A deeper dive into Australian eagle asset management part 2

Earlier in the month I began to build our readership’s knowledge of our new partner manager Australian Eagle Asset Management, focussing on their investment process and how this is now powering The Montgomery Fund going forward. In part two of this series, I will share some return and risk analytics over the team’s impressive 17-year track record which Roger touched on not long ago.

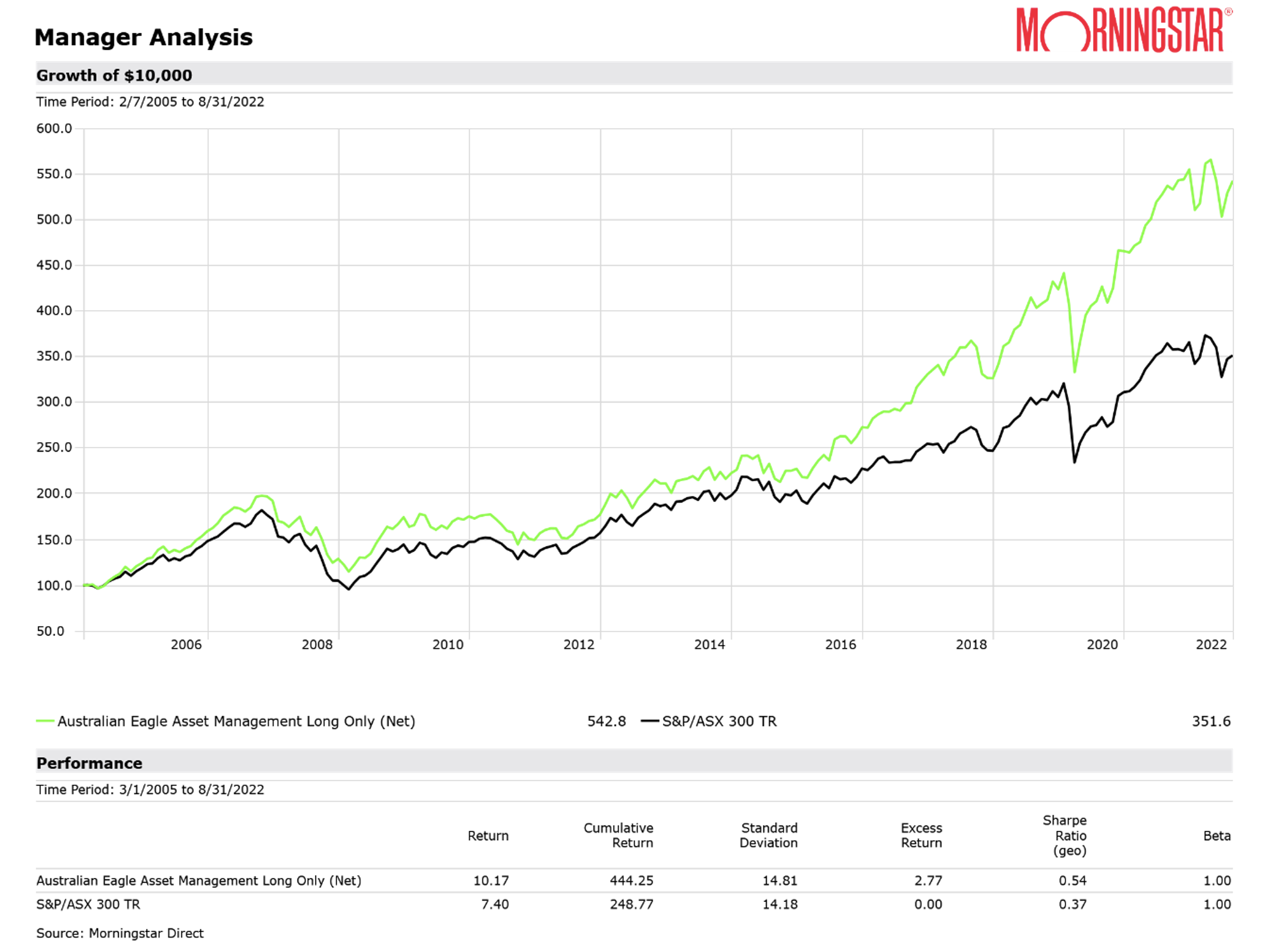

Figure 1 – Australian Eagle performance since inception

(adjusted for the fees of The Montgomery Fund):

Source: Montgomery/Australian Eagle to 31 August 2022.

Performance is based on the actual gross performance of the Australian Eagle Long-Only Equity fund managed by Australian Eagle since 7 February 2005, adjusted for fees and assumes all distributions are reinvested. Effective 12 September 2022, The Montgomery Fund invests using the identical strategy to the Australian Eagle Long-Only Equity fund and is advised by the same investment management team managing to the same investment objectives. Past performance is not a reliable indicator of future performance.

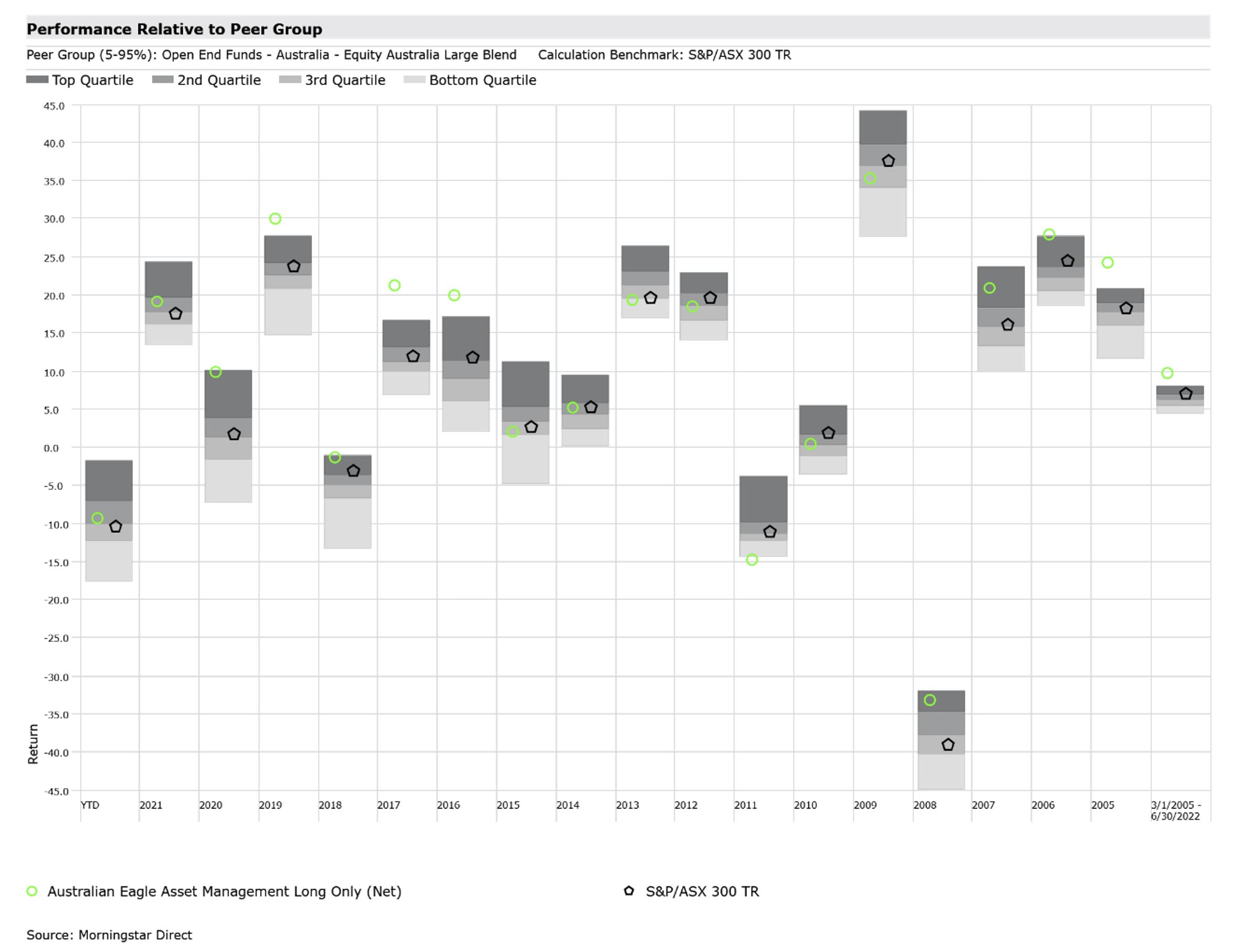

The Australian Eagle team have been running their Australian long-only equity strategy as a Separately Managed Account (SMA) since February 2005. When we look to adjust this return series for the fee load of The Montgomery Fund given this is the vehicle retail investors can now invest in, the strategy has outperformed the S&P/ASX 300 by almost three per cent per annum. What’s impressive about this outcome is the annualised outperformance since inception has been generated with very similar volatility to that of the market, resulting in a much higher sharpe ratio when compared to the S&P/ASX 300 as per the table at the bottom of Figure 1. If we look to breakdown this return series by calendar years since the strategy’s inception, we can actually see in Figure 2 below Australian Eagle have outperformed the market roughly 65 per cent of the time and are further outperforming calendar year to date despite the challenges many quality-based equity investors have faced so far.

Figure 2 – Australian Eagle performance by calendar year

(adjusted for the fees of The Montgomery Fund):

Source: Montgomery/Australian Eagle to 31 August 2022.

Performance is based on the actual gross performance of the Australian Eagle Long-Only Equity fund managed by Australian Eagle since 7 February 2005, adjusted for fees and assumes all distributions are reinvested. Effective 12 September 2022, The Montgomery Fund invests using the identical strategy to the Australian Eagle Long-Only Equity fund and is advised by the same investment management team managing to the same investment objectives. Past performance is not a reliable indicator of future performance.

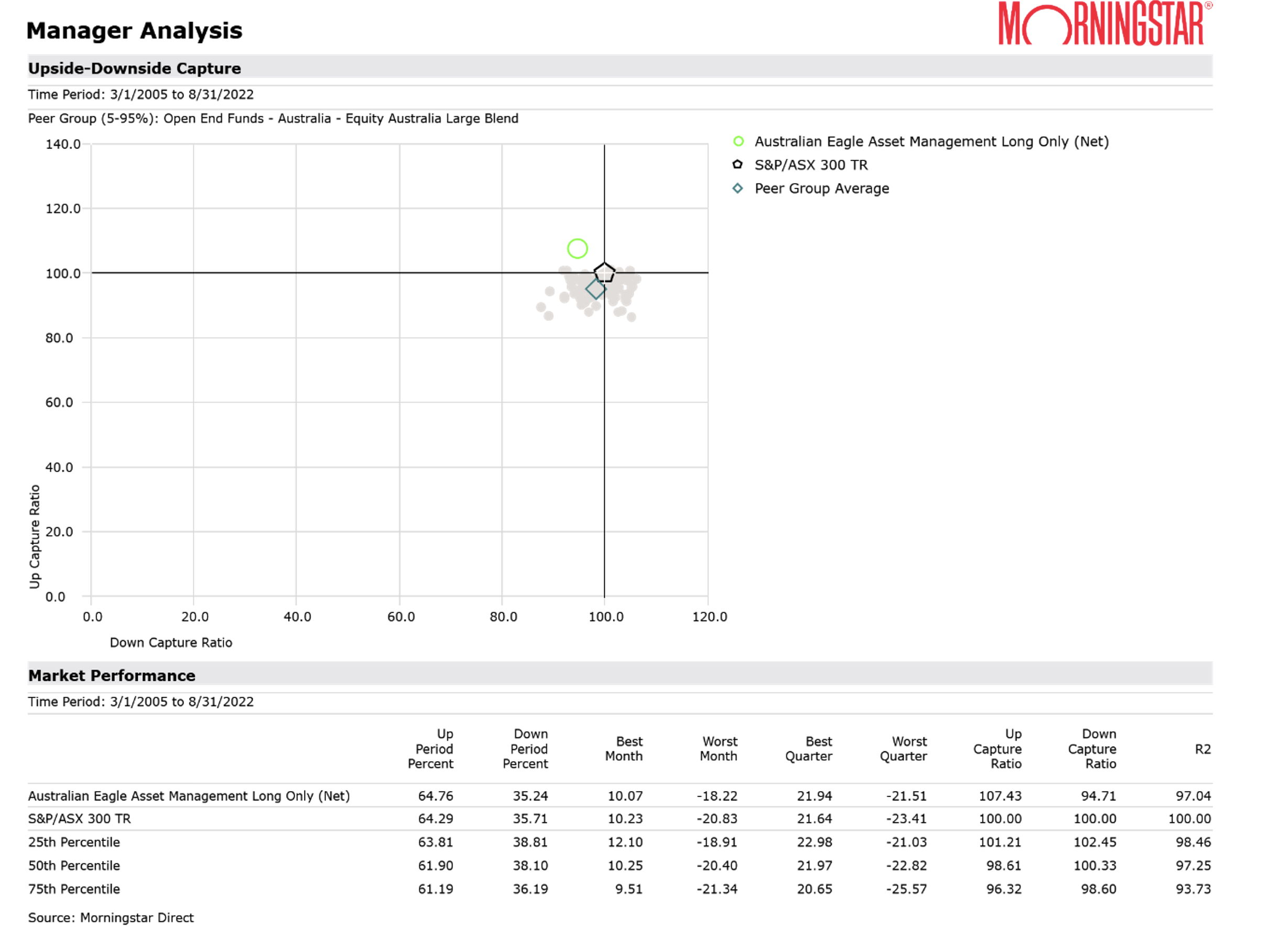

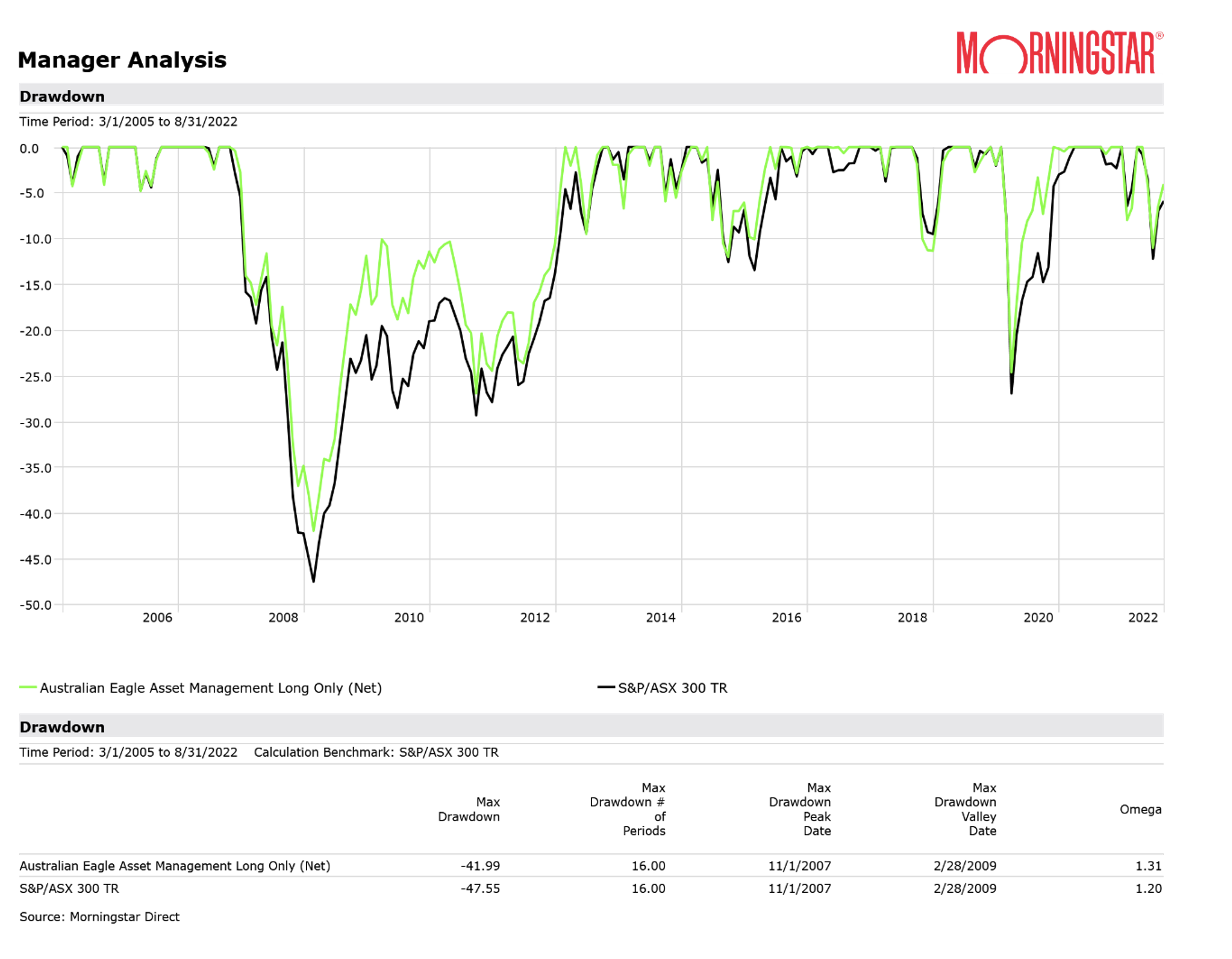

In pivoting to some more risk-oriented analysis, when we look at the strategy’s upside/downside capture a similarly favourable picture has been painted for Australian Eagle’s track record. As illustrated in Figure 3, since inception they have managed on average to capture over 107 per cent of the upside when the market is up, and approximately 95 per cent of the downside when the market is down. This downside capture figure is consistent with some of the larger market drawdowns over the last 17 years which is shown in Figure 4.

If we review the period that corresponds with the GFC on this chart, the strategy fell peak to trough by 42 per cent which in isolation isn’t pretty. However, it actually corresponds to an 88 per cent downside capture versus the market which was down approximately 48 per cent peak to trough. For the reader’s awareness, Australian Eagle actually only held 3 per cent of the strategy in cash during this period. Indeed, the Australian Eagle team have demonstrated some impressive outcomes over the last 17 years which we are delighted to offer investors going forward.

Figure 3 – Australian Eagle upside/downside capture

(adjusted for the fees of The Montgomery Fund):

Source: Montgomery/Australian Eagle to 31 August 2022.

Performance is based on the actual gross performance of the Australian Eagle Long-Only Equity fund managed by Australian Eagle since 7 February 2005, adjusted for fees and assumes all distributions are reinvested. Effective 12 September 2022, The Montgomery Fund invests using the identical strategy to the Australian Eagle Long-Only Equity fund and is advised by the same investment management team managing to the same investment objectives. Past performance is not a reliable indicator of future performance.

Figure 4 – Australian Eagle drawdown since inception

(adjusted for the fees of The Montgomery Fund):

Source: Montgomery/Australian Eagle to 31 August 2022.

Performance is based on the actual gross performance of the Australian Eagle Long-Only Equity fund managed by Australian Eagle since 7 February 2005, adjusted for fees and assumes all distributions are reinvested. Effective 12 September 2022, The Montgomery Fund invests using the identical strategy to the Australian Eagle Long-Only Equity fund and is advised by the same investment management team managing to the same investment objectives. Past performance is not a reliable indicator of future performance.

Read part 1: A deeper dive into Australian Eagle Asset Management Part 1

If you would like to find out more, please visit the Montgomery website to download the Product Disclosure Statement:

If you have any immediate questions, please call the Sydney office 02 8046 5000 and speak to David Buckland or Toby Roberts.

You should read the Product Disclosure Statement (PDS) before deciding to acquire The Montgomery Fund.

The issuer of units in The Montgomery Fund (ARSN 159 364 155) (Fund) is the Fund’s responsible entity Fundhost Limited (ABN 69 092 517 087) (AFSL 233045). The Product Disclosure Statement (PDS) contains all of the details of the offer. Copies of the PDS and Target Market Definition (TMD) are available from Montgomery Investment Management (02) 8046 5000 or at www.montinvest.com and at https://fundhost.com.au/

An investment in the Fund must be through a valid paper or online application form accompanying the PDS. Before making any decision to make or hold any investment in the Fund you should consider the PDS and TMD in full. Australian Eagle Asset Management Pty Limited (ABN 89 629 484 840, Authorised Rep No. 001269301) (Australian Eagle) is an authorised representative of both Montgomery Investment Management Pty. Ltd. (ABN 73 139 161 701, AFSL No. 354564) (Montgomery) and Alleron Investment Management Pty Limited (ABN 71 109 874 160, AFSL No. 278856) (Alleron).

Montgomery is the investment manager of the Fund and will appoint Australian Eagle as a sub-investment manager to assist with the management of the Fund’s assets. Montgomery (and not Alleron) is responsible, and Alleron accepts no liability for, all financial services that Australian Eagle provides with respect to the Fund, including this content. Montgomery takes no responsibility, and will not be liable to any person, for financial services that Australian Eagle provides as authorised representative of Alleron.

The information provided does not take into account your investment objectives, financial situation or particular needs. You should consider your own investment objectives, financial situation and particular needs before acting upon any information provided and consider seeking advice from a financial advisor if necessary. You should not base an investment decision simply on past performance. Past performance is not an indicator of future performance. Returns are not guaranteed and so the value of an investment may rise or fall.