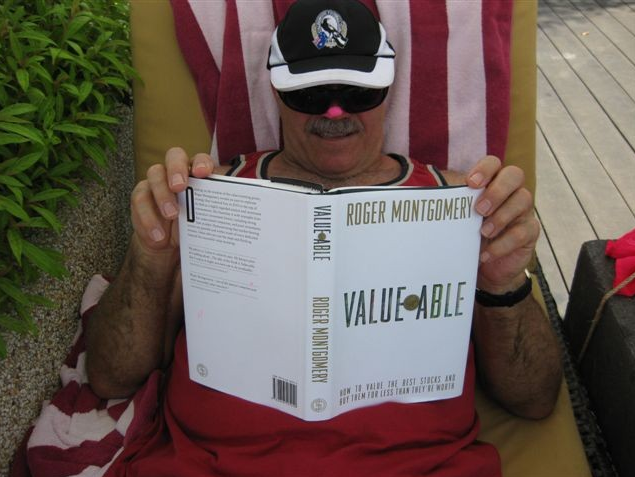

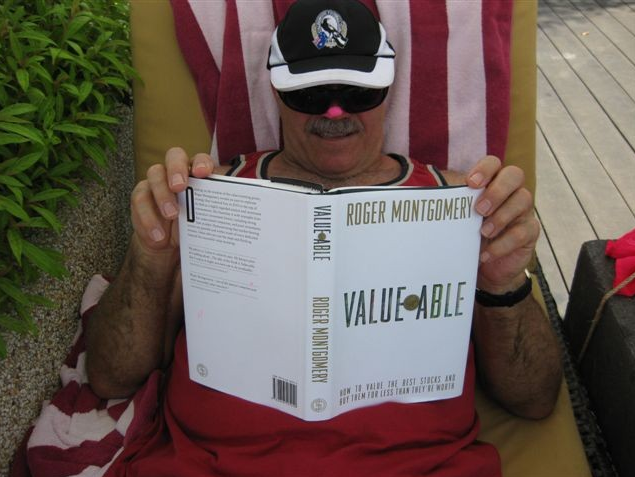

Is Value.able and relaxation mutually exclusive?

It seems that putting your feet up on a deserted island is becoming the standard accompaniment for Value.able graduates. Young Les was one of the first graduates to receive his copy of Value.able in early August, but until now has struggled to find a deserted island to go and read it…

It seems that putting your feet up on a deserted island is becoming the standard accompaniment for Value.able graduates. Young Les was one of the first graduates to receive his copy of Value.able in early August, but until now has struggled to find a deserted island to go and read it…

Hi Roger,

Finally found that deserted island you often talk about. Some one thought it funny to take a picture of me with the pies hat. If only they had known – the real value was in the book. If only we had looked at the intrinsic value of Collingwood and St Kilda on the weekend we would have gone for the draw. At 50 to 1 it was the only value.

Best regards,

Young Les

PS – Going for the pies this weekend… the value is better!

Posted by Roger Montgomery, 29 September 2010

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking. Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

He is also author of best-selling investment guide-book for the stock market, Value.able – how to value the best stocks and buy them for less than they are worth.

Roger appears regularly on television and radio, and in the press, including ABC radio and TV, The Australian and Ausbiz. View upcoming media appearances.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

It seems that putting your feet up on a deserted island is becoming the standard accompaniment for Value.able graduates. Young Les was one of the first graduates to receive his copy of Value.able in early August, but until now has struggled to find a deserted island to go and read it…

It seems that putting your feet up on a deserted island is becoming the standard accompaniment for Value.able graduates. Young Les was one of the first graduates to receive his copy of Value.able in early August, but until now has struggled to find a deserted island to go and read it…

I hope this is the correct place to leave this message.

Have you done any research on Lynas Corporation? It has had a

large run up and pulled back slightly. Is it overbought or is it a

fundamentally sound and reasonably priced company?

Hi Shirley,

Your question is a very rare one on this blog. I am delighted however that you asked it. We tend not to focus on prices here. Have you read Value.able?

Theoretical growth should be retained earnings x ROE. The very best business models achieve better than this because somebody else provides the capital they need for growth, free. (creditors, insurance floats, pre-paids, taxman…. etc) Earnings do not need to be retained but can be returned or fund acquisitions or buy backs.

Where growth is constantly achieved beyond what theoretical growth suggest, you will get ever increasing ROE. In these very rare cases and only in these rare cases I would suggest the following modification to the Value.able method.

Subtract the maintainable growth rate (above what theoretical growth suggest) from your required return and then use the tables as normal.

NVT is one of the few shares on the ASX that I think this adjustment is appropriate for. The trick is to get the discount (for growth beyond theoretical) right for the future, At best we will be making educated guesses – but at the end of the day good guessing is the game we play.

A buffett quote to finish:

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Don’t disregard NVT without some heavy thinking. Happy Investing.

Thats right Gavin. What you refer to as ‘theoretical growth’ I call ‘implied growth’. Given beyond growth is non-linear, one suspects a simple subtraction is not precise but elegant. Given we are advocates for imprecision here, I thinks its a neat fit. Regarding NVT, I agree we need to be ready should it become cheap. Thanks again. I think everyone here appreciates the input.

I note that none of the Navitas “fan club” are mentioning a reduction of some 20% in overseas student numbers next year, or the tightening of the visa requirements. In addition, the removal of permanent resident status qualification from many of the courses acts to reduce the numbers even further. They seem to have a pretty diverse income stream, but some of it could come under threat next year.

Regards, Ken

Hi Ken,

I am guessing that has been addressed in the briefings. To confirm, have a look at the ppt presentations.

Hi Roger and fellow ROA investors

Love to have your thought om ORL rog?

Mine for that it is worth that not suprisingly the magical ROE figure can’t be maintained forever.That is debt up but ROE stable.

Nothing to worry about but it means my IV in future years have been reduced. Still above current levels but not as attractive as before.

This is my view like to hear others.

Thanks again

Hi Roger

A question about manipulating ROE.

If WES wrote down its Coles assets that would reduce net assets and equity in that year and the profit in the same year.

In the following year given the same operating profit ROE should improve as the profit is divided by a lower equity value.

For the purposes of your valuation method is this increase in ROE offset by a lower equity per share figure?

Thanks for the book.

Hi David C,

A higher numerator and lower denominator will produce a different result, the extent to which will depend on the change in their proportions. You would to ask yourself whether or not that write down should be treated as an abnormal or not. The answer will depend on whether management have changed their ways or have been changed!

Roger,

Not completely related to the topic, but I do watch Switzer at times, for entertainment, if not leisure. I note he is very big into “Blue Chip” stocks as a preferred investment category.

When you next appear with him can you ask him a question which has been troubling me for some time:

When does a Blue Chip cease to be a Blue Chip?

In particular, I wonder how long does one persevere with the likes of TLS (to name but one) before it gets thrown out of the Blue Chip category. And what makes this a better money losing proposition (deserving as it apparently is of the Blue Chip tag) than a host of equally poor performing non-Blue Chips?

I await the answer with interest.

Regards

Lloyd

OK Lloyd. Might also be a question for every episode of Your Money Your Call to get a range of views. Given I don’t know what a conventional Blue Chip is, I cannot tell you when it ceases to be one.

G’day Roger ,

Have received my copy of your book and have just finished my first read through.I enjoyed it but only absorbed parts of it on the first read and believe it’s true value will come when I re read it and get pen, paper and calculator out and try what it is i’m reading.

I found that a lot of the ideas presented in the first part of your book I already knew or already agreed with but having them refreshed to me in your easy to read writing style was worth the purchase price alone.

I don’t have any technical questions as yet but during my first read had one thought that I couldn’t reason to myself .

Reading your thoughts on airlines I couldn’t agree with you more. I also listened to this example you used during your latest ASX podcast.

My question to you Roger or your thoughts .

What is Richard Branson doing involving himself in the airline business ? Here is a man who many people believe to be one of modern days most intelligent and he involves himself in a terrible business like an airline company. My only explanation is his personal enjoyment of space and space travel justifying him being involved in a terrible business to achieve this love.

What are your thoughts on Branson Roger ?

Thanks for the book.

Hi Wes,

Buffett often quotes Branson when discussing airlines himself. It was Branson who was once asked how to become a millionaire. Branson answered; Start out a billionaire and then own an airline! Branson knows the economics of airlines just as well as everyone who has read Value.able. Branson also understand the power of brand awareness and all those people flying in his planes everyday for hours at a time, represent eyeballs and attention that no amount of TV advertising can buy.

Hi Rodger, I have finished reading your great book and have a better understanding of the values of my investments. The calculations you have taught me are now part of my portfolio management and hence I have designed a spread sheet which does most of the calculations for a 10% return.

Regards, Harold Janus

Hi Harold,

Delighted to hear you like the book. Some bloggers have suggested a CD with the formula and continuos rather than discrete variables. That is a very good idea. I am working on it.

Great idea re the CD, perhaps even some of your reading recommedations too Roger?

Are there copies of the book still available Rog?

Also i would like you to have your own daily show on sky business.

Cheers

Hi WIlliam,

If you need a book, just order one online. Thanks for the encouragement about a show.

Hi Roger,

Have you thought about getting a forum up and running on your site?

Just another tool we can use to compare and debate.

Regards

Paul

Hi Paul,

There have been a few requests for a forum. There is of course very wide opportunities for abuse and harassment between users which does concern me. Enough of that goes on in people’s work places already and I would not like to introduce another avenue for it. Having said that, I see the merit.

Hi Roger,

My form of investing is very similar to yourself. High ROE. I tend to only stick to small caps but not speccies. This may be the wrong blog to ask this question but here goes: From memory you had MAH’s intrinsic value at around 30c fro memory -one of your you tube videos a while back. I’s currently around 68c. Considering MAH will continue to benefit from the mining boom and govt / private contracts does the 30c level still hold for you? How did you reach such a figure?

Also, not sure if you’ve heard of Martin Roth – he’s also into high ROE levels and sticks to low debt companies

Peter

Hi Peter,

MAH valuation is 50 cents this year, 58 cents next year and 63 cents the year after (no advice, seek and take personal professional advice BEFORE engaging in any activity – your financial situations and needs (which I don’t know) have not been taken into account…)

NVT Valuation.

There were some comments on a NRMA review blog a couple of days ago about NVT Valuation that I wanted to respond to when I got the time. I can’t find those comments now. I believe the valuation for 2011 that you had Roger was $2.08 and others were similarly low.

Following calculations are based on:

Forecasts for 2011 – 2013 of 20.8; 25.5; 28.6.

2011 book value per share of 30 cents. (calcs use ending equity)

Required return of 10%.

Valuations using Value.able formula for 100% payout.

2011 -2013: $2.08; $2.55 & $2.86. (Hope I haven’t misrepresented the book too badly?)

Now let’s suppose that NVT needs to retain 20% of the earnings to maintain its economic business position. You get no more out of the business for the 20% retained so the forecast earnings are exactly the same. Obviously you are worse off because your dividend return has reduced by 20% and the business has not increased its earnings, but strangely Value.able valuations would rise under this scenario.

NVT Valuations using Value.able formula for 80% payout.

2011 – 2013 $3.62; $4.58; $5.08 (again Hope I haven’t misrepresented the book too badly)

So is NVT really only worth $2.08 or is the Value.able formula inappropriate in this circumstance?

I personally value NVT higher than $2.08 (using my methods). Luckily enough the market will happily arbitrate, so we do not need to fight about the value here. But I think it would be appropriate to discuss the strengths/weaknesses of the value.able formula in regards to NVT.

Perhaps somebody could check my calculations as a first step, as I don’t use the value.able method I may have screwed it up on this attempt.

Hi Gavin,

Not at all. You should question everything. Thank you for giving me the opportunity to consider your thoughts and respond! If a portion of retained earnings produce no increase in earnings, then return on equity will fall (equity rises from the retained earnings but profits don’t). The result is a fall in valuation. The reason you don’t get that from your workings is because you are keeping your ROE constant. If that happens then the 20 cents being retained is generating 30%. If you want the 20 cents to produce no increase in earnings then you have to change the ROE. It cannot be constant.

Hi Roger,

For NVT should we make an exceptional model for NVT with 11.1/11.2 tables?. Since it grows its earnings by 20% average with a 100% payout, when I value NVT I have used ROE=65%, RR=10% P/B = $0.31

6.5 * .31 * 100% = $2.02

3.482 * .31 *100%= $1.08

so $3.10 is the valuation even though I have used a dividend payout of 100% + dividend retain of 100%. if it successful and grows its earnings by 20% next year, it should have ROE = 78%, Book value 0.31.

7.8 * .31 * 100% = $2.42

3.482 * .31 *100%= $1.08

=$3.50. This altering to the model would keep Equity constant and ROE “flexible”.

Hi Thomas,

The last company that displayed those sorts of metrics was Unitab. Buffett raves about these sorts of business (that require no reinvestment) with high uninhibited earnings. Sees Candy is often cited as an example in the Berkshire stable. Valuation still comes back to choosing a sustainable rate of return on equity. When all earnings are paid out, ROE’s can stay high for a very long time. Of course, competitive advantage is the driver.

hi roger,

I think Navitas should not be valued like a “no growth” Telstra. What the company does shows that it does not need any growth in assets to increase its earnings. of course there are many businesses like this. E.g. one of my parents owned and ran a pretty successful dental surgery, which only needed 1 commercial building for 10 years, earnings paid out and earnings increasing 5-10%/yr. I believe other private GPs/medical centres would experience these metrics also. I think Navitas is one of those companies who can just increase their “education service” fees, to increase earnings without any increase in equity

by the way…I do not have shares in this company…

Hi Thomas,

Thats exactly why you need to get a sense of what future rates of return on equity are likely to be. My reading however is that the payout ratio is not exactly 100%.

Thomas,

In fact, NVT do not pay out 100%. Their Payout Ratio was 90% in 2010 and 80% in 2009. You need to take your figures from the financial reports to see the ACTUAL dollars paid as opposed to the dividends declared. For a company ending its financial year in June, the final dividend declared for the year is usually paid in Aug/Sep and is accounted for in the next year’s accounts. Although Commsec figures show the earnings per share and the dividends per share as virtually the same each year, they are using the “dividends declared” figure, not the “dividends paid” figure.

Regards, Ken

Operating Capital ex goodwill was (negative 17.9 million) in 2004, In 2010 Operating Capital ex goodwill was (negative 122.8 million)

The corresponding figures inclusive of goodwill are 56.7 million in 2004 and 45.3 million in 2010.

NVT has clearly not needed capital to grow organically. Even after acquisitions are taken into account NVT capital requirements are less than ZERO allowing for a 100% payout ratio or cash accumulation, buyback etc.

The future is not the past and there may be a step change in capital requirement down the track if no more capital efficiency can be rang out of the business. My take though is that prepaid fees are funding capital requirements – Free Use of Money l!!!!!!

Roger how are you going running the NVT scenarios? What valuations do you come up with under the two scenarios?

Hi Gavin,

$2.08 to $2.98 for NVT. Having said that, I looked back at my valuation applied historically and the company has never traded below my estimate of its valuation and the shares have had a low of $1.37 and a high of $5.35 since 2005 – No Advice, Seek And Take Personal Professional Advice.

Roger

What are your Value.able valuations under scenario 1 – 100% payout ratio.

What are your Value able valuations under scenario 2 – 80% payout ratio but same earnings?

My proposition is that this exercise highlights how the method may not be appropriate for valuing a special case like NVT

Hi Gavin,

Delighted to explore this and improve the results. I am very keen to share the numbers if you think there’s a better solution. I am using ROE of 67% and payout ratio of 95 percent for current year. ROE estimate rises to 93% by 2013. What do you suggest? Lower discount rate does sound sensible!

Hi Roger

I haven’t kept the ROE constant.

I have used whatever the ROE works out to be after adding earnings to book and subtracting dividends.

For the 100% Payout example:

ROE used for 2011 -2013 is 69.1%; 84.7% & 95%

For the 80% Payout Example:

ROE used for 2011 – 2013 is 69.1%; 74.5% & 72.7%

Do you have any other explanations for the valuations under this scenario????

Hi Gavin,

Not without running the scenarios myself, which I will do.

Hi All,

I was curious about NVT and this 100% payout idea, so I ran the numbers through my black box.. I get a 90.04% payout for this year. The valuation I get for 2010 is $1.84 using 60% and 10% from Rogers table. Also I get three different ROE figures: Dupont 59.69%, Average 63.05% and beginning 65.29%.

Rob.