Why we’re still cautious on retail stocks

With household costs going up, and the wage index comping down, it’s little wonder Australians are finding it harder to save. If this trend continues, it spells leaner times for Australian businesses exposed to consumer spending.

The trend in cost of living vs. wage development is something we track as it is one of the components that determines how much the population can spend on consuming goods and services that companies produce and hence what kind of growth companies producing such goods and services can expect to generate in total (i.e. excluding changes in purchasing behaviour or market shares).

The theory goes that total consumption of goods and services is a function of:

- The number of people in the population, which is driven by underlying birth/death rates plus the net immigration number.

- The savings rate – in other words, are people building up or drawing down on their savings.

- The income that the population has which is driven by the income from work, income from government grants or income from investments. The largest portion of the total income is derived from compensation for work so this is of particular importance. Income from work can be further broken down in the number of people working and the compensation they receive for that work.

- If there are underlying cost/price increases (inflation), this erodes the purchasing power of consumers and if inflation is in excess of the increase of income generated, an individual has to consume less in real terms (or reduce his savings rate).

The most important components of the above are generally the rate at which wages increase and the increases in the cost of goods and services.

Now, there are two ways of measuring the increases in cost of living:

- The best known is the CPI (Consumer Price Index). This measures the straight-up price of goods and services according to an acquisition approach (i.e. the quoted price for the goods and services).

- The less well known is the LCI (Living Cost Index). This index is constructed according to an outlays approach (i.e. what are the actual outlays that are needed to pay for goods and services).

Normally, outlays and acquisitions occur relatively close together, so there should not be too much difference in the indexes, but there are a couple of areas where they differ:

- Purchase of dwellings. For CPI, the upfront price of dwellings is included, and the interest paid on outstanding debt is disregarded. However, for the LCI, the changes in actual interest rates paid are included but the upfront cost of dwellings is not.

- Financial services and use of credit. The LCI takes into account the use of credit for purchases of a more durable nature (e.g. houses, as explained above, plus cars and other durable goods).

Conceptually, the LCI does describe the actual cashflows for consumers better than the CPI and given that we are seeing, in particular, the cost of mortgages increasing, it is our preferred measure to assess the purchasing power of consumers.

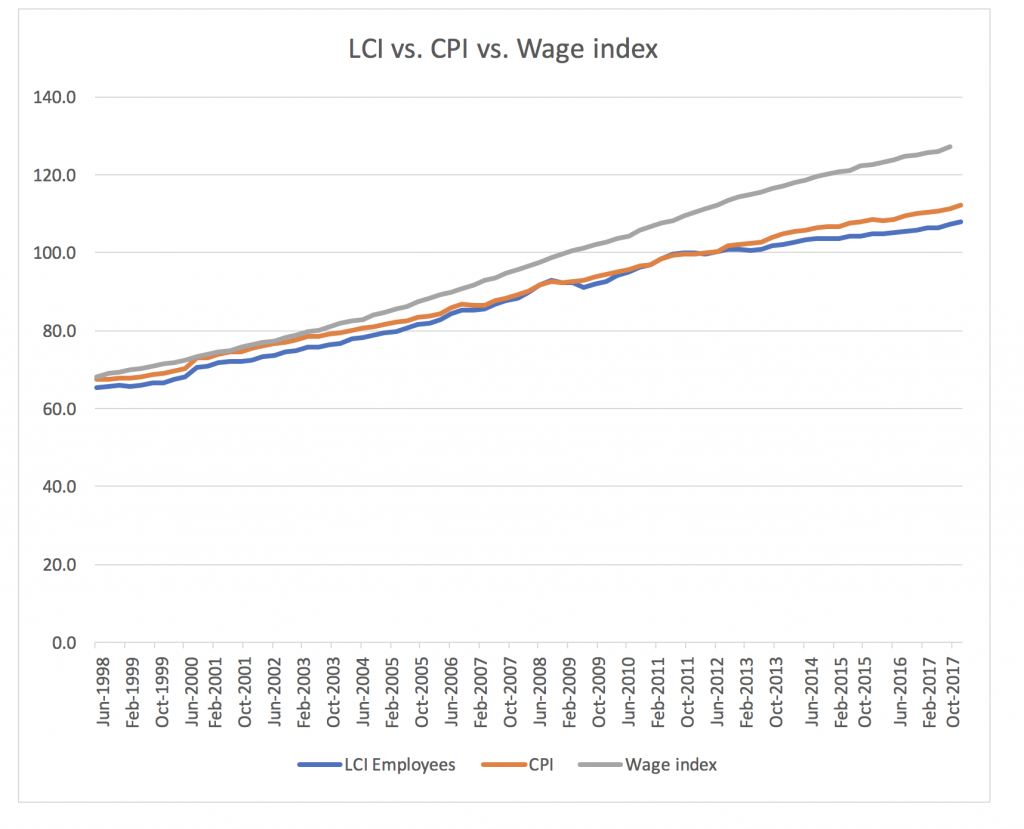

In the charts below, we have focused on the LCI for the people who are employed as we are looking to compare it to the wage price index. This makes up the major part of the households in Australia (~66 per cent of total households) and more in terms of total spending power.

If we look at a long timeframe, we can see that the purchasing power of employees in Australia has been relatively steadily increasing, meaning that they can afford to consume more goods and services, and companies producing these goods and services have seen increased volume of business which is of course a positive.

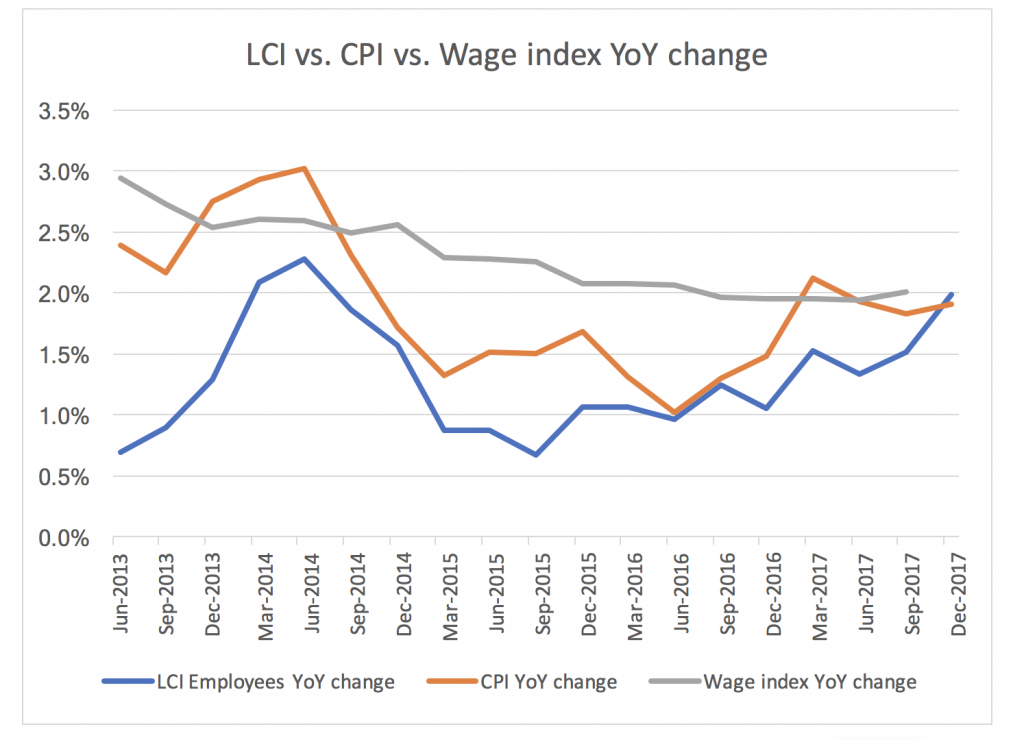

But if we look at a shorter timeframe and focus on the year-on-year change, we can see two trends:

- The wage index is steadily comping down. This is well publicised in the media and in the political debate so should not be a surprise to anyone.

- The LCI is increasing quite sharply. We are seeing a number of cost increases affecting households. The increased cost of electricity and gas is well known, petrol prices are increasing on the back of global oil prices going up and it is possible that we are starting to see increased cost of servicing a mortgage coming through as well.

If there is no pickup in the wage index when the next data is published, we are likely to see flat or even a fall in the real wages for employees meaning that they will either have to reduce their spending or dip further into their savings. Given that the savings ratio is already coming down as shown in the chart from RBA below, it is possible that consumers will forego savings for consumption for some time yet but eventually this is not a sustainable situation.

The slowing property market will likely have an effect on the wealth-effect consumers have been feeling and should over time lead to an increased savings ratio as consumers feel less confident.

We hence continue to be cautious on Australian stocks exposed to consumer spending.

With household costs going up, and the wage index comping down, it’s little wonder Australians are finding it harder to save. What will happen if this trend continues? Share on XThis post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY