Are small-cap stocks poised for a comeback?

The equity bull market has been tough for small company stocks and their investors. The current decade started out with promise. After the short, sharp pandemic bear market in 2020, small cap stocks significantly outpaced the tech-fuelled S&P 500 Index during the post-pandemic bull market ending in December 2021. This was partly because the artificial intelligence (AI)-Tech darlings hadn’t garnered the momentum and euphoria required to concentrate flows of capital and drive the media narratives that produced their immense popularity and stock-market leadership.

But that was the last time small-cap stocks beat large caps in terms of capital appreciation.

Small-cap stocks in the U.S., however, now appear to be one of the more intriguing opportunities in today’s market. Small caps are often overshadowed by their larger counterparts – particularly in this AI-driven boom – but smaller companies look as though they are undervalued, underappreciated, and ready for potential outperformance.

I list compelling valuations and improving market dynamics as just two of the reasons for small caps to outperform at least relatively.

A valuation sweet spot?

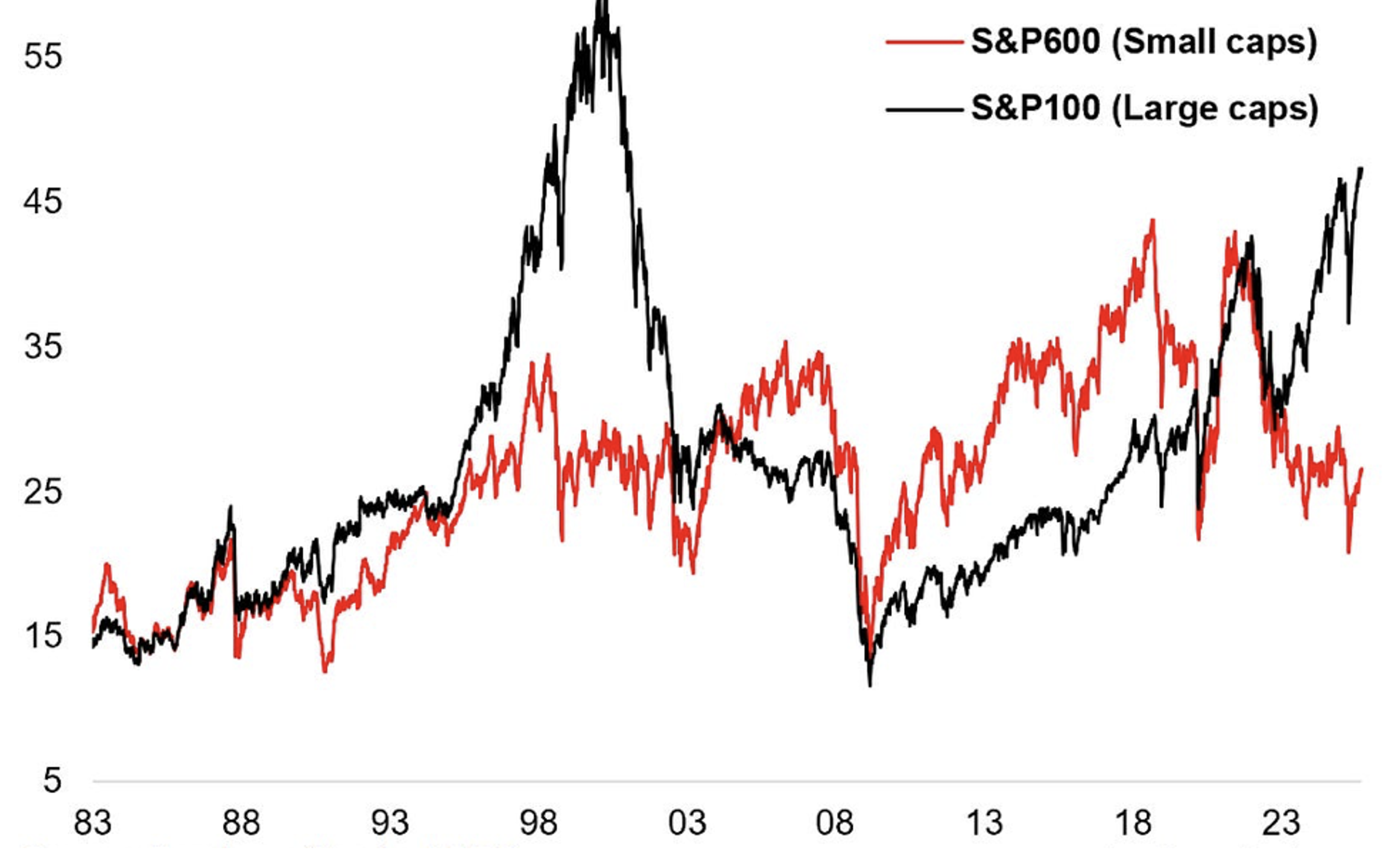

Figure 1. PE small caps versus large caps (price/10 year average earnings)

Source: London Stock Exchange Group, Topdowncharts

Source: London Stock Exchange Group, Topdowncharts

Compared to large caps, small companies have been trading at a significant discount for some time, with price to earnings (PE) ratios reminiscent of the lows seen during the 2020 Covid market trough. Small caps also look relatively cheap compared to their historic long-term averages. And when compared to bonds, U.S. small caps still offer a healthy equity risk premium, making them a relatively compelling choice for value-conscious investors.

Sentiment: A contrarian’s dream

Investor sentiment toward small caps has been cold, but that’s exactly why they’re worth investigating.

This year, small-cap equity funds have seen massive outflows, with allocations hitting historic lows. Meanwhile, futures markets show near-record short positioning, setting the stage for a potential short squeeze if sentiment shifts.

Remembering the adage to ‘be greedy when others are fearful’, it could be that there is sufficient relative negative sentiment (or just too much enthusiasm for mega caps) that the stage is set for small caps to outperform.

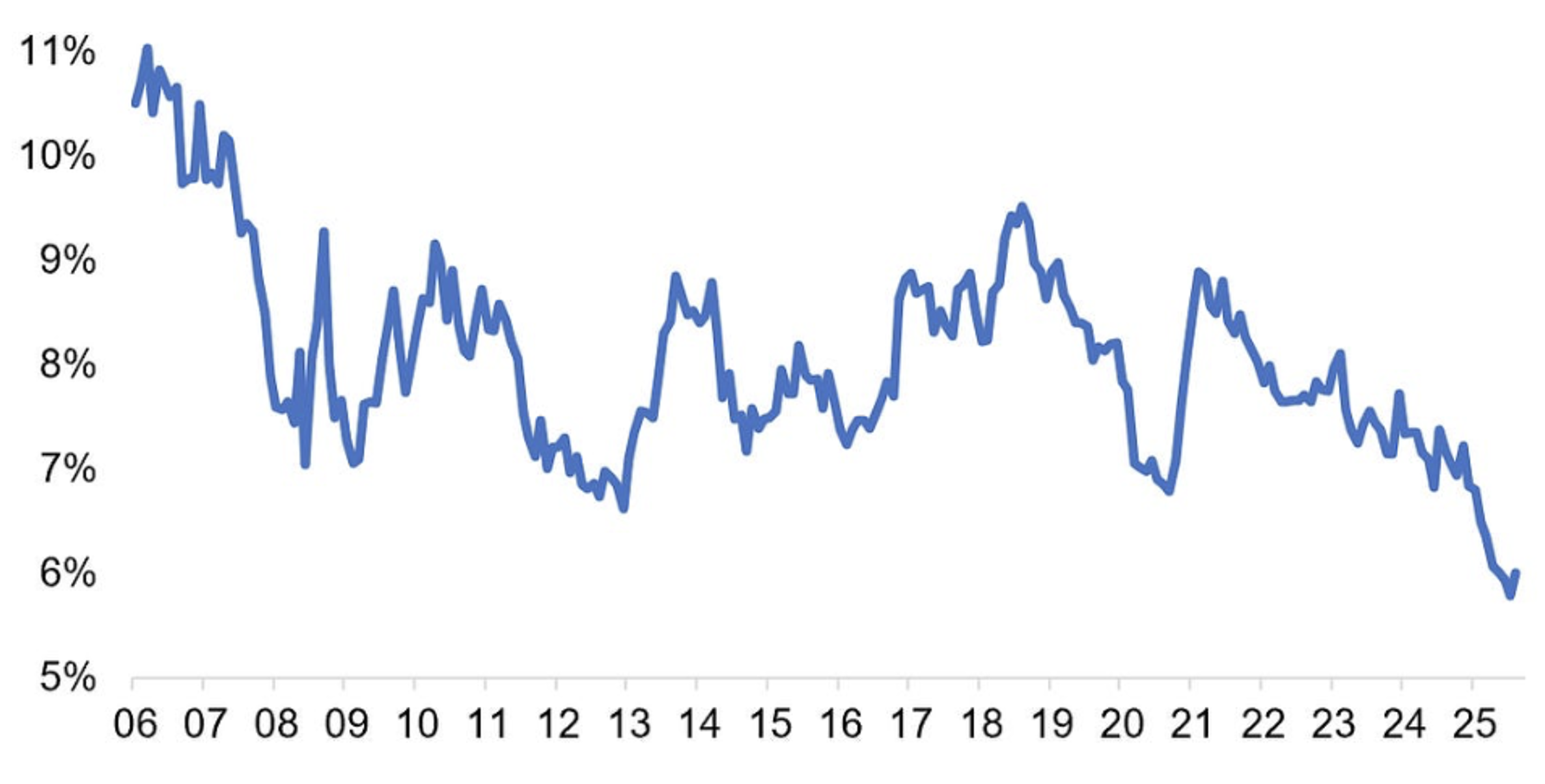

Figure 2. ETF market share: U.S. small caps

Source: London Stock Exchange Group, Investment Company Institute, Topdowncharts

Source: London Stock Exchange Group, Investment Company Institute, Topdowncharts

Figure 2., shows assets under management in small-cap exchange traded funds (ETFs) as a percentage of all U.S. domestic equity ETFs. While the low level is a function not only of flows into large-cap ETFs but also of the price performance of large caps – led by Nvidia and its peers – Figure 2., reveals small caps are nevertheless relatively ignored.

One reason could be that in a world of winner-take-all monopolistic mega-caps, small companies are unlikely to win in business. However, this thinking overlooks the potential pace of earnings growth for individual small companies that are expanding from a small base. And when it comes to big caps, let’s not forget the law of large numbers; Mega caps cannot keep growing at double-digit rates indefinitely, lest they become…well…earth.

And here’s another observation: sentiment is starting to thaw. Recent data shows a slight uptick in small-cap ETF allocations. When an asset class falls out of favour for an extended period of time, and then begins to see renewed interest, it can portend a change of trend, and in this case, a shift in sentiment towards small companies (and maybe away from Mega caps).

Macro tailwinds on the horizon

The macroeconomic environment also appears to be aligning in favour of small caps. With the Federal Reserve poised to launch a new round of interest rate cuts, small caps – often more sensitive to borrowing costs – could be ideally positioned to benefit. Lower interest rates could ease financial pressures on some of these companies, many of which rely on debt to fuel growth.

Interestingly, small caps could also thrive in a scenario where global growth picks up. Unlike large-cap indices, which are heavily weighted toward tech, small-cap indices are also packed with traditional cyclical sectors like industrials and consumer goods. These sectors tend to outperform when economic growth accelerates.

Risks

Risk inheres in all investment cases, and small caps are no exception. A U.S. recession remains a threat. A deep downturn could drag absolute returns lower across the board, including small caps. However, even in a bearish scenario, small caps might hold up better than large caps. Why? Large caps, particularly in tech and AI-driven sectors, are grappling with stretched valuations, speculative froth and even possible irrational exuberance. In a market correction, the AI high-flyers could fall harder, potentially resulting in small caps outperforming on a relative basis.

On the flip side, a short and shallow recession with aggressive rate cuts and fiscal stimulus could actually be a net positive for small caps, further boosting their appeal.

Small cap stocks are at an intriguing inflection point. They’re cheap compared to history, large caps, and bonds. They’re under-owned, with investor sentiment just beginning to shift. Macroeconomic factors are aligning, and earnings revisions appear to be turning up.

For investors willing to look beyond the hype of large-cap tech and AI, small caps offer a compelling mix of value and contrarian appeal.

Do you see the same potential for small caps in Australia?

Hi Martin, Nothing is ever guaranteed, of course, and yes, we are already seeing them outperform locally too.