I feel the need, the need for yield

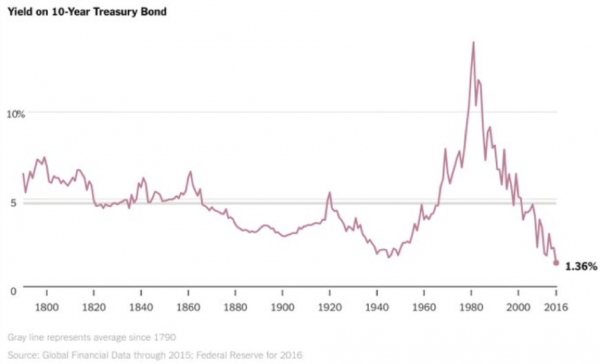

It’s not news to anyone reading the Insights Blog here that bond rates are at record-lows. And it should be no secret that US stocks are summiting record highs. But it shouldn’t be happening and it isn’t logical.

In fact it’s never happened before. It’s the greatest, all-in, epochal, monetary experiment and you are living in it. You may even be oblivious to the dangers of even the slightest shift in sentiment or loss of confidence in central banks.

Changes in interest rates are usually a signal of the health or otherwise of the economy. Plunging rates – now to below the lows set during the Great Depression of the 1930’s –suggests the bond market is certain that the prospects for the economy are bleak.

Meanwhile over in the stock market, investors – spurred on by the need for yield – are pushing stocks to record highs. The median stock, as measured by P/E and Price/Sales, has never been more highly priced than it is now. Given the stock market casts its shadow before it, one can only conclude that the stock market is the most euphoric about future prospects than it has even been.

Of course the bond rates we are seeing today are not the result of the collective actions of rational, profit-motivated investors. They are the work of central bank buying amid a concerted effort to drive investors out of savings and into consumption and investing.

“Since the collapse of Lehman Brothers, the world’s top 50 central banks have on average cut rates once every three trading days, adding up to a total figure of 673. And what do central banks have to show for it? None of them have achieved their economic growth or inflation targets and NIRP (Negative Interest Rate Policy) and ZIRP (Zero Interest Rate Policy) have done incalculable damage to the integrity of markets, how they are valued, and the global economy.”

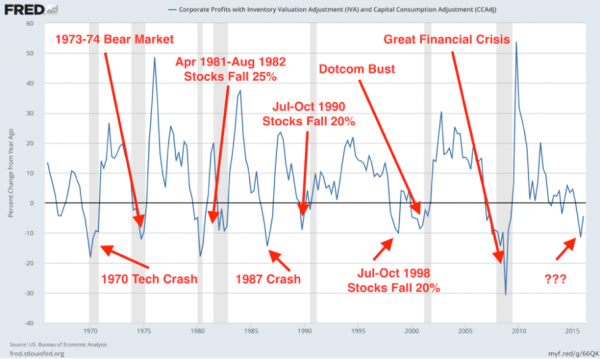

Uncertainty is ever-present, but the magnitude of consequences of getting this wrong is unprecedented. Few are sure of where the economy, corporate profits and bond yields are heading but they’re chasing stocks higher and happy to lock their investors into long term low returns regardless.

Thanks to almost a decade of central bank intervention, and as we have noted here previously, the price-signaling mechanism of the bond market is broken. Italy’s banking system is defunct wiith US$400bn of non performing loans amounting to 25% of GDP and yet they can borrow at rates lower than when the country was on more stable footings.

If confidence about the ability of central banks to ‘keep it together’ reverses, markets will break loose from central bank control. Mayhem would be unleashed. All those gold bugs would suddenly look like geniuses rather than the blatant gamblers that they are.

It is no secret that high share prices, here and in the US, are the product of the chase for yield. And the trend has been helped in no small part by the very significant increase in dividend payout ratios since 2010 as boards acquiesce to shareholder demands for more income while simultaneously admitting that they have no better [reinvestment] use for the cash. Company boards cannot find avenues for growth so they may as well hand back the cash.

Despite a lack of growth in earnings, investors are willing to pay more for the same dollar of those earnings. The 12-month forward P/E on the S&P 500 has almost doubled over the last five years, from roughly 11x to 19x. At the same time the S&P500 median Price/Sales ratio reached another new all time record high in May of 2.23 (Apr 2.22).

Earlier this week, The Wall Street Journal noted that adjusted earnings for the S&P 500 are expected to fall for the fourth consecutive quarter, down 2.6% yoy (year-on-year). Headline revenues are also declining, experiencing their sixth consecutive quarterly decline, down 0.4% yoy.

According top some observers, over the past 50 years, there has never been a decline in earnings, of the magnitude currently being experienced in the US, without at least a 20% decline in the equity market.

Both bond and equity markets are being influenced, if not manipulated, by central banks. According to Bloomberg; “the Bank of Japan..exchange-traded fund purchases have made it a top 10 shareholder in about 90 percent of the Nikkei 225 Stock Average..It’s now a major owner of more Japanese blue-chips than both BlackRock Inc., the world’s largest money manager, and Vanguard Group, which oversees more than $3 trillion… Under the BOJ’s current stimulus plan, the central bank buys about 3 trillion yen ($27.2 billion) of ETFs every year.”

The central bank need for a hit of speed can keep earnings multiples expanding. But for how long? And what happens if and when they exit? What is clear is that the longer they persist, the greater the risk that prices detach from their fundamental, long-term, drivers. If they haven’t already.

The economy and inflation really need to collapse to justify current bond prices, while economic growth and earnings need to rocket higher to explain current stock market multiples. One doesn’t have to stretch the imagination to uncover scenarios where both a painfully wrong.

Roger Montgomery is the founder and Chief Investment Officer of Montgomery Investment Management. To invest with Montgomery, find out more.

Charles

:

It is probably time to reread “Devil Take the Hindmost.” On the other hand, the simplest reading of the interest rate tea leaves is that developed world economies will see low or no growth for a decade. As expectations about rate of return get reset lower long term, one could also expect the price paid for a given amount of earnings to rise. Or maybe tulips will become all the rage again.

sartaj

:

Great article. Terrific Read. Thanks Roger.

xiao fang xu

:

http://historycooperative.org/30-years-of-financial-crisis/

it look like magnitude is getting bigger after every crisis.

what option we have:

property

bonds

stock

cash

gold

art

timber

Kelvin Ng

:

Hi Roger, most hedge fund managers are short and wrong on the US equity market. No doubt US equities are expensive, but not nearly as ridiculously expensive as bonds. The variant perception is that there’ll be a mass migration from bonds into equities (other those bonds masquerading as equities, e.g. REITs, utilities etc.). Commodities and gold are nowhere near big enough an asset class (if you can even call them an asset class) to accommodate the wall of money seeking refuge from the bond market. All the “smart money” and hedge funds are bearish on US equities. They’ll be forced to cover. Better to get away from the NY hedge fund group think.

Kelvin

Ian Caroline

:

Hi Roger,

Give the inevitability of a major stock market collapse at some unknown time in the future and which will happen without warning , what plans do you have for this circumstance in your funds. No doubt this is a subject that has been discussed in house and perhaps might make a good topic for your next breakfast meeting video.

John Boardman

:

For years now the experts and market commentators having been declaring this bull market is about to turn into a bear. They have all been wrong so far. If they keep calling it eventually they will get it right, just like a broken clock only gets it right twice a day. Share market investors should only start to worry when all the experts start saying the market will go higher. At the moment there aren’t many experts saying this. Wait for all the usual speculative signals to appear that precced a crash. As yet those signals are not here.

Roger Montgomery

:

Hi John, On the other hand, the very high prices being paid for stocks suggests most are indeed very bullish.

Arthur

:

Last week, I went from 90% in stocks too 100% cash after some very nice capital gains, very happy to sit out and wait for the inevitable pull back when ever it might be. (they don’t make crystal balls out my way)

Roger Montgomery

:

And I have made so many wrong calls over the years Arthur that I am convinced the Crystal Ball I was sold is a lemon.

Arthur

:

it’s during times such as these, that the hardest part of investing is maintaining the discipline required for fundamentals coupled with margin of safety, might be a good time to go read some of Ben Graham’s writings I think…

Roger Montgomery

:

Indeed Arthur.

jimbo james

:

Anyone know a good quality crystal ball manufacturer with all the hallmarks of a top quality value proposition?!