Lower phone bills for Telstra?

On Monday, the ACCC proposed its intention to reduce the rates that Telstra Corporation (ASX: TLS) can charge for access to its national copper network.

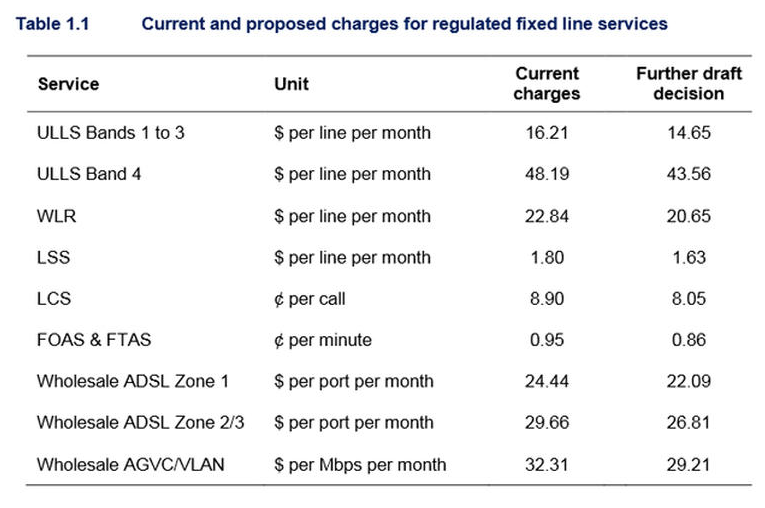

Below is a table of the current and proposed charges for regulated fixed line services.

Source: Josh Taylor of Zdnet, you can find his full article here.

Overall this is a 9.6 per cent price reduction – fairly substantial for any firm but it’s a double whammy for Telstra’s wholesale margins. Not only will Telstra receive less revenue per user, it will later face a reduction in volumes as customers transfer their services to the National Broadband Network. Further, many costs associated with the network are fixed, meaning that as revenues fall, expenses may not to the same magnitude.

The decision is a plus for comparatively smaller telcos such as M2 Group Limited (ASX: MTU), iiNet Limited (ASX: IIN) and TPG Telecom Limited (ASX: TPM) as each respective entity’s cost to serve per client should fall.

However, we’re noticing a degree of price competition in the market. Recently Dodo introduced a $30.00 unlimited ADSL 2+ broadband plan and TPG has lowered its unlimited broadband plan price to $59.99.

As such, it may be that any gains that are incurred in a reduction of the cost of goods sold are passed through to customers, meaning that any upside to profitability from this event may be unlikely.

The Montgomery Funds own shares in M2.

Scott Shuttleworth is an analyst at Montgomery Investment Management. To invest with Montgomery, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Tony C

:

Hi David

Thanks and i see its fixed.

Tony C

:

Hi Scott

I can never read tables or graphs you or the team post hear as i have a add for the fund and scaffold running down the page 200mm from the edge of the screen. Text is ok as that seems to respect the page layout.

Can said add be moved to the edge ?

David Buckland

:

Hi Tony, we are working to fix this now.