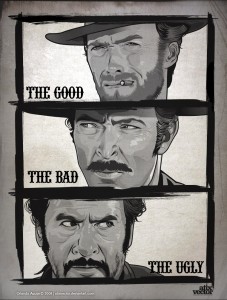

The Good, The Bad and the Ugly

Both Breville Group (BRG) and Flexigroup (FXL) saw solid gains yesterday.

Breville’s share price hit new highs in terms of price (not that we’re looking of course) in anticipation of a solid result. EBITDA was previously forecast to be in the range of $65 to $67 million but not long ago the company upgraded guidance to $71 to $72 million. Investors who are focusing on depressed local retailing and consumption need to have a look at the US retailing index which is up more than 275% since the March 2009 lows. More than half the company’s revenues now come from outside Australia, with roughly a third coming from North America, and growing despite the weak US economy.

FLEXIGROUP (FXL)

Two days ago, Flexigroup announced that it had successfully priced AUD255m of asset-backed securities, supported by a pool of Australian unsecured, retail, “no interest ever” payment plans, originated by Certegy Ezi-Pay Pty Ltd (“Certegy”), a wholly owned subsidiary of FlexiGroup Limited.

This securitisation of Certegy receivables is part of FlexiGroup’s strategy to diversifying its funding sources by regularly accessing wholesale capital markets. The term securitisation is FlexiGroup’s third and its also the second rated by Moody’s.

According to Spencer Wilson, Associate Director in Fitch’s Structured Finance team, “A valuable tool in Certegy’s underwriting strategy is its access to large volumes of historical data, which is then used to identify key risks across product types, demographics and borrower types,” adding “This transaction follows on from the Flexi 2011-1 deal, with notable features being the short weighted average life of the receivables, small contract size and significant levels of excess that are available to offset potential losses”.

FAIRFAX (FXJ)

Fairfax’s decision at the end of June to cut 1900 jobs – almost one-fifth of total staff – and $235 million in costs over the next three years and switching the printed formats of The Sydney Morning Herald and The Age from broadsheet to compact in March as well as introducing digital subscriptions for these two mastheads early next year suggests to me we will see the company write down the value of its mastheads.

Mothballing the printing presses at Chullora in Sydney and Tullamarine in Melbourne in two years, also suggests a writedown has to be in the offing.

So don’t be surprised.

LEIGHTON (LEI)

For a man who fancies exotic sport cars, Leighton’s CEO Hamish Tyrwhitt was reported by the AFR as being unusually subdued at yesterday’s results announcement.

For investor’s, his comment about Airport Link opening ahead of its (revised) schedule as being “an incredible achievement” needs to be remembered. Why? Well, in my opinion, Airport Link it could go broke and I believe Leightons’ are on the hook for a $200 million deferred capital contribution. I mentioned this a year ago and the recent revelation that Brisbane’s $4.1 billion Airport Link has attracted 77,320 vehicles a day on average in its first week of operation – well below its initial 135,000 target – despite being toll free, is a concern.

Perhaps that’s why the CEO was reported as peppering his discussion of the contractor’s future upon their results announcement with words such as “cautious” and “sustainable.”

More conventionally we remain concerned about Leighton’s debt levels and our understanding that Leightons Al Habtoor business continues to suffer from poor receivables collections. We understand (but remaining willing to stand corrected) that the company, by way of example, has not been paid for the Al‑Shaqab‑Equestrian‑Arena in Qatar (see pic).

Andrew Legget

:

Can’t comment on any particular case but some (particularly super funds i think) are mandated to play in a particular pool so there for they are limited to what is in that pool and it can be quite shallow. They aren’t allowed to swim past for example the ASX 100 mark.

But the question as to why people would buy QAN and FXJ is a good question. In FXJ’s instance, i think certain big buyers are more interested in some potential non-monetary benefits that can come with owning a large media business. Newspapers doesn’t offer a compelling business case for a profitable future so at least they may get some benefits out of it.

QAN, well i recently flew Etihad and as long as there are airlines like that around, i really can’t see the International arm of Qantas at least being able to put up much of a fight in the competitive landscape.

A good little test you can do to check the competitiveness of Qantas is just go into Webjet (a good company) and check out the airfares. Searching for a hypothetical flight to take me from Sydney to Paris i can see the following:

Qantas ticket price $2527 with two stopovers ($3000 with one)

Etihad ticket price $2344 with one stop over

Emirates ticket price $2454 with one stop over

Air France ticket price $2323 with one stop over.

I know this isn’t a fixed price so is not 100% accurate and i can also see some prices for emirates on flights starting at $6000 but if you were going to fly to Paris and had to use one of the above, which one would you use. Especially when you consider the great reputations the middle eastern airlines have for service (and the fact you get you use real knives and forks for dinner).

Just some food for thought.

Andrew Legget

:

Sorry, this was meant to be a reply to Mark.

Mark Abfalter

:

Stupid question No. 1 – why have the large ‘growth style’ fund managers been buying QAN & FXJ over the last 12 months?

Andrew Legget

:

My reply is listed above Mark, but i agree.

As an individual investor it is easier as we can pick and choose our criteria and don’t have to be mandadted to a particular industry/type/index etc.

A quote i have adapted from a former english premier league coach and use as a reminder to focus on quality businesses and not chase returns if it means investing in non-quality businesses is:

“If the share market was made up completely of airline companies, and it was at the bottom of my garden I would pull the curtains.”