Are you considering the downside risk?

It’s common knowledge that for a well-diversified portfolio of “blue-chip” shares, expected returns are generally in the order of market returns less transaction costs. What might be surprising to some is how quickly said portfolio can drastically underperform if diversification is removed from the equation.

In a 2014 paper (The Agony and the Ecstasy), Michael Cembalest of JP Morgan writes:

“The data shows that two-thirds of all individual stocks underperform over their “lifetime,” as compared to the Russell 3000. On average, the outcome for individual stocks was underperformance of about 50%”. .. There are some great examples where, with 20/20 hindsight, management missed opportunities and made some mistakes. But, more often, we found that factors completely outside management control contributed to a catastrophic loss. These exogenous factors include: commodity price risks, changes in U.S. or foreign government policy on tariffs and/or trade, unconstrained expansion by competitors, and technological innovation. Even the best management team is hard-pressed to cope with these types of unforeseeable challenges.”

This is a fairly stark reading for any ‘stock-pickers’ in that if we’re looking to invest in most listed stocks, there is clear evidence that we should expect little else but underperformance of the general market over the long term.

There is of course a small group of companies that significantly outperformed the market over the studied timeframe which can be regarded as those whom stock pickers (including ourselves) are seeking to identify. We’ll leave this conversation for another article and begin a focus on the drivers of underperformance noted above. The Australian market has seen several of these issues crop up recently but we’ll begin with commodity price risk.

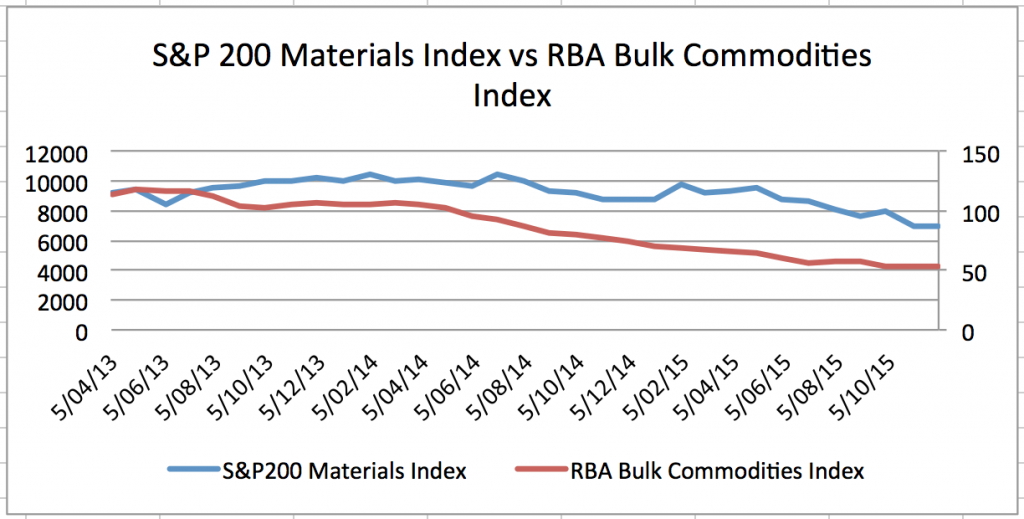

In the graph below we contrast the performance of the S&P200 Materials Index versus that of the RBA Bulk Commodities Index. Clearly, being invested in the materials sector over the past couple of years has been a less than pleasant experience.

Unsurprisingly, the two indexes are correlated. Materials company’s extract bulk commodities for sale and hence their performance is tied to the prices for each commodity that the market is willing to pay (which of course is a function of market supply and demand). When commodity prices fall, profits for materials company’s tend to do likewise.

It’s now known (and was also known back then) that demand for most bulk commodities was linked to a construction boom in China. Billions of dollars of investors capital was subsequently sunk into mining projects on the pretence that commodities prices would remain relatively stable or continue to increase based on this demand. Today, post falls of 50-80% in many of these commodities; many of projects now operate at significantly impaired economics relative to what their original budgets anticipated.

We could ask (even without the hindsight of today), was it really that implausible that the boom may have faded? Booms and busts have been a regular part of economies for thousands of years and recognition of this fact may have saved many investors the loss they have recently experienced.

Clearly what was missed was the realisation that commodity prices could vary in the future at a much greater magnitude than humans would normally expect. This variance was unfortunately to the downside.

It’s been noted recently in the market that some investors are seeking bargains in this sector, however with supply of materials increasing in the future and the outlook for demand actually declining, it’s difficult to see why commodities prices would be materially higher in the future such that these investments would pay off. Just because these asset’s ‘look’ cheap, it doesn’t mean that they necessarily are. There still appears to be considerable downside risk which likely has not been fully priced in for many resource companies.

One can say that if an investor chooses to become less diversified and ‘stock pick’ based on a weak thesis, underperformance is to be more or less expected.

There are several other downside risks worth noting in other sectors and we’ll cover them intermittently over the coming months.

Scott Shuttleworth is an analyst at Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY