Investing in the age of transformation

Over the past two years, the evolution of the pandemic has been the leading force dictating the path of the global recovery. Despite the many challenges still present, Polen Capital believe that several secular trends that were already in motion before COVID-19 will continue to shape the world around us and play an important role in defining tomorrow’s leading businesses. In this whitepaper, Polen Capital look at what they view as some of the most important secular growth themes that may reshape the world over the next decade.

As long-term equity investors, Polen Capital believe that identifying these transformational trends – and the companies harnessing their power – is critical to generating sustainable positive equity market returns. This means looking at a horizon of years instead of just focusing on what could happen over the next week, month, or quarter.

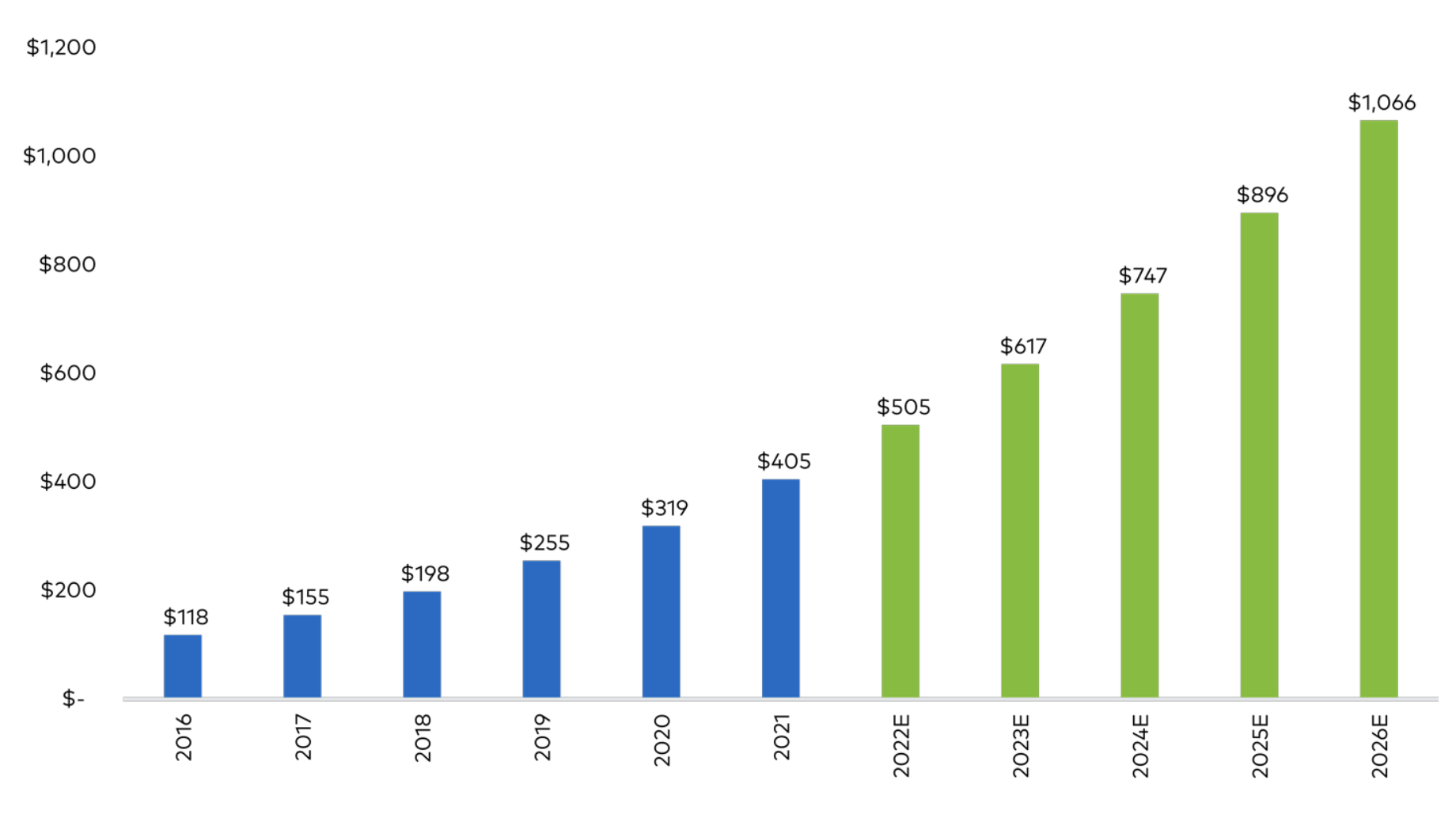

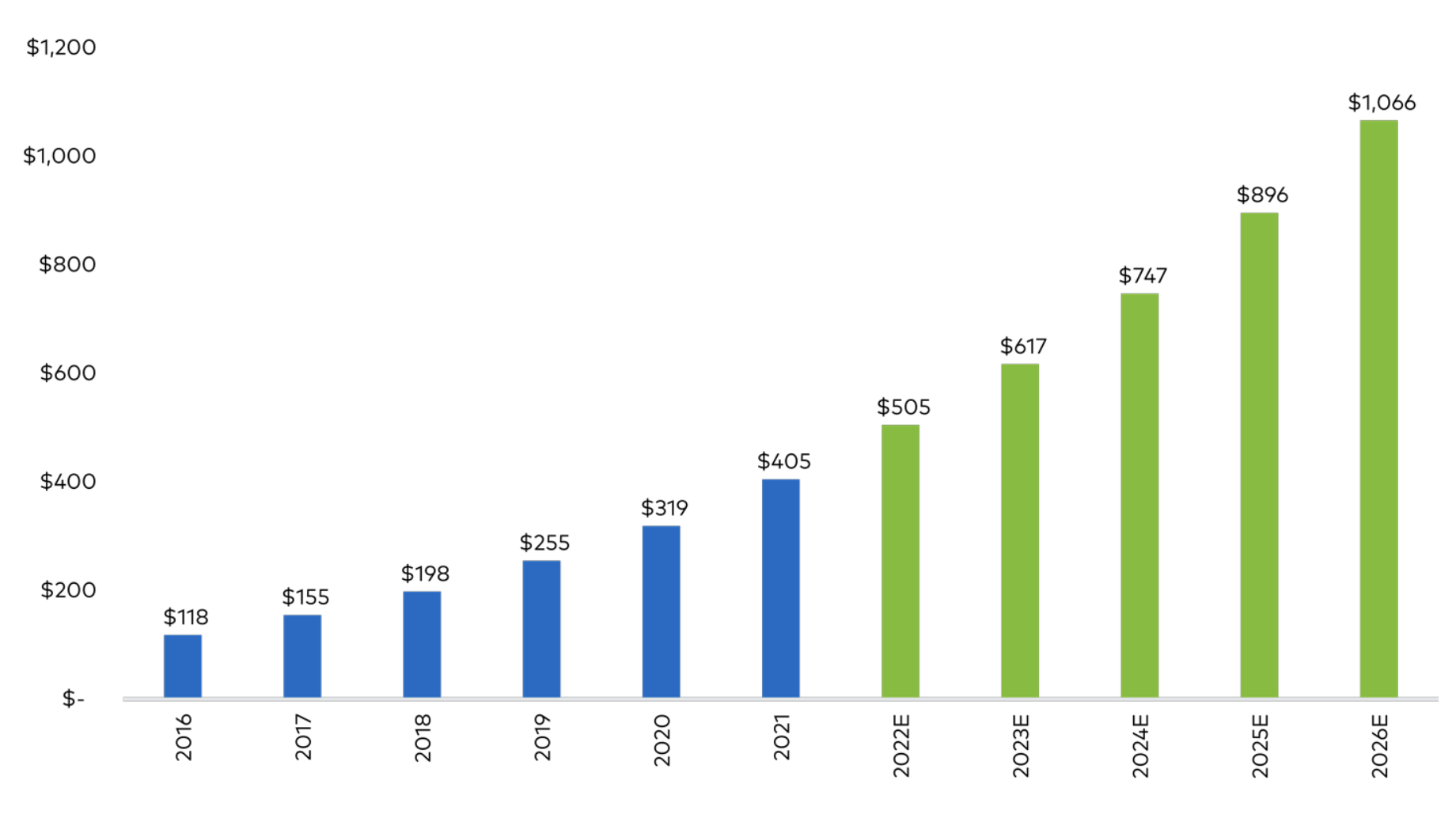

This paper aims to look beyond the short term and shed light on some of the megatrends Polen Capital think could define global economies and markets over the next decade. For example, we will look at the market for public cloud, which Bloomberg estimates may reach $1.1 trillion by 2026 in the U.S. alone.

Download the whitepaper

Total Cloud Market Spending Forecast ($ Billions)

Source: IDC, Bloomberg Intelligence. As of May 2022

MORE BY PolenINVEST WITH MONTGOMERY

Established in 1979, Polen Capital is a high conviction growth investment manager with offices in the US and UK. Polen has been dedicated to serving investors by providing concentrated portfolios of the highest-quality companies for more than three decades. The firm’s established team manages US$71 billion in total assets and their longest-running flagship investment strategy has delivered on average double digit annual returns for more than 30 years.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

I am a little bit sick of hearing about the work-from-home brigade. Tell me how this works for construction workers, electricians, plumbers, home builders, doctors, nurses, landscapers, farmers, “garbologists”, etc.? The world is not all about desk jockeys! I get that new trends, as highlighted in your whitepaper, are continuing to develop. But never forget that so-called old-style businesses with associated workers will always be necessary. The world hasn’t fundamentally changed in that respect, i.e., if you don’t have these businesses, you can forget about any of these new trends because they’ll be useless and redundant. The world cannot function on computing power alone.

More to the point, I think what your whitepaper and other articles are driving at is that as an investor the big gains are likely to come from the new trends, rather than old-style businesses. I think this should be highlighted a bit more to give a more balanced view.

Wes.

The other point Wes, is that while it’s the desk jockeys working from home, it has nevertheless been a significant shift and it’s effects are measurable.