Catch the ups – not the downs

Who wouldn’t want to see their investment go up with everyone else, but not down when everyone was?

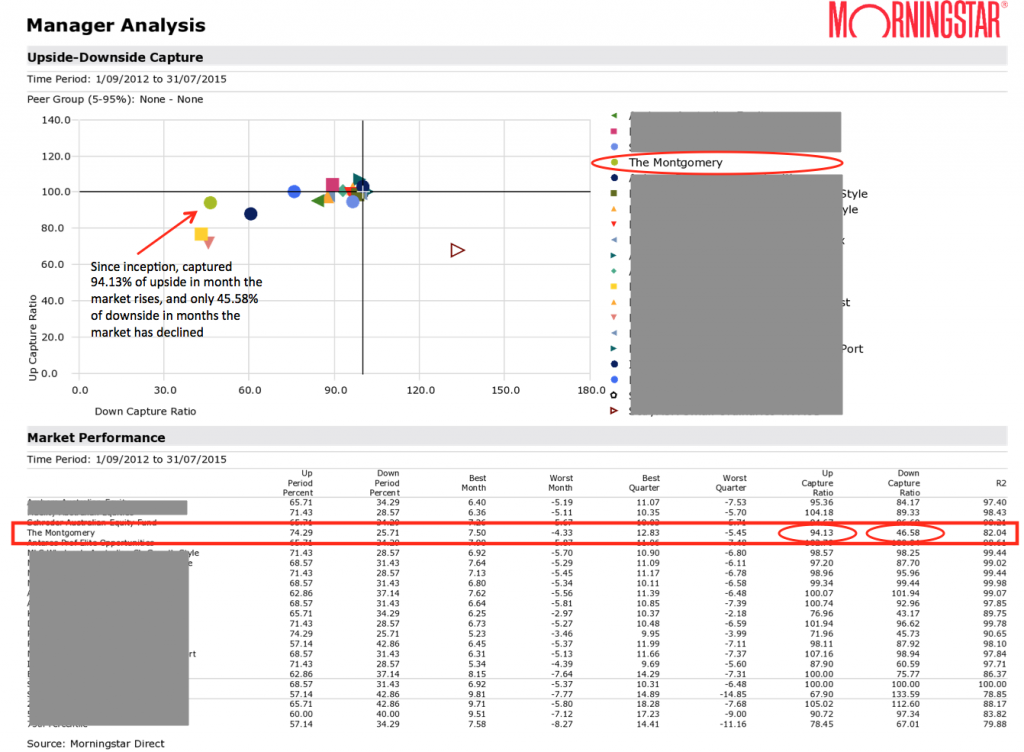

The Upside/Downside Capture chart reveals the ability of The Montgomery Fund, since inception, to shepherd investors through months that have been negative for the broader market.

The vertical black line intersecting the horizontal axis at 100 per cent reveals the market’s natural and expected predisposition to capturing 100 per cent of the downside movement in any month that generated a negative return, since inception. If the market falls in a month, obviously the market index will capture 100 per cent of that movement.

The vertical black line intersecting the horizontal axis at 100 per cent reveals the market’s natural and expected predisposition to capturing 100 per cent of the downside movement in any month that generated a negative return, since inception. If the market falls in a month, obviously the market index will capture 100 per cent of that movement.

Similarly, the black line intersecting the vertical axis at 100 per cent reveals the market’s predisposition to capturing 100 per cent of the upside movement in any month that generated a positive return.

In all the months since its inception, The Montgomery Fund has captured 94.13 per cent of the upside movement during months where the index recorded a positive return. Importantly however, investors have enjoyed the benefits of the fund capturing an average of only 46.58 per cent (less than half) of the downside movement in any month that the index recorded a negative return.

This is a very desirable outcome and while there is no guarantee that this return profile will be repeated in the future, it remains a testament to the advantages and benefits of the particular brand of value investing that Montgomery Investment Management applies across its funds.

This blog is an extract from a forthcoming Whitepaper that will be available to subscribers only. To register to become a blog subscriber and gain access to locked content Click Here.

hi Roger, congrats on performance.

could not the downside be reduced even more by allowing higher cash levels in the Montgomery fund ?

why limit it to maximum 30%, why not 50 or 100% ?

that would be invaluable in a major market meltdown such as the GFC or the 1987 crash. eventually another such event will occur, and the massive losses incurred can devastate people’s money for a long time.

Hi Carlos, 30% is a ‘soft’ target. We believe that every six years or so, there will be cause to raise the cash level higher and we have the ability to go to 50% as you suggest.