hope they are right. I was going to sell the lot then changed my mind to selling half. Since reading this report I have decided to keep them all. On their forcasts I have IV around $3.80 for 2012 on RR of 14%. But that is going totally by their forcasts and ROE on begining equity. I`m far from an expert but it`s enough for me to keep them at the moment.

hi Ken,

it seems to me u r suffering from the case of the ‘when to sell blues’.

to clarify the way u make decisions u should go back and read rogers chapter on the subject.

in addition u need to go back and think why u bought this stock in the first place.

if it was for a short term trading profit, than the decision is easy – SELL!

if its because it was cheap, ticked all the boxes and had bright prospects with rising IV, than the decision is easy – HOLD until something changes or very expensive.

on a side note, go back to my comment i made about this dilemma. u may decide to sell some shares and therefore if share price goes up u win and if share price goes down u win! (and may buy some more)

hope this helps. no advice.

Thanks Ron I`m all over the shop with this one. Because I have 10% of my portfolio in them and they have no competetive advantage it`s good to remember the win win situation. Thanks a lot for reminding me.

Have a look @ STX, ONT, GCS, CDD & RKN

Hi Simon,

I agree re: ONT.

I think it’s a great business, with a great MD who behaves very much like an owner (which he is). The share register has been very tightly held over a number of years, but he has managed to consistently grow EPS at a very good clip. ROE is consistently strong in the 30%-40% range. I don’t think there’s much in the way of MOS at the moment but it’s a company with a great track record.

Disclaimer: I own ONT shares.

On Codan, I find it hard to go past their high debt to equity ratio and so will let that one pass by. The fact they had to increase borrowings to pay their tax bill wasn’t a great look from my perspective.

GCS looks like it has some potential.

RE: ONT

Keep an eye out for the proposed “Denticare” (ie dental form of medicare) scheme which may impact on private dental companies…

Hi Roger and group,

I’m very interested in how Roger has come up with an ROE of 14% for TSM. Obviously I’m missing something very important because my calculation was higher by a concerning amount. Am I missing an important financial note in the statement?

This company raised a significant amount of money near end of their FY so using ending equity would grossly underestimated their ROE, yet 14% is even below the basic ending equity ROE calculation.

Hi Josh,

Don’t know how Roger came up with his ROE but I’m using with an ROE of 22.5% to arrive at an estimated 2011 IV of $0.82 based on the following additional variables.

EQPS – 0.33c

POR – 50%

RR – 12%

Hope this info is of some help to you.

Mully

Hi Roger,

I submitted a post with a few small caps that I like and it has not appeared.

Should I repost this or is it being witheld pending further investigation?

Hi Ash,

Whenever I haven’t posted up a comments it is because 1) its defamatory or judgmental, 2) The writer has subsequently asked me to remove it, 3) Or I have been away and haven’t got around to it. The final possibility is that our technology is not perfect and I cannot see it. If it still hasn’t popped up, go ahead. I would warn you that if you are going to start putting up anything resembling a newsletter or regular list of stocks, it may have to go up elsewhere, with its own AFSL etc…

Hi Roger,

Thanks it has now appeared,

Pretty sure that a newsletter from me wont be very well subscribed to so I wont have to worry about that AFSL

Keep up the good work

Hi Ash, I don’t see it, what do you like? :)

Ash, Where is it? What date? Or could you post it again. I can`t find it. We would all be very interested. Anything that goes on this site is worth investigating even though it is just someones opinion and none of us are experts or qualified to advise. I reckon I would have some of them in my portfolio as I have no so called blue chips at the moment. A friend of mine knows someone who is high up in VOC and he said next year will be the big decider of how they will go in the near future. He said 2012 is the make or break year. He said margins are being squezzed by Telstra at the moment but it`s not affecting them too much. He didn`t say why next year is the make or break year. I`ll have to ask him next time I talk to him. He suggested I should buy VOC a fair while ago when they were about 40 cents I think but I didn`t buy them then unfortunately. They owe me $1.55 at the moment.

Ash, always interested in your valuable comments

hi roger,

can i make a suggestion to add a search feature where you can search the blog by user. this way if we want to see what someone said on the blog previously or refer to one of our previous comments, its possible to find it.

currently i feel its near impossible to refer to my previous posts or anyone else, as who knows on which post we made them.

hope your IT team can do something about it.

cheers.

Thats a good idea Ron,

I have pit it on the to-do list. Stay tuned.

Searching Roger’s site with google allows deep and specific results.

For example if you want to see all of Ron’s comments put the following into a google search.

ron shamgar site:http://rogermontgomery.com

Then depending on your browser use the “find on page” to find each comment.

Thanks for the tip Luke. Works well on my browser.

Mully

Roger. if interested, you could include a google search on your blog. It would then allow us to search all text on your site including company codes, people’s names – any text at all. It is quick and easy and free.

It would give the same results as my example.

You can default it to search your site only. It would possibly display some adds although you get some control as to types of ads. Who knows you might retire on the click through commissions.

By the way if you want to search for a company put this into google.

mce site:http://rogermontgomery.com

or

matrix site:http://rogermontgomery.com

I’ll let my team know LukeW. Thank you. Not too sure about displaying ads…

Luke you’re a gem. I’ve been struggling with the same problem. The web page search only searches Roger’s articles and not the comments.

Cheers and thanks

Rob

Hi All,

I notice that Warren Buffett is regularly misquoted or quoted way out of context. I think this article clears up any suggestion that he owns, or is interested in owning Apple. Lets be mindful of this and not misquote or misinterpret him in our posts on Roger’s blog.

Source Bloomberg

“Warren Buffett said he’ll probably prolong his aversion to electronics makers such as Apple Inc. (AAPL) because their business prospects are harder to predict than companies such as Coca-Cola Co. (KO)

“We held very few in the past and we’re likely to hold very few in the future,” the billionaire chairman of Berkshire Hathaway Inc. (BRK/A) said in Daegu, South Korea, today, referring to electronics makers. Coca-Cola, based in Atlanta, is “very easy for me to come to a conclusion as to what it will look like economically in five or 10 years, and it’s not easy for me to come to a conclusion about Apple,” he said. ”

“Even though Apple may have the most wonderful future in the world, I’m not capable of bringing any drink to that particular party and evaluating that future,” Buffett said. “I simply look at businesses where I think I have some understanding of what they might look like in five or 10 years.”

I would add a caveat that even though Warren Buffett doesn’t invest in these type of companies it doesn’t mean that everyone should.

If you truly understand this business, its industry etc then you are able to come to make an informed investment decision. There are some people who can make informed decisions and understand what they will look like in 5-10 years time. I’m not one of them but they are out there.

What this quote says to me is the backing up of the concept “Don’t invest in things you don’t understand or can’t confidently predict the future of”.

It is exactly this reason why i have not jumped on the Matrix band wagon. No matter how much of a discount it is or how great a company it is, i am not accuratley able to predict what the future will be for this company as i can do others so i pass and will wait until i get around to learning more about it.

Hi Andrew

Misery loves company, so you can take consolation in the fact that I looked at MCE early and passed. I could see the potential, but also a lot of earnings risk and didn’t have the knowledge to be in front of the pack if things changed. Since then it seems all the earnings risk has been to the upside!

I’m sure there’s a lesson in MCE for me but I haven’t quite figured out what it is yet. I think it is to ignore opportunity costs outside my area of competence but then the sirens with their sweet songs keep luring me to this one.

Gavin,

Me too. “Regrets…I have a few…”

C’est la vie.

I also passed on Vocus at 0.65 cents in September/October last year also, choosing Zicom and FSA Group instead.

One of those looks like working out pretty well, but still….could be sitting a lot prettier at the moment.

Need to keep sharpening that blade!

in regards to gr engineering and resource development group (and all other mining services groups).

this starts to remind me the beginning of the end of a commodity boom.

i remember when the share market boom was coming to an end in 2007, a bunch of stock broking firms were rushing to list on the ASX.

we all know what happened then….

now I’m beginning to notice a rush of mining services firms are rushing for the cash registers!

I’m not saying the boom will end this year, but bubbles usually end much shorter than what everyone else thinks!

be frugal and know when to take profits.

good luck!

I know what you are saying Ron – but the events and dynamics of 2007 are vastly different to what can be compared with a commodity boom. I don’t think you can draw to many parallels.

While the boom will end, and I believe we are ~2/3 our way through it, when it will end is anyone’s guess. I agree with you that the downturn is always sharp, but at the moment I do not see any good indicators to say the boom end is in the near-term.

With regards to GR Engineering, if you can get in on the float then they look like a good opportunity. I am mindful of the small number of projects they are relying on, which is a risk, and I think you mentioned this also. The company management appears to be experienced and have been involved in a number of other successful companies.

In light of my post above – Bank of Canada Governor Mark Carney has a few interesting things to say on the commodity boom. Worth a read –

http://www.businessspectator.com.au/bs.nsf/Article/WRAPUP-1-Commodity-boom-weighs-on-policy-in-Americ-FBRTE?OpenDocument&src=mp

“CALGARY – Canada says the current commodities boom could last decades and warned developing countries against being too timid with interest rate hikes, while the International Monetary Fund said that much of the Latin American economy is overheating.

Bank of Canada Governor Mark Carney told policymakers from North and South America on Saturday that they should not count on commodities prices coming down any time soon, a position likely to be much discussed at this weekend’s meeting of Western Hemisphere finance officials in snowy Calgary.

“It’s a mistake to chalk this all up to cyclical (factors),” Carney said, referring to the argument that prices for goods such as copper and grains have risen only because of an upswing in the global business cycle.

“We’re in an environment that is probably going to be with us for several decades,” he said during a panel discussion at the Inter-American Development Bank’s annual meeting.

Across Latin America, inflation is accelerating on both strong consumer demand and because a soaring commodities market has pushed food prices higher.

Indeed, the head of the International Monetary Fund warned that many Latin American economies, which have rebounded from the global financial crisis with help from strong demand for their commodities exports, are now growing too quickly.

“In many of them there are worrisome signs of overheating,” IMF Managing Director Dominique Strauss-Kahn said in a blog, adding that growth in the region’s financial markets put Latin America at greater risk of credit bubbles.

Strauss-Kahn said he discussed the region’s policy challenges earlier in the day in Calgary with Western Hemisphere finance ministers, who held meetings in parallel with the IDB meeting.

Some Latin American policymakers have argued that the food-price boom will pass and that focus should be put on whether the temporary price shock will poison inflation expectations.

But Carney said in a speech on Saturday that the outlook for underlying demand is strong because of the rapid development of emerging markets.

He warned that misguided policies in emerging markets for dealing with high inflation and a flood of capital could lead to financial instability and weak global economic growth.

“That’s where one can make pretty big mistakes and delay too much, both on the monetary side, or on the pretty fundamental structural reforms,” he said.

As the world recovers from recession, nations have clashed over foreign exchange policy as many countries adjust to ultra-low US interest rates and China’s reluctance to let the yuan appreciate more freely. Investors seeking high yields have put their money into Latin America, exacerbating these tensions.

Referring to what Brazil’s finance minister dubbed the “currency wars,” Carney said that when large economies keep their currencies from appreciating, others feel pressured to follow suit. This leads to a chain reaction of other distortional policies.

“The collective impact of this behaviour risks inflation and asset bubbles in emerging economies and, over time, subpar global growth,” he said.

This boom is different

Carney sees the current high commodity prices persisting for much longer than in past boom cycles because of the rapid urbanisation and mushrooming middle classes in emerging economies such as China and India.

“Even though history teaches that all booms are finite, this one could go on for some time,” he said.

The other thing that is different about this commodity boom – and which could lead to dangerous global imbalances – is that the strong demand from emerging markets is combined with tepid growth in core advanced economies such as the United States.

This shift to a “multipolar economy” is permanent and should not be underestimated, Carney said.

“Some countries are postponing monetary tightening in the hope that old relationships reassert.” Others have introduced measures to curb capital inflows. “All appear to be underestimating the scale of what is happening. Therein lies the risk of another crisis,” he said.”

hi Robert,

thanks for your comments and link.

but from my memory i don’t remember any reserve bank board ever predicting a bubble and certainly not when it will end!

remember that in the long term commodities revert back to the marginal cost of production.

also it will never feel like the end of any bubble as if it did, it would be too late.

again im not predicting anything but im just noticing a trend with these recent rush of listings.

i share ur thoughts about GR engineering and would love to pickup shares at a dollar.

cheers.

Nice post Robert,

Jim Roger thinks if you want to be rich in the future then become a farmer,

I hope so because we service lots of farmers

The commodity boom is set to continue for as long as governments print money and “stimulate” the economy. This rise of Asia is also not going to stop in a hurry. I think this commodity boom still have plenty of legs in it. Still, I agree it pays to be vigilant and not too carried away.

Medusa Mining (MML) was recommended to me and sounds promising:

Code: MML

Price: 7.21

INPUT:

……….. EqPS .. Shares … DPS … EPS … RR