A quick way to analyse a bank

Banks are relatively simple businesses to analyse. Despite claims of being ‘different’ in an attempt to win wallet share, behind the scenes there is often very little differentiation between CBA, ANZ, WBC and NAB in the services they offer to their customers.

Australian banks offer the same commoditised products including everyday banking, loans, credit cards, wealth management and insurance, and because of this, comparing their financial statements and metrics is relatively simple.

In simple terms, Australian banks generate revenue via two main sources. The primary source is their lending activity (or loan books), on which they make a ‘margin’. Also known as the Net Interest Income or Net Interest Margin (NIM), this simply refers to the difference between their cost of borrowing from savers (deposits) and other funding sources, and the price of the loan. In a competitive market, this margin is usually around 2% when compared to the bank’s asset base.

The second source of income, which can offer a revenue return of 0.5-1.0% on assets in a good year, comes from proprietary trading, and services such as insurance and wealth management. In combination, a well performing bank will generate about 2.5%-3.0% in revenue on its asset base.

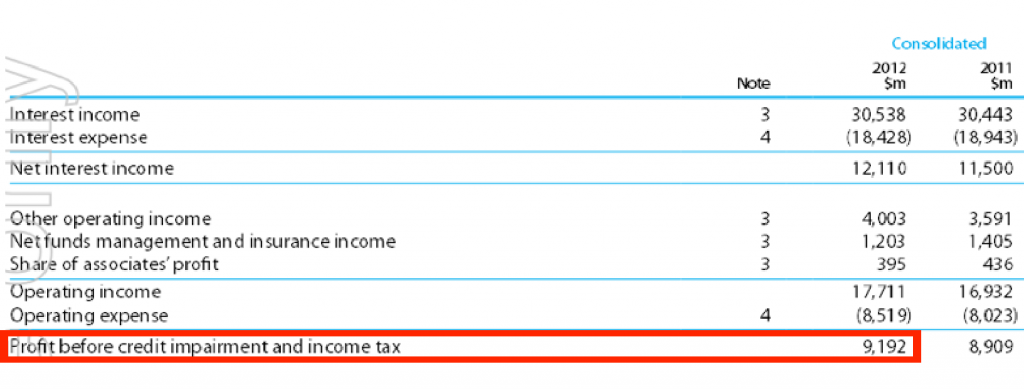

Let’s look at ANZ as an example. Their 2012 annual financial report showed $642,127m in assets. A 2.5%-3.0% return on this figure generates $16.05b to $19.26b in revenue. In the year to September 2012, ANZ reported operating income of $17.71b.

Like any business, there are costs associated with this revenue. For Australia’s big four banks, about 50% of their revenues are chewed up by expenses.

Multiplying the revenue range (as calculated above) by 50% and we get $8.025b to $9.63b as a profit before tax and before bad debts. Again this ties in closely with ANZ’s profit before credit impairment and income tax of $9.19b.

The only spanner that can be thrown into the works from here are bad and doubtful debts. Given the pre-tax return on total assets is running at 1.25% to 1.5%, if for example 1% of a bank’s loan book should go sour, then virtually their entire profit could be wiped out for that year. It is here that we note the huge operational leverage that banks have and why they are some of the most heavily leveraged businesses on the ASX.

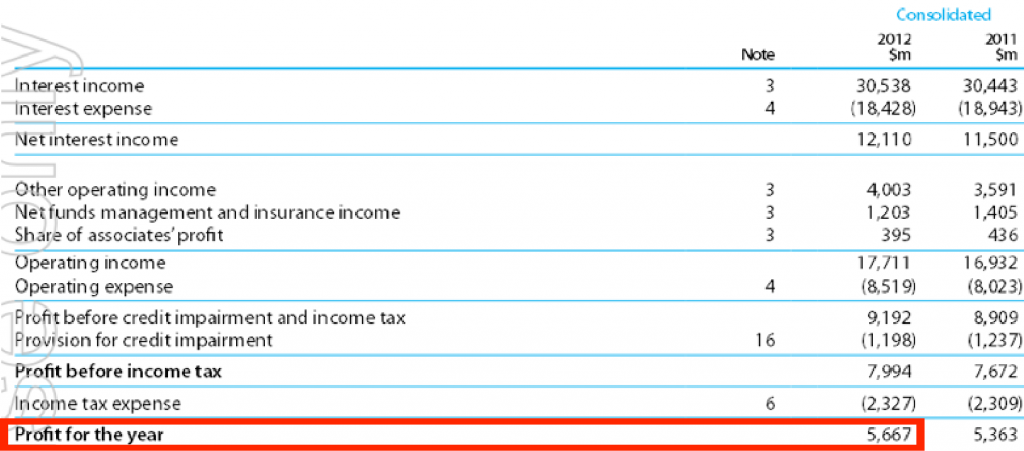

Then there’s the tax man. He usually takes around 30%; so in my example 70% of $8.025b to $9.636b gives $5.62b to $6.74b or a return on assets of 0.87% to 1.05%. ANZ actually reported $5.667b or a 0.88% return on total assets.

This is a quick and simple analytical framework that can help you to compare any listed bank in the world. The benchmarks suggested are revenue returns on total assets of 2% for Net Interest Margin, 1% return on total assets for Other Income, and a 50% cost-to-income ratio efficiency after tax equivalent to 1.0% Return on Total Assets. Try running the above tests for CBA, WBC and NAB and see how they compare.

Please ensure you pursue those banks with the best financial metrics, the brightest prospects, and if you buy them below assessed intrinsic value you should be rewarded in time.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Russell, thanks for your insights. In this global world it would be more interesting to compare the same ratios for US banks (such as JPM or WFC) versus the Australian banks (CBA or ANZ). Can you please do this & explain how the relative differences in their Balance Sheets impacts their performance & risk profiles?

Low return on assets is one reason Warren Buffett isn’t crazy about banks as investments.

When he bought Wells Fargo, putting his risk management hat on, said that even if 10% of the loans of Wells Fargo were hit by problems, a very unlikely scenario, Wells Fargo would survive it.

mortgage contracts are very long investments for banks and investors needs to consider the risks to interest rate changes & quality of loan underwriting.

how good are the quality in revenues, when unemployment rises & house prices start to decline?

I thought Credit Cards also provided a hefty slice of Bank profits Roger, with fairly large interest rates so I believe?

if for example 1% of a bank’s loan book should go sour, then virtually their entire profit could be wiped out for that year??????? Didn’t they expand into the China market ? Isn’t the China housing market cooling like there is no tomorrow ?

For higher LTV loans the banks make borrowers take out mortgage insurance which is to the benefit of the banks. If you were concerned about a housing collapse in Australia, the first hit would be taken by the two key LMI providers – QBE and Genworth (a former GE spin off). Interestingly, Genworth has been trying to list their Australian operations for the past 12 months!

A risk around the bank’s residential exposure has been the reduction in capital that they have held against mortgages as property values have risen. A fall in house prices would create issues for their capital adequacy provisions.

Regarding China – whilst it is concerning from an Australian macro context – iron ore demand, misallocation of resources, liquidity problems etc etc; I don’t believe that the Australian banks have lent much (any?) against individual mortgages or for that matter to the developers.

Forgive my ignorance. But how does one estimate the fair value of such banks?

“Forgive my ignorance. But how does one estimate the fair value of such banks?”

Truthfully speaking on one can. You have to trust people in charge. If they are crooks you are toast.