Record low interest rates and the chase for yield

With the Bank of Japan and the European Central Bank adopting negative interest rates – 5 year sovereign bonds in Japan, Germany and France are negative 0.23 per cent, negative 0.38 per cent and negative 0.18 per cent, respectively – and the Reserve Bank of Australia following suit by cutting the record low cash rate further to 1.75 per cent earlier in May, it seems the chase for high yielding Australian stocks is back on the agenda.

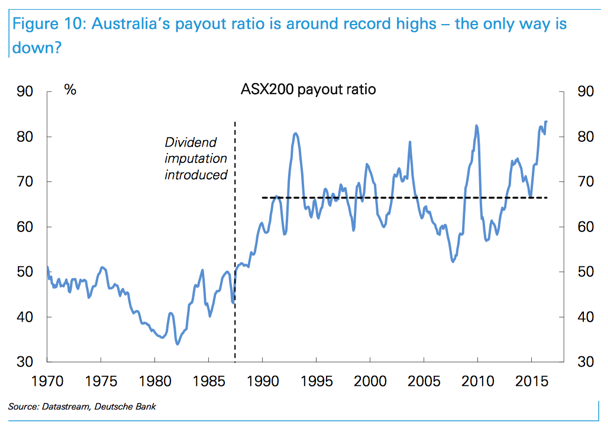

Following on from my previous article the following graph, produced by Deutsche Bank, warns that Australian companies are paying out a record share of earnings to deliver dividends.

While earnings growth, a key driver of sustainable equity returns, is hard to come by, Australia’s 12-month forward dividend yield at 4.6 per cent is considerably higher than most other world markets.

Investors need to ask whether the record high dividend payout is simply a priority because most listed companies are struggling to sustainably grow their earnings?

The exercise below has been one of the stockbrokers’ favourite. “Buy the big Banks on a cum dividend basis and over the next twelve and a half months, you will receive $x of dividends”. Interestingly, investors who followed this advice over the period between 30 April 2015 and 18 May 2016 saw the exercise yield them a pre-tax (pre-franking credit) loss of between 6.8 per cent (CBA) and 19.7 per cent (ANZ), as per below.

| ANZ | CBA | NAB | WBC | |

| Price at 30/4/15 | $33.99 | $88.49 | $34.95 | $36.25 |

| Price at 18/5/16 | $24.60 | $78.30 | $27.80 | $30.26 |

| Dividends paid | $2.61 | $4.20 | $2.97 | $2.81 |

| Capital Loss + Dividends | $6.69 | $5.99 | $4.18 | $3.18 |

| Pre-tax Return (%) | -19.7% | -6.8% | -12.0% | -8.8% |

We encourage readers not to look blindly at dividend yields during this period of record low interest rates.

The Montgomery [Private] Fund and The Montgomery Fund own shares in CBA and Westpac.

To learn more about our funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.

Jim Hasn

:

Hi David

Thank you for the article. I think you’ll find that CBA went ex-div only twice in the time period, whereas the other banks went ex-div three times. Nevertheless, I agree if there is no earnings growth , then a re-rating of any company that does this is inevitable.

David Buckland

:

You are correct Jim. CBA’s balance date is 30 June and they have paid two dividends in the period under review, and ANZ, NAB and WBC have a 30 September balance date and have paid (or gone ex) three dividends in the period under review.

Shane

:

If a company can’t retain its earnings and grow them at a suitable ROE, then I’ll happily receive them, as long as I don’t have to pay too much up front for the stock. Having said that, I do find it difficult to value the risk of dividends potentially decreasing.

David Buckland

:

Thanks Shane, I particularly thought the big miners’ “progressive” dividend policy was ridiculous.

The problem I see with your sentiment is if you analyse a company like BHP I believe its difficult to ascertain when you aren’t paying too much.

In 2006, its ROE was 41% (Normalised Net Profit of $13.6b on Shareholders’ Funds of $32.6b) and its net debt was $11b.

In 2016, its ROE is forecast to be 1.5% (Normalised Net Profit of $1.3b on Shareholders’s Funds of $84.7b) and its net debt is expected to be $36b.

Gav J

:

David, you guys have again done a short-term trade out of ANZ. I’ve asked this a few times but it still doesn’t make much sense to me that you hold the big 4 banks at all. Given that these banks make up such a large portion of the index, are you holding onto them to reduce your chance of your deviating too far from the index/benchmark?

David Buckland

:

Hi Gav, we exited ANZ several months ago and our CBA and WBC holding represent a very large underweight position relative to the benchmark.

As you should know we pay little attention to the benchmark.

Gav J

:

In a low growth environment, rather than taking a risk and having a crack as they should be, many boards and management are paying out dividends to improve total shareholder (TSR) return in the short-term. TSR is a key driver for “long-term incentive” bonus salary payments (if you consider 3 years long-term, which is what many ASX200 companies use) offered to senior executive and key management personel. The cynic would suggest they are more interested in lining their own pockets in the short-term than long-term value creation for their shareholders.