Will 2015 be the year Australia enters a recession?

This week the question, whether 2015 will be the year Australian enters a recession, was asked by one of our subscribers, here is what I had to say in response:

Sadly, successive Australian governments have done little to diversify our economy away from dependence on agriculture and resources. These are commodity cycle industries that suffer peaks and troughs. And so do their employees, and by extension, the income, consumption and confidence of the country.

Governments have known for decades that car manufacturing, for example, was flogging a dead horse. But what plan or structure was put in place to grow alternative industries that could one day employ the thousands that would lose their businesses, their jobs and their livelihoods? A failure of foresight, of ability and of planning by every government in Australia to date has lead to this moment where we stand, today, on the cusp of a recession. We already have a nominal income recession and China’s growth has dropped off a cliff. Imports in China from Australia, plunged 35 per cent in January and this will impact all of us. There would have to be a very significant turnaround to stop our March quarterly accounts and terms of trade from revealing a significant deterioration.

If we want to avoid a recession – it’s a case of too little, too late. I cannot tell you whether we will have a recession this year or not, but it doesn’t matter. The economy is in trouble. Unemployment is rising, confidence is falling and business is suffering from this and increasing competition from overseas.

Many on the ABC’s Q&A program are putting their faith in Malcolm Turnbull. Watching Mr Turnbull last night on Q&A explaining that Australia has to be “More productive, smarter and innovative”, made me wonder why his party has cut so much funding to R&D and why we don’t have a tax regime that incentivises entrepreneurs like Singapore. Then he said “we have to be more cost effective at every level”, while later explaining that government is “a third of the economy”. Note, he didn’t say that was cost ineffective.

Further, a three year term is simply not enough time for any government to get the job done. If the states changed to a four year term, our federal government should go for at least four years and perhaps five as in the UK.

Low interest rates are here to stay for a little while and for the time being that will be supportive for assets prices. Eventually however the price of those assets (stocks and property) will be pushed way too high (we think a strong bull market is likely for some part of this year) as people panic buy amid a fear of missing out and while their wealth is eroded from low rates on cash. After that, a large number of investors will, sadly, suffer financially again – from buying too late and paying too much. There is a way to avoid it: You must be invested in high quality businesses with bright prospects and buy them when they are cheap. We can think of only a handful of stocks that meet this criteria currently and have invested in them through The Montgomery Fund and The Montgomery [Private] Fund. When we cannot find such opportunities, the only safe alternative is cash (even though rates are low) and we are 20-30 per cent invested in cash at the moment.

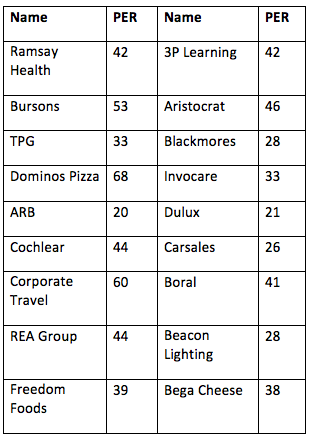

If you are invested in a high performing fund but one that is fully invested, and in stocks like REA GROUP (P/E Ratio 44 times), Dominoes Pizza (68 times), or many of the expensive stocks below, be sure to speak to your advisor about perhaps switching at least some of your retirement nest egg to a fund that can and does have have a large cash weighting.

At Montgomery, the cash won’t make your investment 100 per cent immune to a declining market but it will allow additional purchases at cheaper prices, which offers the opportunity to significantly reduce the time to recovery.

Table 1. Expensive stocks? You be the judge…

Roger Montgomery is the founder and Chief Investment Officer of Montgomery Investment Management. To invest with Montgomery, find out more.

Carlos Cobelas

:

re : Domino’s Pizza, it always saddens me that people would rather spend only $6 on a crappy quality cheap pizza, than a mere $10 or $12 for a far, far better pizza from one of the many pizza stores and Italian restaurants that are everywhere in Melbourne. I certainly won’t invest in Dominos and am staggered at the lofty share price. A very overrated business in my opinion.

Roger Montgomery

:

Carlos, it might surprise you to know that there are people in my industry, with whom I occasionally lunch, that complain about their very tasty Malaysian Kwa Teow now costing $8.50. Now, to be balanced, there are a great many people in this country that for a variety reasons cannot and should not spend $8.50 per day on lunch, but I am talking about economists, brokers and bankers – who arguably should not be complaining but rather should be very, very grateful.

xiao fang xu

:

Mr. Montgomery

Government job should be to protect human rights : “life, liberty, and property.”

or this:

“Government has three primary functions. It should provide for military defense of the nation. It should enforce contracts between individuals. It should protect citizens from crimes against themselves or their property. When government– in pursuit of good intentions tries to rearrange the economy, legislate morality, or help special interests, the cost come in inefficiency, lack of motivation, and loss of freedom. Government should be a referee, not an active player.”

― Milton Friedman

Government is not God and government employees are not angels. Government employees are bureaucrats not entrepreneurs.

all government action is inherently coercive. If nothing else, government action requires taxes. If taxes were freely paid, they wouldn’t be called taxes, they’d be called donations.

man is not free unless government is limited

As government expands, liberty contracts.

freedom is the absence of government coercion

“The world runs on individuals pursuing their separate interests. The great achievements of civilization have not come from government bureaus. Einstein didn’t construct his theory under order from a bureaucrat. Henry Ford didn’t revolutionize the automobile industry that way. In the only cases in which the masses have escaped from the kind of grinding poverty you’re talking about, the only cases in recorded history, are where they have had capitalism and largely free trade. If you want to know where the masses are worse off, worst off, it’s exactly in the kinds of societies that depart from that. So that the record of history is absolutely crystal clear, that there is no alternative way so far discovered of improving the lot of the ordinary people that can hold a candle to the productive activities that are unleashed by the free-enterprise system.”

Aaron Somner

:

Hi Roger, to your headline is the Australian economy headed for recession the answer of course is yes, it’s only a matter of time. We have had them before and we will have them in the future. The Australian economy booms and busts, just like the rest of the world and the agriculture & commodity markets you referenced.

The idea or concept that the government can somehow flatline the economy in response to these fluctuations is not the answer. Thinking that somehow the government can steer the economy or business in a particular direction is also not the answer. You will notice that when you are fighting against personalities and or conditions within your business progress is stagnant. When you use those personalities and go WITH the conditions progress seems effortless. The answer is to acknowledge the fluctuations and work with them. This is the problem with government. Whenever the downturn comes they fight it and make poor regulation decisions that include bailing out failing business’s, borrowing with no means to repay, increasing taxes and then the Australian public decides to vote for the other side and a whole new destablising regime comes in, the economy recover’s in spite of this madness and the whole thing start’s again in an endless cycle that is then repeated in every other nation around the world!

The answer is not within government. The problem is the government! Turnball misunderstands the government’s role within the economy. They are not 1/3 of the productive part of the economy. They consume at least 1/3 of the economy. They are like a maid. They keep the house looking nice but they produce nothing. As it currently stands Australian’s typically work the first 6 months of the year providing for all 3 levels of government (income tax, GST, stamp duty, rates etc). This means that they are consuming approx 50% of the nations productive capacity! The general theory seems to be that the government knows how to spend our money better than we do! Absurd. As you said the Australian economy is in trouble under this theory.

We need a whole new approach that must include reducing the burden of government on the economy and drastically reducing taxes. When you reduce taxes everyone gets a pay rise so there is greater spending from consumers. A lower tax regime also attracts foriegn capital. This is very important to understand as capital flows from investment out weighs trade at least 10:1. Why we make such a big deal out of the trade numbers escapes me as it is only a fraction of investment capital flows which have a far greater impact on employment.

The governments primary role is to uphold the rule of law so we can come together as a society and function. The economy under those conditions will flourish. It will still fluctuate however, recessions included.

Roger Montgomery

:

Hi Aaron, Like the way you have thought about the consuming/producing dichotomy. Nice.

tahereh talebi

:

Thanks Roger for article. Happy to see that my question is worth to put it on your blog. Good to know which stocks are expensive, would you please list the stocks that have fair price or cheap? Thanks.

Tahereh

Roger Montgomery

:

Will endeavour to do something after reporting season is over Tahereh

tahereh talebi

:

Thanks Roger.

Roger Montgomery

:

Any time Tahereh. Thanks for the suggestions and comments.

Adam Novek

:

If you ran for prime minister, I (and I think a lot of other people) would vote for you. We need more money managers and less lawyers in parliament.

Roger Montgomery

:

Thanks Adam.

tahereh talebi

:

I agree with Adam, I will vote for you, too. Economy needs real help and fast.

Roger Montgomery

:

That’s two, just need another 7.5 million for a landslide….

Tony C

:

I had Domino’s last night and while cheap the food was average at best with a couple of the pizzas half cooked. Looking around the store they were packed and unable to keep up with the orders coming in

I wouldn’t be rushing back cheap low quality party food

Roger Montgomery

:

Thanks for the insights from the coal face. WOuld love to see the nutritional table for the pizza!

Peter Murphy

:

Hi Roger,

This might be a bit more than a comment but I have been amazed for quite a while at the strength of DMP’s share price rally.

For what its worth and in no particular order I make the following points about DMP as I think at some point in time in the not to distant future, valuations will matter again;

· Domino’s Pizza (DMP) closed last Friday at $34.47 after releasing 1H15 eps of 33.8cps. The closing price implies a trailing PE of 64 and a fwd PE of 49 based on full year eps of 70c.

· Page 6 of the recent market presentation summary gives the network store count and indicates that worldwide 89 store were added to total 1422 throughout AUS/NZ, Europe and Japan.

· Within this, AUS/NZ added 34 stores to total 646 (franchise + corporate stores) however total corporate stores reduced by 13 so the total number of new AUS/NZ franchises was 49.

· Going to the Domino’s website franchise FAQ you can see that to become a new franchisee requires an initial franchise fee of $60k to Dominos + set up costs. Franchisee’s must then pay an ongoing royalty fee of 7% of gross sales every month and contribute 6% of sales towards advertising.

· This means that Dominos collected a ‘one off’ franchisee profit of approximately $3m just on the new AUS/NZ franchises plus receives an ongoing 13% of gross sales.

· I am not sure what the franchise fees are for Europe and Japan but the total new franchises worldwide were 122 so if fees are the same as in AUS then DMP would have booked a one off profit of $7.3m inclusive within 1Y15 NPAT of $29.1m.

· The EBITDA margin of 34.3% in AUS/NZ compares to 8.3% in Europe and 11.5% in Japan meaning AUS/NZ is clearly the most profitable geographic location. Growth prospects in AUS/NZ when viewed against the total number of other fast food franchise companies doesn’t leave the growth implied in the PE multiple. As of Jan 2012 there were 869 McDonalds in AUS and circa 161 in NZ. Therefore the total, (assuming generous growth of 150stores) would roughly give an AUS/NZ count of 1180 stores of arguably the most successful fast food chain in the world. As mention earlier DMP presently has 646 stores in AUS/NZ.

· Therefore doubling the DMP AUS/NZ store count would result in a similar store count as McDonalds. Doubling DMP’s forecast profit would still result in a fwd PE of 25.

· To drive growth, circa $211m was spent acquiring 75% of the Japan franchise from private equity (Bain Capital). To complete this DMP conducted a $156m equity raising and drew down $101 in new debt. This acquisition is a 75% of a master franchise agreement with the US parent company expiring in 16 years but with an option to renew a further 10 years at the parent companies discretion.

· DMP added $237m of goodwill as part of the acquisition and has negative net tangible assets per share leaving no margin of safety.

· A final observation about the higher profitability of the AUS/NZ operations is that the recent presentation indicated that the $4.95 cheaper everyday campaign generated substantial sales growth. I see that they are now advertising $3.95 pizza’s. I wonder how much profit is left in a $3.95 pizza for the franchisee when 13% of gross sales must be paid to DMP (royalty fee + advertising contribution) before taking out rent, salaries and utilities. I can’t see franchisee’s absorbing these prices for long during DMP’s drive to gain market share.

Whilst valuations in Australia haven’t quite reached the craziness happening in America, I think we have our own craziness reflected in property prices and by default the 4 banks. Interesting times!

Thanks again for the effort your team provides in keeping & updating this blog.

Cheers,

Peter