The magic of being publically listed

We’ve been looking into the Medibank Private IPO (apologies readers, I won’t be giving out any hints as to our intentions) and noted a small but quite interesting detail. As the firm lists, its management will be receiving a generous increase in their pay packets.

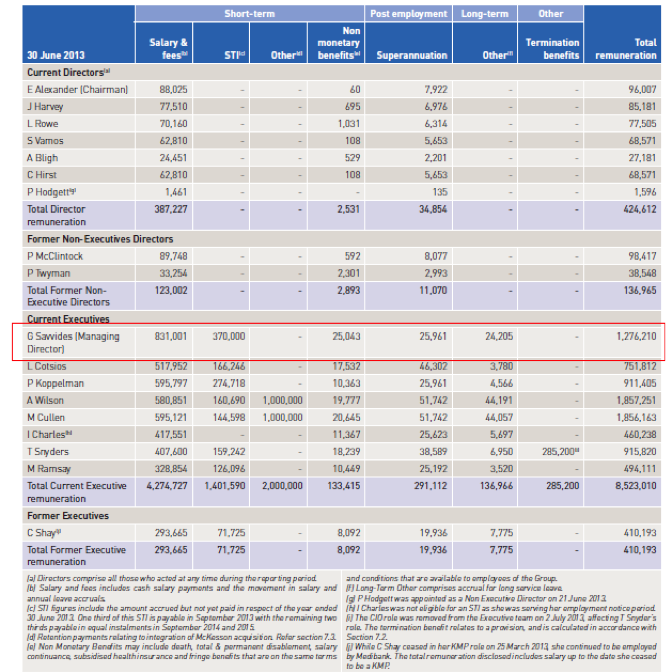

Take, for example, their Managing Director George Savvides. On an annualised basis, his remuneration packet could reach approximately $4 million in FY15, up from $1.3 million in prior years (this includes a $750K listing bonus). I’ve taken a quick screenshot from their FY13 report (which you can download for yourself here).

It makes sense that management should be paid more for good performance; however, in this case it appears that the increase has been granted for… well, somewhat soft reasons.

One reason that’s been noted in SMH (which you can read here) is that the management would face more scrutiny and would have to deal with a lot more shareholders. Fine, but it appears difficult to stretch the value of this extra service to be comparable to such a large raise.

Let’s just hope that shareholders see a similar increase in the value of their shareholdings….

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Having looked at a list of ‘Pros & Cons’ re this IPO in this morning’s AFR (29th Oct), I’ve chaned my mind about taking up some shares initially – and it was #10 in the ‘Cons’ – the IT project risk.

In reviewing the details about this in the prospectus, you’d have to say I think that it’s shameful that for such a potentially big risk, the details provided are so scant e.g. we have no clue as to how this is progressing i.e. 2 years into a 10 year project or what – and no idea as to how it is running to budget.

What we do know is that ‘Project Delphi’ is a very large IT project, and we also know that the contractors, IBM & SAP have some significant project failures in their history.

I believe they were the contractors involved with the Qld Health IT debacle and I saw one estimate that this could cost a $BILLION before it’s rectified – so if any sort of ‘pearshapiness’ like that hit Delphi, it would likely result in a nasty impact on the share price. And these IT debacles, when they happen, can take a looooong time to finally resolve.

I’ve decided to sit on the sidelines for a while, and with a degree of schadenfreude will watch those Announcements come into the ASX on the IT Delphi project progess.

I think the process where you throw money into a bookbuild to find out the price is the bit that is difficult to stomach

In that case, you have to be willing to accept the final price and your valuation needs to be above the top end of the range.

It is an interesting comment that gov depts don’t need to face scrutiny,

I was wondering what the health of Sigma was when George left and his track record at Medibank?

Google seems to be blind to questions on this one.