Health insurers feel the pinch as younger people opt out

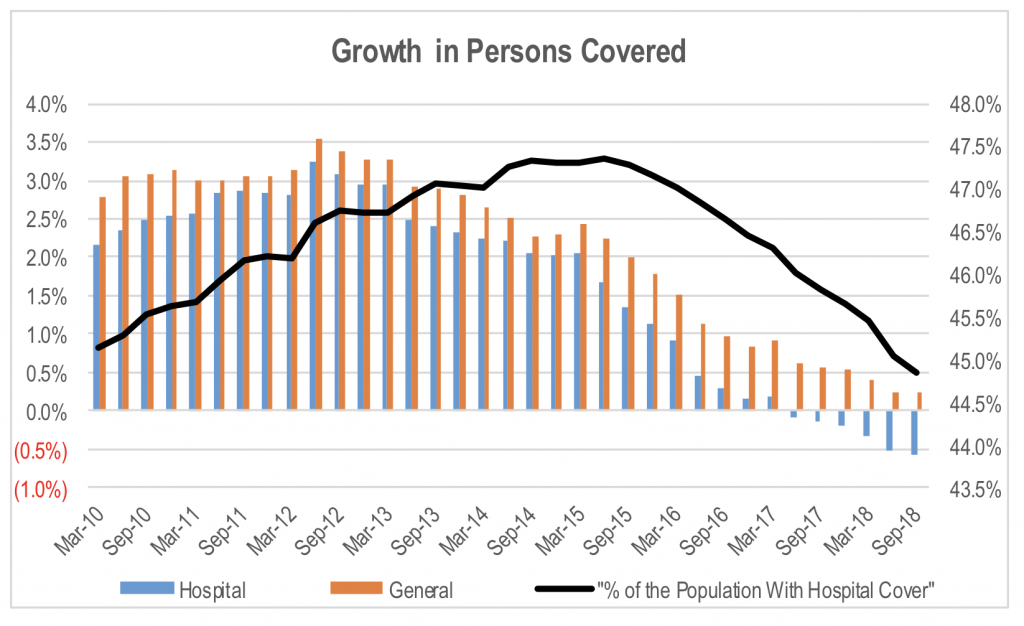

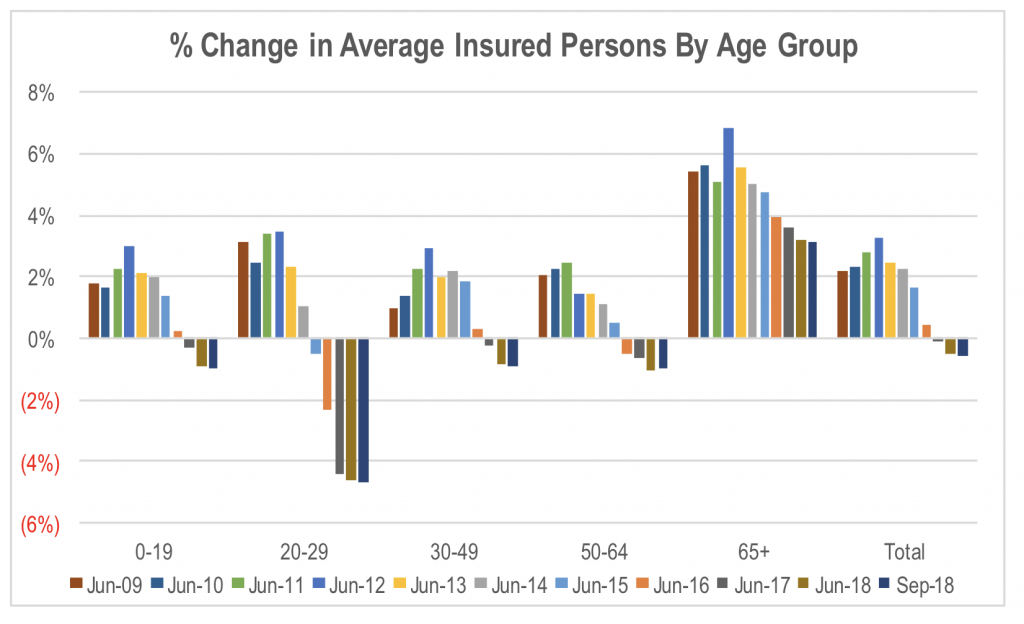

The proportion of Australians with private hospital cover has fallen to its lowest level in 10 years. This is largely because younger people are opting out, shifting the mix of insured people towards older, higher claiming age groups. The resulting cost pressures could be too much for some health insurers, leading to industry consolidation. APRA recently reported its statistics for the private health insurance industry for the three months to September 2018. The data showed the number of people that have private hospital insurance coverage has declined 0.5 per cent in the 3 month period relative to the same time last year. Ancillary (also know as general or extras cover) continues to increase, but at fairly slow rates.

Source: APRA

The proportion of the overall population that has private hospital coverage has now fallen to its lowest level since September 2008.

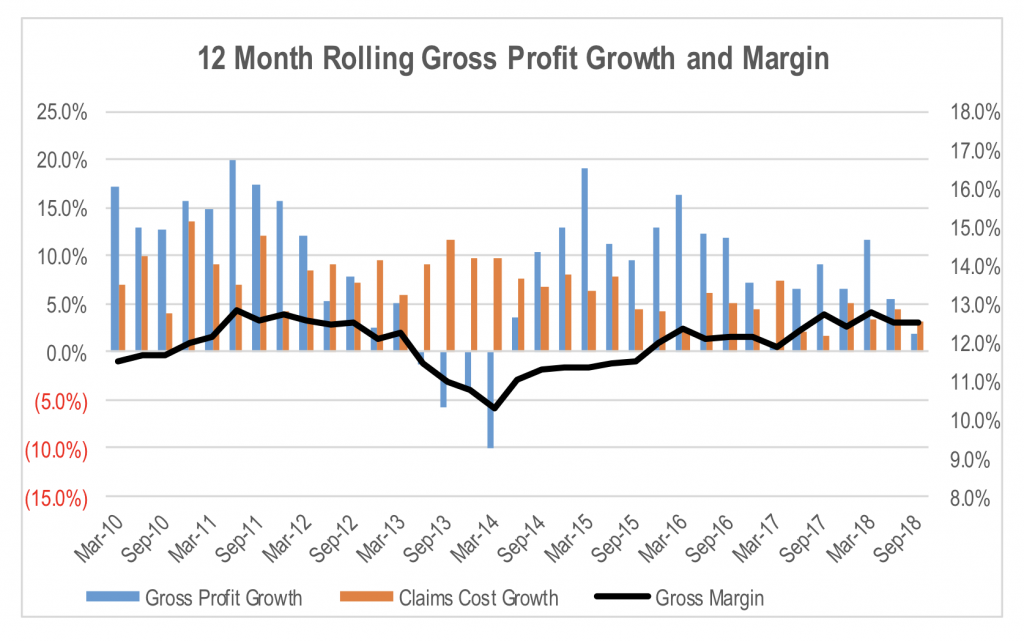

This is clearly a reflection of the deterioration in affordability and the consumer’s perception of the value of private health insurance. This isn’t helped by rhetoric from the opposition that private sector insurance companies are “gouging” customers given premium inflation has exceeded the rate of inflation and wages growth by a considerable margin over a number of years. If this was indeed case, it would show up as higher industry gross margins relatively to longer term historical levels in the quarterly APRA data.

However, industry gross margins have been stable over the last 5 quarters. While gross margins are higher than a few years ago, this was merely a recovery in margins by the industry after a period of accelerated claims cost growth in the early part of the decade.

Source: APRA

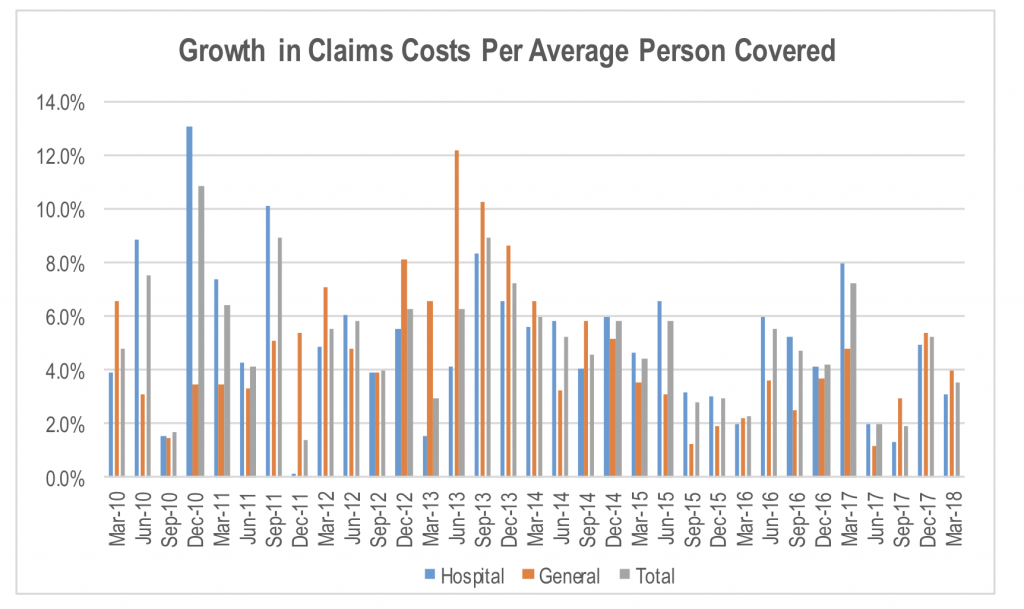

While claims growth per person has slowed over the last few years, it remains above the level of inflation.

Source: APRA

This is due to a number of factors. One of which is a result of the community rating system. By law, private health insurers are not allowed to risk price policies. This means that everyone pays the same premium for a given list of covered items and benefits, irrespective of the underlying risk factors that materially impact the consumers likelihood of claiming. This means that a healthy 25-year-old pays the same premium for hospital cover as a 95-year-old on the same policy, despite the fact that a 95-year-old is far more likely to claim than the 25-year-old.

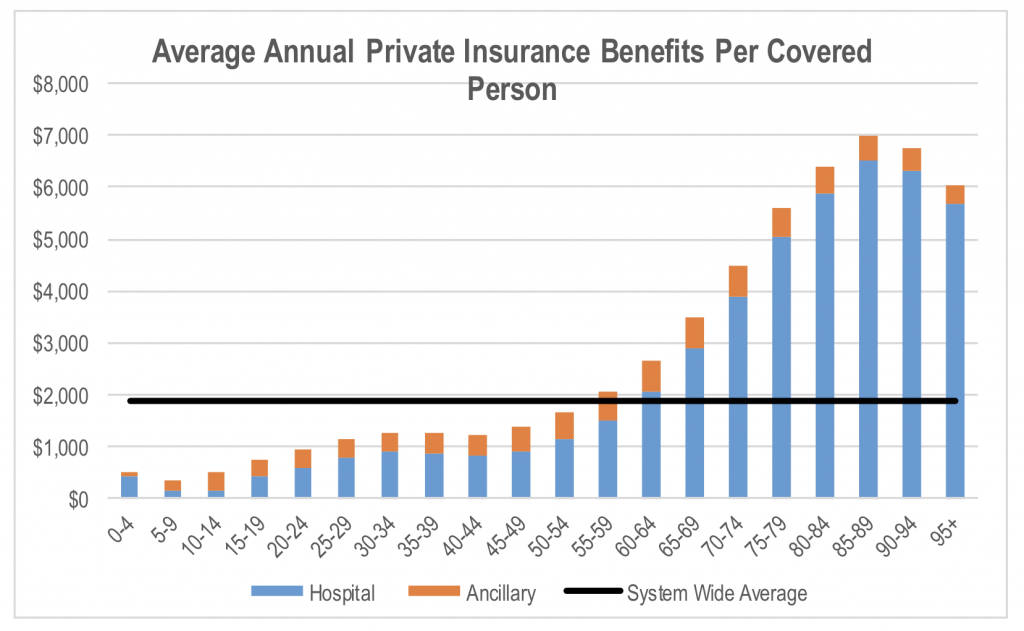

To highlight the scale of this claims disparity, the chart below shows the average annual claims paid to covered policyholders in the year to September 2018 by the age of the covered person.

Source: APRA

This shows that on average someone with private health insurance aged between 25 and 29 years old claimed around A$778 in the last 12 months. This compares to A$7,000 in average claims for people aged between 85 and 89 years old. However, insurance companies are forced to price their policies on the basis of the average claims costs per person across the overall covered population, which was around A$1,900 over the last 12 months.

On the basis of the average industry gross margin, this would set the average premium at around A$2,200 per covered person. If you are over 60, the age at which the average claim per year exceeds this average premium, the product offers a good deal. However, for the those under 50, the value proposition is more stretched on a pure cost versus average claims.

So it is not surprising that the decline in coverage is largely occurring in the younger age brackets.

Source: APRA

As younger people drop out of private health insurance, the mix of insured people shifts toward older, higher claiming people. This results in an acceleration in the rate of growth in claims per person.

The ageing population in Australia is also making this issue worse over time, as the average age of policyholders gradually increases. This adds to the upward pressure on claims cost growth coming from younger people dropping out of private health insurance.

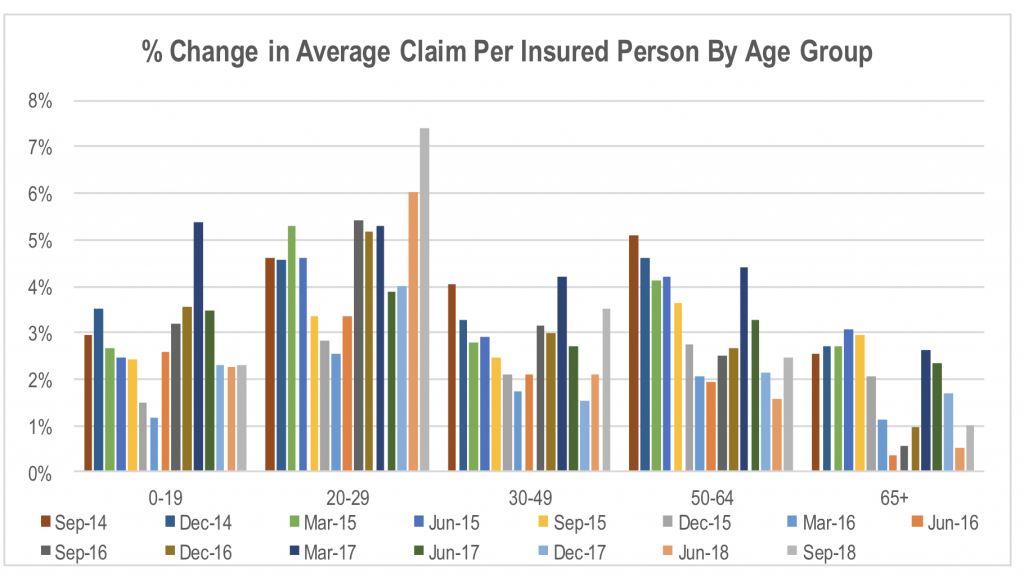

If we look as the rate of claims cost growth per person covered for each age group, we see that the rate of inflation over the last few years has been much closer to the 2 per cent rate of general inflation. Of course, the growth rate includes the impact of consumer downgrading of their policies. Therefore, the underlying rate of growth on a like-for-like basis is higher than the averages in the chart.

Source: APRA

The only exception for this is the 20-29-year-old demographic, in which claims cost growth per person has been well above inflation and that of the other demographic. This is likely to be due to adverse selection (i.e. low risk people dropping coverage leaving the higher risk/claiming people in the pool), and the growth in mental health claims.

Despite the fact a cap on premium increases will do nothing to fix this problem, that is what the industry faces under a change of government. This is likely to result in significant financial stress for smaller insurers that lack scale and could force a consolidation of the industry.

Medibank commented recently that the industry has seen more structural change in the last 18 months than it saw in the preceding 18 years. This is likely to continue in the coming years, and it will test the core competencies of all market participants. Competitive advantage will be critical in determining whether individual companies can successfully navigate their way through the coming rapidly changing environment.

The Montgomery Funds own shares in Medibank Private. This article was prepared 20 November with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Medibank Private you should seek financial advice.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

I sense a further “incentive” via increased tax if you don’t hold insurance coming on. Let’s face it, the only reason many people ever held private health insurance (me included) was that when you factor in the effect of paying more tax for NOT having it you may as well get it. Looks like a few of the youngsters don’t feel the same way. As your article points out, the entire system relies upon “encouraging” the young to take part – and if the way the young are treated nowadays is any indicator, they are simply going to be whacked with a stick until they comply.

Hi Luke,

The Government has focused on trying to take inefficiencies out of the system over the last few years with auditing of the MBS and prostheses pricing reform, and while there is a lot of cost inefficiencies that can still be removed from the system, it is unlikely to make enough of the difference to keep overall costs per capita down to the level of inflation. Given the current stick used by Government in the form of the Medicare surcharge, was set based on wages and private insurance premiums in 2010, inevitably it will need to be re-calibrated to current costs.

Very interesting piece of research Stuart. Thanks for sharing.